As global markets navigate a complex landscape of trade policies and economic indicators, small-cap stocks have shown resilience despite facing challenges such as tariffs and inflationary pressures. With the S&P 600 and other smaller-cap indices posting positive returns amidst these conditions, investors may find opportunities in lesser-known stocks that demonstrate strong fundamentals and potential for growth. In this environment, identifying undiscovered gems involves looking for companies with robust financial health, innovative strategies, or unique market positions that can thrive even amid broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mendelson Infrastructures & Industries | 23.11% | 5.81% | 10.57% | ★★★★★★ |

| Nantong Guosheng Intelligence Technology Group | NA | 8.02% | 1.71% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 0.81% | 6.04% | 4.07% | ★★★★★★ |

| Shenzhen Tongye TechnologyLtd | 8.22% | 15.89% | -9.68% | ★★★★★★ |

| Hiconics Eco-energy Technology | NA | 30.59% | 27.60% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 14.55% | 29.05% | ★★★★★☆ |

| Jiangsu Lianfa TextileLtd | 26.67% | 2.17% | -26.08% | ★★★★★☆ |

| Forth Smart Service | 51.94% | -6.63% | -7.91% | ★★★★☆☆ |

| Libra Insurance | 45.82% | 46.39% | 68.41% | ★★★★☆☆ |

| Malam - Team | 89.67% | 12.93% | -2.22% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Nanhua Futures (SHSE:603093)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nanhua Futures Co., Ltd. offers financial services with a focus on the derivatives business and has a market cap of CN¥7.86 billion.

Operations: Nanhua Futures generates revenue primarily through its derivatives-focused financial services. The company's net profit margin has exhibited variability, reflecting changes in cost structures and market conditions.

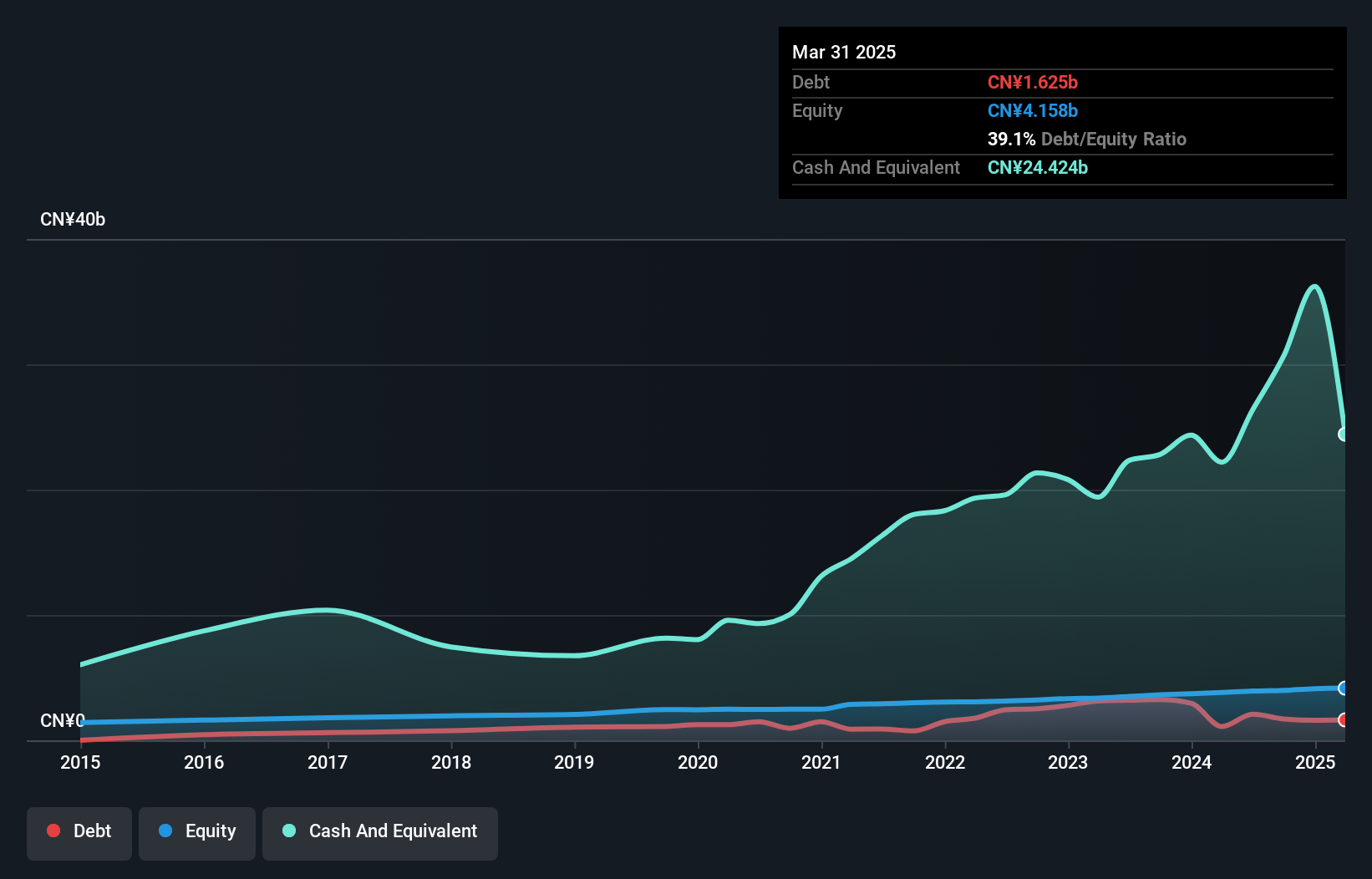

Nanhua Futures, a lesser-known player in the financial sector, demonstrates a strong financial footing with more cash than total debt and a reduced debt-to-equity ratio from 50% to 39.1% over five years. Despite earnings growth of 34.2% annually over the past five years, its recent annual revenue dipped to CNY 5.71 billion from CNY 6.25 billion the previous year, while net income rose to CNY 457.97 million from CNY 401.85 million, indicating resilience in profitability amidst fluctuating revenues. The company's price-to-earnings ratio stands at an attractive 17x compared to the broader CN market's average of nearly double that figure (37x).

- Delve into the full analysis health report here for a deeper understanding of Nanhua Futures.

Assess Nanhua Futures' past performance with our detailed historical performance reports.

Guangzhou Kingteller TechnologyLtd (SZSE:002177)

Simply Wall St Value Rating: ★★★★★★

Overview: Guangzhou Kingteller Technology Co., Ltd. specializes in the research, development, production, sale, and servicing of financial self-service equipment and software both in China and internationally, with a market capitalization of CN¥4.83 billion.

Operations: Kingteller Technology derives its revenue primarily from the sale and servicing of financial self-service equipment and software. The company's cost structure includes expenses related to research, development, production, and sales operations. It is important to note that Kingteller's net profit margin has shown variation over recent periods, reflecting changes in operational efficiency and market conditions.

Kingteller Technology, a nimble player in the tech sector, has shown impressive earnings growth of 17.5% over the past year, outpacing the broader industry’s 8.1%. The company remains debt-free and boasts positive free cash flow, providing a solid financial footing despite recent volatility in its share price. A notable one-off loss of CN¥8M impacted its annual results; however, profitability isn't a concern. Recent dividends were modest at CNY 0.01 per 10 shares for 2024 and CNY 0.02 for Q1 2025, reflecting cautious distribution amid steady net income growth from CN¥5M to CN¥6M year-over-year.

Lianhe Chemical TechnologyLtd (SZSE:002250)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lianhe Chemical Technology Co., Ltd. is involved in the production and sale of chemical products in China, with a market capitalization of CN¥8.27 billion.

Operations: Lianhe Chemical Technology Co., Ltd. generates revenue primarily from the production and sale of chemical products in China. The company's financial performance includes a notable net profit margin, which has shown variability across reporting periods.

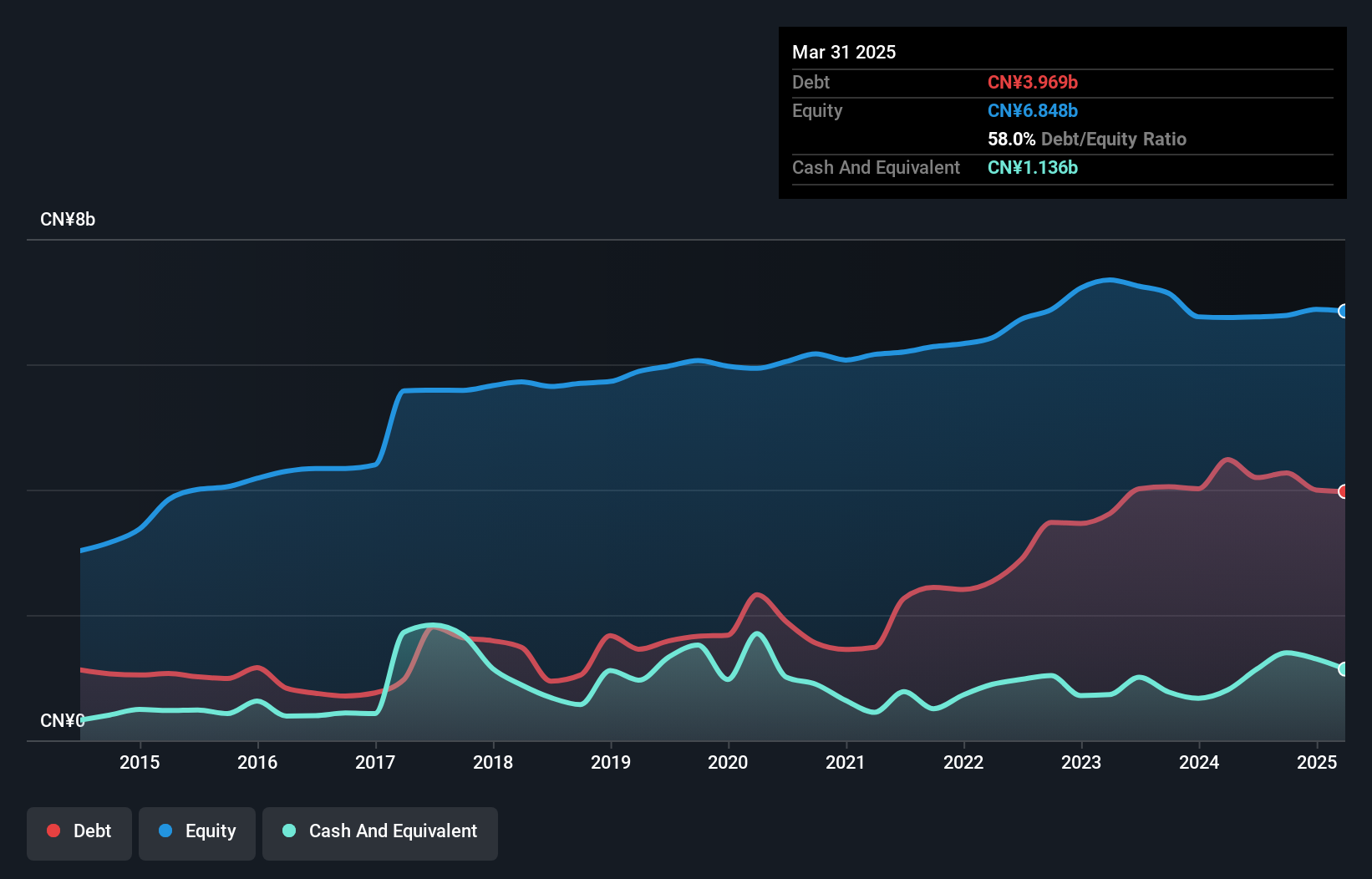

Lianhe Chemical Technology Ltd. has shown notable improvements, particularly in profitability, with net income soaring to CNY 49.72 million for Q1 2025 from just CNY 2.69 million a year prior. The company is trading at a substantial discount of 84% below its estimated fair value, suggesting potential undervaluation. Despite an increase in debt to equity from 39.2% to 58% over five years, interest payments are well covered by EBIT at 3.6 times coverage, reflecting manageable financial obligations. Recently, Lianhe completed a share buyback of approximately CNY 80 million for over eleven million shares, indicating confidence in its valuation and future prospects.

Where To Now?

- Click this link to deep-dive into the 3171 companies within our Global Undiscovered Gems With Strong Fundamentals screener.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002250

Lianhe Chemical TechnologyLtd

Engages in the production and sale of chemical products in China.

Excellent balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives