- China

- /

- Electronic Equipment and Components

- /

- SZSE:300657

Exploring High Growth Tech Stocks Including None And Two More

Reviewed by Simply Wall St

As global markets continue to react positively to political developments and AI enthusiasm, major indices like the S&P 500 have reached record highs, with growth stocks outpacing value shares for the first time this year. In this environment of optimism and technological advancement, identifying high-growth tech stocks involves looking at companies that are well-positioned to capitalize on emerging trends such as artificial intelligence infrastructure development and favorable trade policies.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.13% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1226 stocks from our High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

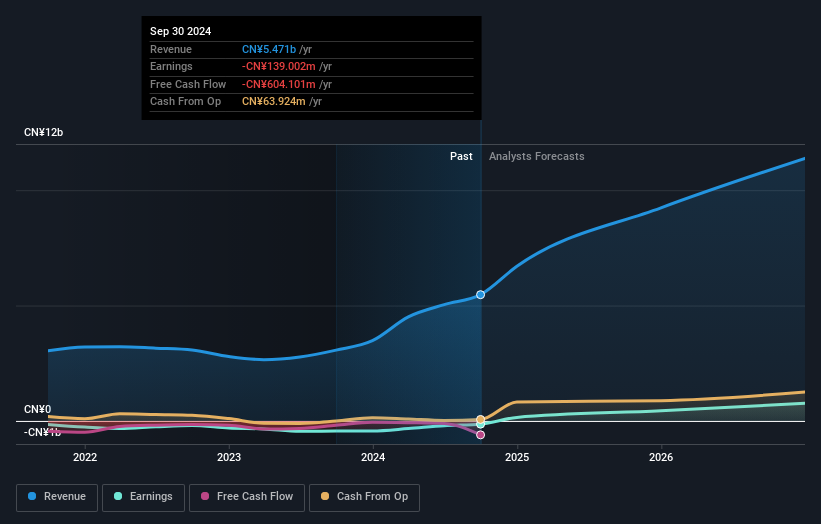

Accelink Technologies CoLtd (SZSE:002281)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Accelink Technologies Co., Ltd. is a company that focuses on the research, development, manufacturing, sales, and technical services of optoelectronic chips, devices, modules, and subsystem products primarily in China with a market cap of CN¥41.20 billion.

Operations: Accelink Technologies generates revenue primarily from the communication equipment manufacturing segment, which amounts to CN¥7.10 billion. The company is involved in producing optoelectronic components and systems within China.

Accelink Technologies has demonstrated robust financial growth, with revenue surging by 24.3% to CNY 5.38 billion in the nine months ending September 2024, and net income rising to CNY 464 million from CNY 413.31 million year-over-year. This performance is underscored by a significant earnings growth rate of 26.5% over the past year, outpacing the electronic industry's average of just 2.3%. Despite a volatile share price recently, Accelink’s commitment to innovation is evident in its R&D efforts; however, specific expenditure figures are not disclosed here. The company's future prospects look promising with expected annual earnings and revenue growth forecasted at an impressive rate of approximately 29% and above market trends respectively, positioning it well within a competitive tech landscape.

Shenzhen Everwin Precision Technology (SZSE:300115)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Everwin Precision Technology Co., Ltd. is a company with a market cap of CN¥26.42 billion, focusing on precision manufacturing and technology solutions.

Operations: Everwin Precision Technology generates revenue primarily through its precision manufacturing and technology solutions, with a focus on high-quality components for various industries. The company has a market cap of CN¥26.42 billion, reflecting its significant presence in the sector.

Shenzhen Everwin Precision Technology is navigating a transformative phase, marked by a notable 334.4% surge in earnings over the past year, significantly outpacing the electronic industry's average growth of 2.3%. This performance is bolstered by an aggressive R&D strategy, with expenditures strategically allocated to foster innovation and maintain competitive edge in a rapidly evolving tech landscape. The firm's recent shareholder meeting agenda suggests further strategic shifts, potentially enhancing operational frameworks and financial management. With revenue and earnings forecasted to grow at 15.2% and 26.1% respectively, Shenzhen Everwin is poised to capitalize on market trends while addressing its high debt levels through refined financial strategies.

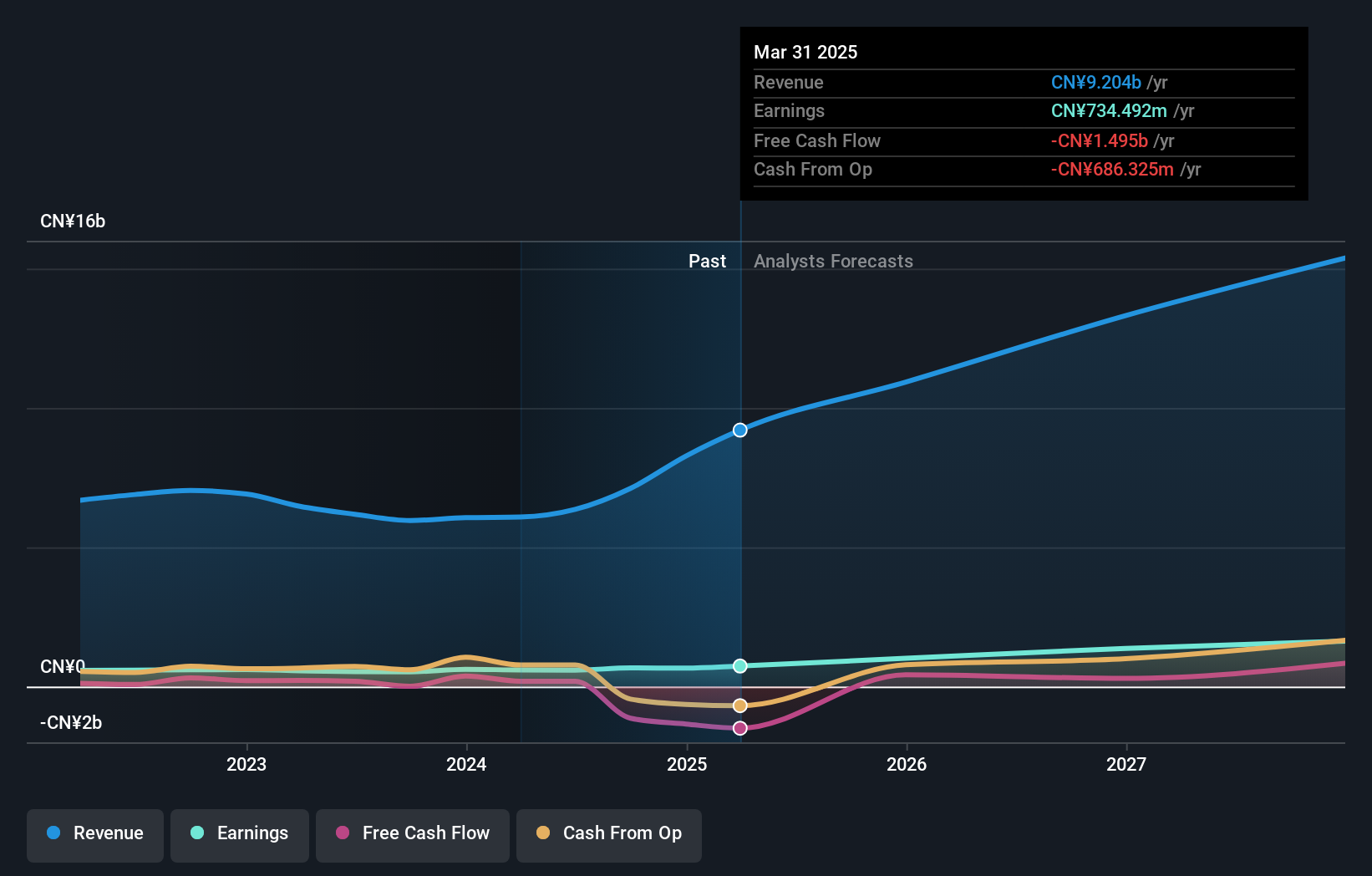

Xiamen Hongxin Electronics Technology Group (SZSE:300657)

Simply Wall St Growth Rating: ★★★★★★

Overview: Xiamen Hongxin Electronics Technology Group Inc. engages in electronics manufacturing and has a market cap of approximately CN¥10.97 billion.

Operations: The company generates revenue primarily from the electronics manufacturing industry, amounting to CN¥5.40 billion.

XiaMen HongXin Electron-tech Group Co.,Ltd has demonstrated a robust turnaround, transitioning from a net loss to reporting significant earnings growth with net income reaching CNY 54.7 million from a previous loss of CNY 241.82 million. This resurgence is underscored by an impressive annual revenue increase of 31.1%, positioning the company well above the industry average growth rate. Strategic corporate actions, including recent shareholder meetings focused on governance enhancements and capital adjustments, signal ongoing efforts to fortify its market position and attract strategic investments, as evidenced by a substantial private placement fetching CNY 693 million at CNY 14.20 per share. These moves are pivotal for HongXin's trajectory in leveraging advanced technologies and expanding its market footprint amidst dynamic industry demands.

- Unlock comprehensive insights into our analysis of Xiamen Hongxin Electronics Technology Group stock in this health report.

Learn about Xiamen Hongxin Electronics Technology Group's historical performance.

Where To Now?

- Gain an insight into the universe of 1226 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Xiamen Hongxin Electronics Technology Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300657

Xiamen Hongxin Electronics Technology Group

Xiamen Hongxin Electronics Technology Group Inc.

Exceptional growth potential and fair value.

Similar Companies

Market Insights

Community Narratives