- China

- /

- Electronic Equipment and Components

- /

- SZSE:001389

Undervalued Global Stocks Estimated Below Intrinsic Value In May 2025

Reviewed by Simply Wall St

As global markets show signs of easing trade tensions and a mixed economic landscape, investors are keenly observing opportunities amid fluctuating indices. With U.S. equities rebounding and European stocks gaining ground, the focus shifts to identifying undervalued stocks that may be trading below their intrinsic value. In such an environment, a good stock is often characterized by strong fundamentals and resilience in the face of economic uncertainties, making it a potential candidate for those seeking value investments amidst current market conditions.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Maire (BIT:MAIRE) | €9.50 | €18.76 | 49.4% |

| Pegasus (TSE:6262) | ¥465.00 | ¥918.01 | 49.3% |

| Bethel Automotive Safety Systems (SHSE:603596) | CN¥57.62 | CN¥114.61 | 49.7% |

| LPP (WSE:LPP) | PLN15400.00 | PLN30331.05 | 49.2% |

| Stille (OM:STIL) | SEK186.00 | SEK368.43 | 49.5% |

| World Fitness Services (TWSE:2762) | NT$82.40 | NT$163.77 | 49.7% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.50 | CN¥20.76 | 49.4% |

| China Ruyi Holdings (SEHK:136) | HK$2.04 | HK$4.06 | 49.8% |

| Expert.ai (BIT:EXAI) | €1.31 | €2.58 | 49.3% |

| Bactiguard Holding (OM:BACTI B) | SEK31.70 | SEK62.33 | 49.1% |

Here's a peek at a few of the choices from the screener.

Emaar Development PJSC (DFM:EMAARDEV)

Overview: Emaar Development PJSC, along with its subsidiaries, focuses on developing and selling residential and commercial build-to-sell properties in the United Arab Emirates, with a market capitalization of AED52.80 billion.

Operations: The company generates revenue of AED19.15 billion from its real estate development business in the United Arab Emirates.

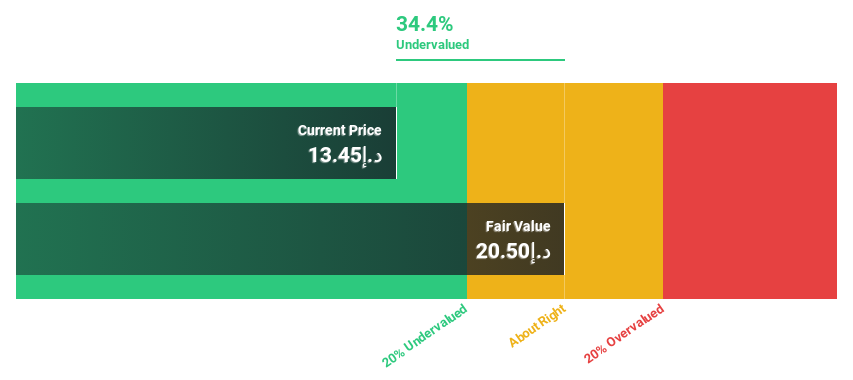

Estimated Discount To Fair Value: 35.5%

Emaar Development PJSC is trading at AED13.2, significantly below its estimated fair value of AED20.47, suggesting it may be undervalued based on cash flows. The company reported robust growth with sales reaching AED19.15 billion and net income at AED7.63 billion for 2024, reflecting strong revenue growth forecasts of 20.4% annually, outpacing the market's 7%. Despite an unstable dividend track record, its earnings are expected to grow faster than the market average.

- In light of our recent growth report, it seems possible that Emaar Development PJSC's financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Emaar Development PJSC.

Delton Technology (Guangzhou) (SZSE:001389)

Overview: Delton Technology (Guangzhou) Inc. is engaged in the research, development, production, and sale of printed circuit boards both in China and internationally, with a market cap of CN¥20.40 billion.

Operations: The company's revenue segments include the research, development, production, and sale of printed circuit boards both domestically and internationally.

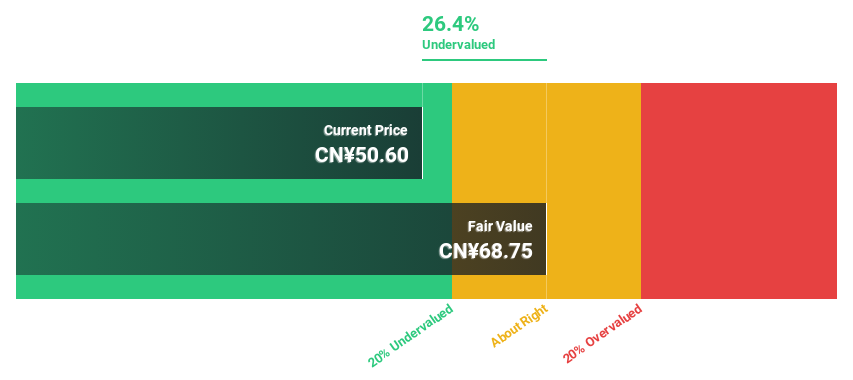

Estimated Discount To Fair Value: 31.4%

Delton Technology (Guangzhou) Inc. is trading at CN¥47.98, which is 31.4% below its estimated fair value of CN¥69.94, highlighting potential undervaluation based on cash flows. The company reported strong revenue growth with sales reaching CNY 1.12 billion in Q1 2025, up from CNY 784.36 million a year ago, and net income increasing to CNY 240.37 million from CNY 145.09 million, despite non-cash earnings impacting quality assessments.

- The growth report we've compiled suggests that Delton Technology (Guangzhou)'s future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of Delton Technology (Guangzhou).

DTS (TSE:9682)

Overview: DTS Corporation offers systems integration services in Japan and has a market capitalization of ¥165.02 billion.

Operations: The company's revenue segments include systems integration services in Japan.

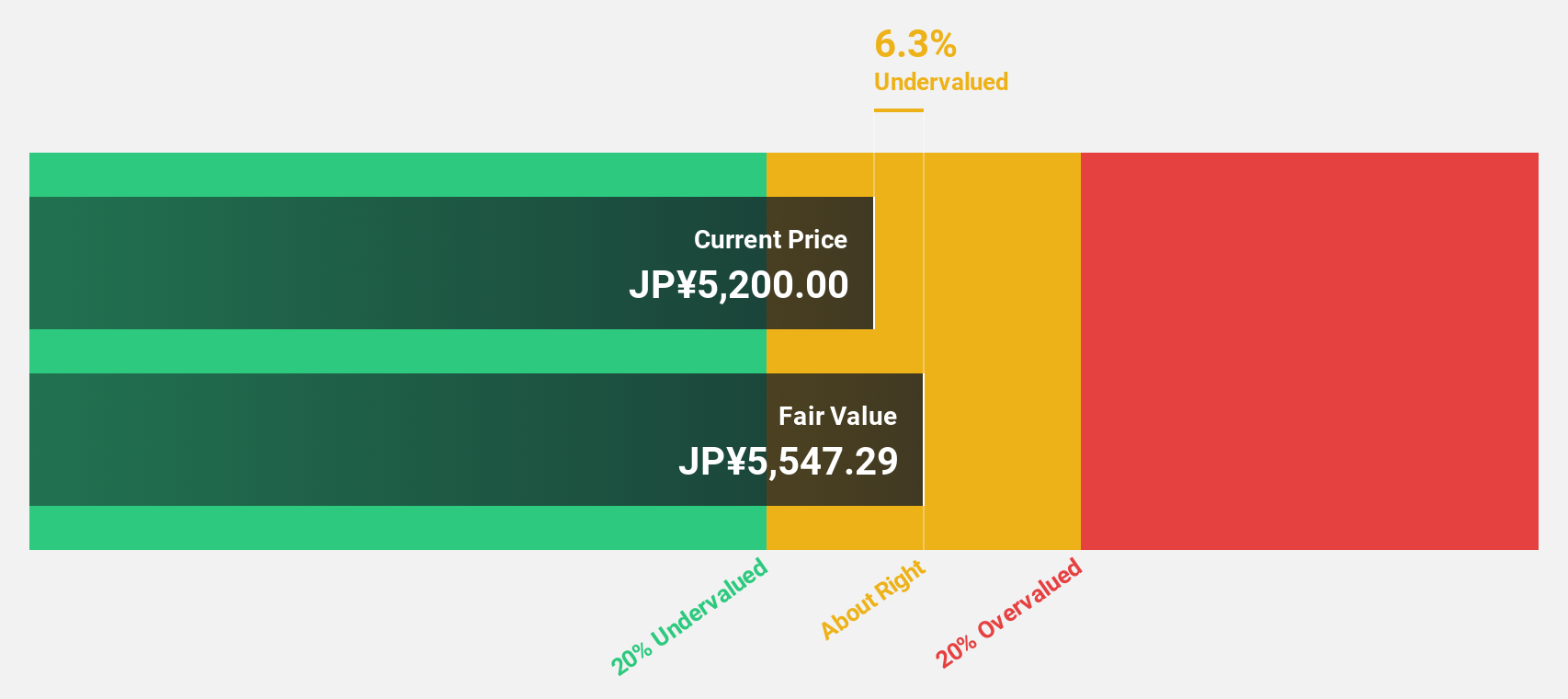

Estimated Discount To Fair Value: 10.2%

DTS Corporation is trading at ¥4,565, slightly below its estimated fair value of ¥5,085.79. Despite slower forecasted earnings growth compared to the market, DTS has implemented a share buyback program worth ¥2.5 billion to enhance shareholder returns and capital efficiency. The company is reorganizing for strategic growth in generative AI and sustainability sectors while maintaining a stable revenue forecast above the JP market average at 6.7% annually.

- Upon reviewing our latest growth report, DTS' projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of DTS stock in this financial health report.

Taking Advantage

- Click here to access our complete index of 463 Undervalued Global Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Delton Technology (Guangzhou), open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:001389

Delton Technology (Guangzhou)

Researches and develops, produces, and sells printed circuit boards in China and internationally.

Undervalued with high growth potential.

Market Insights

Community Narratives