- China

- /

- Electronic Equipment and Components

- /

- SHSE:688628

Discovering Three Undiscovered Gems For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a rebound, with U.S. stocks propelled higher by easing core inflation and strong bank earnings, investors are keenly observing the performance of smaller companies as indicated by the S&P MidCap 400's notable gains. Amidst this backdrop of economic optimism and shifting market dynamics, identifying lesser-known stocks that offer potential growth can be an attractive strategy for diversifying portfolios. In this context, a good stock often combines solid fundamentals with the ability to capitalize on prevailing economic trends and sectoral strengths.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Darya-Varia Laboratoria | NA | 1.44% | -11.65% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tait Marketing & Distribution | 0.75% | 7.36% | 18.40% | ★★★★★★ |

| Pakistan National Shipping | 2.77% | 30.93% | 51.80% | ★★★★★★ |

| Cardig Aero Services | NA | 6.60% | 69.79% | ★★★★★★ |

| Pro-Hawk | 30.16% | -5.27% | -2.93% | ★★★★★☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Cementos Molins (BDM:CMO)

Simply Wall St Value Rating: ★★★★★★

Overview: Cementos Molins, S.A. is engaged in the manufacturing and sale of cement, lime, precast concrete, and other construction materials across various countries including Spain, Argentina, Mexico, and others with a market cap of €1.65 billion.

Operations: Cementos Molins generates revenue primarily from the sale of cement, lime, and precast concrete across multiple countries. The company's cost structure includes expenses related to raw materials, production, and distribution. Notably, its net profit margin has shown variability over recent periods.

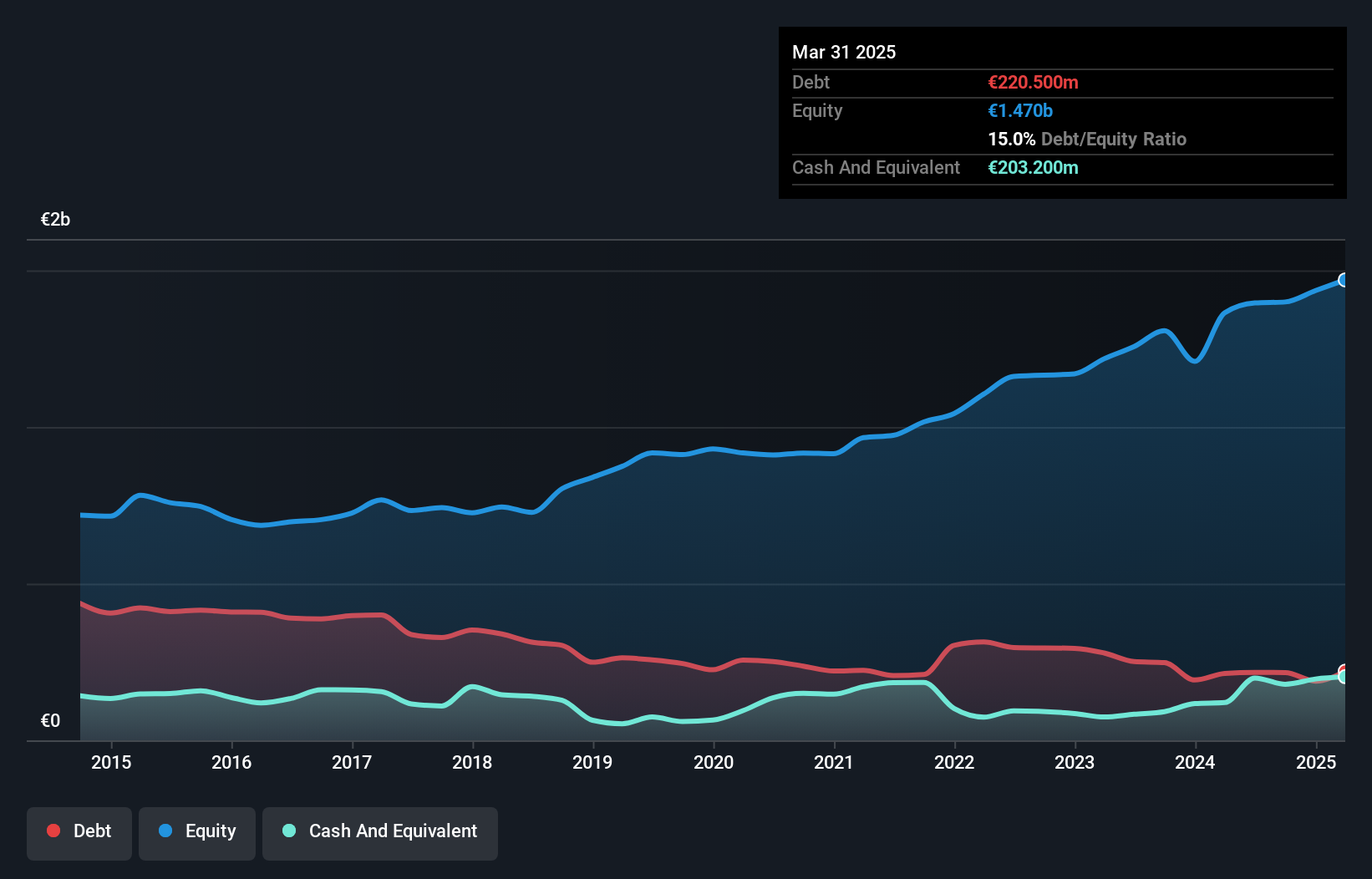

Cementos Molins, a smaller player in the cement industry, showcases promising financial health with its debt to equity ratio improving from 26.9% to 15.5% over five years, reflecting prudent financial management. The net debt to equity ratio stands at a satisfactory 2.7%, and earnings have surged by 23.3% in the past year, outpacing the Basic Materials sector's downturn of -11.5%. With a price-to-earnings ratio of 9.1x compared to Spain's market average of 18.8x, it appears undervalued while maintaining high-quality earnings and robust interest coverage at 14.7 times EBIT, indicating sound operational performance.

- Dive into the specifics of Cementos Molins here with our thorough health report.

Evaluate Cementos Molins' historical performance by accessing our past performance report.

Mediterranean and Gulf Cooperative Insurance and Reinsurance (SASE:8030)

Simply Wall St Value Rating: ★★★★★☆

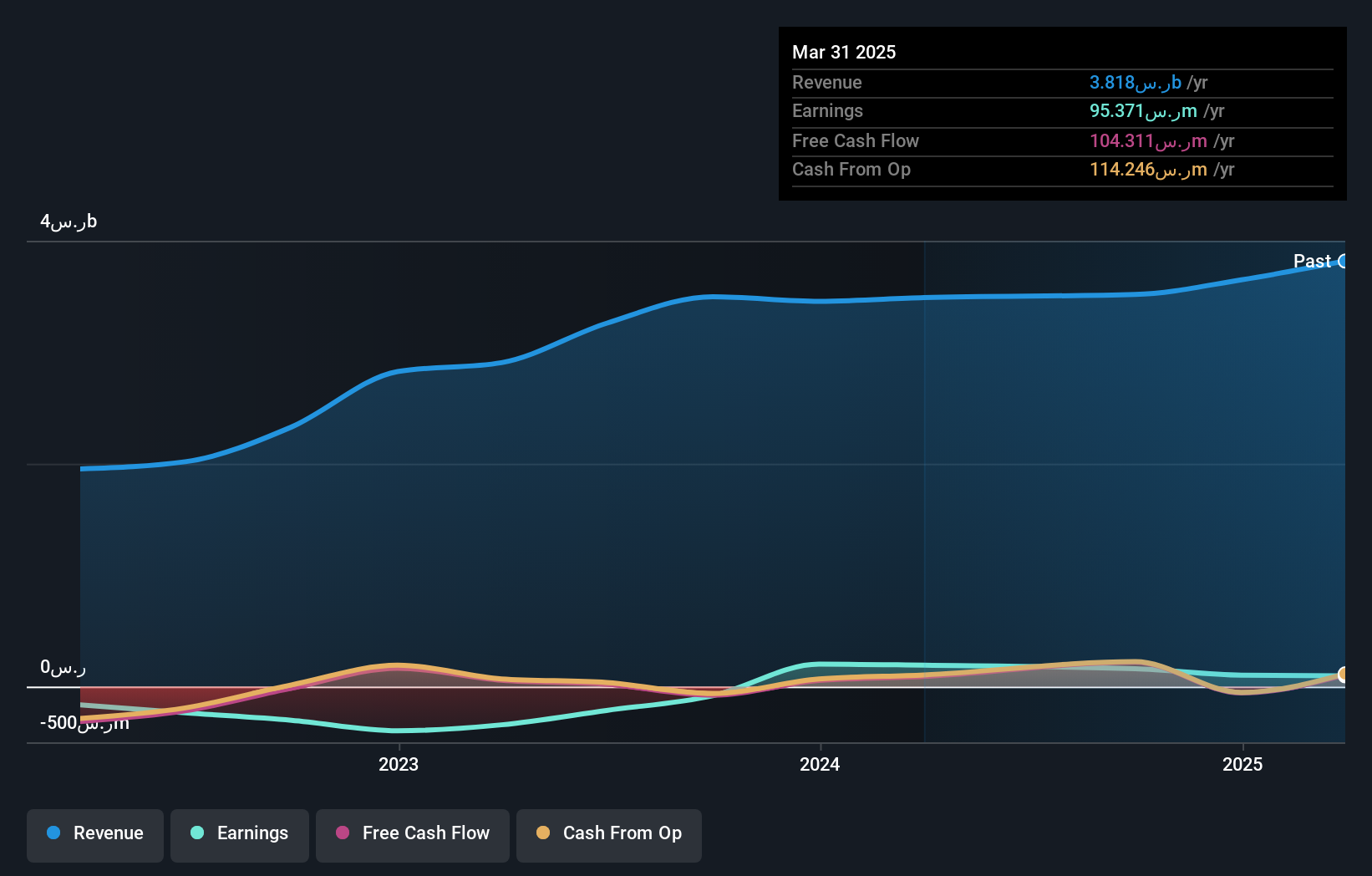

Overview: The Mediterranean and Gulf Cooperative Insurance and Reinsurance Company operates in the Kingdom of Saudi Arabia, offering a range of insurance and reinsurance products, with a market capitalization of SAR 2.88 billion.

Operations: MedGulf generates revenue primarily from its insurance operations, with the medical segment contributing SAR 2.72 billion and the motor segment adding SAR 358.78 million. The property and casualty segment also plays a role, bringing in SAR 336.88 million.

Mediterranean and Gulf Cooperative Insurance, a nimble player in the insurance sector, has shown resilience by becoming profitable this year despite volatile market conditions. Its price-to-earnings ratio of 18.6x undercuts the broader SA market's 24.3x, suggesting potential value for investors. The company reported SAR 39.12 million net income for Q3 2024, slightly down from SAR 39.79 million last year, with basic earnings per share at SAR 0.37 compared to SAR 0.38 previously. Over nine months, net income was SAR 98.99 million versus last year's SAR 140.56 million, reflecting challenges yet opportunities in its financial journey without debt concerns looming overhead.

Uni-Trend Technology (China) (SHSE:688628)

Simply Wall St Value Rating: ★★★★★★

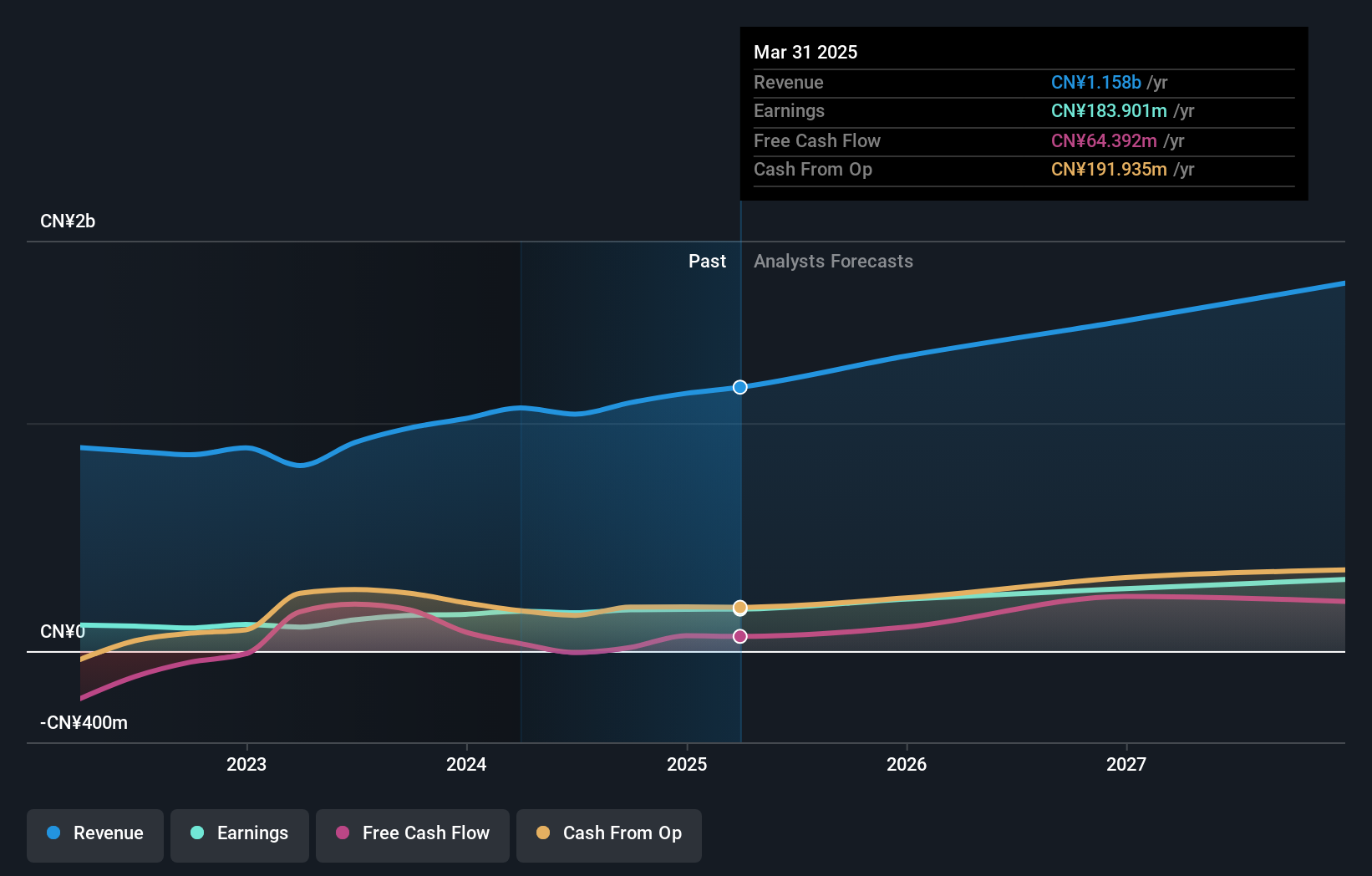

Overview: Uni-Trend Technology (China) Co., Ltd. designs and manufactures test and measurement products globally, with a market capitalization of CN¥4.08 billion.

Operations: Uni-Trend Technology generates revenue primarily from the design and manufacture of test and measurement products. The company has a market capitalization of approximately CN¥4.08 billion, reflecting its financial standing in the industry.

Uni-Trend Technology, a smaller player in the electronics sector, has shown impressive financial health with earnings growth of 15.6% over the past year, surpassing the industry average of 2.3%. The company's debt to equity ratio improved significantly from 17.6% to 6.5% in five years, indicating robust financial management. Trading at a substantial discount of 41.7% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent buybacks totaling CNY 25.38 million for nearly 0.67% of shares could signal confidence in future prospects as earnings are forecasted to grow by about 23.65% annually.

Summing It All Up

- Click here to access our complete index of 4654 Undiscovered Gems With Strong Fundamentals.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688628

Uni-Trend Technology (China)

Designs and manufactures test and measurement products worldwide.

Excellent balance sheet and fair value.

Market Insights

Community Narratives