- China

- /

- Semiconductors

- /

- SHSE:688720

October 2024's Top Growth Companies With Insider Stake

Reviewed by Simply Wall St

As global markets navigate a landscape of shifting interest rates and fluctuating oil prices, the U.S. indices have shown resilience with notable gains in the S&P 500 and Nasdaq Composite, driven by sectors like utilities and technology. In this environment, growth companies with high insider ownership often attract attention due to their potential for strong alignment between management and shareholder interests, making them compelling considerations for investors looking to capitalize on current market dynamics.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Atlas Energy Solutions (NYSE:AESI) | 29.1% | 41.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 35.6% |

| Medley (TSE:4480) | 34% | 30.4% |

| KebNi (OM:KEBNI B) | 36.3% | 86.1% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.9% | 95% |

| Adveritas (ASX:AV1) | 21.2% | 144.2% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.4% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's dive into some prime choices out of the screener.

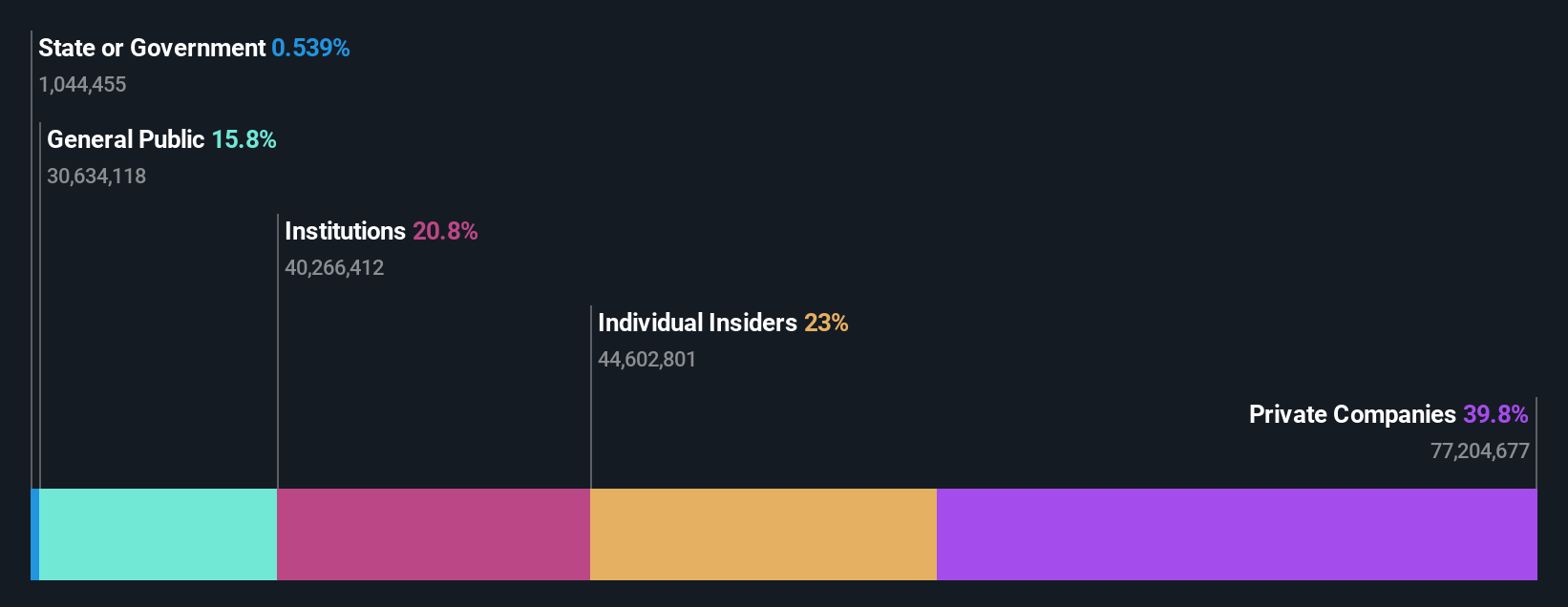

KEDE Numerical Control (SHSE:688305)

Simply Wall St Growth Rating: ★★★★★☆

Overview: KEDE Numerical Control Co., Ltd. manufactures and markets CNC systems and functional components in China, with a market cap of CN¥7.50 billion.

Operations: The company generates revenue primarily from its General Equipment Manufacturing segment, amounting to CN¥506.78 million.

Insider Ownership: 18.1%

Earnings Growth Forecast: 39.2% p.a.

KEDE Numerical Control demonstrates strong growth potential, with revenue expected to grow at 37% annually, outpacing the Chinese market's 13.5%. Despite a slight decline in basic earnings per share from CNY 0.5108 to CNY 0.5045, net income rose marginally to CNY 48.44 million for the half year ending June 2024. Forecasted earnings growth of over 39% annually is significant compared to the broader market's expectations, though past shareholder dilution warrants attention.

- Click to explore a detailed breakdown of our findings in KEDE Numerical Control's earnings growth report.

- According our valuation report, there's an indication that KEDE Numerical Control's share price might be on the expensive side.

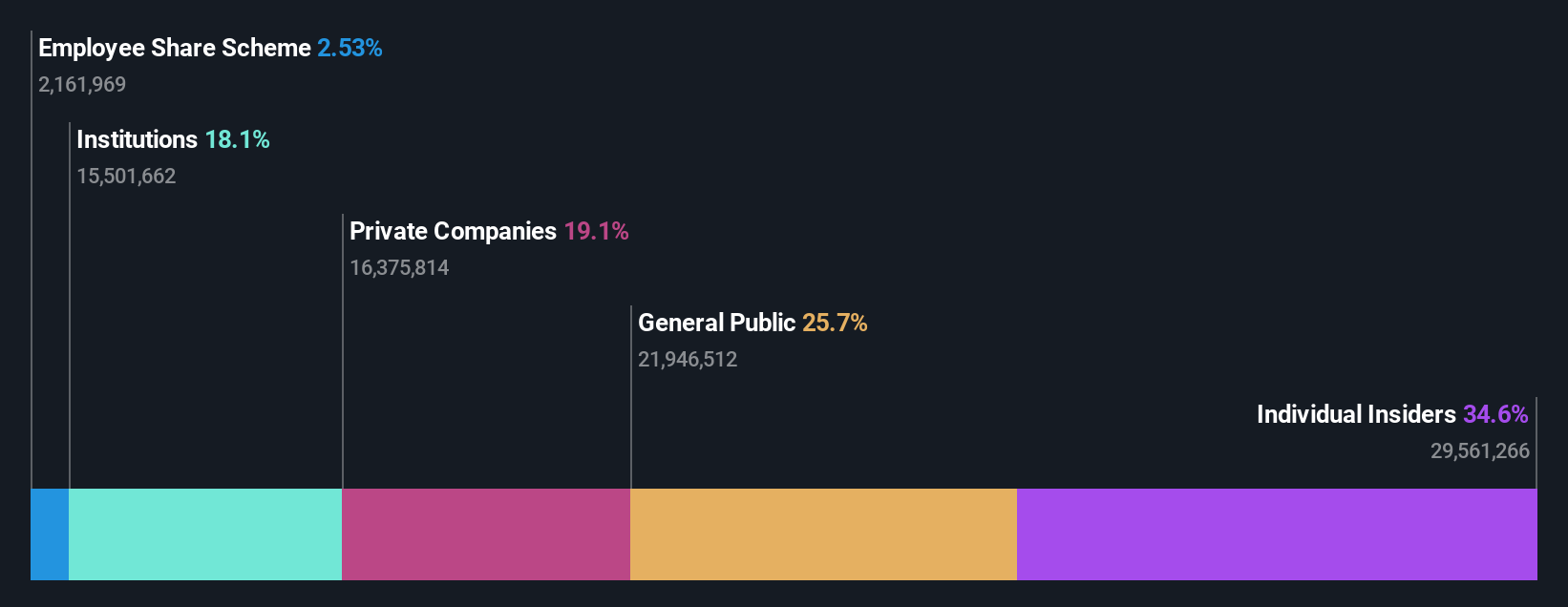

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Rigol Technologies Co., Ltd. manufactures and sells test and measurement instruments globally, with a market cap of CN¥6.47 billion.

Operations: The company's revenue primarily comes from its Electronic Test & Measurement Instruments segment, amounting to CN¥666.69 million.

Insider Ownership: 21.9%

Earnings Growth Forecast: 44.6% p.a.

Rigol Technologies is poised for substantial growth, with earnings expected to rise 44.6% annually, surpassing the Chinese market's 23.8%. However, recent financials show a decline in net income to CNY 7.65 million from CNY 46.05 million year-over-year and profit margins have decreased from 16.2% to 10.4%. Despite trading below fair value and completing a share buyback worth CNY 30.01 million, past shareholder dilution remains a concern.

- Click here and access our complete growth analysis report to understand the dynamics of Rigol Technologies.

- Our expertly prepared valuation report Rigol Technologies implies its share price may be too high.

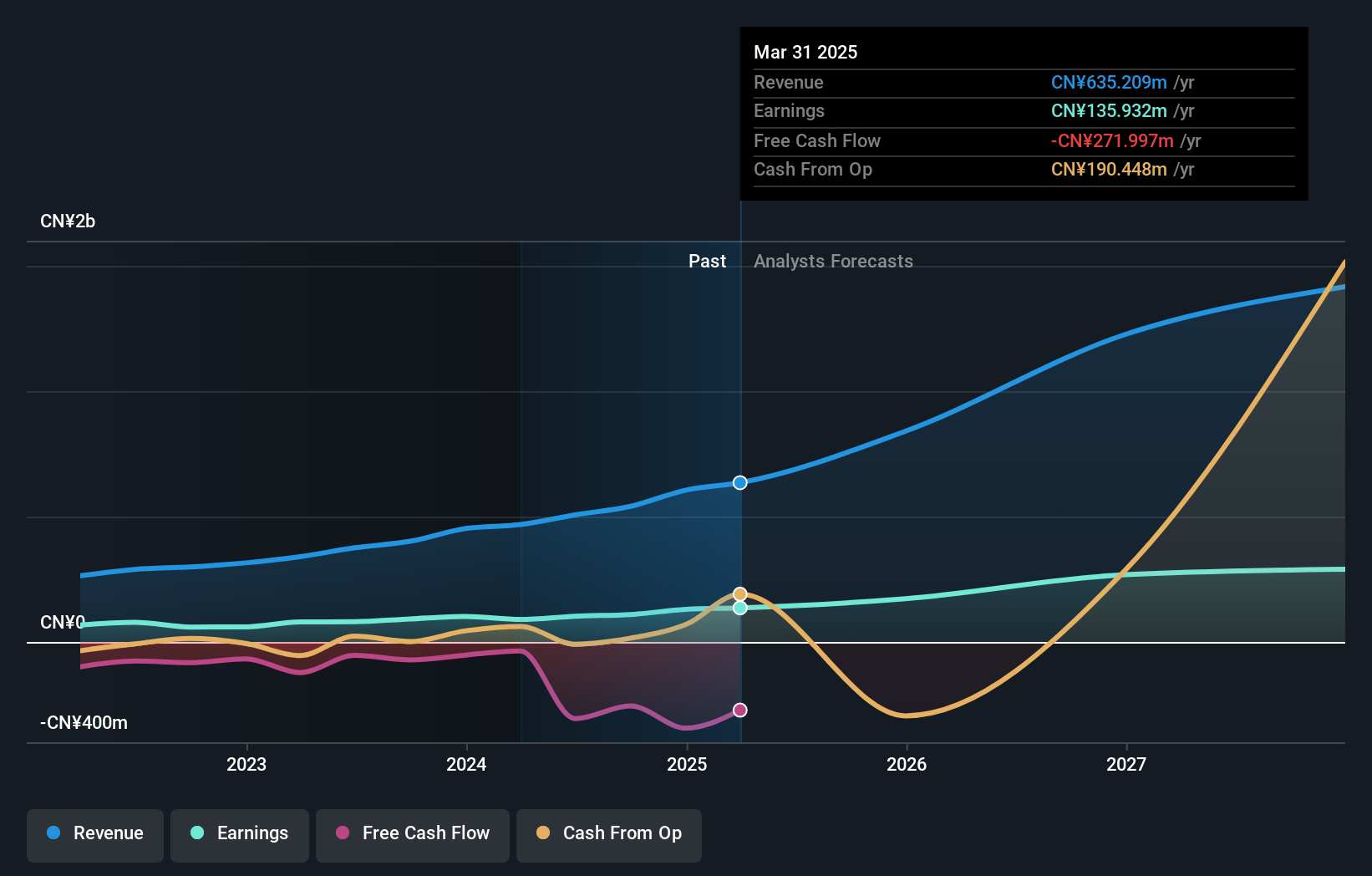

Jiangsu Aisen Semiconductor MaterialLtd (SHSE:688720)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Jiangsu Aisen Semiconductor Material Co., Ltd. (SHSE:688720) operates in the semiconductor industry, focusing on the production and supply of semiconductor materials, with a market cap of approximately CN¥3.88 billion.

Operations: I'm sorry, but the provided text does not include specific revenue segment information for Jiangsu Aisen Semiconductor Material Co., Ltd. If you can provide the relevant details, I would be happy to help summarize them for you.

Insider Ownership: 33.7%

Earnings Growth Forecast: 38.8% p.a.

Jiangsu Aisen Semiconductor Material Ltd. demonstrates robust growth potential, with earnings projected to increase by 38.8% annually, outpacing the Chinese market's average. Recent financials reveal a rise in revenue to CNY 185.8 million and net income of CNY 13.74 million for the half-year ending June 2024, indicating solid performance despite a slight dip in earnings per share from continuing operations. While insider trading activity is minimal, high volatility in share price persists as a concern.

- Get an in-depth perspective on Jiangsu Aisen Semiconductor MaterialLtd's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Jiangsu Aisen Semiconductor MaterialLtd is trading beyond its estimated value.

Taking Advantage

- Access the full spectrum of 1483 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688720

Jiangsu Aisen Semiconductor MaterialLtd

Jiangsu Aisen Semiconductor Material Co.,Ltd.

Adequate balance sheet with poor track record.

Market Insights

Community Narratives