- China

- /

- Electronic Equipment and Components

- /

- SHSE:688320

Asian Growth Stocks With High Insider Ownership For April 2025

Reviewed by Simply Wall St

As of April 2025, Asian markets are experiencing a cautious optimism amid easing global trade tensions and expectations for economic stimulus in key regions like China. In this environment, growth companies with high insider ownership can be particularly appealing as they often signal strong alignment between management and shareholder interests, potentially offering resilience amidst market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| AcrelLtd (SZSE:300286) | 34.2% | 34.9% |

| WinWay Technology (TWSE:6515) | 22.1% | 21.4% |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 40.2% |

| Global Tax Free (KOSDAQ:A204620) | 20.8% | 35.1% |

| Nanya New Material TechnologyLtd (SHSE:688519) | 11.1% | 63.3% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 61.9% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 77.7% |

| Fulin Precision (SZSE:300432) | 13.6% | 74.7% |

| Vuno (KOSDAQ:A338220) | 15.6% | 148.2% |

We're going to check out a few of the best picks from our screener tool.

Zhejiang Hechuan Technology (SHSE:688320)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Hechuan Technology Co., Ltd. focuses on the research, development, manufacturing, sale, and application integration of industrial automation products and has a market cap of CN¥6.59 billion.

Operations: Zhejiang Hechuan Technology Co., Ltd. generates revenue through its involvement in the research, development, production, sales, and integration of industrial automation products.

Insider Ownership: 30.8%

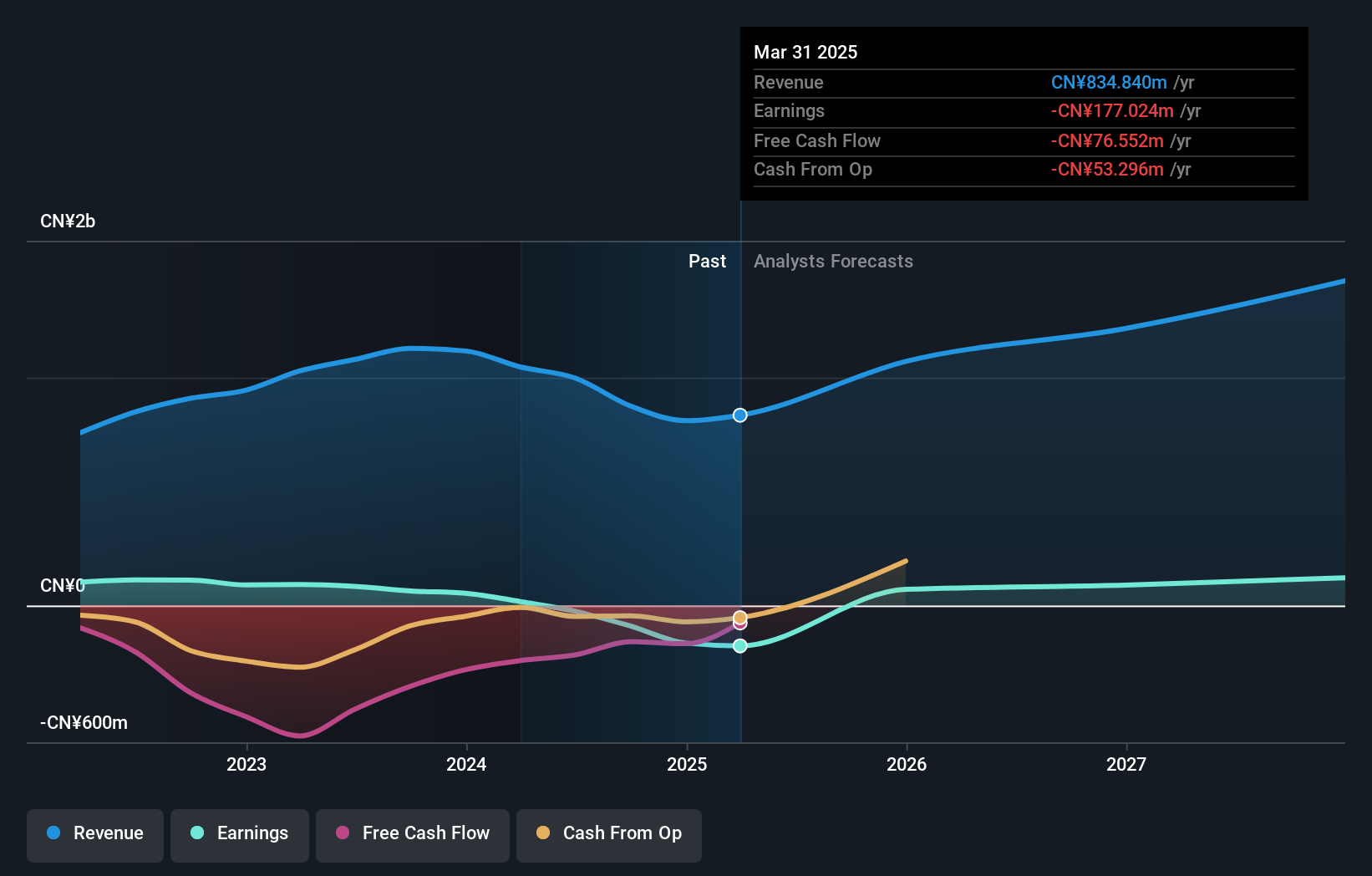

Zhejiang Hechuan Technology is forecast to achieve robust revenue growth of 23.9% annually, outpacing the Chinese market's average. Despite a challenging past year with sales declining to CNY 815.14 million and a net loss of CNY 157.23 million, the company is expected to become profitable in three years, indicating strong growth potential. Insider ownership remains high with no significant insider trading activity recently, while share price volatility persists over the last three months.

- Click here and access our complete growth analysis report to understand the dynamics of Zhejiang Hechuan Technology.

- Our expertly prepared valuation report Zhejiang Hechuan Technology implies its share price may be too high.

Guangzhou Sie Consulting (SZSE:300687)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Guangzhou Sie Consulting Co., Ltd. is a solution provider specializing in industrial Internet, intelligent manufacturing, core ERP, and business operation centers in China with a market cap of CN¥12.76 billion.

Operations: The company generates revenue of CN¥2.40 billion from its software services segment.

Insider Ownership: 29.1%

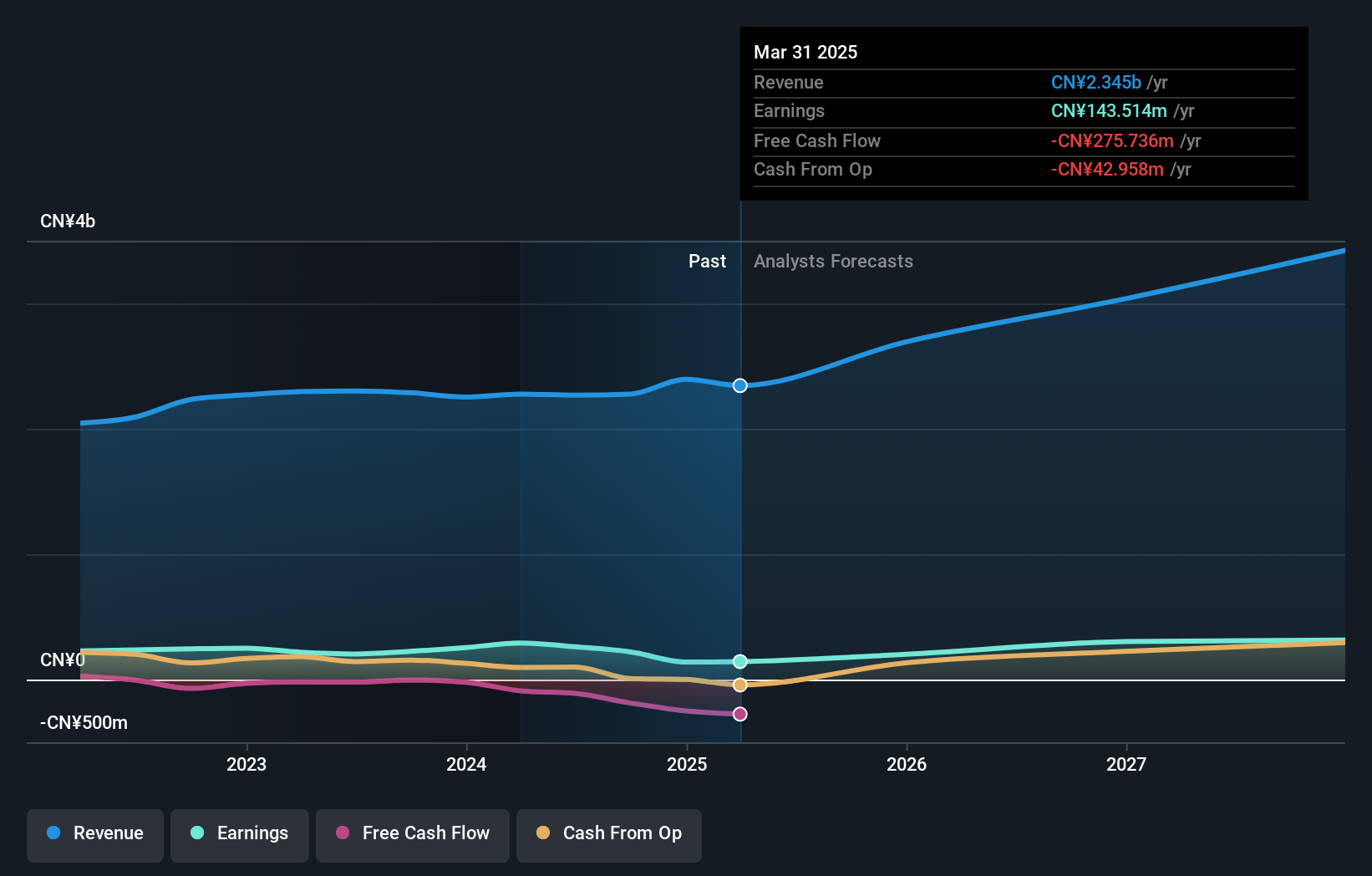

Guangzhou Sie Consulting faces challenges with declining net income and profit margins, yet it is poised for significant earnings growth at 49.6% annually, surpassing the Chinese market's average. Revenue growth is slower at 12.7% but still above market expectations. The company completed a share buyback program, enhancing shareholder value despite recent high share price volatility. Insider ownership remains substantial without notable trading activity in the past three months, supporting confidence in long-term prospects.

- Navigate through the intricacies of Guangzhou Sie Consulting with our comprehensive analyst estimates report here.

- Our valuation report here indicates Guangzhou Sie Consulting may be overvalued.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally with a market capitalization of ¥1.16 trillion.

Operations: Lasertec's revenue primarily comes from its operations in designing, manufacturing, and selling inspection and measurement equipment across domestic and international markets.

Insider Ownership: 11.1%

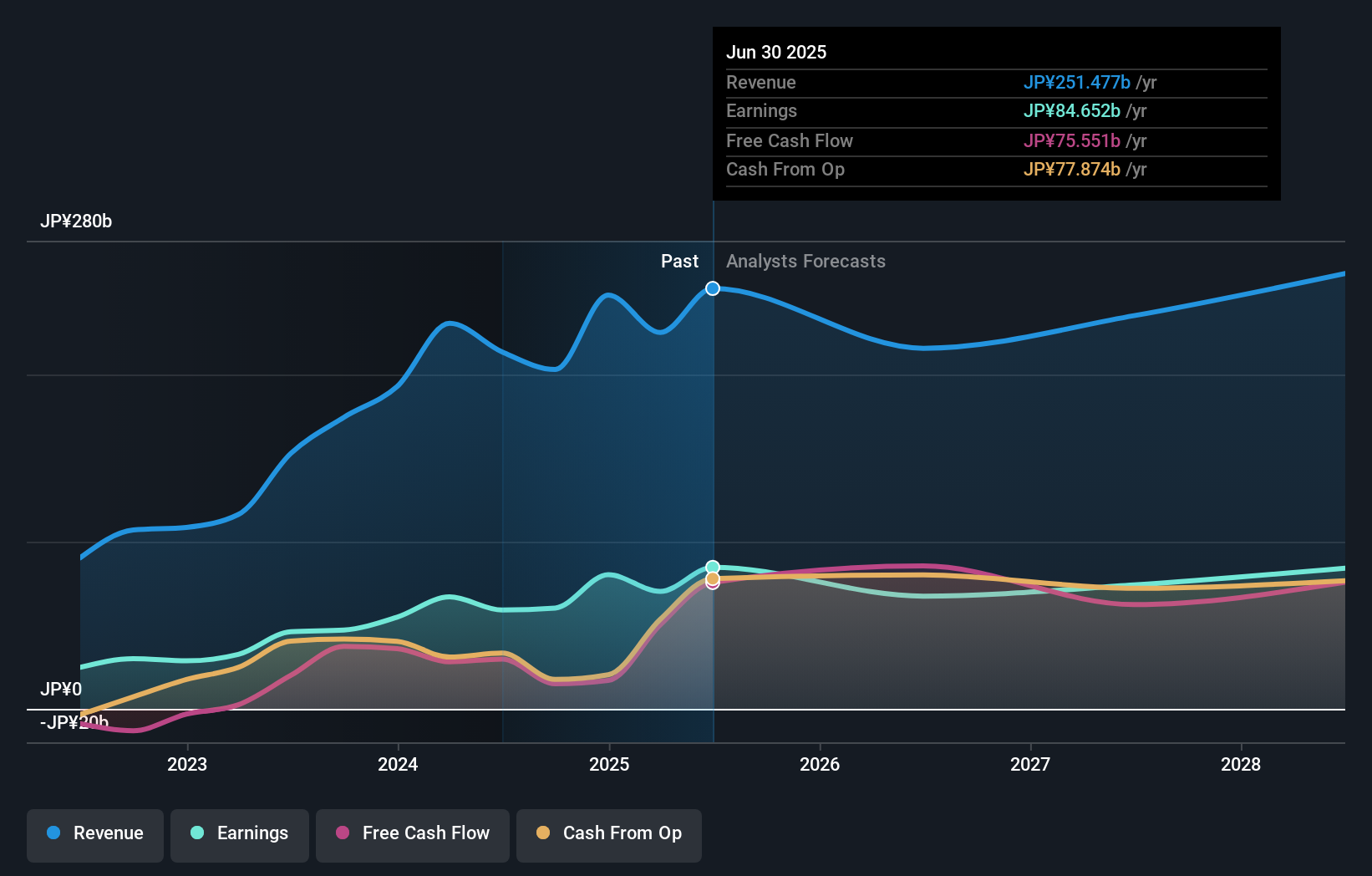

Lasertec's earnings are expected to grow at 7.73% annually, slightly above the Japanese market average, with revenue growth forecasted at 8.8%, outpacing the broader market. Despite recent share price volatility and no significant insider trading activity reported in the past three months, substantial insider ownership suggests confidence in its long-term potential. The company pays a reliable dividend of 2.24%. Recent executive changes include Hiroki Miyai's appointment as Executive Officer effective April 1, 2025.

- Click here to discover the nuances of Lasertec with our detailed analytical future growth report.

- Upon reviewing our latest valuation report, Lasertec's share price might be too optimistic.

Next Steps

- Click here to access our complete index of 631 Fast Growing Asian Companies With High Insider Ownership.

- Contemplating Other Strategies? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Hechuan Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688320

Zhejiang Hechuan Technology

Engages in the research and development, manufacturing, sale, and application integration of industrial automation products.

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives