- China

- /

- Food and Staples Retail

- /

- SZSE:301078

Global Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

In the wake of recent tariff announcements by the Trump administration, global markets have experienced significant volatility, with major indices suffering their steepest declines in years. Amidst this uncertainty, investors are increasingly focusing on growth companies with strong insider ownership as potential opportunities, given that such stocks often indicate a high level of confidence from those closest to the business.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Zhejiang Jolly PharmaceuticalLTD (SZSE:300181) | 23.3% | 26% |

| Arctech Solar Holding (SHSE:688408) | 37.9% | 24.7% |

| AcrelLtd (SZSE:300286) | 40% | 32% |

| Pharma Mar (BME:PHM) | 11.8% | 40.8% |

| Vow (OB:VOW) | 13.1% | 111.2% |

| Laopu Gold (SEHK:6181) | 36.4% | 39.9% |

| Nordic Halibut (OB:NOHAL) | 29.8% | 56.3% |

| CD Projekt (WSE:CDR) | 29.7% | 37.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 88.2% |

| Synspective (TSE:290A) | 13.2% | 44.5% |

Here's a peek at a few of the choices from the screener.

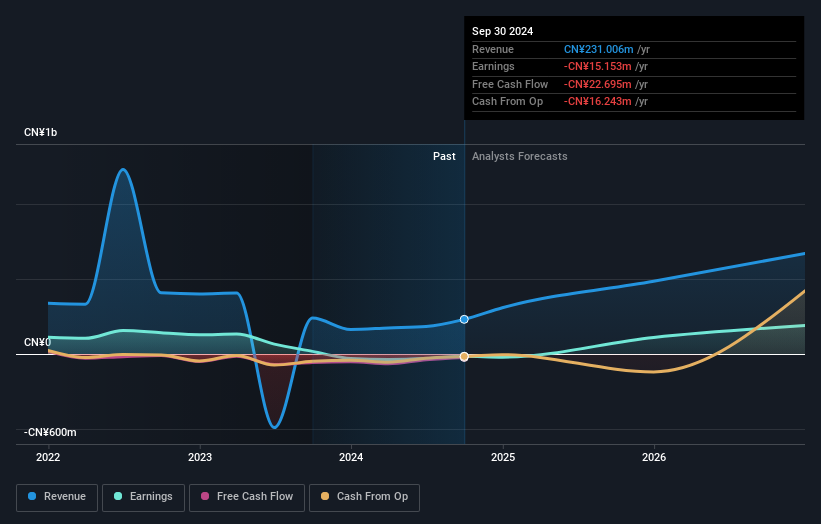

Hunan Kylinsec Technology (SHSE:688152)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Kylinsec Technology Co., Ltd. is a company that supplies software products and has a market cap of approximately CN¥4.40 billion.

Operations: Hunan Kylinsec Technology Co., Ltd. generates its revenue primarily from the supply of software products.

Insider Ownership: 38.3%

Earnings Growth Forecast: 88.6% p.a.

Hunan Kylinsec Technology demonstrates strong growth potential, with earnings forecast to grow significantly at 88.56% annually and revenue expected to outpace the CN market at 39.9% per year. Despite a volatile share price, the company recently reported a turnaround from a net loss to CNY 7.87 million in net income for 2024. However, its Return on Equity is projected to remain low at 12.3%, and there is no recent insider trading activity noted.

- Click to explore a detailed breakdown of our findings in Hunan Kylinsec Technology's earnings growth report.

- Our valuation report here indicates Hunan Kylinsec Technology may be overvalued.

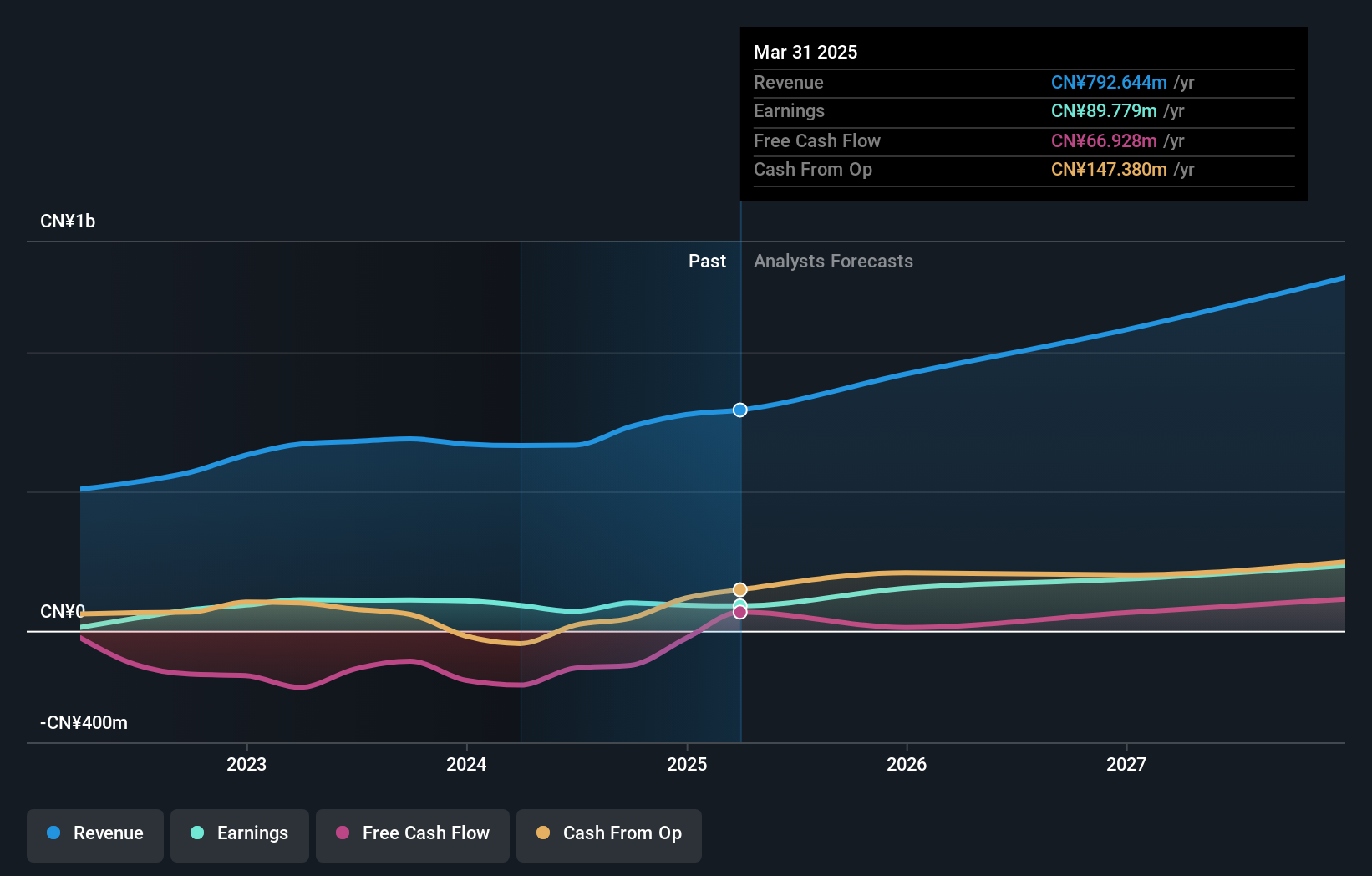

Rigol Technologies (SHSE:688337)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rigol Technologies Co., Ltd. manufactures and sells test and measurement instruments globally, with a market cap of CN¥6.22 billion.

Operations: The company's revenue primarily comes from its Electronic Test & Measurement Instruments segment, which generated CN¥775.83 million.

Insider Ownership: 22%

Earnings Growth Forecast: 41.2% p.a.

Rigol Technologies shows promising growth prospects, with earnings expected to grow significantly at 41.19% annually, surpassing the CN market average. Revenue is also forecast to increase faster than the market at 18.9% per year, though slightly below the high-growth threshold. Despite a recent decline in net income to CNY 88.91 million for 2024 and low projected Return on Equity of 6.6%, the stock trades modestly below its fair value estimate without notable insider trading activity recently observed.

- Navigate through the intricacies of Rigol Technologies with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Rigol Technologies shares in the market.

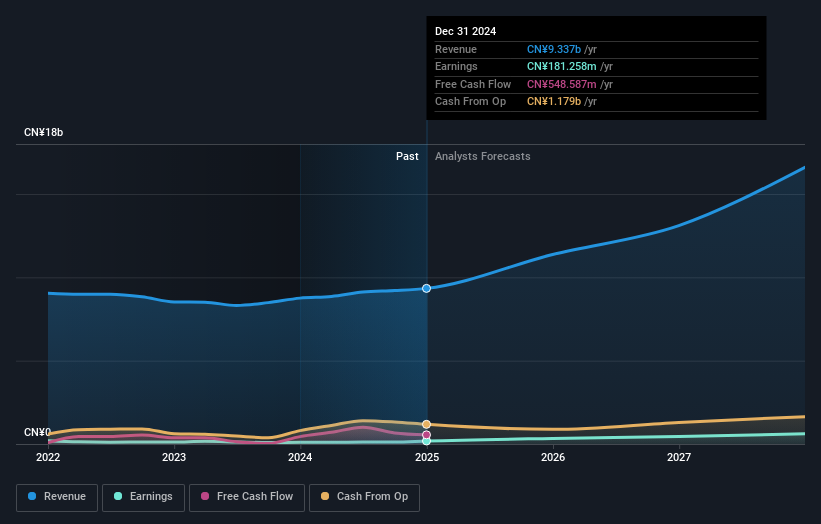

Kidswant Children ProductsLtd (SZSE:301078)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kidswant Children Products Co., Ltd. operates as a retailer of maternal, infant, and child products in China with a market cap of CN¥15.16 billion.

Operations: The company generates revenue of CN¥9.20 billion from its retailing segment focused on mother and baby products in China.

Insider Ownership: 28.6%

Earnings Growth Forecast: 41.4% p.a.

Kidswant Children Products Ltd. demonstrates significant growth potential with earnings forecasted to grow at 41.4% annually, outpacing the CN market average. Revenue is also projected to rise faster than the market at 16.2% per year, though below high-growth levels. Despite a volatile share price and low expected Return on Equity of 11.3%, the stock trades substantially below its fair value estimate, with no recent insider trading activity reported and a proposed dividend of CNY 0.50 per share for 2024.

- Dive into the specifics of Kidswant Children ProductsLtd here with our thorough growth forecast report.

- The analysis detailed in our Kidswant Children ProductsLtd valuation report hints at an inflated share price compared to its estimated value.

Make It Happen

- Delve into our full catalog of 898 Fast Growing Global Companies With High Insider Ownership here.

- Ready For A Different Approach? Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kidswant Children ProductsLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301078

Kidswant Children ProductsLtd

Engages in the retail of maternal, infant, and child products in China.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives