High Growth Tech Stocks To Watch For Potential Portfolio Strengthening

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions, tariff concerns, and mixed economic indicators, the tech sector remains a focal point for investors seeking potential growth opportunities. In this environment, identifying high-growth tech stocks that can navigate uncertainty and capitalize on technological advancements becomes crucial for those looking to strengthen their portfolios.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.86% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 24.94% | 24.24% | ★★★★★★ |

| Pharma Mar | 23.77% | 45.40% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 24.99% | 104.40% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1192 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

ArcSoft (SHSE:688088)

Simply Wall St Growth Rating: ★★★★★☆

Overview: ArcSoft Corporation Limited is a global provider of algorithms and software solutions in the computer vision industry, with a market capitalization of CN¥22.35 billion.

Operations: ArcSoft Corporation Limited focuses on developing algorithms and software solutions within the computer vision sector globally. The company's revenue streams are primarily derived from its innovative software offerings, which cater to various industries requiring advanced visual processing capabilities.

ArcSoft's trajectory in the tech sector is underscored by a robust annual revenue growth rate of 30.6% and an even more impressive earnings increase of 43.5% per year, signaling strong market performance and potential for continued expansion. The company's commitment to innovation is evident from its R&D spending trends, which have consistently aligned with or exceeded industry norms, fostering advancements that keep it competitive despite a highly volatile share price recently. With earnings expected to surge by 43.48% annually, ArcSoft appears well-positioned to capitalize on evolving market demands, particularly in areas where it has shown operational strength and client engagement.

- Take a closer look at ArcSoft's potential here in our health report.

Gain insights into ArcSoft's past trends and performance with our Past report.

CASTECH (SZSE:002222)

Simply Wall St Growth Rating: ★★★★★☆

Overview: CASTECH Inc. focuses on the research, development, production, and sale of crystal components, precision optical components, and laser devices mainly in China with a market cap of CN¥18.33 billion.

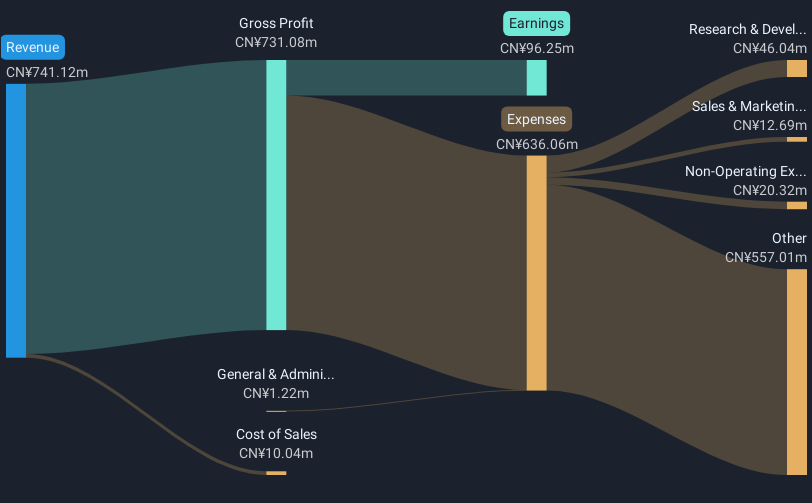

Operations: The company generates revenue primarily from the optoelectronics industry, totaling approximately CN¥851 million.

CASTECH stands out in the tech landscape with a notable annual revenue growth of 25.1%, surpassing the broader Chinese market's average of 13.4%. This growth is complemented by an impressive earnings increase forecast at 29.5% annually, highlighting its potential in a competitive sector. The company's dedication to innovation is reflected in its R&D investments, crucial for maintaining technological edge and driving future growth despite recent challenges like the change of audit firms discussed at their last shareholders meeting on November 29, 2024. These strategic moves could enhance CASTECH's ability to respond to dynamic market demands and sustain its growth trajectory amidst evolving industry trends.

iFLYTEKLTD (SZSE:002230)

Simply Wall St Growth Rating: ★★★★☆☆

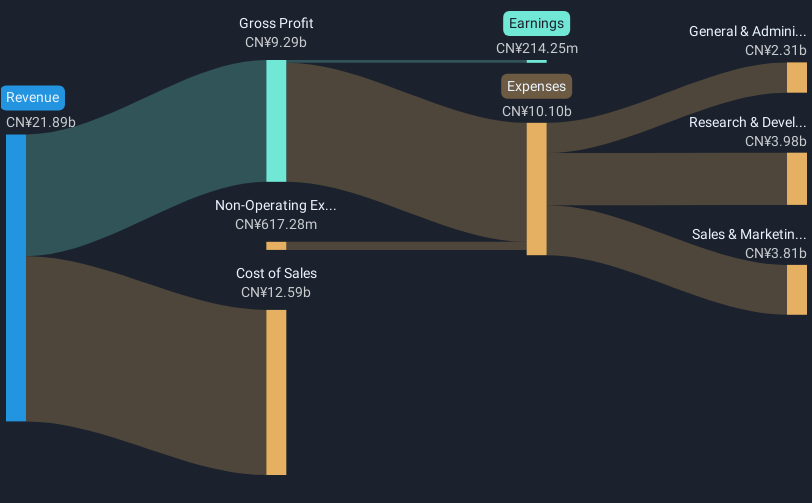

Overview: iFLYTEK CO., LTD. specializes in artificial intelligence (AI) technology services in China, with a market capitalization of CN¥127.55 billion.

Operations: iFLYTEK CO., LTD. focuses on AI technology services in China, leveraging its expertise to drive revenue through innovative solutions and applications. The company operates within the AI sector, contributing to its significant market presence.

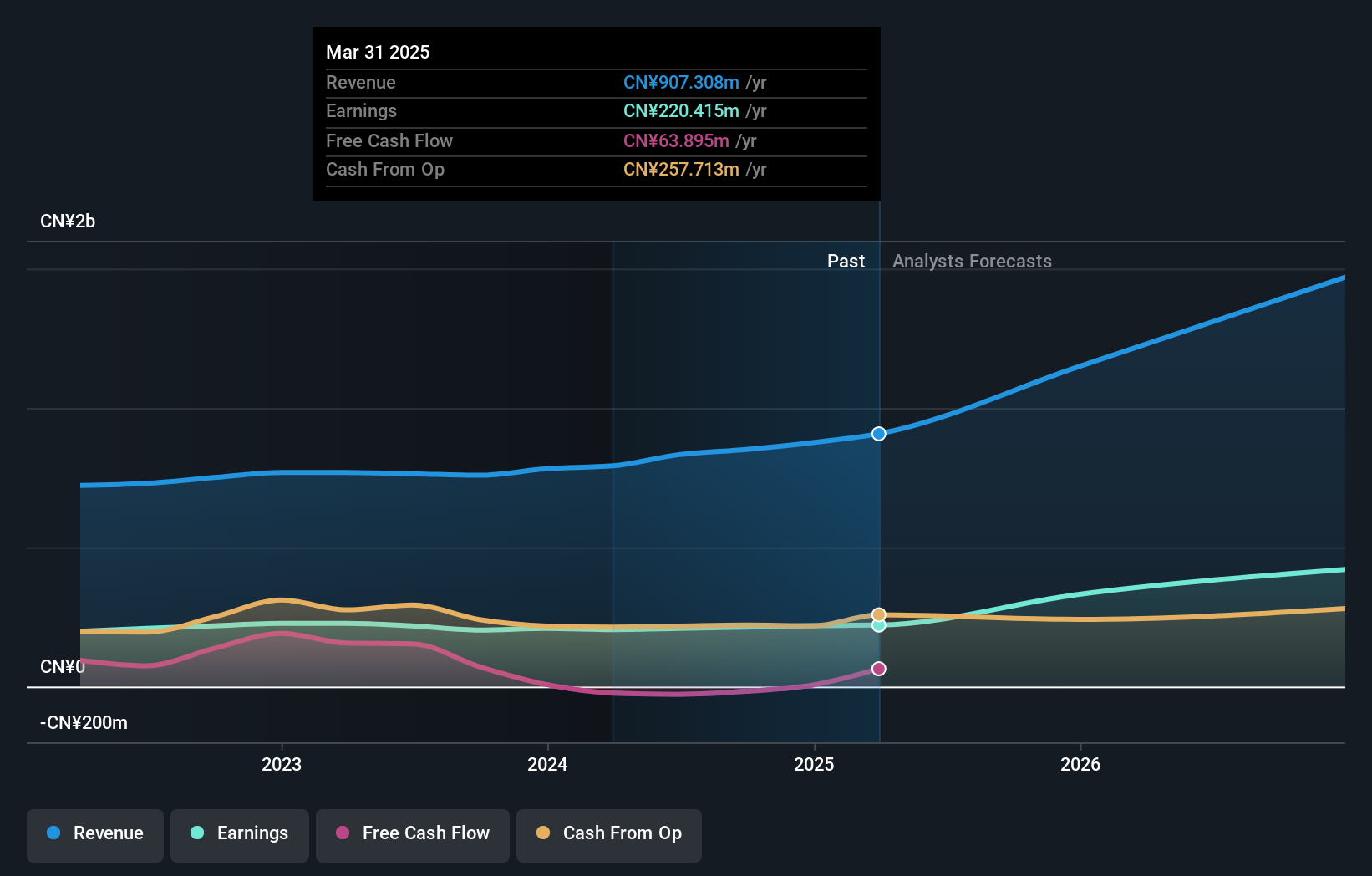

iFLYTEK CO., LTD's strategic focus on R&D is evident from its substantial investment in this area, aligning with its commitment to maintaining a competitive edge in AI and tech innovation. Despite a challenging past year with earnings growth at -10.9%, the company's future looks promising with an expected annual earnings increase of 62.4%. This forecast surpasses the broader Chinese market's average, positioning iFLYTEK favorably among peers. The recent shareholders meeting highlighted plans for stock repurchase and structural adjustments, signaling proactive governance that could further stabilize and fuel its growth trajectory amidst dynamic technological advancements.

- Click to explore a detailed breakdown of our findings in iFLYTEKLTD's health report.

Review our historical performance report to gain insights into iFLYTEKLTD's's past performance.

Summing It All Up

- Embark on your investment journey to our 1192 High Growth Tech and AI Stocks selection here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if iFLYTEKLTD might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002230

iFLYTEKLTD

Engages artificial intelligence (AI) technologies services in China.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives