- China

- /

- Electronic Equipment and Components

- /

- SHSE:688665

3 Elite Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

In a week marked by cautious earnings reports and economic uncertainties, global markets experienced significant volatility, with major U.S. indices like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating sharply. Amidst this backdrop, growth stocks have generally underperformed compared to value shares, highlighting the importance of insider ownership as a potential indicator of confidence in a company's long-term prospects. In such an environment, companies with high insider ownership can be particularly appealing as they often suggest alignment between management and shareholder interests, which may be crucial when navigating uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 49.1% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 14.8% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Here we highlight a subset of our preferred stocks from the screener.

Aether Industries (NSEI:AETHER)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aether Industries Limited is engaged in the production and sale of advanced intermediates and specialty chemicals both in India and internationally, with a market cap of ₹114.15 billion.

Operations: The company's revenue segments comprise ₹1.46 billion from Contract Manufacturing, ₹4.10 billion from Large Scale Manufacturing, and ₹881.27 million from Contract Research and Manufacturing Services (CRAMS).

Insider Ownership: 31.1%

Revenue Growth Forecast: 35.2% p.a.

Aether Industries demonstrates strong growth potential with forecasted revenue and earnings growth rates of 35.2% and 44.8% per year, respectively, outpacing the Indian market averages. Despite a recent decline in profit margins to 12.4%, insider ownership remains significant, reflecting management's confidence in the company's trajectory. Recent earnings reports show increased sales but slightly decreased net income compared to last year, while a new manufacturing agreement with Seqens highlights strategic expansion efforts.

- Click here to discover the nuances of Aether Industries with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of Aether Industries shares in the market.

Cubic Sensor and InstrumentLtd (SHSE:688665)

Simply Wall St Growth Rating: ★★★★★★

Overview: Cubic Sensor and Instrument Co., Ltd. specializes in manufacturing gas sensors and sensor solutions in China, with a market cap of CN¥3.26 billion.

Operations: Cubic Sensor and Instrument Co., Ltd. generates revenue from the production of gas sensors and sensor solutions within China.

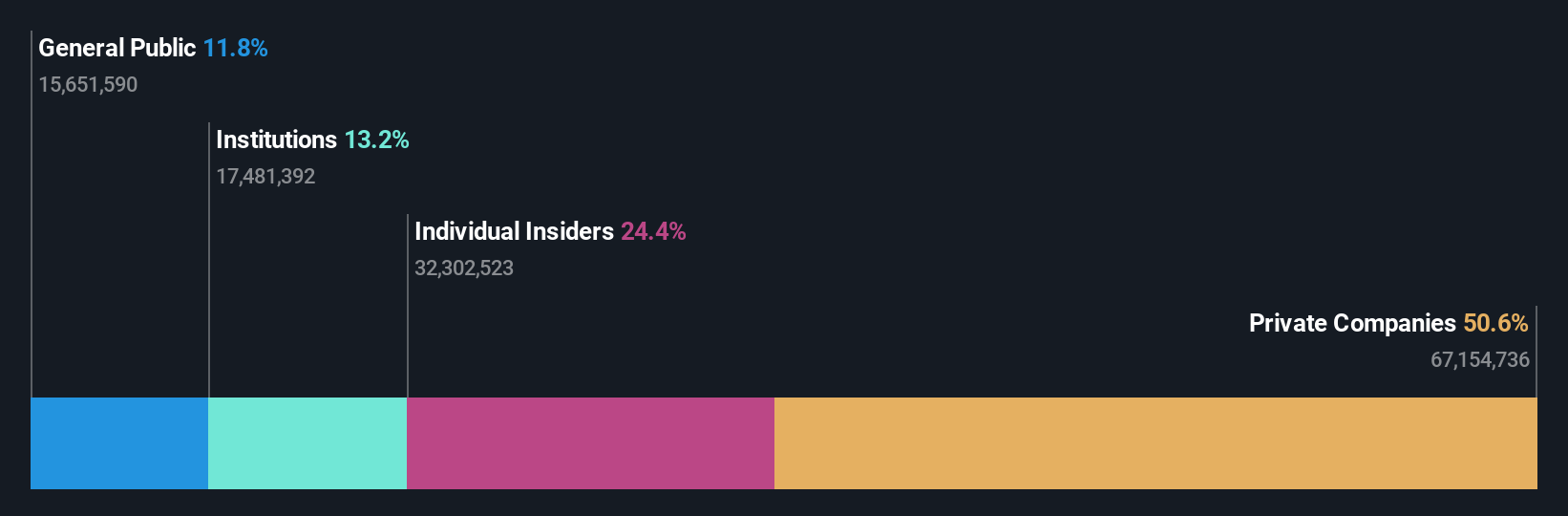

Insider Ownership: 10.1%

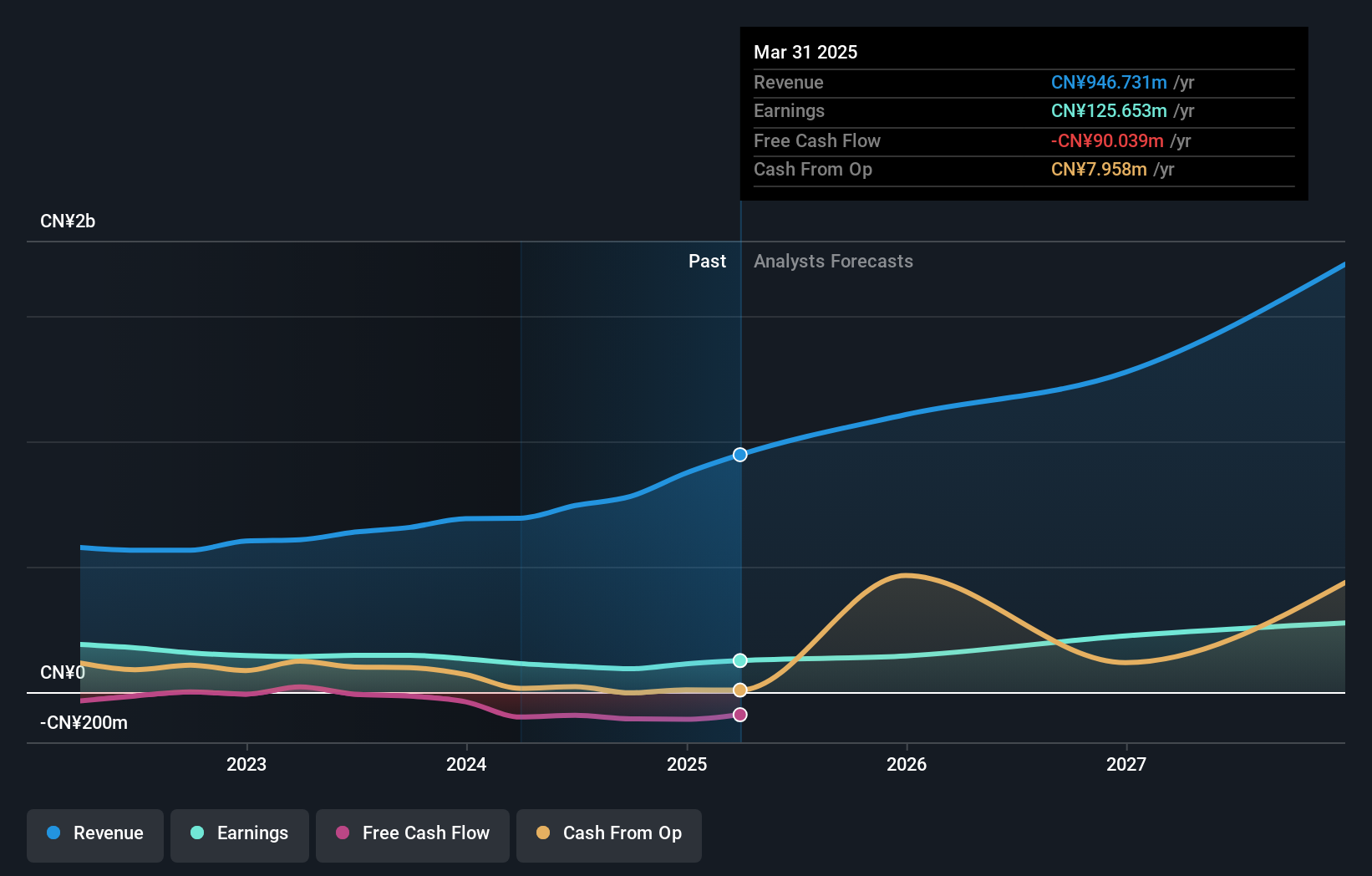

Revenue Growth Forecast: 25.8% p.a.

Cubic Sensor and Instrument Ltd. shows promising growth potential with forecasted earnings growth of 42.9% annually, surpassing the Chinese market average of 26.3%. Despite a decrease in net income from CNY 101.28 million to CNY 61.56 million over nine months, revenue increased to CNY 540.44 million from CNY 451.91 million year-over-year, indicating robust sales performance amidst lower profit margins and high insider ownership supporting strategic direction confidence.

- Get an in-depth perspective on Cubic Sensor and InstrumentLtd's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Cubic Sensor and InstrumentLtd's shares may be trading at a discount.

Wondershare Technology Group (SZSE:300624)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Wondershare Technology Group Co., Ltd. develops application software products both in China and internationally, with a market cap of approximately CN¥11.90 billion.

Operations: Wondershare Technology Group Co., Ltd. generates revenue through its development of application software products across various international and domestic markets.

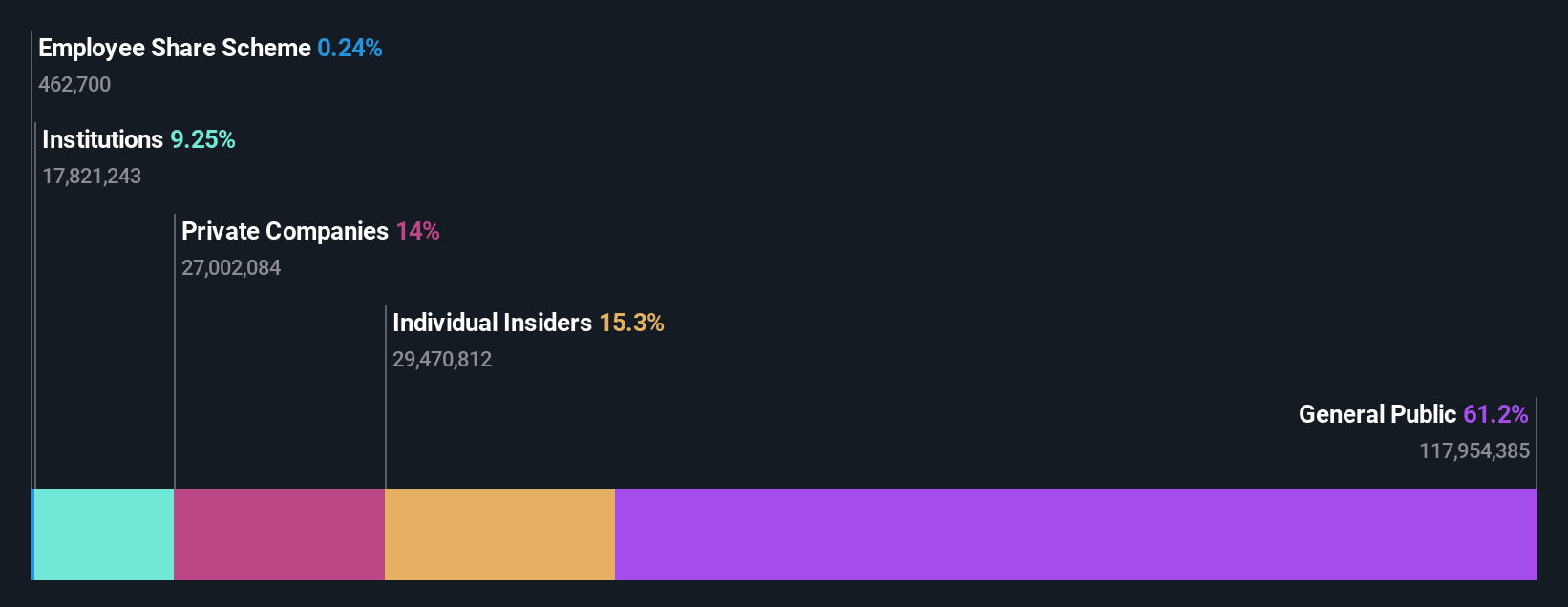

Insider Ownership: 15.2%

Revenue Growth Forecast: 16.2% p.a.

Wondershare Technology Group demonstrates growth potential with forecasted earnings growth of 74.5% annually, outpacing the Chinese market average. However, recent financials show a net loss of CNY 5.5 million for the nine months ending September 2024, compared to a net income of CNY 64.85 million last year, reflecting challenges in profitability despite stable revenue. The launch of SelfyzAI 3.0 and other product innovations highlight its commitment to technological advancement amidst high insider ownership supporting strategic initiatives.

- Navigate through the intricacies of Wondershare Technology Group with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, Wondershare Technology Group's share price might be too optimistic.

Taking Advantage

- Take a closer look at our Fast Growing Companies With High Insider Ownership list of 1531 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688665

Cubic Sensor and InstrumentLtd

Engages in the development, production, and sale of gas sensors and sensor solutions in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives