- China

- /

- Electronic Equipment and Components

- /

- SZSE:300515

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets experience a surge in optimism due to hopes for softer tariffs and enthusiasm surrounding artificial intelligence, major indices like the S&P 500 have reached record highs, while growth stocks are outperforming value shares. In this dynamic environment, identifying high-growth tech stocks involves looking for companies with strong exposure to AI advancements and robust potential to capitalize on increased spending in tech infrastructure.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Pharma Mar | 25.50% | 55.11% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.37% | 56.70% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Travere Therapeutics | 30.46% | 62.05% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1228 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Guangzhou Fangbang ElectronicsLtd (SHSE:688020)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Guangzhou Fangbang Electronics Co., Ltd is involved in the research, development, production, sale, and service of electronic materials in China with a market capitalization of CN¥2.64 billion.

Operations: The company focuses on the electronic materials sector, leveraging its capabilities in research and development, production, sales, and service. It operates primarily within China and holds a market capitalization of approximately CN¥2.64 billion.

Guangzhou Fangbang ElectronicsLtd, amidst a transformative phase, is poised for significant growth with projected annual revenue increases of 60.9%, outpacing the Chinese market's average of 13.3%. Despite current unprofitability, the company's earnings could surge by an impressive 237.8% annually over the next three years. This forecasted leap into profitability and robust revenue acceleration highlight its potential in a competitive electronics sector. The recent shareholders' meeting underscores strategic initiatives likely to propel future growth, aligning with industry trends towards higher efficiency and market responsiveness.

Shaanxi Fenghuo Electronics (SZSE:000561)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shaanxi Fenghuo Electronics Co., Ltd. is involved in the research, production, and sale of communications and electroacoustic equipment in China, with a market cap of CN¥4.64 billion.

Operations: Fenghuo Electronics generates revenue primarily from its communications and electroacoustic equipment segments. The company focuses on research, production, and sales within China.

Shaanxi Fenghuo Electronics, amidst evolving market dynamics, is strategically positioning itself for robust growth. With a projected annual revenue increase of 24.5%, it outstrips the Chinese market's average of 13.3%. Despite a challenging past marked by a significant earnings drop of 81.7% last year, future earnings are expected to surge by an impressive 44% annually over the next three years. The recent special shareholders' meeting and audit firm changes underscore proactive governance adjustments aimed at enhancing operational efficiencies and stakeholder confidence in its strategic direction. Additionally, the company has actively repurchased shares worth CNY 4.95 million, signaling strong belief in its intrinsic value and commitment to shareholder returns.

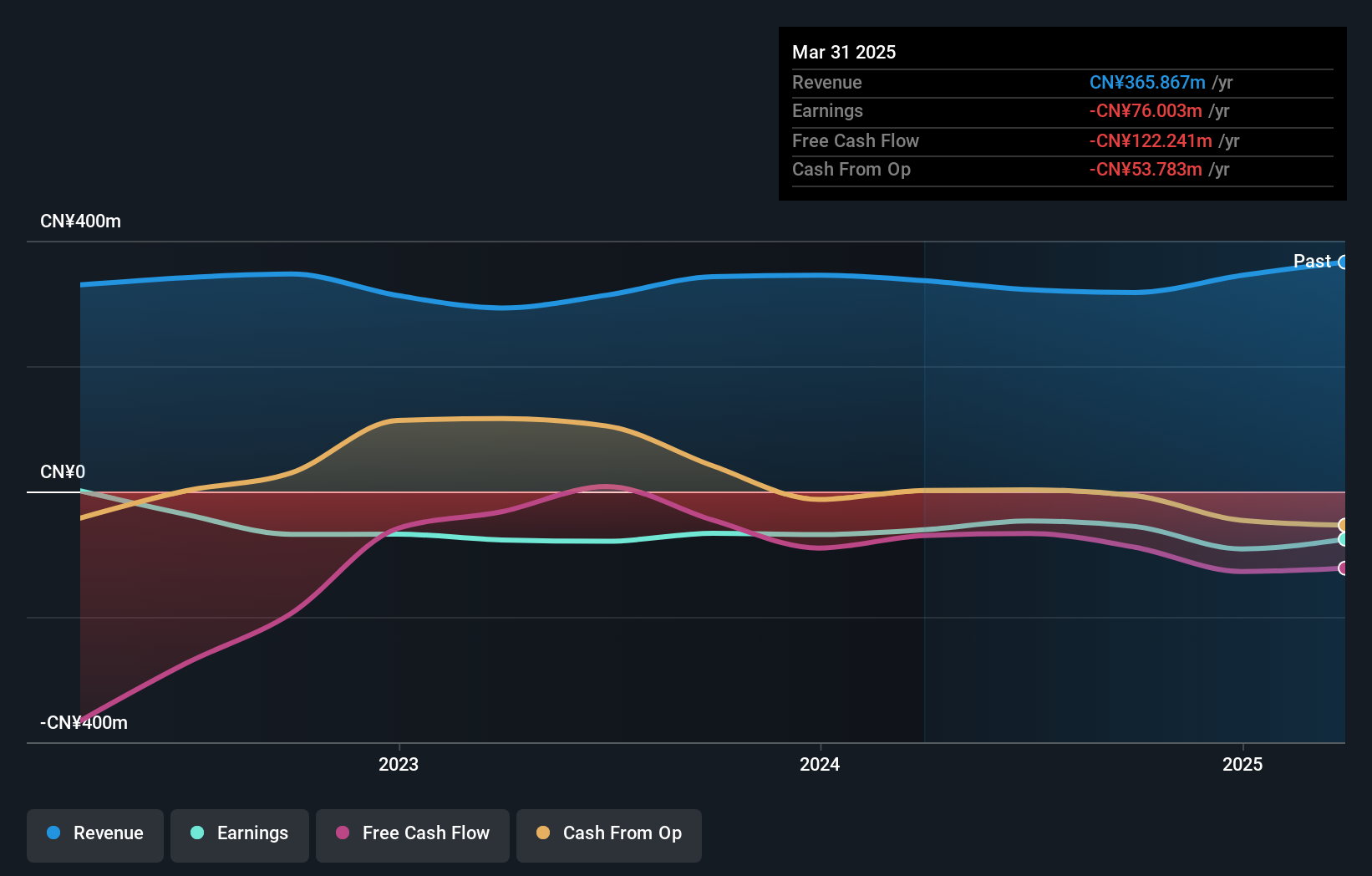

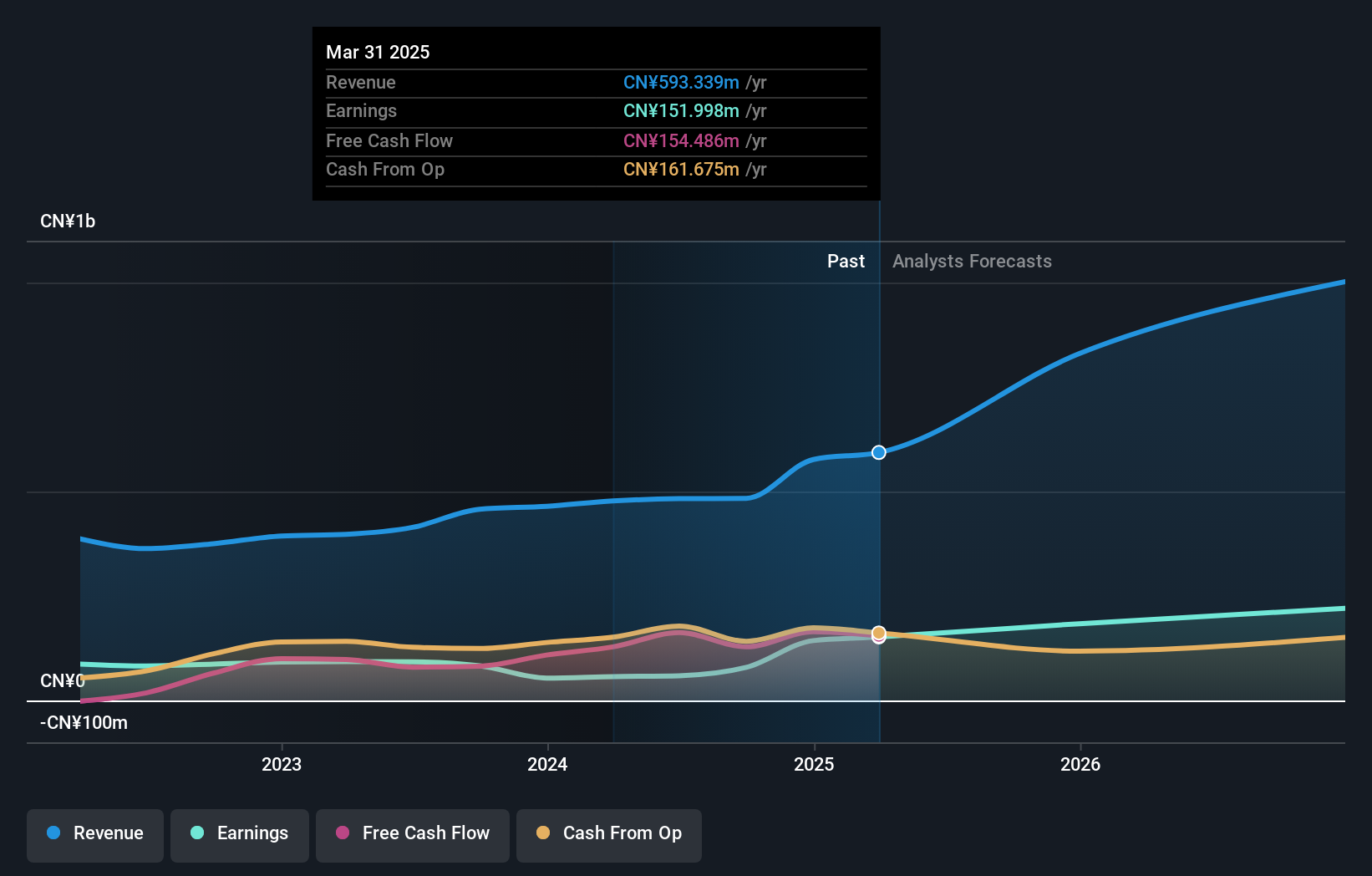

Hunan Sundy Science and Technology (SZSE:300515)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Sundy Science and Technology Co., Ltd provides coal analysis solutions both domestically in the People’s Republic of China and internationally, with a market capitalization of CN¥2.95 billion.

Operations: Sundy Science and Technology focuses on the instrumentation industry, generating revenue of CN¥483.69 million from coal analysis solutions.

Hunan Sundy Science and Technology is navigating through a transformative phase, marked by significant governance changes and strategic directorial appointments, as evidenced in their recent extraordinary general meeting. With an impressive forecasted annual revenue growth of 28%, the company is outpacing the Chinese market average of 13.3%. Furthermore, its earnings are expected to surge by 34.3% annually, reflecting robust financial health and operational efficiency. These figures underscore Hunan Sundy's potential in leveraging technological advancements to sustain high growth trajectory amidst a volatile market environment.

- Take a closer look at Hunan Sundy Science and Technology's potential here in our health report.

Learn about Hunan Sundy Science and Technology's historical performance.

Seize The Opportunity

- Delve into our full catalog of 1228 High Growth Tech and AI Stocks here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hunan Sundy Science and Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300515

Hunan Sundy Science and Technology

Supplies coal analysis solutions in the People’s Republic of China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives