- China

- /

- Metals and Mining

- /

- SHSE:603211

Undiscovered Gems With Potential For December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape, with major indices like the S&P 500 and Nasdaq Composite reaching record highs while small-cap stocks in the Russell 2000 face declines, investors are keenly observing economic indicators such as job growth and interest rate adjustments. In this environment of mixed signals and sector divergence, identifying undiscovered gems requires a focus on companies that demonstrate resilience, innovative potential, and adaptability to changing economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Marítima de Inversiones | NA | 82.67% | 21.14% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.44% | 27.31% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.99% | 23.94% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

FRoSTA (DB:NLM)

Simply Wall St Value Rating: ★★★★★★

Overview: FRoSTA Aktiengesellschaft, along with its subsidiaries, specializes in developing, producing, and marketing frozen food products across Germany, Poland, Austria, Italy, and Eastern Europe with a market cap of €412.16 million.

Operations: FRoSTA generates revenue primarily through the sale of frozen food products across several European countries. The company's cost structure includes expenses related to production, distribution, and marketing. Notably, its net profit margin has shown variability over recent periods, reflecting changes in operational efficiency and market conditions.

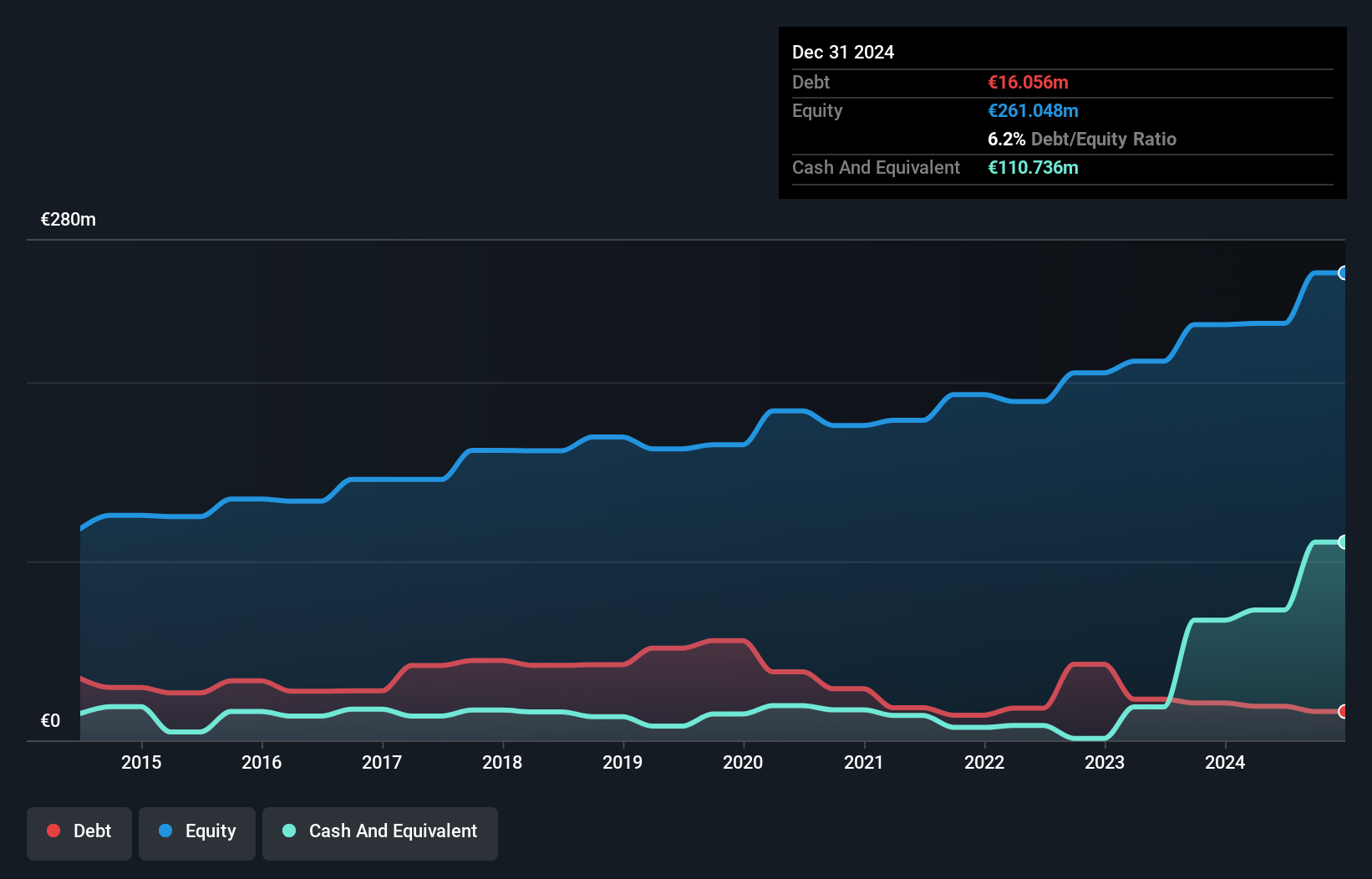

FRoSTA, a notable player in the food sector, has been making strides with earnings growing 16% annually over five years. Despite this, its recent annual growth of 7.6% lagged behind the broader food industry at 48.7%. The company appears to be trading at a significant discount, valued at roughly 96% below estimated fair value. Financially sound, FRoSTA's debt-to-equity ratio improved from 31.6% to 8.2%, and it maintains more cash than total debt, indicating robust financial health and high-quality past earnings that can potentially support future endeavors in the competitive market landscape.

- Get an in-depth perspective on FRoSTA's performance by reading our health report here.

Gain insights into FRoSTA's historical performance by reviewing our past performance report.

Jintuo Technology (SHSE:603211)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Jintuo Technology Co., Ltd. focuses on the research, development, production, and sale of aluminum alloy precision die castings with a market capitalization of CN¥4.69 billion.

Operations: Jintuo Technology generates revenue primarily from the sale of aluminum alloy precision die castings. The company's financial performance is characterized by specific trends in its profit margins, with a notable net profit margin that reflects its cost management and pricing strategies.

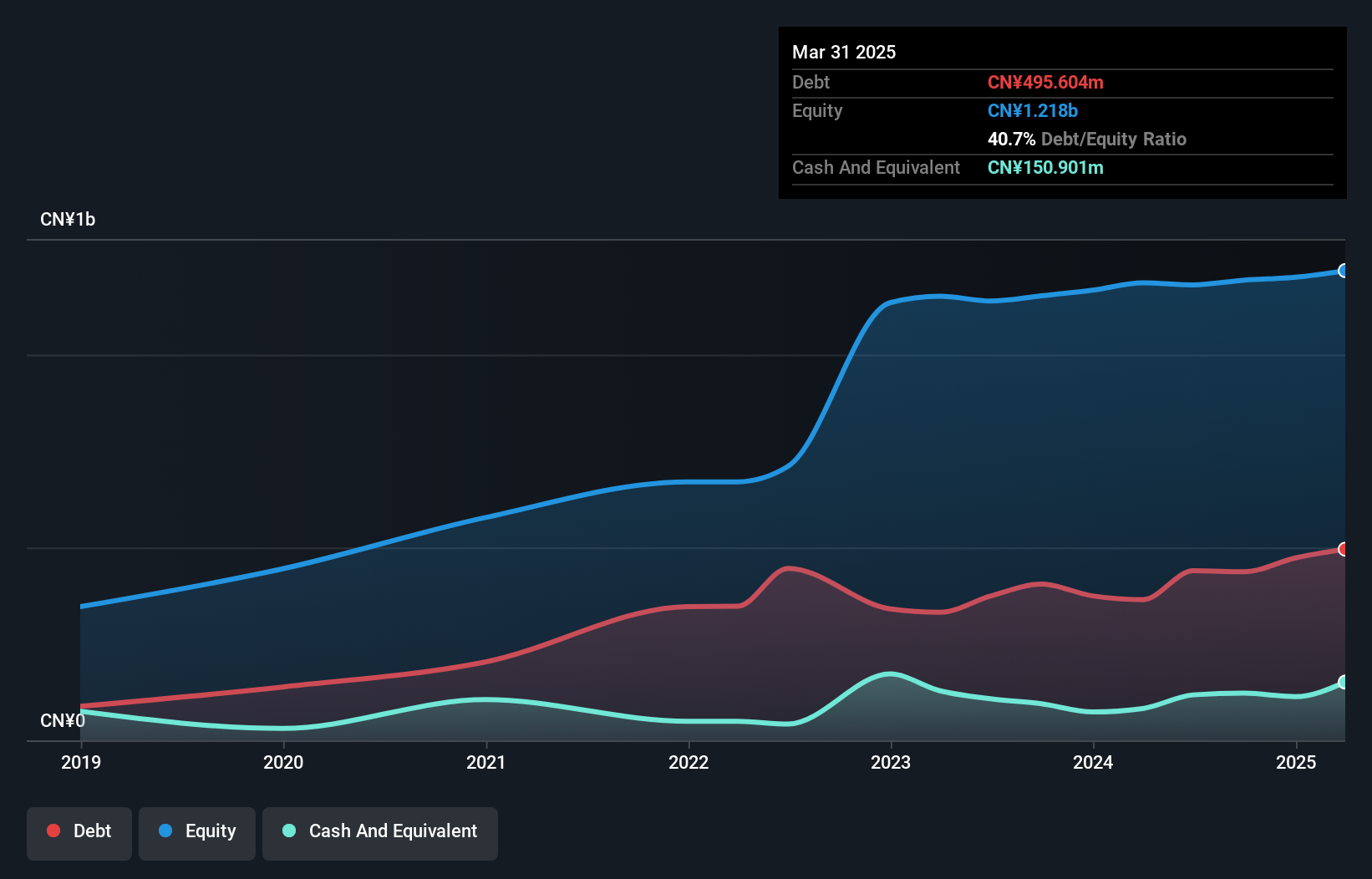

Jintuo Technology, a smaller player in its field, is showing signs of robust performance with a 7.8% earnings growth over the past year, outpacing the broader Metals and Mining industry which saw a -2.3% earnings change. Despite an increase in debt to equity from 29.9% to 36.6% over five years, the net debt to equity ratio remains satisfactory at 26.4%. Recent financial results reveal sales of CNY 829 million for nine months ending September 2024, up from CNY 729 million last year, and net income rising to CNY 43 million from CNY 39 million previously.

Beijing Haohan Data TechnologyLtd (SHSE:688292)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Haohan Data Technology Co., Ltd specializes in network intelligence, information security protection, network security protection, and big data application products in China with a market cap of CN¥3.75 billion.

Operations: Haohan Data Technology generates revenue primarily from its communications equipment segment, totaling CN¥563.83 million.

Beijing Haohan Data Technology, a nimble player in the tech space, showcases a mix of strengths and challenges. With no debt on its books, interest coverage isn't an issue, highlighting financial prudence. Earnings surged by 41% last year, outpacing the broader communications sector's downturn of 3%, indicating robust performance. However, recent reports show sales at CNY 316.76 million for nine months ended September 2024 compared to CNY 368.5 million previously, with net income dropping to CNY 36.9 million from CNY 51.49 million. Trading at about 74% below estimated fair value suggests potential undervaluation despite share price volatility recently observed over three months.

- Navigate through the intricacies of Beijing Haohan Data TechnologyLtd with our comprehensive health report here.

Learn about Beijing Haohan Data TechnologyLtd's historical performance.

Taking Advantage

- Reveal the 1400 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603211

Jintuo Technology

Engages in the research, development, production, and sale of aluminum alloy precision die castings.

Adequate balance sheet with acceptable track record.