- China

- /

- Electronic Equipment and Components

- /

- SHSE:688522

Naruida Technology (SHSE:688522) Seems To Use Debt Quite Sensibly

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Naruida Technology Co., Ltd. (SHSE:688522) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Naruida Technology

How Much Debt Does Naruida Technology Carry?

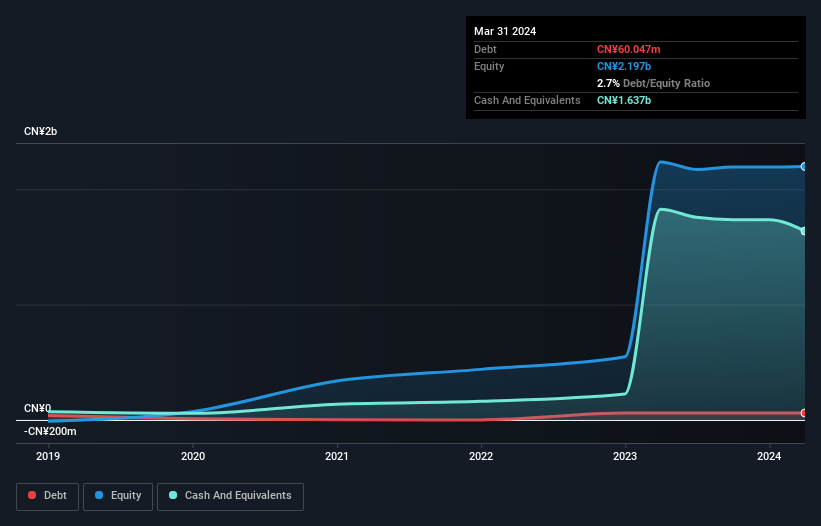

As you can see below, Naruida Technology had CN¥60.0m of debt, at March 2024, which is about the same as the year before. You can click the chart for greater detail. However, its balance sheet shows it holds CN¥1.64b in cash, so it actually has CN¥1.58b net cash.

How Healthy Is Naruida Technology's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Naruida Technology had liabilities of CN¥130.9m due within 12 months and liabilities of CN¥16.9m due beyond that. On the other hand, it had cash of CN¥1.64b and CN¥314.0m worth of receivables due within a year. So it can boast CN¥1.80b more liquid assets than total liabilities.

This surplus suggests that Naruida Technology is using debt in a way that is appears to be both safe and conservative. Due to its strong net asset position, it is not likely to face issues with its lenders. Succinctly put, Naruida Technology boasts net cash, so it's fair to say it does not have a heavy debt load!

In fact Naruida Technology's saving grace is its low debt levels, because its EBIT has tanked 80% in the last twelve months. Falling earnings (if the trend continues) could eventually make even modest debt quite risky. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Naruida Technology can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. While Naruida Technology has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Naruida Technology burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Summing Up

While it is always sensible to investigate a company's debt, in this case Naruida Technology has CN¥1.58b in net cash and a decent-looking balance sheet. So we are not troubled with Naruida Technology's debt use. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. To that end, you should learn about the 3 warning signs we've spotted with Naruida Technology (including 2 which are significant) .

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688522

Guangdong Naruida Technology

Manufactures and sells polarized multifunctional active phased array radars in China.

Exceptional growth potential with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026