3 Growth Companies With High Insider Ownership Seeing Up To 42% Revenue Growth

Reviewed by Simply Wall St

In the midst of a choppy start to the year for global markets, with U.S. equities experiencing declines amid inflation concerns and political uncertainty, investors are seeking stability and growth in companies that demonstrate strong fundamentals. One key indicator of potential resilience is high insider ownership, which often aligns management interests with those of shareholders, particularly in growth companies that are navigating challenging economic landscapes.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| CD Projekt (WSE:CDR) | 29.7% | 32.2% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.2% | 66.3% |

| Fulin Precision (SZSE:300432) | 13.6% | 66.7% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 110.9% |

Let's review some notable picks from our screened stocks.

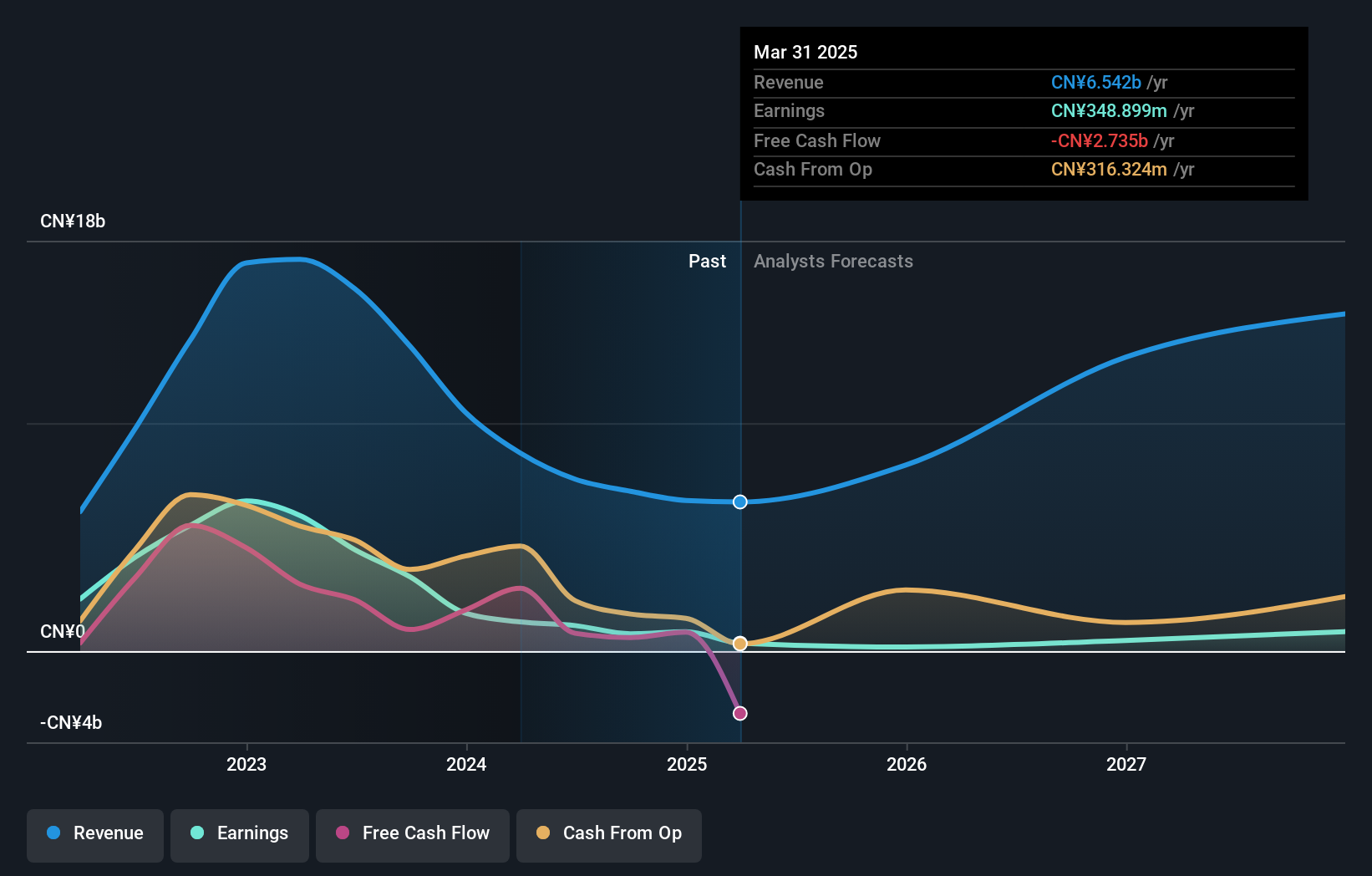

Shenzhen H&T Intelligent ControlLtd (SZSE:002402)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen H&T Intelligent Control Co. Ltd, along with its subsidiaries, is engaged in the research, development, manufacturing, sales, and marketing of intelligent controller products both in China and globally, with a market cap of CN¥16.23 billion.

Operations: The company generates revenue from its intelligent controller products, which are developed, manufactured, sold, and marketed both domestically and internationally.

Insider Ownership: 16.2%

Revenue Growth Forecast: 21.9% p.a.

Shenzhen H&T Intelligent Control Ltd. shows robust growth potential with earnings expected to rise significantly at 38.73% annually, outpacing the broader Chinese market. Despite a volatile share price and lower profit margins year-over-year, its revenue growth forecast of 21.9% remains strong. The company recently completed a buyback program worth CNY 104.99 million, reflecting strategic capital allocation despite no insider trading activity in the past three months.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen H&T Intelligent ControlLtd.

- The valuation report we've compiled suggests that Shenzhen H&T Intelligent ControlLtd's current price could be inflated.

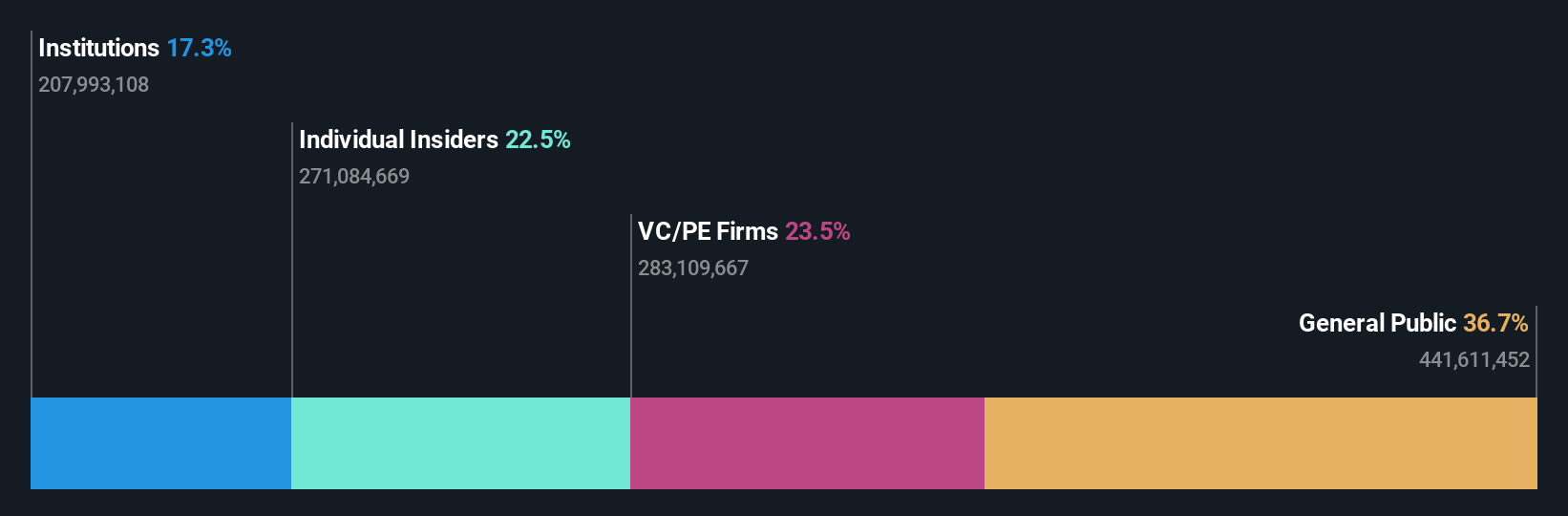

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. offers network security products, trusted security management platforms, and specialized security services globally, with a market cap of CN¥17.63 billion.

Operations: Venustech Group generates revenue through its offerings in network security products, trusted management platforms, and specialized security services on a global scale.

Insider Ownership: 22.4%

Revenue Growth Forecast: 15.5% p.a.

Venustech Group faces challenges with a recent net loss of CNY 210.07 million, contrasting last year's profit. Despite this, earnings are forecast to grow significantly at 28.4% annually, surpassing the Chinese market's growth rate. However, revenue growth is slower and profit margins have decreased from 23.3% to 6.7%. Trading below estimated fair value suggests potential undervaluation despite low return on equity forecasts and an unsustainable dividend yield of 1.85%.

- Click to explore a detailed breakdown of our findings in Venustech Group's earnings growth report.

- The analysis detailed in our Venustech Group valuation report hints at an deflated share price compared to its estimated value.

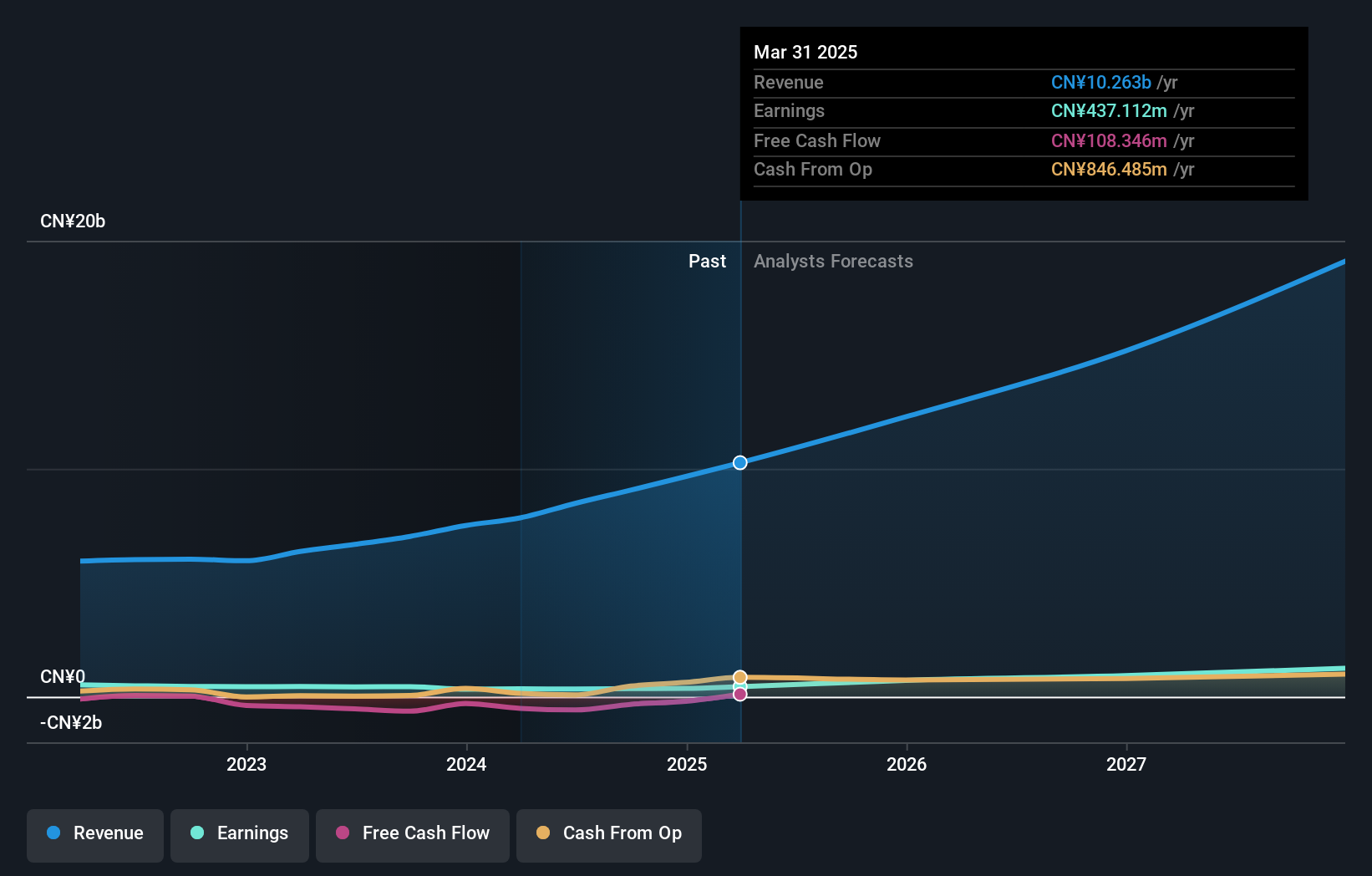

Canmax Technologies (SZSE:300390)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Canmax Technologies Co., Ltd. specializes in providing new energy lithium battery materials and has a market cap of CN¥18.57 billion.

Operations: The company's revenue segments are not provided in the text.

Insider Ownership: 33.7%

Revenue Growth Forecast: 42.2% p.a.

Canmax Technologies has seen a decline in financial performance, with net income dropping to CNY 923.32 million for the nine months ended September 2024, compared to CNY 1,821.6 million a year ago. Despite this, its earnings are forecast to grow significantly at 35.92% annually, outpacing the Chinese market's growth rate of 25.3%. The company trades at a favorable price-to-earnings ratio of 24.5x compared to the CN market average of 34.2x but faces challenges with reduced profit margins and an unsustainable dividend yield of 4.45%.

- Take a closer look at Canmax Technologies' potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Canmax Technologies is trading behind its estimated value.

Summing It All Up

- Gain an insight into the universe of 1465 Fast Growing Companies With High Insider Ownership by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300390

High growth potential with adequate balance sheet.

Market Insights

Community Narratives