- China

- /

- Entertainment

- /

- SZSE:300251

Exploring High Growth Tech Stocks With Promising Potential

Reviewed by Simply Wall St

As global markets reach new highs fueled by optimism around AI advancements and political developments, growth stocks have notably outperformed value shares, capturing investor attention. In this environment of heightened enthusiasm for technology-driven innovation, identifying high-growth tech stocks with robust potential can be crucial for investors looking to capitalize on emerging opportunities in the sector.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Jonhon Optronic Technology (SZSE:002179)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Jonhon Optronic Technology Co., Ltd. focuses on the research and development of optical, electrical, and fluid connection technologies and equipment in China, with a market cap of CN¥79.87 billion.

Operations: Jonhon Optronic Technology Co., Ltd. specializes in developing technologies for optical, electrical, and fluid connections. The company generates revenue primarily through its advanced connection solutions tailored to various industries in China.

Jonhon Optronic Technology, with its recent name change and strategic shareholder meetings, signals a restructuring phase aimed at enhancing operational efficiencies and market adaptability. Despite a slight underperformance in earnings growth compared to the broader Electronic industry, Jonhon's revenue is expected to grow at an impressive rate of 20.3% annually, outpacing the CN market's 13.4%. The company also reported a modest increase in annual net income to CNY 3.36 billion from CNY 3.34 billion last year, reflecting steady financial health amidst industry challenges. This backdrop of financial resilience combined with proactive corporate actions may position Jonhon favorably for future technological advancements and market demands.

- Click here and access our complete health analysis report to understand the dynamics of Jonhon Optronic Technology.

Learn about Jonhon Optronic Technology's historical performance.

Venustech Group (SZSE:002439)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Venustech Group Inc. is a global provider of network security products, trusted security management platforms, and specialized security services and solutions with a market cap of CN¥18.14 billion.

Operations: Venustech Group generates revenue through its offerings in network security products, security management platforms, and specialized security services. The company operates globally, catering to a diverse client base with its comprehensive cybersecurity solutions.

Despite a challenging fiscal period marked by a net loss of CNY 210.07 million, Venustech Group's strategic focus on innovation and development remains evident. The company's recent earnings report reveals a dip in sales to CNY 2,326.05 million from the previous year; however, it maintains an ambitious annual revenue growth forecast of 14.1%, slightly outpacing the broader CN market's projection of 13.4%. This resilience is underpinned by expected earnings growth at an impressive rate of 33.6% per year, signaling potential recovery and robust future performance despite current setbacks in profitability and market conditions.

- Delve into the full analysis health report here for a deeper understanding of Venustech Group.

Examine Venustech Group's past performance report to understand how it has performed in the past.

Beijing Enlight Media (SZSE:300251)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Enlight Media Co., Ltd. is involved in the investment, production, and distribution of film and television projects in China, with a market cap of CN¥27.77 billion.

Operations: Enlight Media focuses on film and television investment, production, and distribution within China.

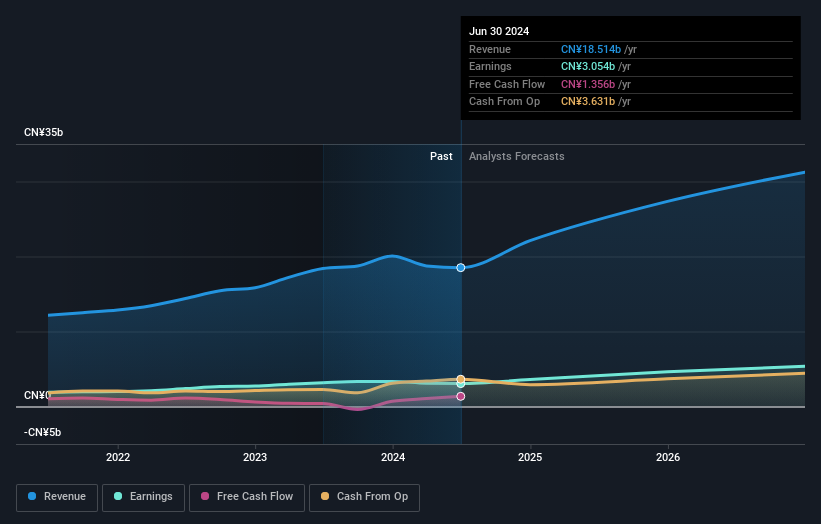

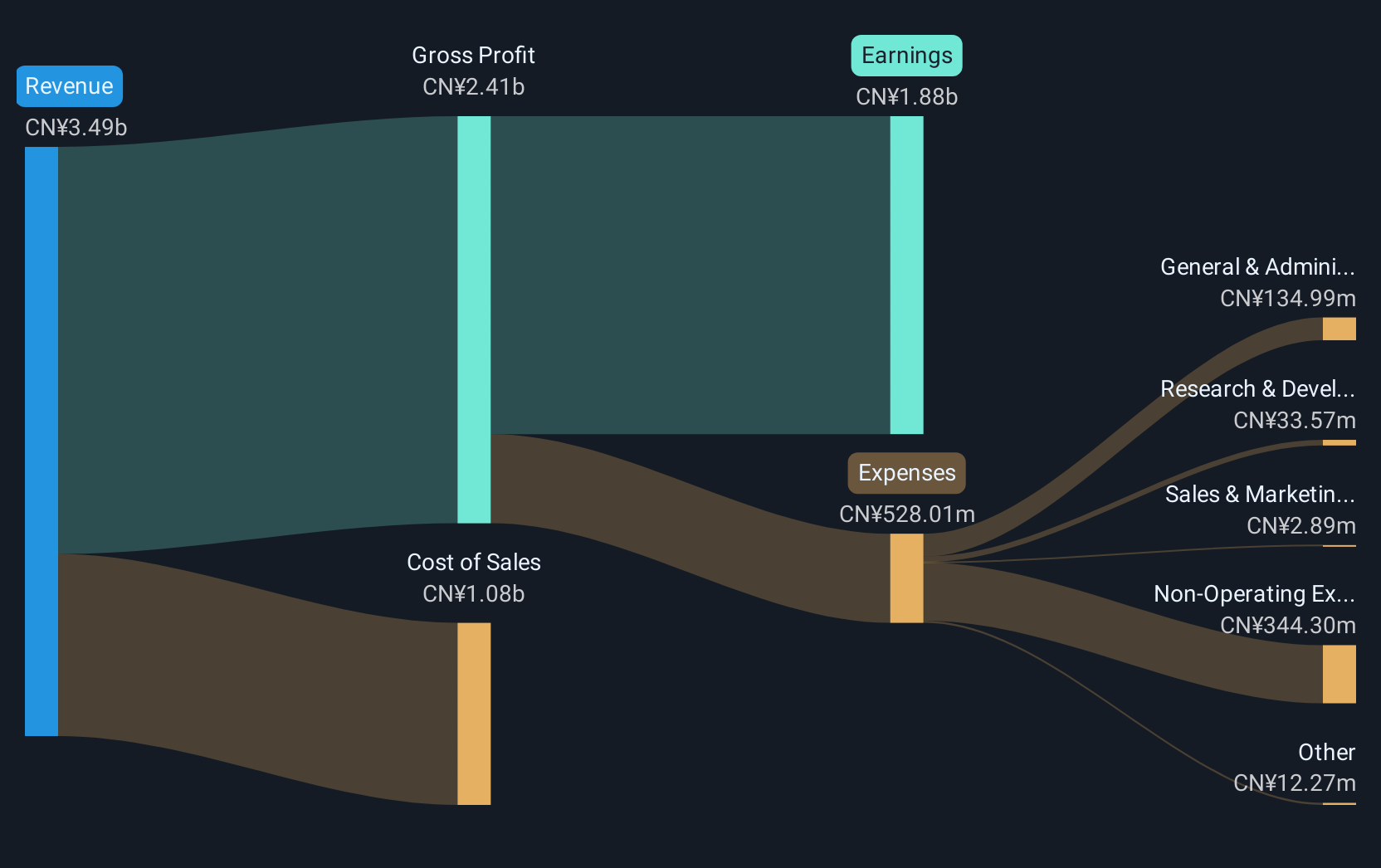

Beijing Enlight Media has demonstrated a robust recovery, with its recent earnings report showing a significant revenue jump to CNY 1.44 billion from CNY 940.08 million year-over-year, alongside an increase in net income to CNY 460.88 million. This growth trajectory is underscored by an annual revenue growth rate of 18.2% and earnings forecasted to surge by 35.3% annually, outpacing the broader Chinese market's expectations of 13.4% and 25.1%, respectively. The company's strategic advancements in content production have not only enhanced its market position but also promise sustained financial health, evidenced by a positive free cash flow and an anticipated modest Return on Equity of about 10%.

- Click here to discover the nuances of Beijing Enlight Media with our detailed analytical health report.

Evaluate Beijing Enlight Media's historical performance by accessing our past performance report.

Turning Ideas Into Actions

- Click here to access our complete index of 1225 High Growth Tech and AI Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Enlight Media might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300251

Beijing Enlight Media

Engages in the investment, production, and distribution of film and television projects in China.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Community Narratives