As we approach the end of 2024, global markets have shown mixed signals with major U.S. stock indexes like the Nasdaq Composite experiencing moderate gains, although recent declines in consumer confidence and durable goods orders have raised concerns about economic stability. In this environment, high growth tech stocks are particularly intriguing due to their potential to capitalize on innovation and adaptability amidst fluctuating market conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Sarepta Therapeutics | 24.07% | 43.17% | ★★★★★★ |

| CD Projekt | 24.92% | 27.00% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 131.08% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1270 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Vitrolife (OM:VITR)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitrolife AB (publ) specializes in providing products for assisted reproduction and has a market capitalization of approximately SEK29.81 billion.

Operations: Vitrolife generates revenue through three primary segments: Genetics (SEK1.23 billion), Consumables (SEK1.61 billion), and Technologies (SEK721 million).

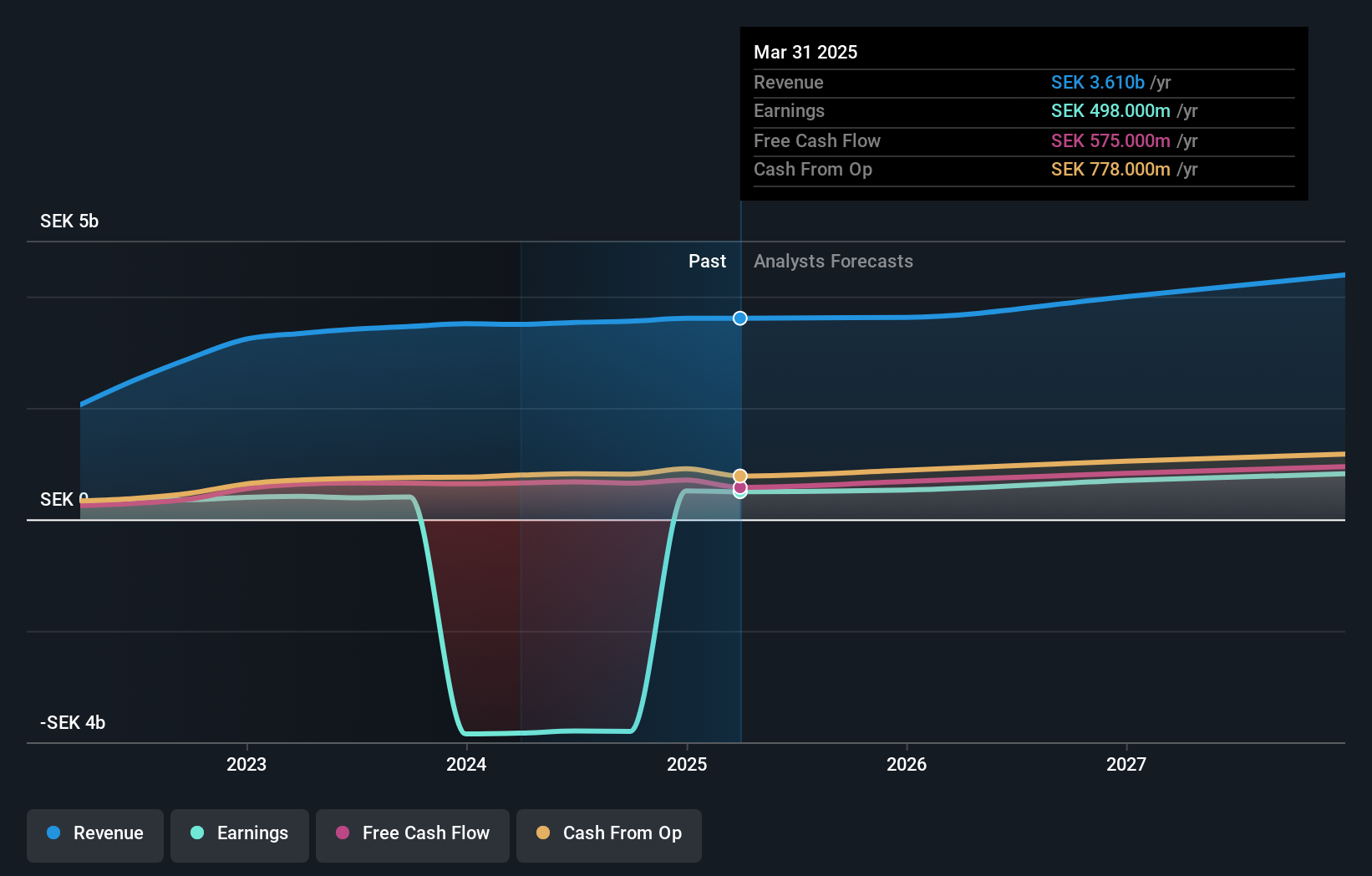

Vitrolife, amidst executive shifts and active conference participation, reported a slight dip in third-quarter net income to SEK 116 million from SEK 122 million year-over-year, despite a revenue increase to SEK 867 million. This scenario underscores a resilience in sales growth but highlights challenges in profit retention. The company's commitment to innovation is evident as it navigates through leadership transitions and strategic presentations at major healthcare conferences. With an expected annual revenue growth of 8.2%, Vitrolife is outpacing the Swedish market's growth of 1.2%, yet it faces hurdles to achieving profitability within three years—a testament to its potential tempered by immediate financial realities.

- Navigate through the intricacies of Vitrolife with our comprehensive health report here.

Examine Vitrolife's past performance report to understand how it has performed in the past.

Jonhon Optronic Technology (SZSE:002179)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jonhon Optronic Technology Co., Ltd. focuses on the research and development of optical, electrical, and fluid connection technologies and equipment in China, with a market cap of CN¥84.34 billion.

Operations: The company generates revenue primarily from its optical, electrical, and fluid connection technologies and equipment. It operates within China, leveraging its expertise in these specialized fields to drive business activities.

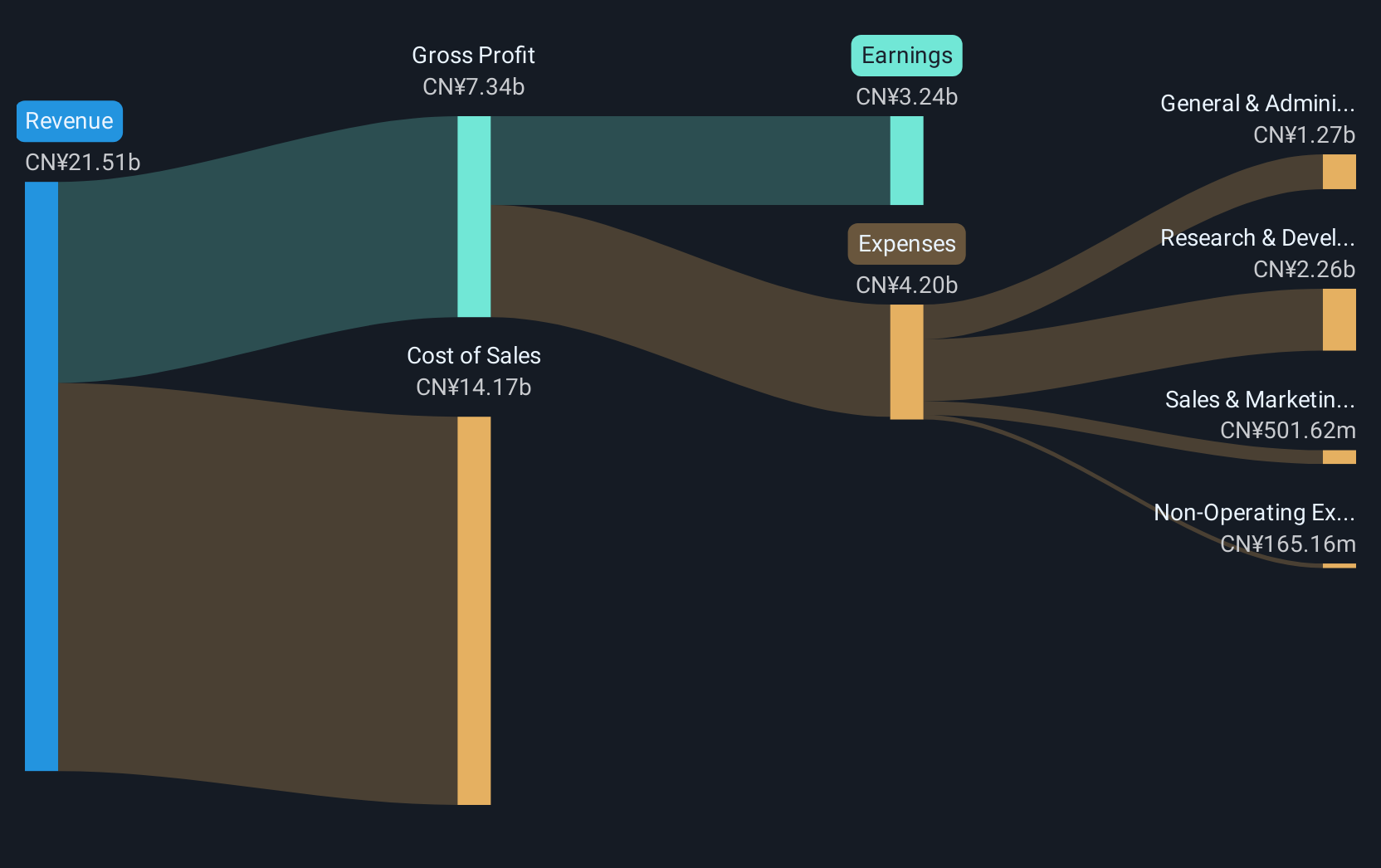

Jonhon Optronic Technology, amidst a name change and multiple corporate events, reported a revenue of CNY 14.1 billion for the nine months ending September 2024, down from CNY 15.36 billion year-over-year. Despite this dip, the company’s net income stood at CNY 2.51 billion compared to CNY 2.89 billion previously. These figures reflect resilience in maintaining substantial earnings despite revenue fluctuations. The firm's commitment to growth is underscored by its proactive shareholder engagements and strategic corporate adjustments aimed at refining its operational focus and market positioning.

Broadex Technologies (SZSE:300548)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Broadex Technologies Co., Ltd. focuses on the research, development, production, and sale of integrated optoelectronic devices for optical communications both in China and internationally, with a market cap of CN¥13.10 billion.

Operations: The company engages in the development, production, and sale of integrated optoelectronic devices for optical communications. It operates both domestically in China and internationally.

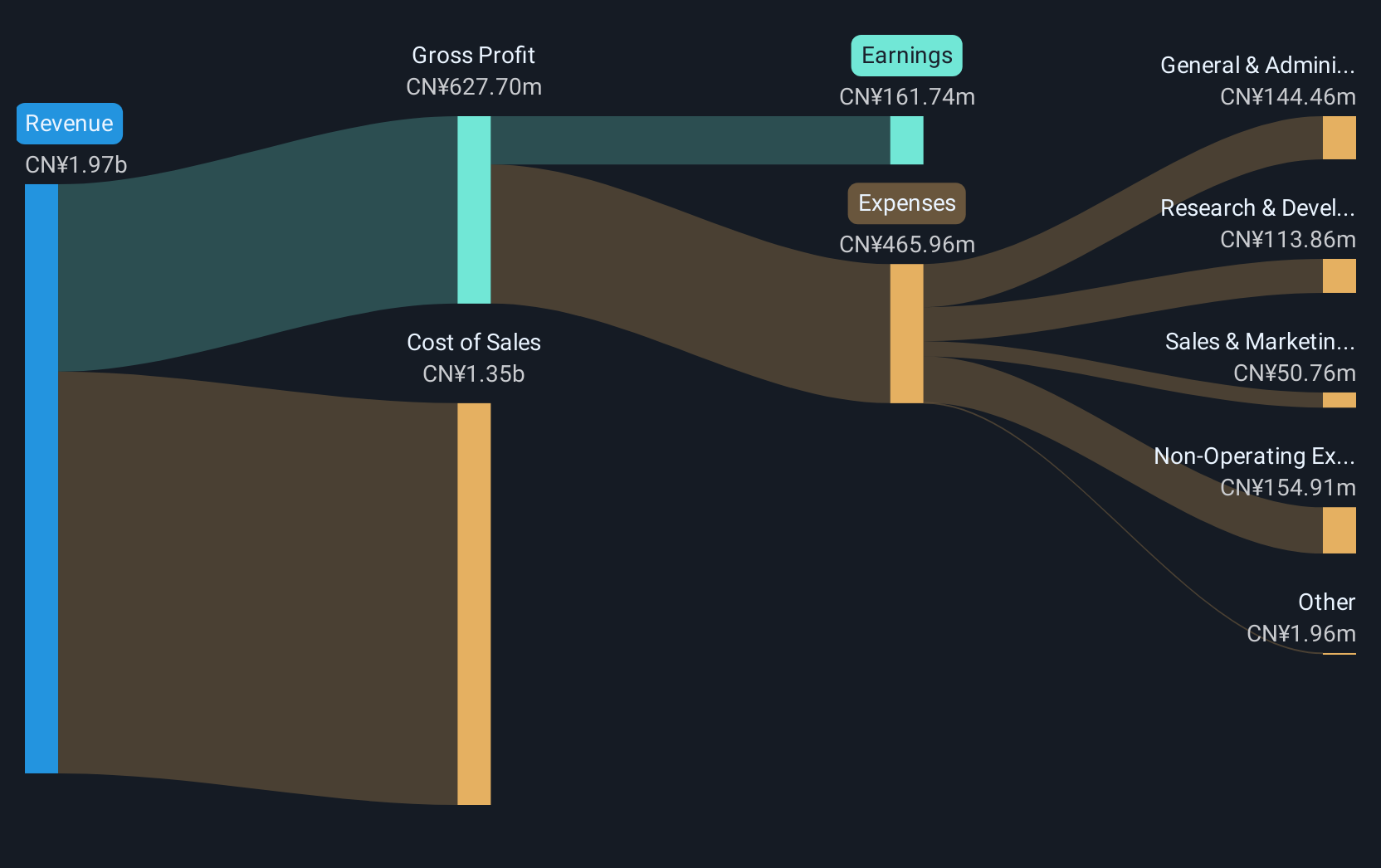

Amidst a challenging fiscal period, Broadex Technologies demonstrated resilience with its latest earnings report, showing a revenue of CNY 1.23 billion for the nine months ending September 2024, slightly down from CNY 1.29 billion in the previous year. Despite this dip, the company's strategic maneuvers are evident in its recent acquisition by Ningbo Ningju Asset Management, enhancing shareholder value through significant equity changes. This move aligns with Broadex’s forward-looking approach as it aims to stabilize and expand amidst forecasts of annual revenue growth at an impressive rate of 24.3%. The firm’s commitment to innovation and market adaptation is further underscored by its expected transition into profitability within three years, supported by a robust forecasted earnings growth of 63.88% annually.

Seize The Opportunity

- Access the full spectrum of 1270 High Growth Tech and AI Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:VITR

Vitrolife

Provides assisted reproduction products in Europe, the Middle East, Africa, Asia-Pacific, and the Americas.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)