- China

- /

- Electronic Equipment and Components

- /

- SHSE:688401

3 High-Growth Companies With Insider Ownership Up To 32%

Reviewed by Simply Wall St

As global markets continue to show resilience, with U.S. stock indexes nearing record highs and growth stocks outperforming value shares, investors are increasingly seeking opportunities in high-growth companies with substantial insider ownership. In such a dynamic environment, companies where insiders hold significant stakes can often indicate strong confidence in their future prospects, making them appealing candidates for those looking to capitalize on potential market gains.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.1% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 119.4% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Findi (ASX:FND) | 35.8% | 133.7% |

Here we highlight a subset of our preferred stocks from the screener.

KEDE Numerical Control (SHSE:688305)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KEDE Numerical Control Co., Ltd. manufactures and markets CNC systems and functional components in China with a market cap of CN¥7.67 billion.

Operations: The company generates revenue of CN¥605.47 million from its General Equipment Manufacturing segment.

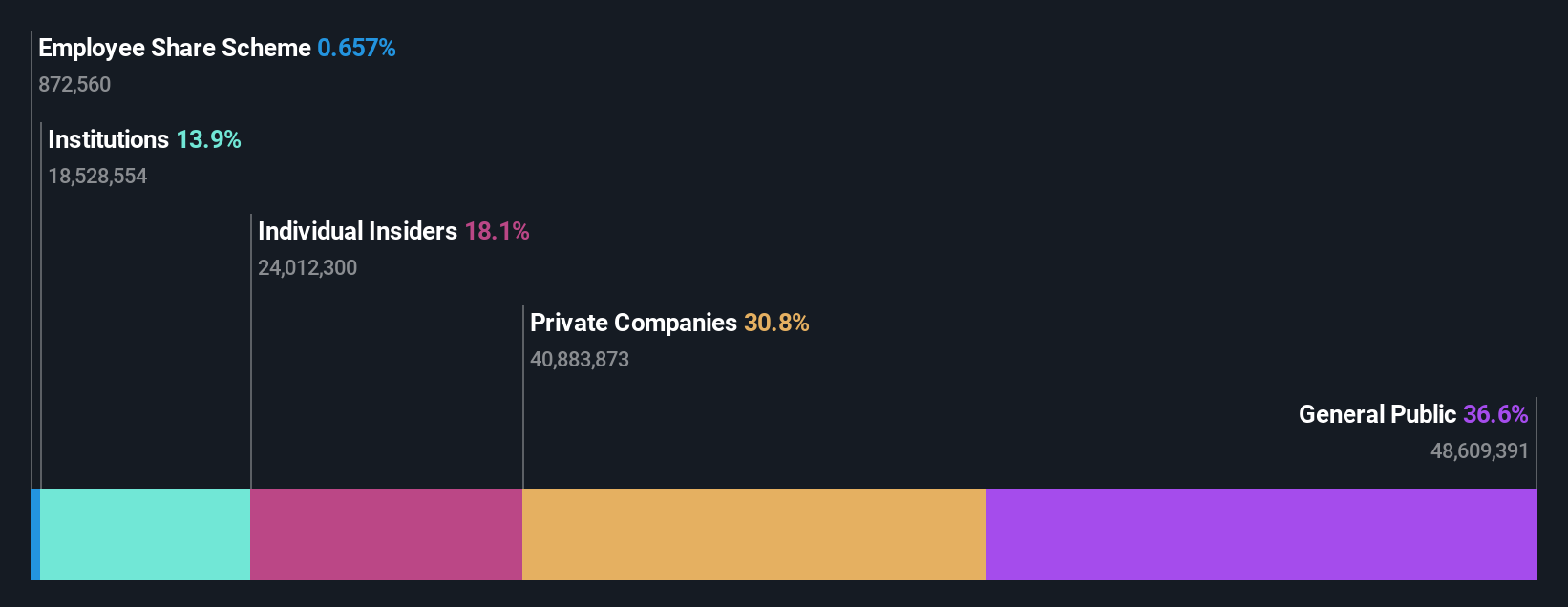

Insider Ownership: 18.1%

KEDE Numerical Control demonstrates strong growth potential, with earnings forecasted to increase by 36.1% annually, outpacing the broader Chinese market. Revenue is also expected to grow significantly at 37% per year. Recent earnings results show a rise in sales from CNY 452.26 million to CNY 605.47 million and net income from CNY 101.99 million to CNY 130.45 million year-over-year, indicating solid financial performance despite a forecasted low return on equity of 13.7%.

- Click to explore a detailed breakdown of our findings in KEDE Numerical Control's earnings growth report.

- Insights from our recent valuation report point to the potential overvaluation of KEDE Numerical Control shares in the market.

Shenzhen Newway Photomask Making (SHSE:688401)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen Newway Photomask Making Co., Ltd, with a market cap of CN¥6.22 billion, is a lithography company involved in the design, development, and production of mask products in China.

Operations: Shenzhen Newway Photomask Making Co., Ltd generates its revenue through the design, development, and production of mask products in China.

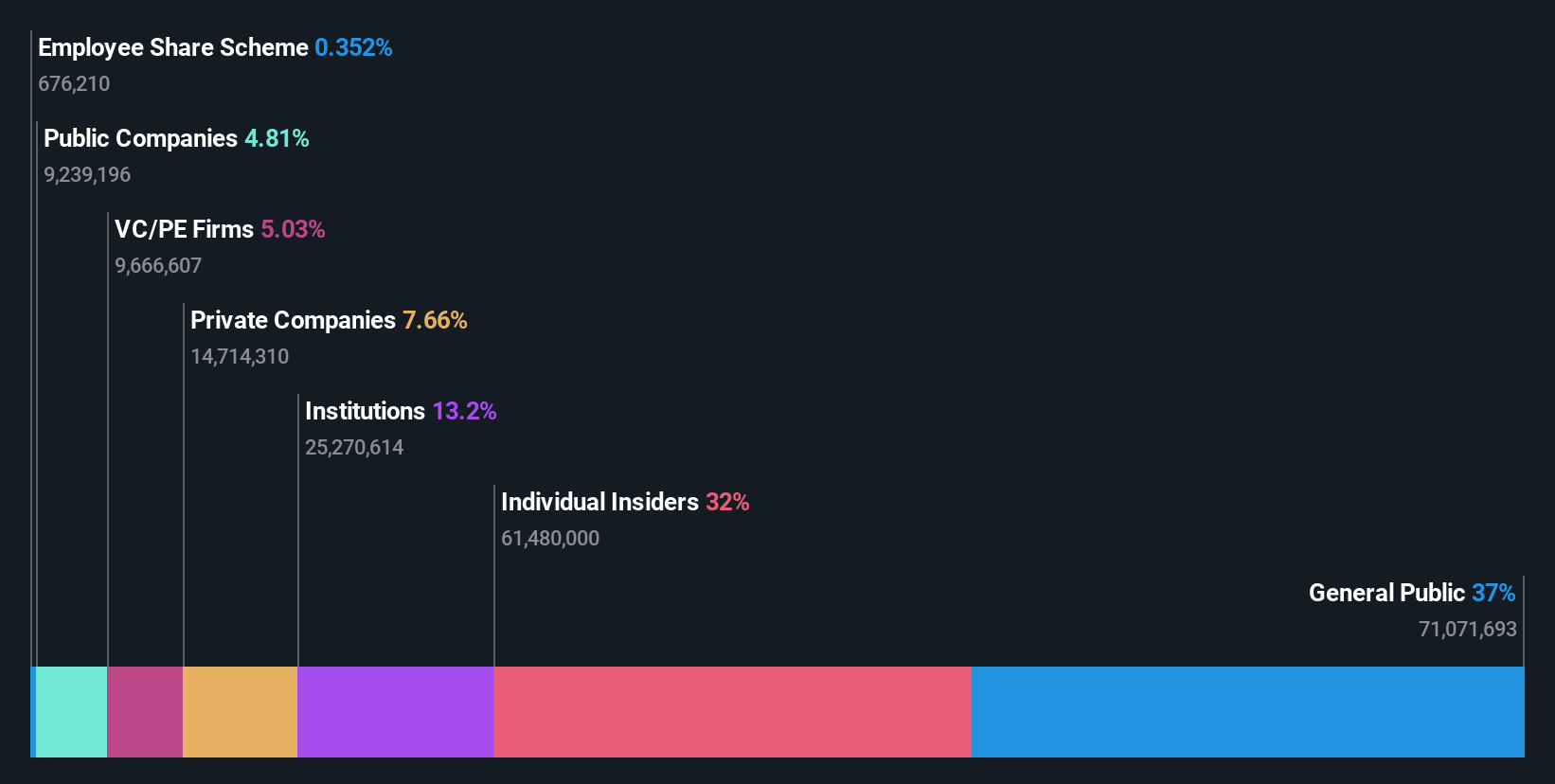

Insider Ownership: 32.1%

Shenzhen Newway Photomask Making shows promising growth prospects, with earnings expected to grow 27.8% annually, surpassing the Chinese market average. The company reported a revenue increase from CNY 672.39 million to CNY 875.55 million and net income growth from CNY 148.8 million to CNY 192.26 million over the past year, reflecting robust financial performance despite a forecasted low return on equity of 16.3%. Its price-to-earnings ratio of 32.4x indicates good value relative to peers.

- Click here and access our complete growth analysis report to understand the dynamics of Shenzhen Newway Photomask Making.

- The valuation report we've compiled suggests that Shenzhen Newway Photomask Making's current price could be quite moderate.

Tri Chemical Laboratories (TSE:4369)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tri Chemical Laboratories Inc. specializes in producing chemical products for industries such as semiconductors, coatings, optical fibers, solar cells, and compound semiconductors, with a market capitalization of ¥123.33 billion.

Operations: The company generates revenue primarily from its High-Purity Chemical Compound Business for Manufacturing Semiconductors, amounting to ¥16.14 billion.

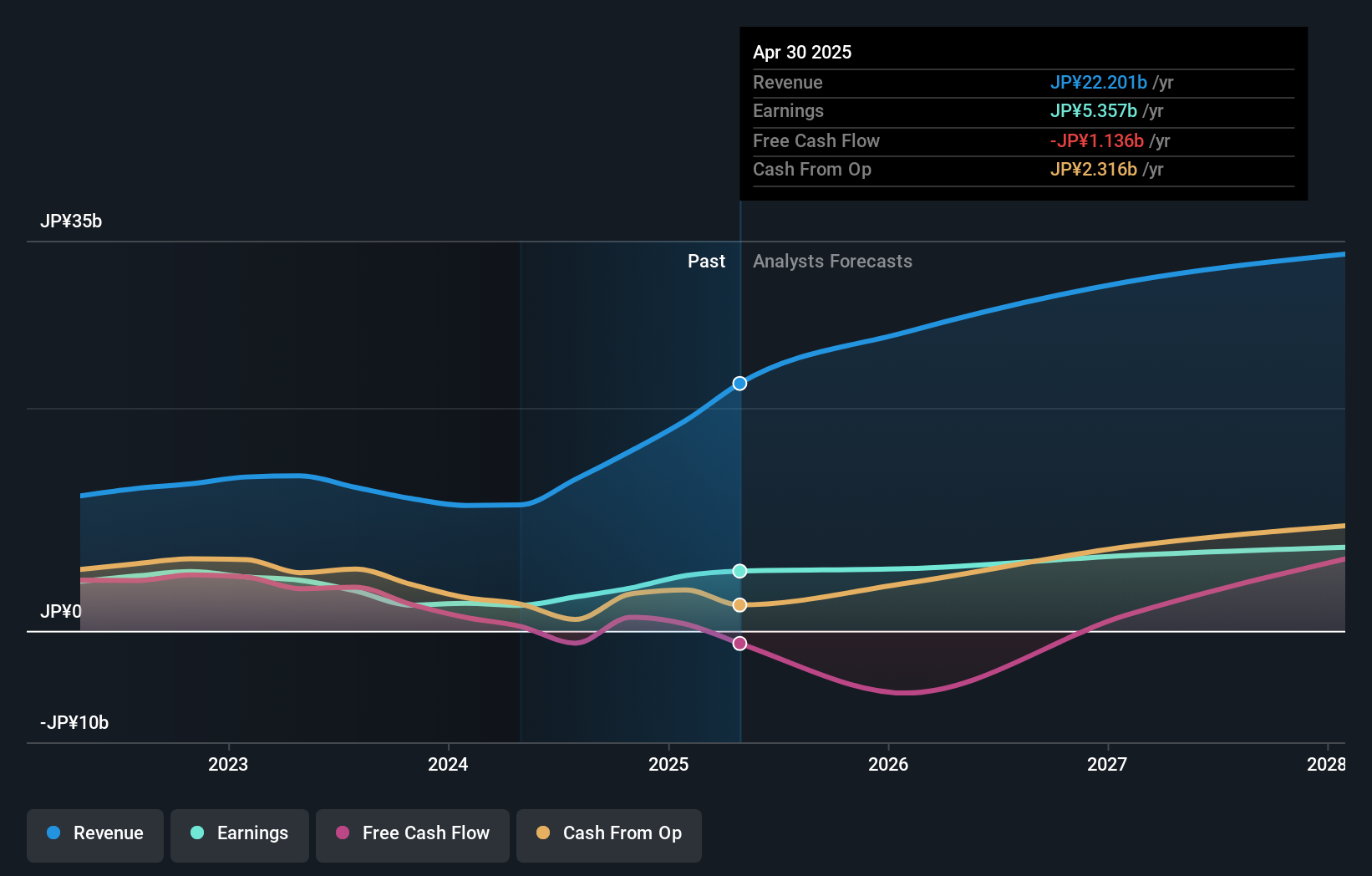

Insider Ownership: 17%

Tri Chemical Laboratories is poised for substantial growth, with revenue expected to rise by 22.3% annually, outpacing the Japanese market average. Earnings are forecast to grow significantly at 28.4% per year, indicating strong financial prospects despite a volatile share price recently. Although the return on equity is projected to remain low at 18.7%, analysts agree on a potential stock price increase of 22.8%, suggesting positive sentiment towards its future performance.

- Delve into the full analysis future growth report here for a deeper understanding of Tri Chemical Laboratories.

- Upon reviewing our latest valuation report, Tri Chemical Laboratories' share price might be too optimistic.

Seize The Opportunity

- Click here to access our complete index of 1458 Fast Growing Companies With High Insider Ownership.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688401

Shenzhen Newway Photomask Making

A lithography company, engages in the design, development, and production of mask products in China.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives