- China

- /

- Electronic Equipment and Components

- /

- SZSE:002869

Undiscovered Gems None And 2 Other Small Caps With Promising Potential

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and consumer spending concerns, small-cap stocks have faced their own challenges, with the S&P 600 SmallCap Index reflecting broader market sentiment. Despite these hurdles, the search for promising opportunities within this segment continues to captivate investors who are keen on uncovering potential growth stories. In such an environment, a good stock often stands out through its resilience and adaptability to economic shifts, offering a unique value proposition that aligns with emerging market trends.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Omega Flex | NA | 0.39% | 2.57% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Minsud Resources | NA | nan | -29.01% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Anbio Biotechnology | NA | 8.43% | 184.88% | ★★★★★★ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

| Central Cooperative Bank AD | 4.88% | 37.94% | 537.05% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Shanghai Holystar Information Technology (SHSE:688330)

Simply Wall St Value Rating: ★★★★★★

Overview: Shanghai Holystar Information Technology Co., Ltd. (ticker: SHSE:688330) operates in the technology sector, focusing on providing innovative information technology solutions, with a market capitalization of CN¥3.86 billion.

Operations: Shanghai Holystar generates revenue from its information technology solutions, with a market capitalization of CN¥3.86 billion.

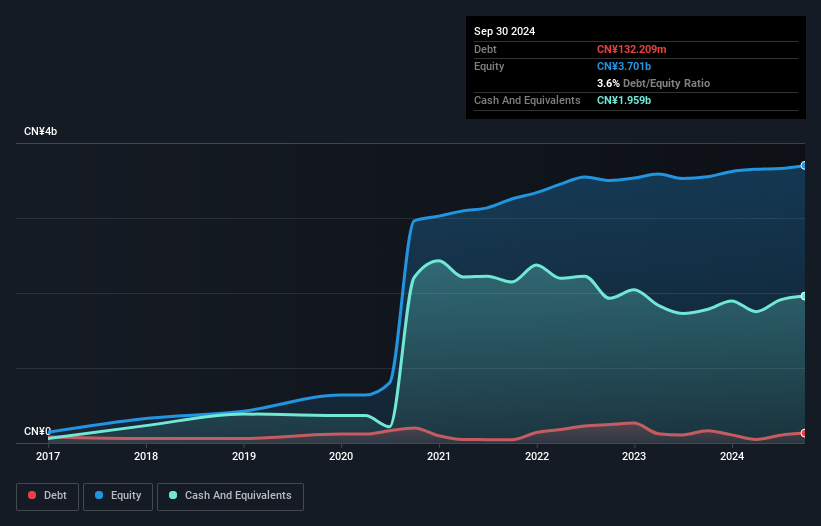

Shanghai Holystar Information Technology, a relatively small player in the tech sector, has demonstrated impressive financial resilience. The company's earnings surged by 61% over the past year, significantly outpacing the Electronic industry's modest 1.6% growth. A notable one-off gain of CN¥47M influenced its recent performance, highlighting potential volatility. Over five years, debt management improved as the debt-to-equity ratio fell from 18% to just under 4%. Trading at a substantial discount of nearly 64% below estimated fair value suggests it might be undervalued despite past earnings declining by about 8% annually over five years.

- Dive into the specifics of Shanghai Holystar Information Technology here with our thorough health report.

Learn about Shanghai Holystar Information Technology's historical performance.

Yuan Cheng CableLtd (SZSE:002692)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Yuan Cheng Cable Co., Ltd. is involved in the design, R&D, production, operation, and sales of wire and cable products in China with a market capitalization of approximately CN¥3.55 billion.

Operations: The primary revenue stream for Yuan Cheng Cable Co., Ltd. comes from its wire and cable segment, generating approximately CN¥4.11 billion.

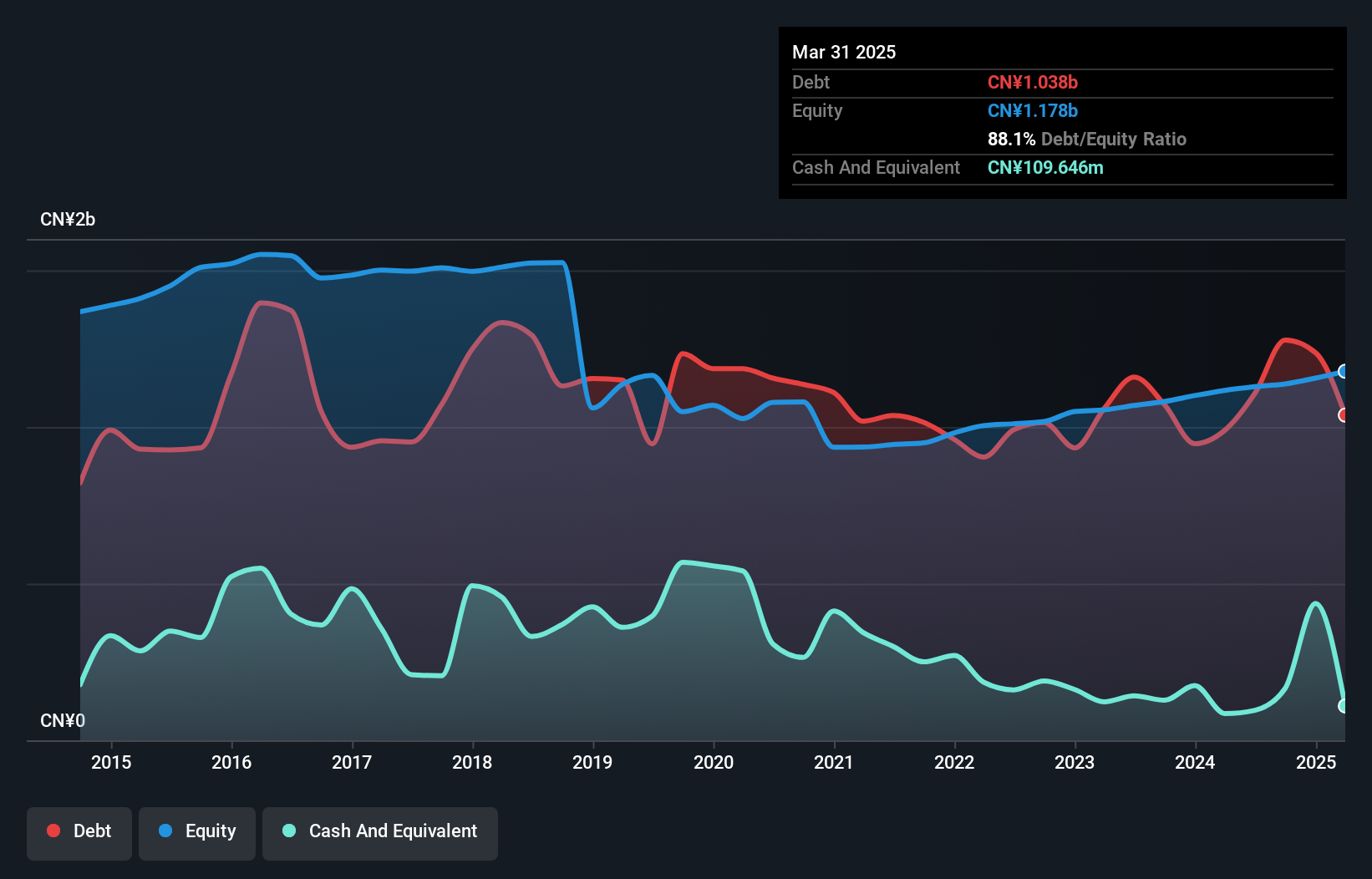

Yuan Cheng Cable, a promising player in the electrical sector, has seen its earnings grow by 10% over the past year, outpacing the industry's 1.3% growth. Despite having a high net debt to equity ratio of 97.7%, it has improved from 117.7% five years ago and maintains profitability with high-quality earnings. The company's interest payments are well covered by EBIT at 4.4 times coverage, although free cash flow remains negative. Recent board changes suggest strategic shifts could be underway following an extraordinary shareholders meeting in January where new directors were elected and liability insurance for executives was discussed.

- Unlock comprehensive insights into our analysis of Yuan Cheng CableLtd stock in this health report.

Understand Yuan Cheng CableLtd's track record by examining our Past report.

Shenzhen Genvict Technologies (SZSE:002869)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Genvict Technologies Co., Ltd. focuses on the research, development, and industrialization of smart transportation technology in China, with a market cap of CN¥5.07 billion.

Operations: Genvict Technologies generates revenue primarily from its Intelligent Traffic Industry segment, which reported earnings of CN¥514.77 million.

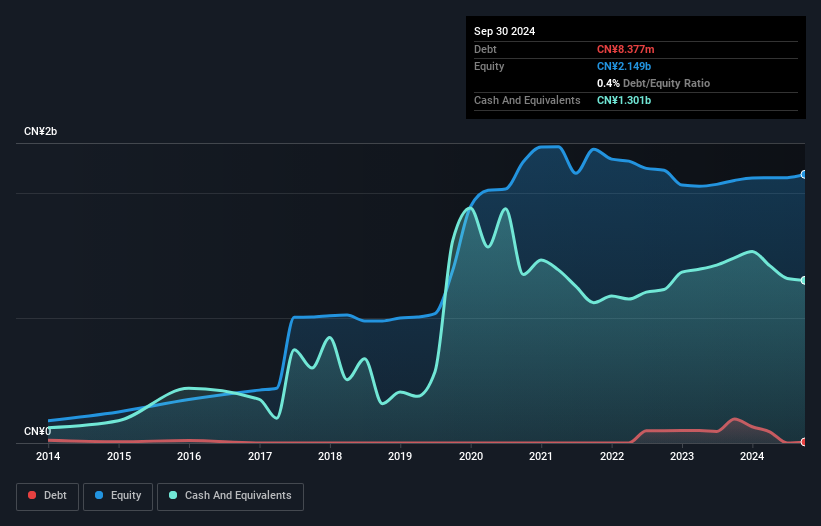

Genvict Technologies, a nimble player in the tech space, is debt-free, eliminating concerns over interest payments. Earnings soared by 65% last year, outpacing the electronic industry's modest 1.6% growth rate. A notable one-off gain of CN¥34 million influenced recent financials, yet profitability remains robust with an expected annual earnings growth of 40%. Although free cash flow isn't positive currently, the company’s strong earnings trajectory suggests potential for future improvement. A recent extraordinary shareholders meeting hints at strategic moves on continuing connected transactions for 2025, potentially shaping its path forward.

Next Steps

- Click here to access our complete index of 4752 Undiscovered Gems With Strong Fundamentals.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002869

Shenzhen Genvict Technologies

Engages in the research, development, and industrialization of smart transportation technology in China.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives