- China

- /

- Electronic Equipment and Components

- /

- SZSE:000925

Here's Why UniTTECLtd (SZSE:000925) Has A Meaningful Debt Burden

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that UniTTEC Co.,Ltd (SZSE:000925) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. If things get really bad, the lenders can take control of the business. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first thing to do when considering how much debt a business uses is to look at its cash and debt together.

View our latest analysis for UniTTECLtd

What Is UniTTECLtd's Net Debt?

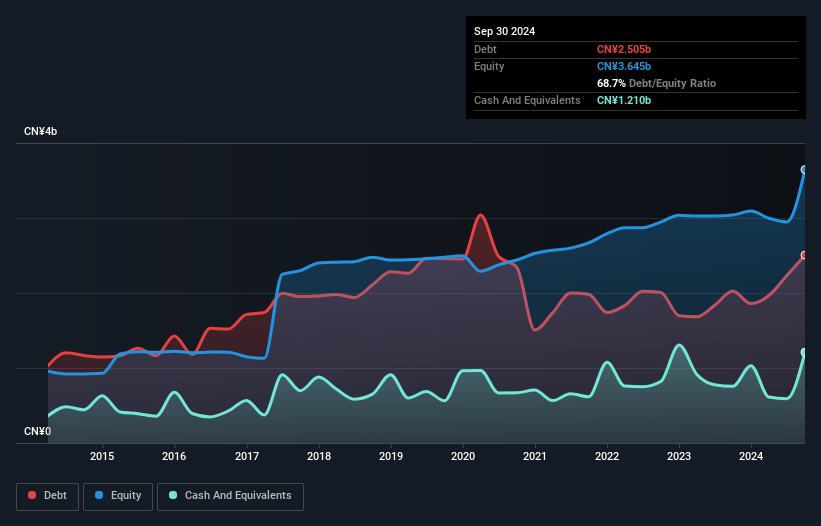

You can click the graphic below for the historical numbers, but it shows that as of September 2024 UniTTECLtd had CN¥2.50b of debt, an increase on CN¥2.03b, over one year. However, it also had CN¥1.21b in cash, and so its net debt is CN¥1.29b.

How Strong Is UniTTECLtd's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that UniTTECLtd had liabilities of CN¥3.37b due within 12 months and liabilities of CN¥1.28b due beyond that. On the other hand, it had cash of CN¥1.21b and CN¥2.44b worth of receivables due within a year. So it has liabilities totalling CN¥1.0b more than its cash and near-term receivables, combined.

Given UniTTECLtd has a market capitalization of CN¥5.39b, it's hard to believe these liabilities pose much threat. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

UniTTECLtd shareholders face the double whammy of a high net debt to EBITDA ratio (5.1), and fairly weak interest coverage, since EBIT is just 1.6 times the interest expense. This means we'd consider it to have a heavy debt load. One redeeming factor for UniTTECLtd is that it turned last year's EBIT loss into a gain of CN¥134m, over the last twelve months. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately the future profitability of the business will decide if UniTTECLtd can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So it's worth checking how much of the earnings before interest and tax (EBIT) is backed by free cash flow. Over the last year, UniTTECLtd saw substantial negative free cash flow, in total. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

On the face of it, UniTTECLtd's interest cover left us tentative about the stock, and its conversion of EBIT to free cash flow was no more enticing than the one empty restaurant on the busiest night of the year. Having said that, its ability to handle its total liabilities isn't such a worry. Looking at the bigger picture, it seems clear to us that UniTTECLtd's use of debt is creating risks for the company. If everything goes well that may pay off but the downside of this debt is a greater risk of permanent losses. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. For example, we've discovered 1 warning sign for UniTTECLtd that you should be aware of before investing here.

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:000925

UniTTECLtd

Provides integrated solutions in the areas of rail transit, digitalization, semiconductors, and environmental protection in China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026