As global markets navigate the effects of rising U.S. Treasury yields, which have placed downward pressure on equities, particularly small-cap stocks, the tech-heavy Nasdaq Composite has shown resilience by posting slight gains. In this environment of moderated economic growth and cautious monetary policy adjustments, identifying high-growth tech stocks requires a focus on companies with robust innovation potential and strong adaptability to shifting market dynamics.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Material Group | 20.45% | 24.01% | ★★★★★★ |

| Yggdrazil Group | 24.66% | 85.53% | ★★★★★★ |

| TG Therapeutics | 30.63% | 46.00% | ★★★★★★ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| Scandion Oncology | 40.71% | 75.34% | ★★★★★★ |

| Seojin SystemLtd | 33.39% | 49.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 27.88% | 79.61% | ★★★★★★ |

| Alkami Technology | 21.90% | 101.89% | ★★★★★★ |

| UTI | 114.97% | 134.60% | ★★★★★★ |

Click here to see the full list of 1281 stocks from our High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Pexip Holding (OB:PEXIP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pexip Holding ASA is a video technology company offering a comprehensive video conferencing platform and digital infrastructure globally, with a market capitalization of NOK4.37 billion.

Operations: The company's primary revenue stream is the sale of collaboration services, generating NOK1.06 billion.

Pexip Holding has demonstrated a notable turnaround, with recent earnings showing a shift from a net loss of NOK 19.2 million to a net income of NOK 7.03 million in Q2 2024, underscoring its recovery trajectory. This improvement aligns with an anticipated revenue growth rate of 10.2% per year, outpacing the Norwegian market's average of just 2.1%. Moreover, the company's commitment to innovation is evident in its R&D spending, crucial for sustaining long-term competitiveness in the evolving tech landscape. These financial and operational strides suggest Pexip is positioning itself effectively within the high-growth tech sector despite previous profitability challenges.

- Navigate through the intricacies of Pexip Holding with our comprehensive health report here.

Gain insights into Pexip Holding's historical performance by reviewing our past performance report.

Genew TechnologiesLtd (SHSE:688418)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genew Technologies Co., Ltd. focuses on the research, development, production, and sale of communication and network products globally, with a market cap of CN¥4.40 billion.

Operations: Genew Technologies Co., Ltd. generates revenue primarily through the sale of its communication and network products. The company invests significantly in research and development to enhance its product offerings, impacting its cost structure. Its market cap stands at CN¥4.40 billion, reflecting its position in the global communications sector.

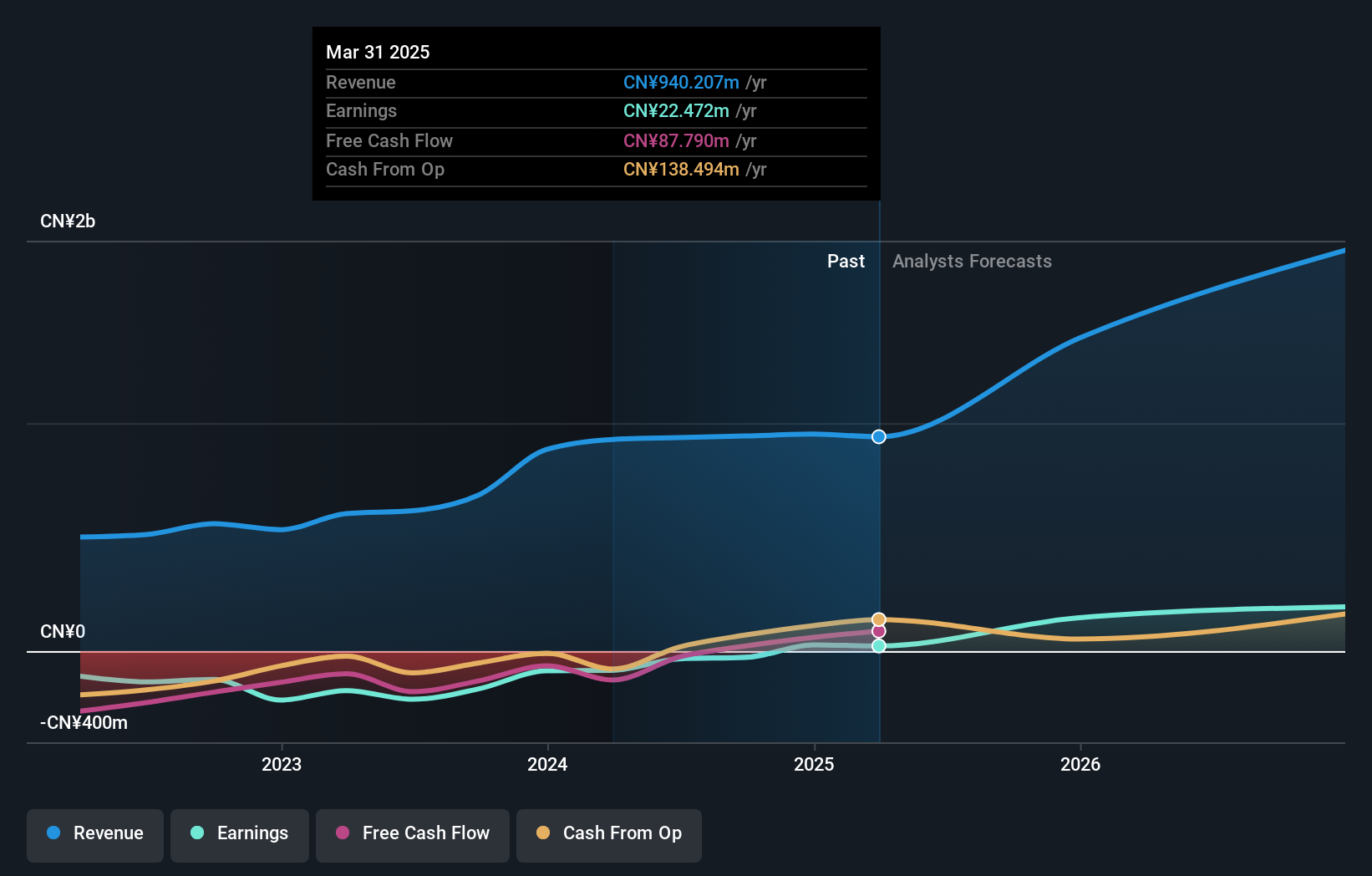

Genew TechnologiesLtd has pivoted from a substantial net loss to a net income of CNY 16.61 million in the past nine months, signaling robust recovery and operational efficiency. This turnaround is underscored by an impressive revenue jump to CNY 576.71 million, up from CNY 517.55 million year-over-year, highlighting a growth trajectory that outpaces many in its sector with an annual increase forecasted at 39.4%. The firm’s commitment to innovation is reflected in its R&D spending, which supports its strategic positioning for sustainable growth amidst competitive tech landscapes. These financial indicators and strategic investments suggest Genew TechnologiesLtd is on a path to not just stability but potentially lucrative growth in the burgeoning tech industry.

- Get an in-depth perspective on Genew TechnologiesLtd's performance by reading our health report here.

Evaluate Genew TechnologiesLtd's historical performance by accessing our past performance report.

Xiamen Jihong Technology (SZSE:002803)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Xiamen Jihong Technology Co., Ltd. operates in the cross-border social e-commerce sector in Southeast Asia and has a market capitalization of approximately CN¥4.77 billion.

Operations: Jihong Technology derives its revenue primarily from the e-commerce business, contributing CN¥3.62 billion, followed by its packaging business at CN¥2.13 billion. The company focuses on cross-border social e-commerce in Southeast Asia, with a notable emphasis on expanding its digital commerce footprint.

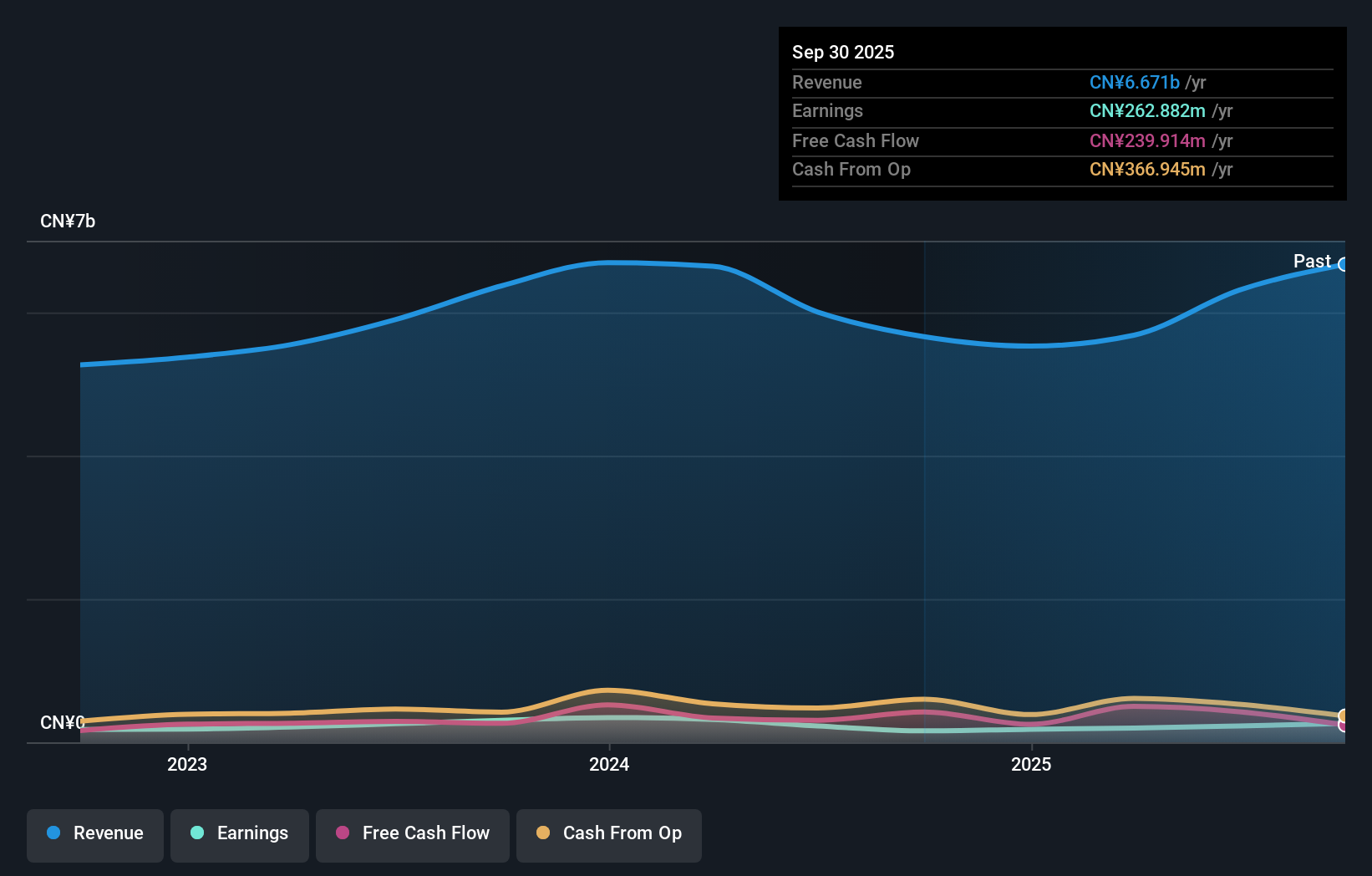

Amidst a challenging fiscal period, Xiamen Jihong Technology has demonstrated resilience with its strategic focus on R&D, which remains a cornerstone of its operations. The company's commitment to innovation is evident from its substantial R&D expenditure, crucial for maintaining competitiveness in the rapidly evolving tech landscape. Despite a downturn in sales and net income as reported in the recent earnings for the nine months ending September 2024—CNY 3.9 billion and CNY 134.67 million respectively, down from last year—the firm continues to invest in future growth capabilities. Notably, it repurchased shares worth CNY 86.02 million over the past year, underscoring confidence in its long-term prospects and commitment to shareholder value amidst market fluctuations. With expected revenue and earnings growth rates of 19.8% and 30.9% per annum respectively, Xiamen Jihong is poised to potentially outpace broader market trends if it successfully leverages its innovative drive into tangible products and solutions that resonate with emerging tech demands.

Taking Advantage

- Gain an insight into the universe of 1281 High Growth Tech and AI Stocks by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Pexip Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:PEXIP

Pexip Holding

A video technology company, provides end-to-end video conferencing platform and digital infrastructure worldwide.

Flawless balance sheet with high growth potential.