- China

- /

- Electronic Equipment and Components

- /

- SHSE:688519

High Growth Tech Stocks Leading Global Innovation

Reviewed by Simply Wall St

Amid favorable trade deal news and record highs in key indices such as the S&P 500 and Nasdaq Composite, global markets have shown strong momentum, supported by positive corporate earnings and economic indicators like the U.S. services sector's growth. In this environment of innovation-driven expansion, identifying high-growth tech stocks that are leading global innovation requires a focus on companies with robust AI exposure and adaptability to evolving market dynamics.

Top 10 High Growth Tech Companies Globally

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 28.42% | 47.04% | ★★★★★★ |

| Gold Circuit Electronics | 20.76% | 25.89% | ★★★★★★ |

| Pharma Mar | 26.67% | 43.29% | ★★★★★★ |

| eWeLLLtd | 24.95% | 24.40% | ★★★★★★ |

| KebNi | 20.56% | 94.46% | ★★★★★★ |

| Shengyi Electronics | 26.23% | 37.40% | ★★★★★★ |

| Global Security Experts | 20.56% | 28.04% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 81.53% | 96.08% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| JNTC | 55.45% | 94.52% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Nanya New Material TechnologyLtd (SHSE:688519)

Simply Wall St Growth Rating: ★★★★★☆

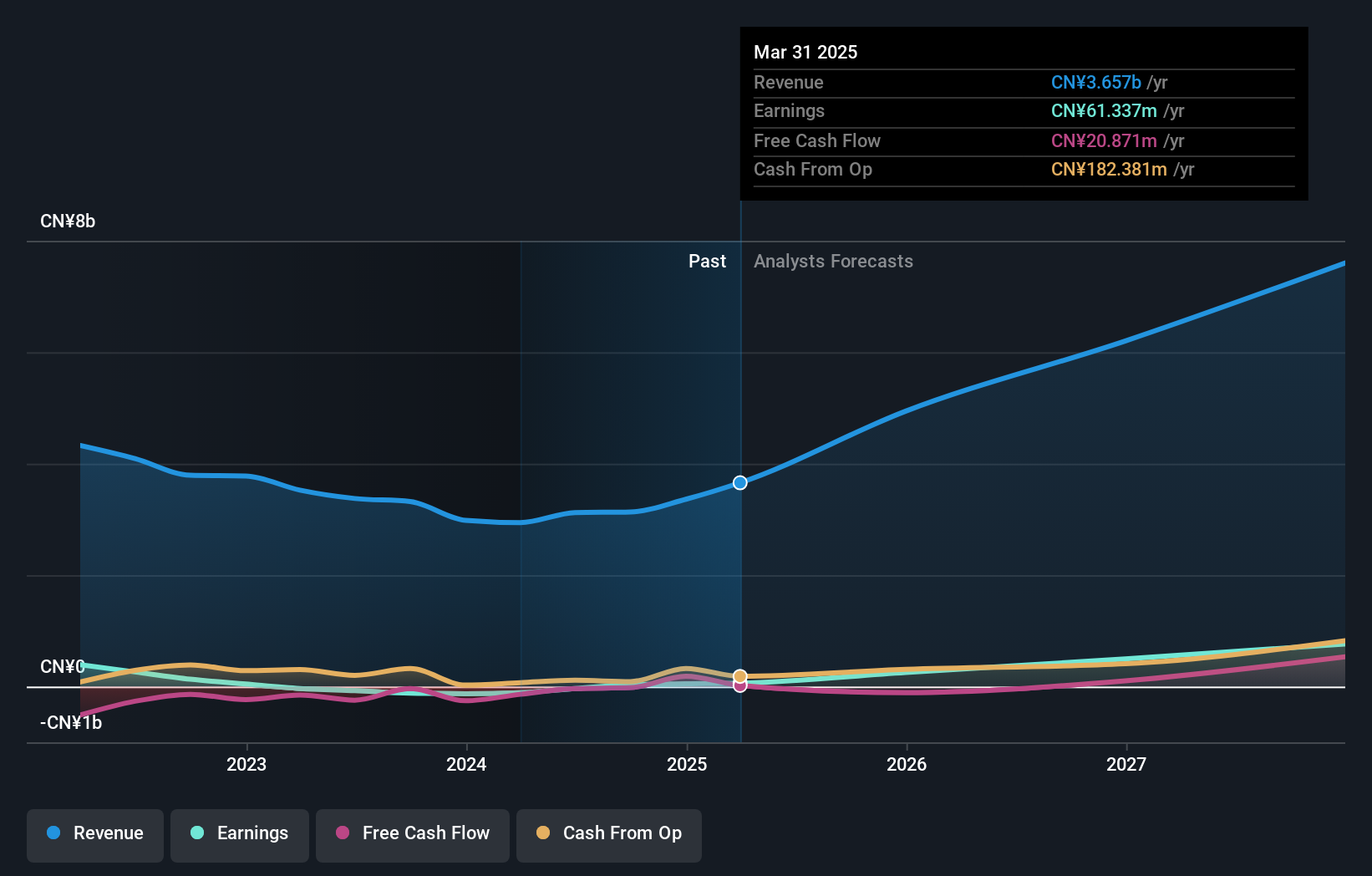

Overview: Nanya New Material Technology Co., Ltd specializes in the manufacturing, design, development, and sale of composite materials with a market capitalization of CN¥9.41 billion.

Operations: Nanya New Material Technology Co., Ltd focuses on producing and selling composite materials, generating revenue primarily from these activities. The company's market capitalization stands at CN¥9.41 billion.

Nanya New Material TechnologyLtd has demonstrated robust growth metrics, with earnings forecasted to surge by 64.6% annually and revenue expected to expand at a rate of 25.2% per year, outpacing the broader CN market's projections of 23.5% and 12.5%, respectively. This performance is particularly noteworthy given the firm's transition from non-profitability to profitability within the last fiscal year, underscoring its potential in the competitive electronics sector despite past volatility influenced by a significant one-off gain of CN¥26.8M in its recent financials. The company's commitment to innovation is evident from its R&D investments, crucial for sustaining long-term growth amidst evolving technological demands.

Huagong Tech (SZSE:000988)

Simply Wall St Growth Rating: ★★★★★☆

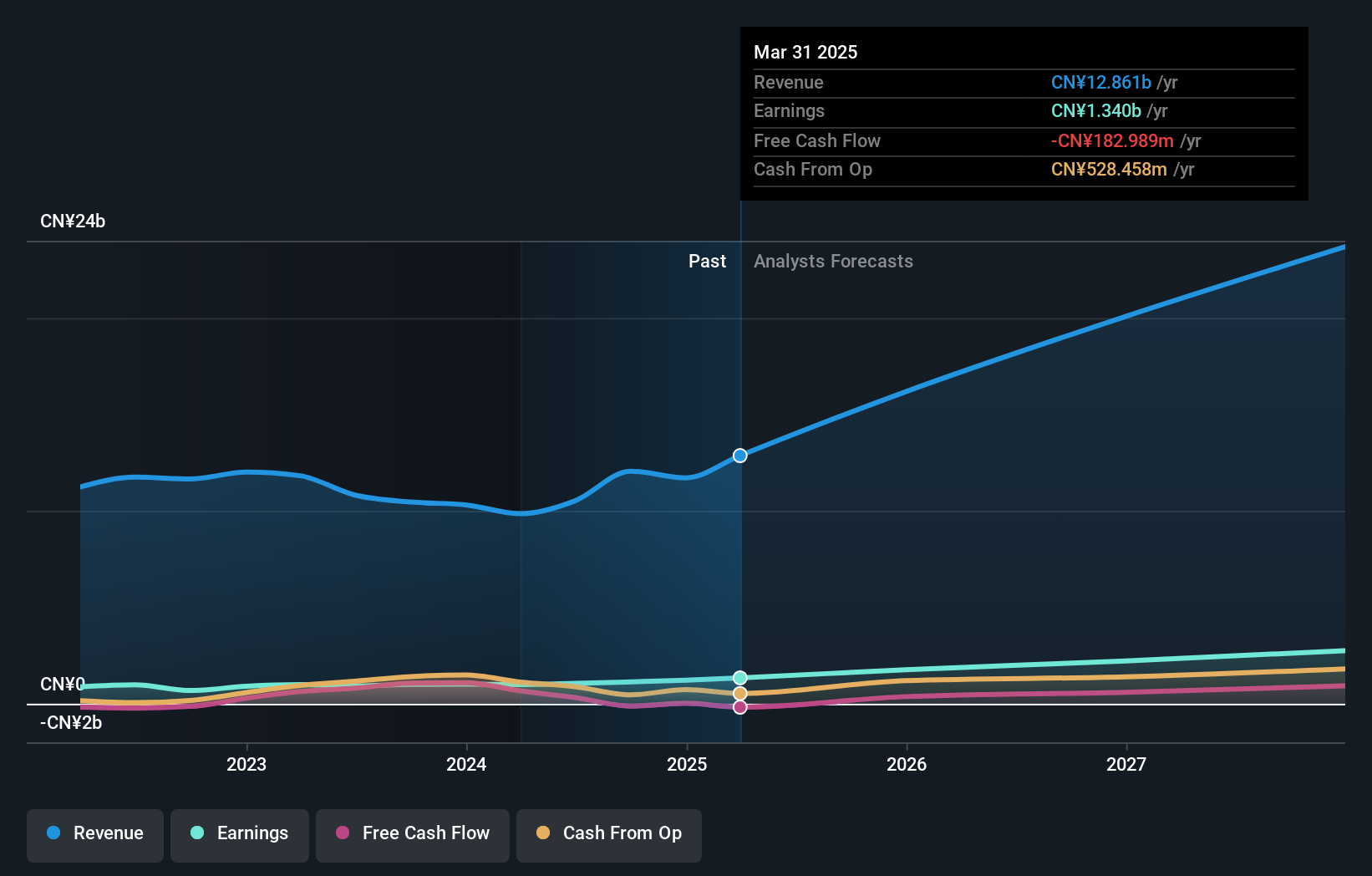

Overview: Huagong Tech Company Limited is engaged in the manufacturing and sale of laser equipment, hologram products, optical communication devices, and electronic components both domestically in China and internationally, with a market cap of CN¥48.11 billion.

Operations: The company's revenue streams include laser equipment, hologram products, optical communication devices, and electronic components. It operates both in China and internationally. The market cap stands at CN¥48.11 billion.

Huagong Tech is carving out a strong position in the tech landscape, with its revenue and earnings growth rates at 21.6% and 25.1% per year respectively, surpassing broader market averages. This growth is supported by strategic R&D investments that accounted for significant annual expenses, aligning with the company's focus on evolving technological demands. Recent activities including a substantial share repurchase of 9.8 million shares for CNY 394.97 million underline management’s confidence in the firm’s trajectory. Moreover, Huagong Tech's commitment to innovation was highlighted during recent shareholder meetings where future-oriented resolutions were passed, ensuring it remains at the forefront of technological advancements.

Tansun Technology (SZSE:300872)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Tansun Technology Co., Ltd. specializes in offering IT solutions and services to the financial industry both within China and globally, with a market capitalization of approximately CN¥12.44 billion.

Operations: Tansun Technology Co., Ltd. focuses on delivering IT solutions and services primarily to the financial sector, catering to both domestic and international markets. The company's operations are centered around providing innovative technology solutions tailored for financial industry needs.

Tansun Technology has demonstrated robust growth with a notable 17% annual revenue increase, outpacing the broader Chinese market's 12.5%. This performance is bolstered by a significant earnings surge at an annual rate of 52.4%, reflecting strong operational efficiency and market demand. Despite recent volatility in net income as seen in Q1 2025 results, where net income dropped to CNY 25.6 million from CNY 91.02 million year-over-year, the company's strategic focus on R&D—which constitutes a substantial portion of their budget—positions them well for sustained innovation and competitiveness in the tech sector. Their recent approval of a dividend also signals confidence in financial stability and shareholder value enhancement.

- Click here to discover the nuances of Tansun Technology with our detailed analytical health report.

Examine Tansun Technology's past performance report to understand how it has performed in the past.

Next Steps

- Investigate our full lineup of 742 Global High Growth Tech and AI Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nanya New Material TechnologyLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688519

Nanya New Material TechnologyLtd

Manufactures, designs, develops, and sells composite materials.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives