- China

- /

- Electronic Equipment and Components

- /

- SHSE:688330

Improved Earnings Required Before Shanghai Holystar Information Technology Co., Ltd. (SHSE:688330) Stock's 29% Jump Looks Justified

Those holding Shanghai Holystar Information Technology Co., Ltd. (SHSE:688330) shares would be relieved that the share price has rebounded 29% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 46% in the last twelve months.

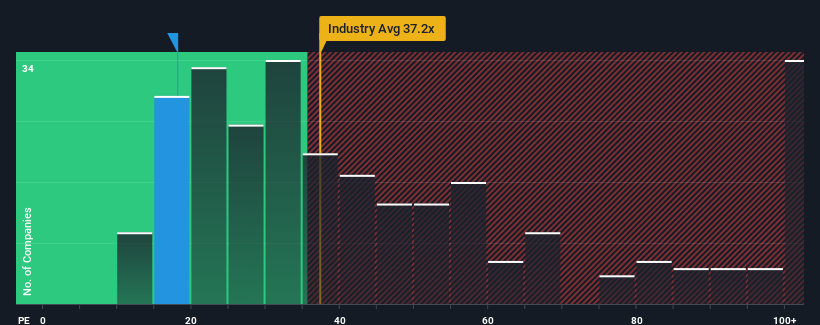

In spite of the firm bounce in price, Shanghai Holystar Information Technology's price-to-earnings (or "P/E") ratio of 18.1x might still make it look like a buy right now compared to the market in China, where around half of the companies have P/E ratios above 30x and even P/E's above 55x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings that are retreating more than the market's of late, Shanghai Holystar Information Technology has been very sluggish. The P/E is probably low because investors think this poor earnings performance isn't going to improve at all. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping the earnings slide doesn't get any worse if your plan is to pick up some stock while it's out of favour.

See our latest analysis for Shanghai Holystar Information Technology

What Are Growth Metrics Telling Us About The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Shanghai Holystar Information Technology's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 39%. As a result, earnings from three years ago have also fallen 50% overall. Accordingly, shareholders would have felt downbeat about the medium-term rates of earnings growth.

Shifting to the future, estimates from the sole analyst covering the company suggest earnings should grow by 18% over the next year. With the market predicted to deliver 41% growth , the company is positioned for a weaker earnings result.

In light of this, it's understandable that Shanghai Holystar Information Technology's P/E sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Final Word

The latest share price surge wasn't enough to lift Shanghai Holystar Information Technology's P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Shanghai Holystar Information Technology maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Shanghai Holystar Information Technology that you should be aware of.

Of course, you might find a fantastic investment by looking at a few good candidates. So take a peek at this free list of companies with a strong growth track record, trading on a low P/E.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:688330

Shanghai Holystar Information Technology

Engages in the research, development, production, and sale of intelligent equipment for distribution networks in China.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Insiders Sell, Investors Watch: What’s Going On at PG?

Waiting for the Inevitable

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026