- China

- /

- Tech Hardware

- /

- SHSE:688636

After Leaping 29% Chengdu Zhimingda Electronics Co., Ltd. (SHSE:688636) Shares Are Not Flying Under The Radar

Chengdu Zhimingda Electronics Co., Ltd. (SHSE:688636) shares have had a really impressive month, gaining 29% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 27% in the last twelve months.

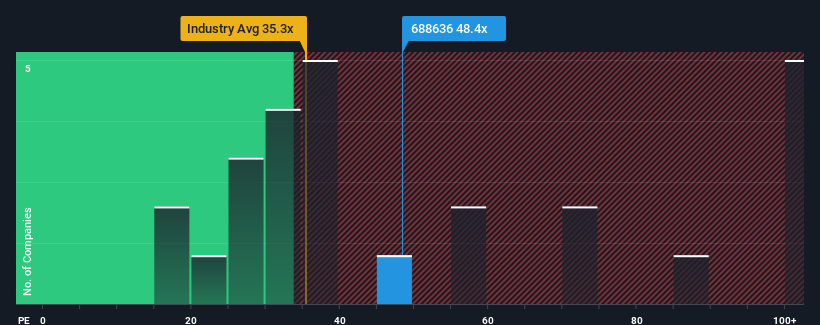

After such a large jump in price, Chengdu Zhimingda Electronics may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 48.4x, since almost half of all companies in China have P/E ratios under 29x and even P/E's lower than 18x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

With earnings that are retreating more than the market's of late, Chengdu Zhimingda Electronics has been very sluggish. One possibility is that the P/E is high because investors think the company will turn things around completely and accelerate past most others in the market. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Chengdu Zhimingda Electronics

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Chengdu Zhimingda Electronics would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 61% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 53% per annum as estimated by the two analysts watching the company. That's shaping up to be materially higher than the 19% per annum growth forecast for the broader market.

With this information, we can see why Chengdu Zhimingda Electronics is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What We Can Learn From Chengdu Zhimingda Electronics' P/E?

Chengdu Zhimingda Electronics' P/E is flying high just like its stock has during the last month. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Chengdu Zhimingda Electronics' analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 2 warning signs with Chengdu Zhimingda Electronics (at least 1 which doesn't sit too well with us), and understanding them should be part of your investment process.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688636

Chengdu Zhimingda Electronics

Provides customized embedded modules and solutions in China.

High growth potential with excellent balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

CEO: We are winners in the long term in the AI world

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.