- China

- /

- Tech Hardware

- /

- SZSE:000066

China Greatwall Technology Group Co., Ltd.'s (SZSE:000066) Subdued P/S Might Signal An Opportunity

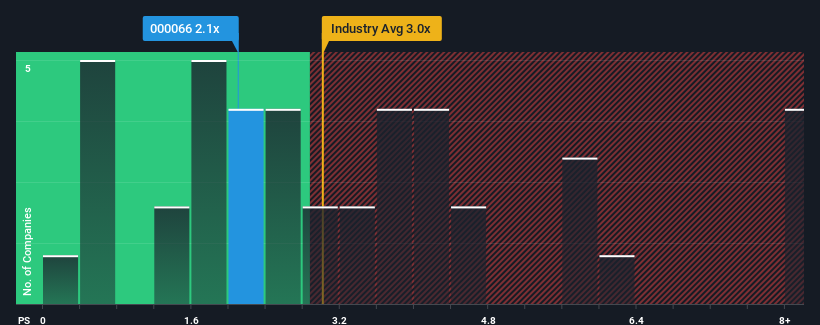

China Greatwall Technology Group Co., Ltd.'s (SZSE:000066) price-to-sales (or "P/S") ratio of 2.1x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Tech industry in China have P/S ratios greater than 3x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for China Greatwall Technology Group

How Has China Greatwall Technology Group Performed Recently?

With revenue growth that's inferior to most other companies of late, China Greatwall Technology Group has been relatively sluggish. It seems that many are expecting the uninspiring revenue performance to persist, which has repressed the growth of the P/S ratio. If you still like the company, you'd be hoping revenue doesn't get any worse and that you could pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on China Greatwall Technology Group will help you uncover what's on the horizon.How Is China Greatwall Technology Group's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like China Greatwall Technology Group's to be considered reasonable.

If we review the last year of revenue growth, the company posted a worthy increase of 3.6%. However, this wasn't enough as the latest three year period has seen an unpleasant 16% overall drop in revenue. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 23% as estimated by the three analysts watching the company. With the industry only predicted to deliver 19%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that China Greatwall Technology Group's P/S sits behind most of its industry peers. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

The Bottom Line On China Greatwall Technology Group's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

To us, it seems China Greatwall Technology Group currently trades on a significantly depressed P/S given its forecasted revenue growth is higher than the rest of its industry. The reason for this depressed P/S could potentially be found in the risks the market is pricing in. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for China Greatwall Technology Group that you should be aware of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000066

China Greatwall Technology Group

China Greatwall Technology Group Co., Ltd.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives