- China

- /

- Electronic Equipment and Components

- /

- SHSE:688551

Subdued Growth No Barrier To Hefei Kewell Power System Co.,Ltd. (SHSE:688551) With Shares Advancing 28%

Hefei Kewell Power System Co.,Ltd. (SHSE:688551) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 4.0% in the last twelve months.

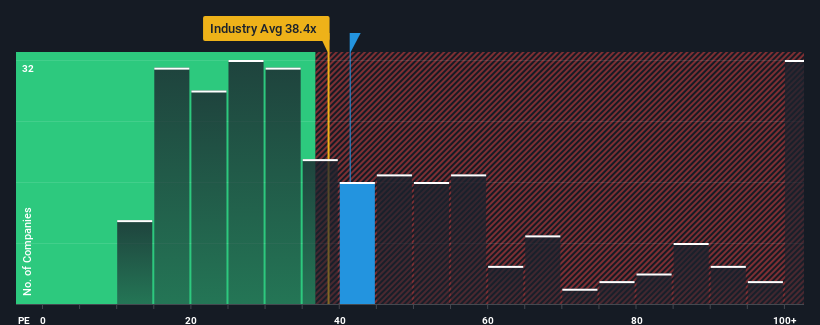

Since its price has surged higher, given around half the companies in China have price-to-earnings ratios (or "P/E's") below 30x, you may consider Hefei Kewell Power SystemLtd as a stock to potentially avoid with its 41.3x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/E.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Hefei Kewell Power SystemLtd has been doing quite well of late. The P/E is probably high because investors think the company will continue to navigate the broader market headwinds better than most. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Hefei Kewell Power SystemLtd

Does Growth Match The High P/E?

The only time you'd be truly comfortable seeing a P/E as high as Hefei Kewell Power SystemLtd's is when the company's growth is on track to outshine the market.

If we review the last year of earnings growth, the company posted a terrific increase of 87%. The latest three year period has also seen an excellent 69% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Shifting to the future, estimates from the six analysts covering the company suggest earnings should grow by 39% over the next year. Meanwhile, the rest of the market is forecast to expand by 41%, which is not materially different.

With this information, we find it interesting that Hefei Kewell Power SystemLtd is trading at a high P/E compared to the market. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. Although, additional gains will be difficult to achieve as this level of earnings growth is likely to weigh down the share price eventually.

What We Can Learn From Hefei Kewell Power SystemLtd's P/E?

Hefei Kewell Power SystemLtd's P/E is getting right up there since its shares have risen strongly. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Hefei Kewell Power SystemLtd's analyst forecasts revealed that its market-matching earnings outlook isn't impacting its high P/E as much as we would have predicted. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

There are also other vital risk factors to consider before investing and we've discovered 3 warning signs for Hefei Kewell Power SystemLtd that you should be aware of.

If these risks are making you reconsider your opinion on Hefei Kewell Power SystemLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Hefei Kewell Power SystemLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688551

Hefei Kewell Power SystemLtd

Provides testing equipment for test systems and intelligent manufacturing equipment in China.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026