- China

- /

- Electrical

- /

- SZSE:002606

None Highlights These 3 Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

In the midst of a volatile global market landscape, characterized by geopolitical tensions and consumer spending concerns, small-cap stocks have faced challenges as reflected in the declines of indices such as the S&P MidCap 400 and Russell 2000. Despite these headwinds, this environment can present opportunities for discerning investors to identify promising stocks that may not yet be widely recognized. In such conditions, a good stock often demonstrates resilience through strong fundamentals and growth potential that can weather economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Analyst I.M.S. Investment Management Services | NA | 20.75% | 18.12% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Isracard | 69.54% | 9.35% | 3.37% | ★★★★★☆ |

| Polyram Plastic Industries | 45.46% | 11.39% | 10.98% | ★★★★★☆ |

| Malam - Team | 102.85% | 10.82% | -10.47% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Beijing BDStar Navigation (SZSE:002151)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing BDStar Navigation Co., Ltd. is a global provider of chips, data services, navigation products, and ceramic components with a market cap of CN¥14.48 billion.

Operations: BDStar Navigation generates revenue primarily from its chips, data services, navigation products, and ceramic components. The company's net profit margin has shown fluctuations over recent periods.

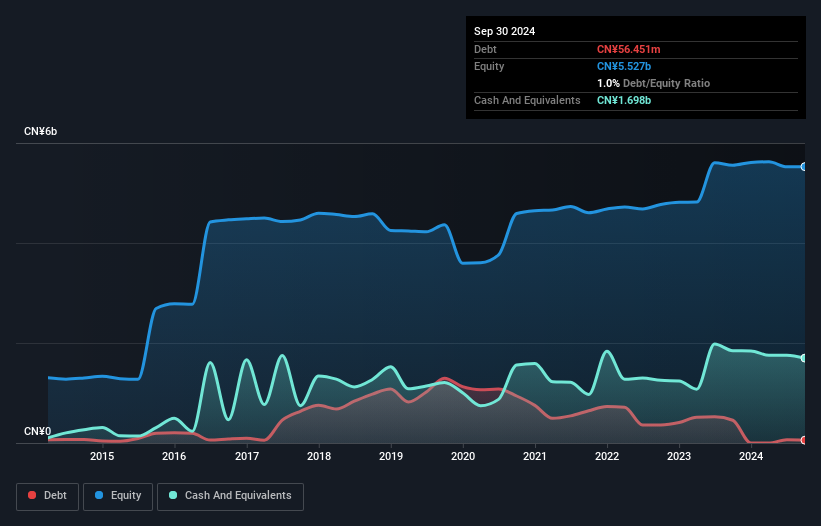

BDStar Navigation, a smaller player in the tech landscape, has shown robust earnings growth of 38% over the past year, outpacing the broader communications industry which saw a -3% shift. Despite a significant one-off loss of CN¥22M impacting recent financials, its debt-to-equity ratio impressively dropped from 29.6% to just 1% over five years. The company holds more cash than total debt, indicating financial stability despite not being free cash flow positive. Recent shareholder meetings suggest strategic shifts with capital increases and guarantees for subsidiaries, hinting at potential expansion or restructuring efforts in the near future.

Dalian Insulator Group (SZSE:002606)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Dalian Insulator Group Co., Ltd, along with its subsidiaries, focuses on the research, development, manufacture, and sale of porcelain insulators both in China and internationally, with a market cap of CN¥4.34 billion.

Operations: Dalian Insulator Group generates revenue primarily from the sale of porcelain insulators. The company has a market cap of CN¥4.34 billion.

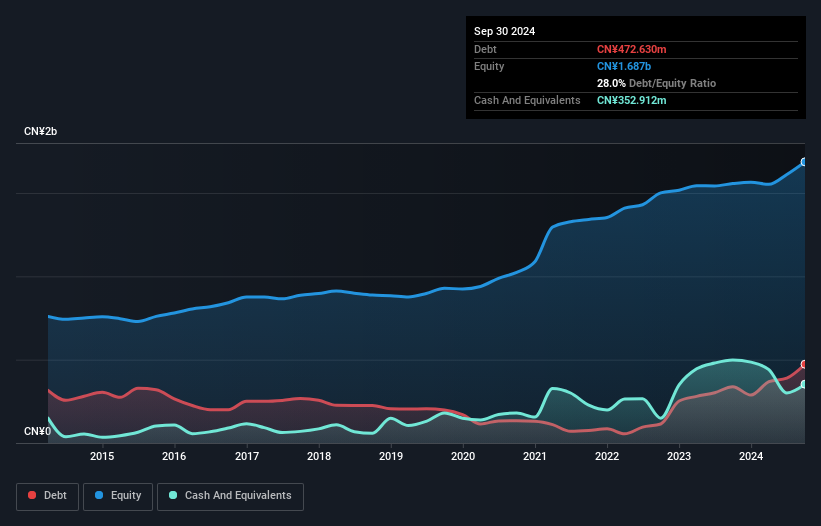

Dalian Insulator Group, a smaller player in the electrical industry, has seen its earnings skyrocket by 235% over the past year, outpacing the industry's modest 1.3% growth. The firm's net debt to equity ratio stands at a satisfactory 7.1%, suggesting prudent financial management despite an increase from 21.3% to 28% over five years. With a price-to-earnings ratio of 25.6x below the CN market average of 37.9x, it appears attractively valued for potential investors looking for growth prospects, especially with earnings forecasted to grow by another impressive rate of about 33% annually in future years.

Qingdao Gon Technology (SZSE:002768)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Qingdao Gon Technology Co., Ltd. focuses on the research, development, production, and sale of modified plastic particles and functional plastic plates both in China and internationally, with a market cap of CN¥6.32 billion.

Operations: Qingdao Gon Technology generates revenue primarily through the sale of modified plastic particles and functional plastic plates. The company's net profit margin has shown notable fluctuations, with recent figures indicating a shift in profitability dynamics.

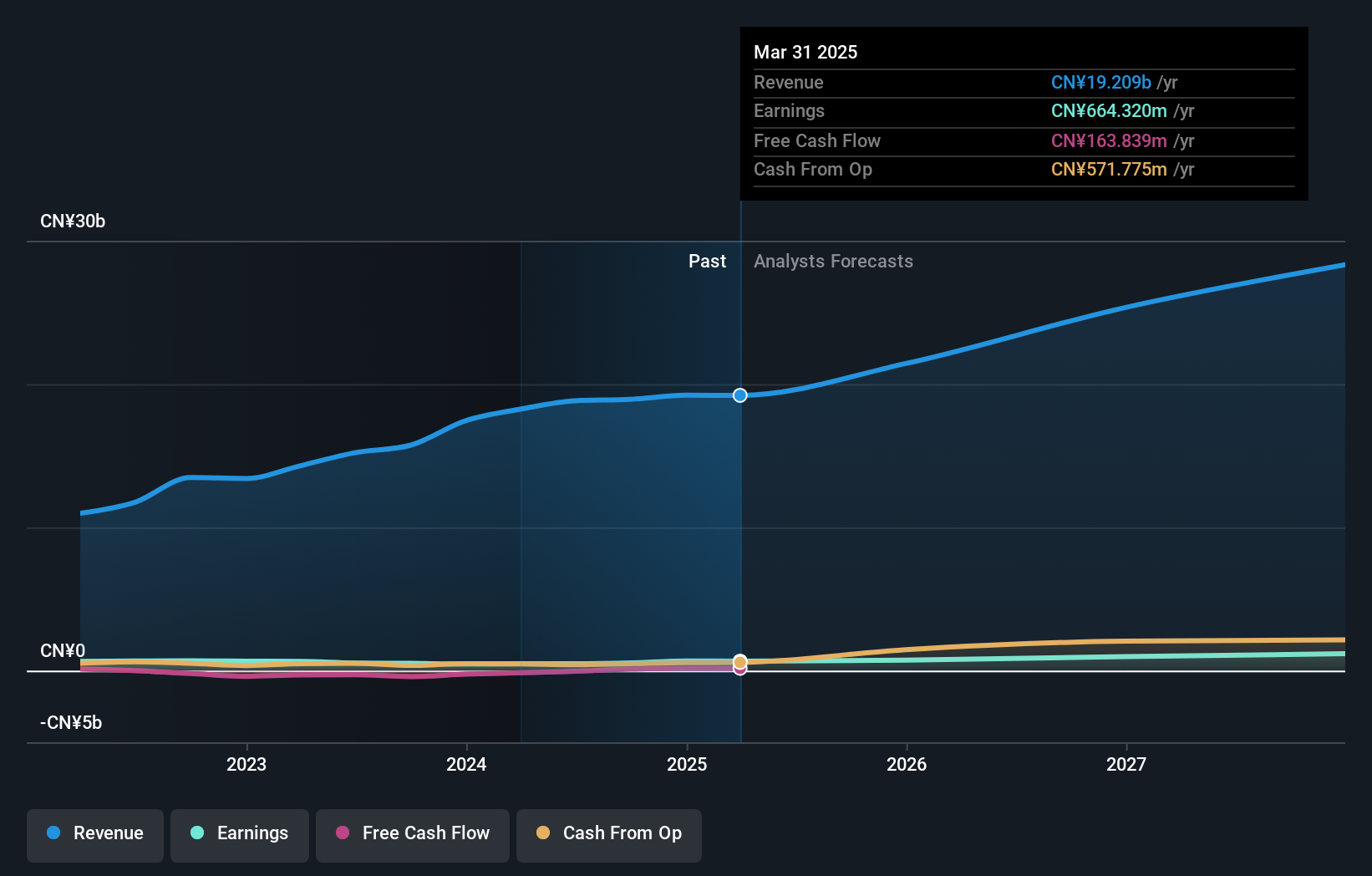

Qingdao Gon Technology shines with its high-quality earnings and a solid financial position. The company's earnings grew by 7.9% last year, outpacing the chemicals industry, which saw a -5.4% performance. Its price-to-earnings ratio of 11.6x is notably lower than the CN market average of 37.9x, suggesting good value relative to peers. Qingdao Gon's debt to equity ratio has risen from 36.7% to 71.8% over five years but remains manageable with interest payments well covered by EBIT at seven times coverage, indicating financial stability amidst growth prospects forecasted at an impressive annual rate of 29.56%.

- Click here and access our complete health analysis report to understand the dynamics of Qingdao Gon Technology.

Learn about Qingdao Gon Technology's historical performance.

Turning Ideas Into Actions

- Reveal the 4754 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002606

Dalian Insulator Group

Engages in the research, development, manufacture, and sale of porcelain insulators in China and internationally.

High growth potential with proven track record.

Market Insights

Community Narratives