As global markets face a mix of challenges, including concerns over elevated valuations and increased scrutiny around AI spending, the Asian tech sector has shown resilience with mainland Chinese stock markets recently edging higher due to easing U.S.-China trade tensions. In this environment, identifying high-growth tech stocks requires a keen focus on companies that not only demonstrate strong innovation and adaptability but also have the potential to thrive amid evolving geopolitical landscapes and shifting economic conditions.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Accton Technology | 21.66% | 24.66% | ★★★★★★ |

| Giant Network Group | 33.47% | 39.54% | ★★★★★★ |

| Suzhou TFC Optical Communication | 34.08% | 35.52% | ★★★★★★ |

| Shengyi TechnologyLtd | 21.50% | 32.87% | ★★★★★★ |

| Zhongji Innolight | 30.75% | 31.56% | ★★★★★★ |

| Fositek | 37.70% | 51.13% | ★★★★★★ |

| Gold Circuit Electronics | 27.50% | 35.18% | ★★★★★★ |

| ISU Petasys | 21.11% | 32.81% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Underneath we present a selection of stocks filtered out by our screen.

Chanjet Information Technology (SEHK:1588)

Simply Wall St Growth Rating: ★★★★☆☆

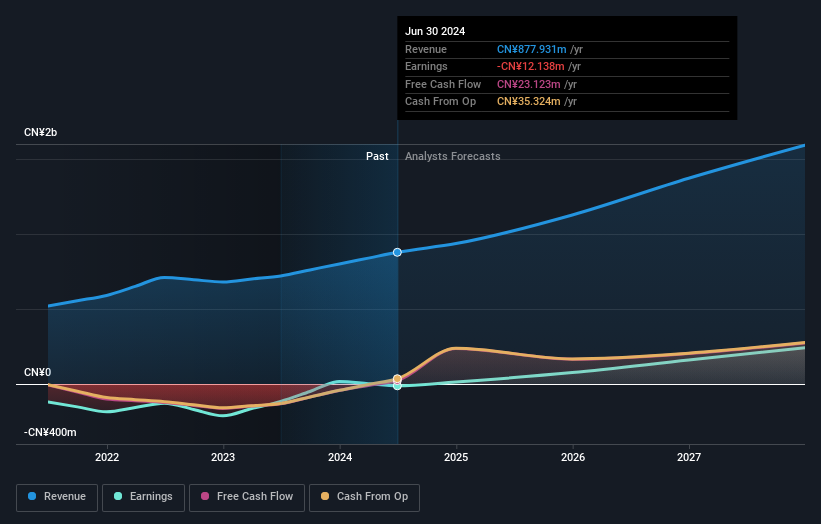

Overview: Chanjet Information Technology Company Limited operates in the cloud service and software sectors both in Mainland China and internationally, with a market capitalization of HK$2.78 billion.

Operations: Chanjet Information Technology focuses on cloud services, generating CN¥989.50 million in revenue from this segment.

Chanjet Information Technology has demonstrated robust growth, with a notable 14.1% annual increase in revenue and an even more impressive 32.1% surge in earnings per year, outpacing the Hong Kong market averages of 8.5% and 11.7%, respectively. This financial vigor is supported by strategic R&D investments that are crucial for maintaining technological edge and driving future growth, evidenced by their recent enhancements to company bylaws aimed at fostering innovation. Additionally, the company's recent share repurchase program underscores a commitment to shareholder value, utilizing legally available funds to potentially boost per-share metrics further. As Chanjet continues to evolve within the high-growth tech sector in Asia, these strategic decisions could significantly influence its market standing and operational success.

Sansec Technology (SHSE:688489)

Simply Wall St Growth Rating: ★★★★★☆

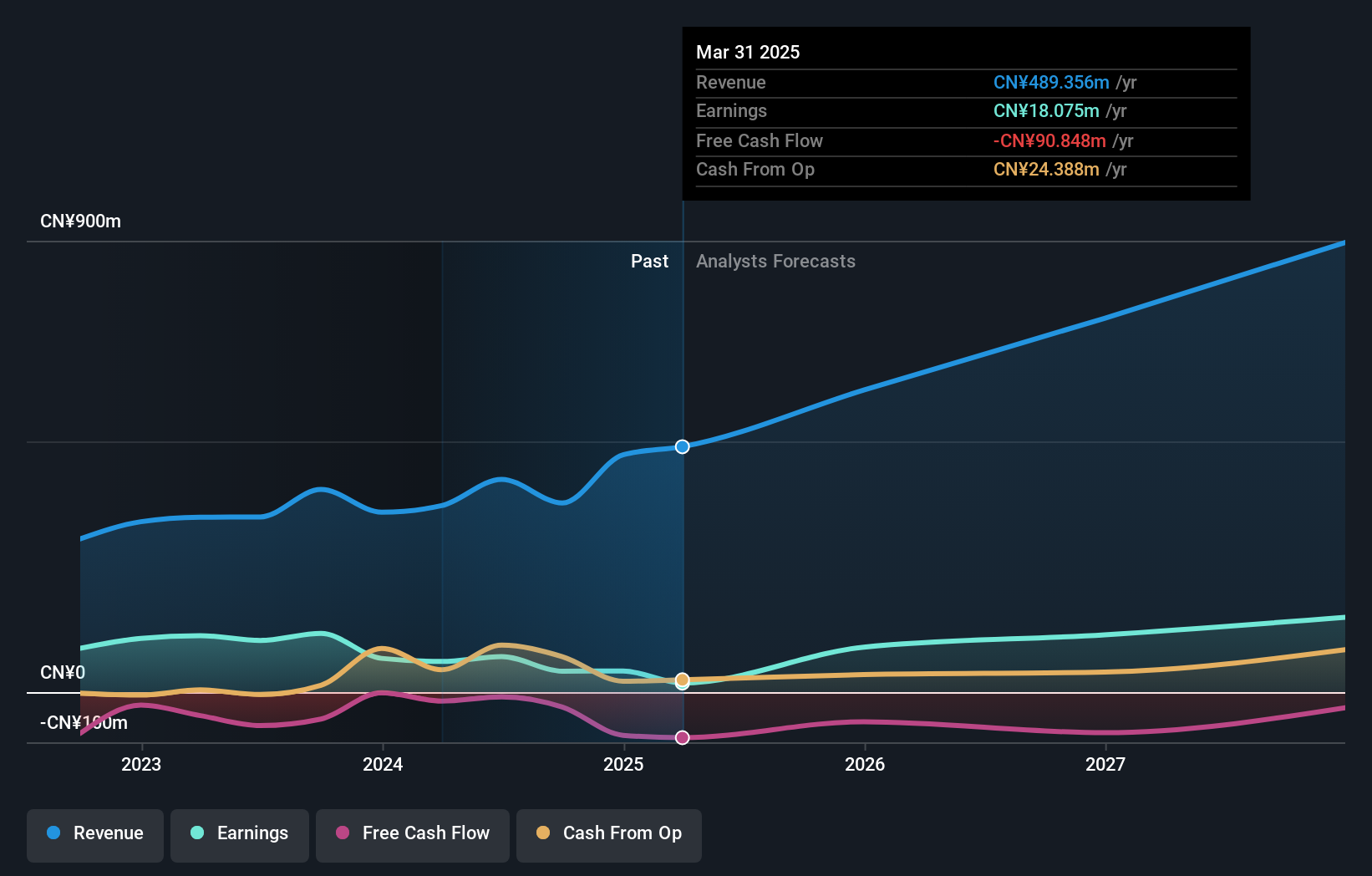

Overview: Sansec Technology Co., Ltd. focuses on the research, development, and production of commercial cryptographic products and solutions for internet information security in China, with a market cap of CN¥5.07 billion.

Operations: Sansec Technology specializes in creating cryptographic products and solutions aimed at enhancing internet information security across China. The company derives its revenue primarily from the sale of these specialized security products, focusing on commercial applications to meet the growing demand for secure digital communication.

Sansec Technology's recent financial performance reflects a challenging phase, with revenue rising to CNY 294.81 million from CNY 254.66 million year-over-year, yet transitioning from a net income of CNY 14.16 million to a net loss of CNY 39.18 million over the same period. This shift underscores volatility but also highlights resilience in revenue growth amidst market adversities. The company's strategic focus may pivot towards enhancing operational efficiencies and harnessing its R&D capabilities, which are crucial for rebounding into profitability and sustaining long-term growth in the competitive tech landscape of Asia.

Beijing Beetech (SZSE:300667)

Simply Wall St Growth Rating: ★★★★☆☆

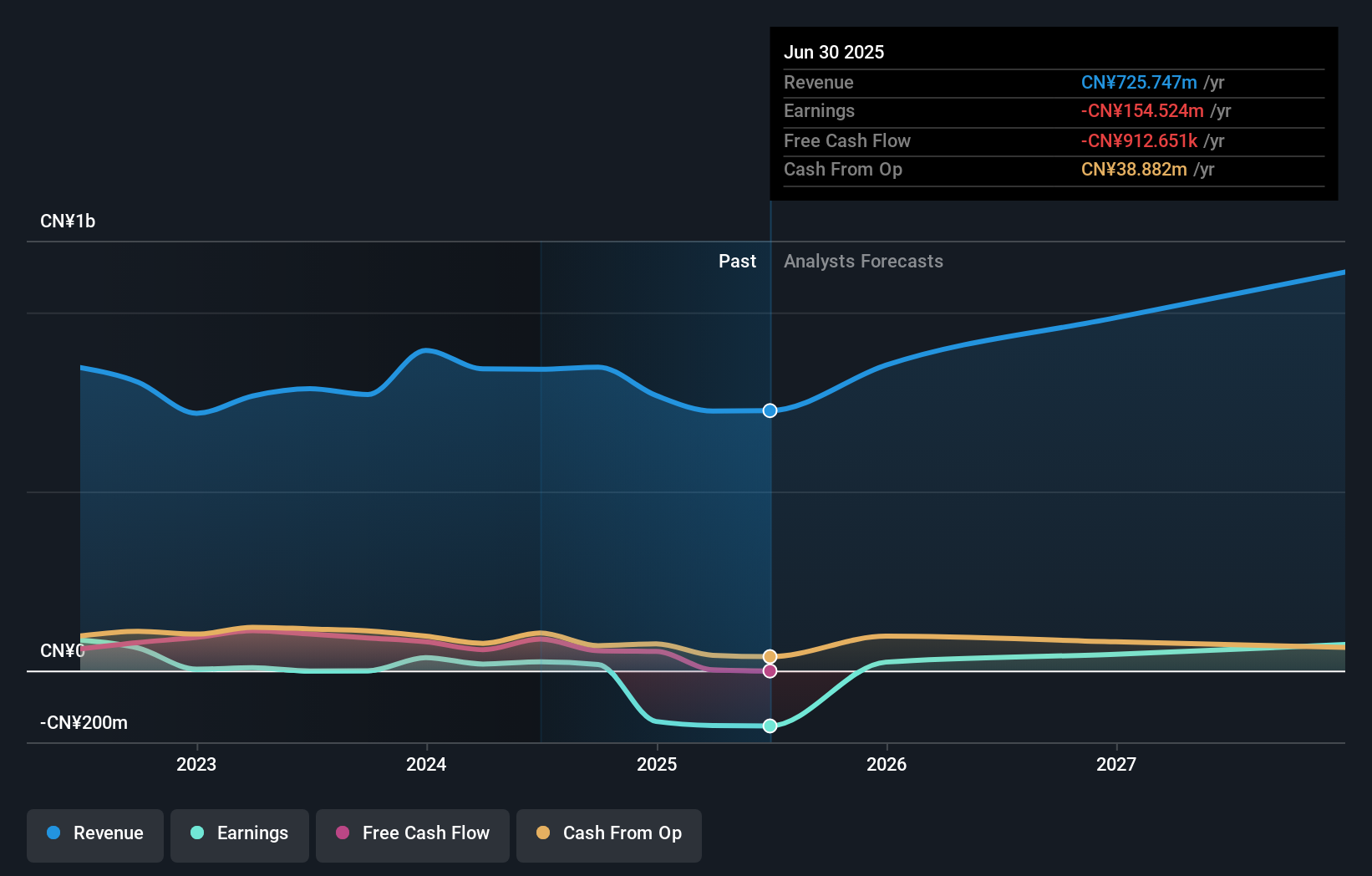

Overview: Beijing Beetech Inc. specializes in the production and sale of smart sensors and optoelectronic instruments, with a market cap of CN¥3.25 billion.

Operations: Smart sensors and optoelectronic instruments constitute the core of Beijing Beetech's product offerings.

Despite recent setbacks, Beijing Beetech's resilience is evident with its commitment to strategic adjustments and R&D investment. The company's revenue decreased slightly year-over-year to CNY 470.88 million, reflecting a challenging market; however, it maintains a robust annualized revenue growth forecast of 17.4%. With earnings expected to surge by 101.1% annually, the firm is poised for a turnaround, bolstered by significant amendments in its business scope aimed at aligning with evolving tech demands in Asia. This strategic pivot could enhance Beijing Beetech’s market position as it navigates through current financial turbulence towards profitability within three years.

- Click to explore a detailed breakdown of our findings in Beijing Beetech's health report.

Gain insights into Beijing Beetech's past trends and performance with our Past report.

Key Takeaways

- Dive into all 190 of the Asian High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1588

Chanjet Information Technology

Engages in the cloud service and software businesses in Mainland China and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives