- China

- /

- Electronic Equipment and Components

- /

- SHSE:688400

High Growth Tech Stocks in Asia for May 2025

Reviewed by Simply Wall St

As global markets show signs of optimism with easing trade tensions and better-than-expected earnings, the Asian tech sector continues to capture investor interest, particularly in the realm of high-growth opportunities. In this environment, a good stock is often characterized by strong fundamentals and the ability to adapt to shifting economic landscapes while harnessing technological advancements to drive growth.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 28.00% | 28.07% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Range Intelligent Computing Technology Group | 28.40% | 29.29% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| China Leadshine Technology | 21.16% | 26.09% | ★★★★★★ |

| Nanya New Material TechnologyLtd | 22.72% | 63.29% | ★★★★★★ |

| PharmaResearch | 21.74% | 25.00% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Shanghai BOCHU Electronic Technology (SHSE:688188)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai BOCHU Electronic Technology Corporation Limited operates in the electronic technology sector and has a market capitalization of CN¥40.00 billion.

Operations: The company generates revenue primarily from its electronic technology products and services. It has a market capitalization of CN¥40 billion, reflecting its position in the sector.

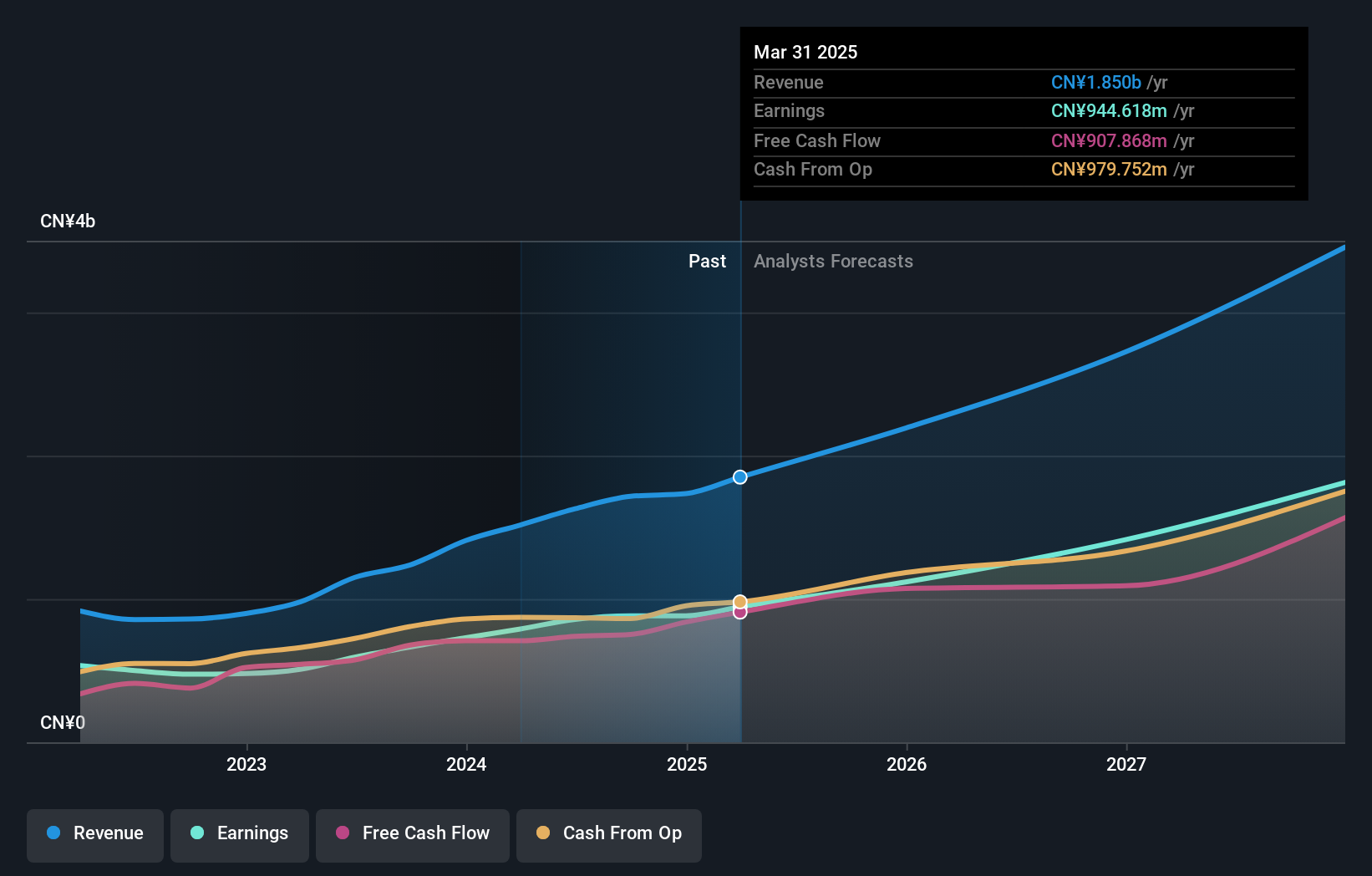

Shanghai BOCHU Electronic Technology has demonstrated robust financial performance, with a significant uptick in quarterly sales from CNY 381.06 million to CNY 495.84 million and net income rising to CNY 255.46 million from CNY 193.55 million year-over-year as of March 2025. This growth trajectory is underscored by an annual revenue increase of 22.3% and earnings growth forecast at 23.76% per year, outpacing the broader Chinese market's expansion rates of 12.7% and close to the market’s earnings growth rate of 24.1%. The firm's strategic focus on innovation is evident from its R&D investments, aligning with industry trends towards advanced electronic technologies which could further cement its competitive position in high-growth sectors within Asia.

LUSTER LightTech (SHSE:688400)

Simply Wall St Growth Rating: ★★★★★☆

Overview: LUSTER LightTech Co., LTD. specializes in the research and development of configurable visual systems, intelligent visual equipment, and core visual devices in China with a market cap of CN¥12.90 billion.

Operations: LUSTER LightTech focuses on developing visual technology solutions, including configurable systems and intelligent equipment.

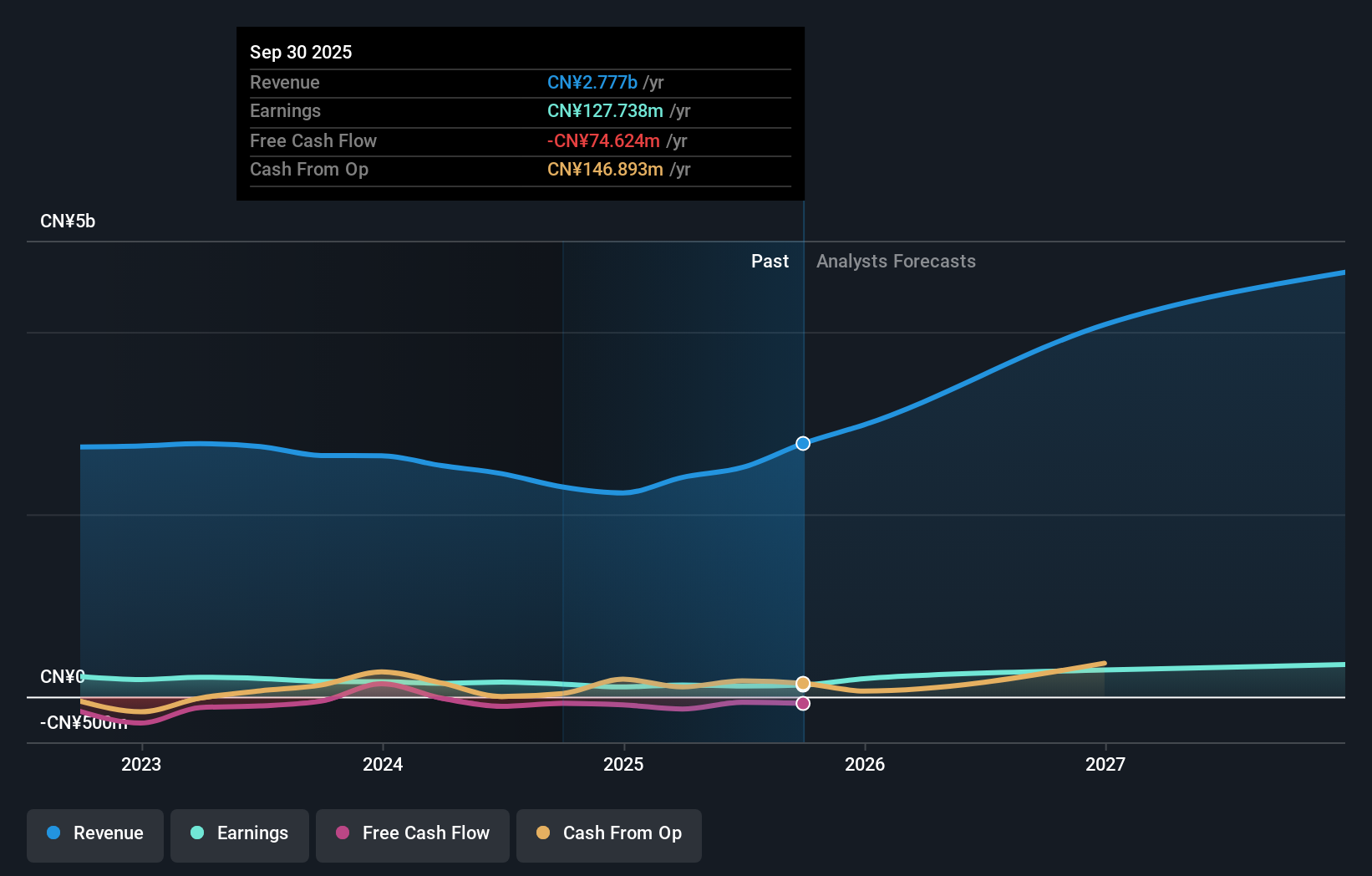

LUSTER LightTech's recent performance showcases a significant turnaround, with Q1 sales surging to CNY 614.46 million from CNY 443.43 million year-over-year, and a shift to a net income of CNY 14.99 million from a previous net loss of CNY 6.68 million. This rebound is part of a broader trend where the company's revenue is expected to grow by an impressive 25.3% annually, outpacing the Chinese market average growth rate of 12.6%. Despite facing challenges with earnings declining by 13.7% over the past year compared to the electronics industry average growth of 3.2%, LUSTER LightTech is poised for robust future earnings growth estimated at nearly double the market forecast at 39.9% annually, highlighting its potential resilience and adaptability in high-growth tech sectors in Asia.

- Get an in-depth perspective on LUSTER LightTech's performance by reading our health report here.

Gain insights into LUSTER LightTech's past trends and performance with our Past report.

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc. operates in Japan, offering services such as purchase support and restaurant reviews through its subsidiaries, with a market capitalization of approximately ¥513.81 billion.

Operations: Kakaku.com, Inc. generates revenue primarily through its purchase support and restaurant review services in Japan.

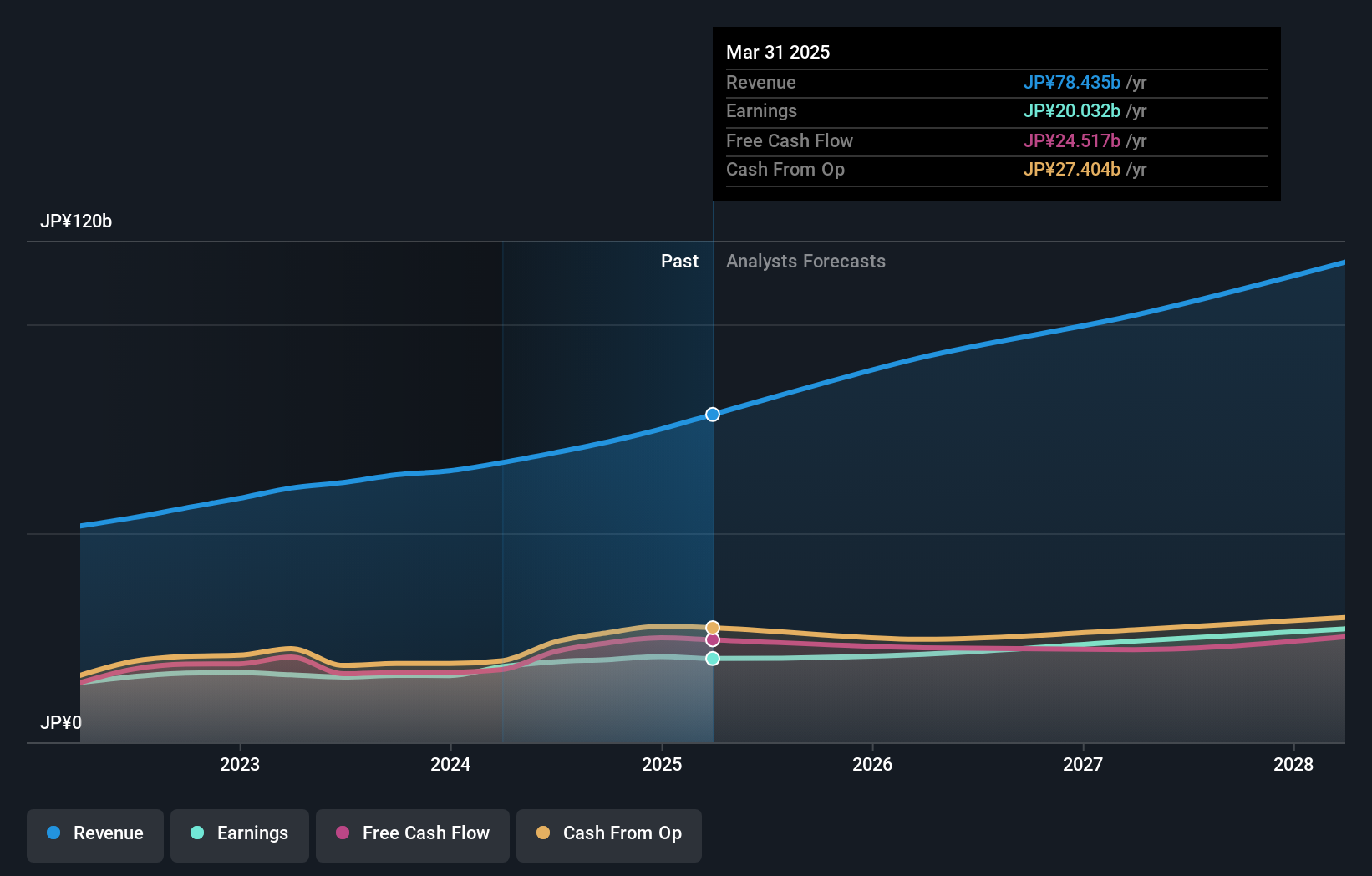

Kakaku.com, Inc. has demonstrated robust financial performance with a revised upward forecast for fiscal 2025, anticipating revenues of JPY 78 billion and profits of JPY 19.8 billion, surpassing previous estimates due to strong sales in its Tabelog and Kyujin Box segments. This adjustment reflects an annual revenue growth rate of 9.8% and earnings growth at 8%, outperforming the broader Japanese market's growth rates of 4.1% and 7.5%, respectively. Strategic executive shifts aim to enhance innovation within these key divisions, positioning the company well amidst Asia's competitive tech landscape.

- Unlock comprehensive insights into our analysis of Kakaku.com stock in this health report.

Assess Kakaku.com's past performance with our detailed historical performance reports.

Seize The Opportunity

- Investigate our full lineup of 475 Asian High Growth Tech and AI Stocks right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade LUSTER LightTech, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688400

LUSTER LightTech

Researches and develops configurable visual systems, intelligent visual equipment, and core visual devices in China.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives