3 Growth Companies With High Insider Ownership Expecting Up To 123% Earnings Growth

Reviewed by Simply Wall St

As global markets navigate the complexities of rising inflation and potential shifts in trade policies, U.S. stock indexes are climbing toward record highs, with growth stocks notably outperforming their value counterparts. In this environment, companies that exhibit robust insider ownership often signal confidence from those closest to the business, making them compelling candidates for investors seeking exposure to potential earnings growth.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 17.3% | 22.8% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 50.1% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.5% | 38.7% |

| Pricol (NSEI:PRICOLLTD) | 25.4% | 25.2% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| On Holding (NYSE:ONON) | 19.1% | 29.9% |

| Pharma Mar (BME:PHM) | 11.9% | 45.4% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

We'll examine a selection from our screener results.

Runben Biotechnology (SHSE:603193)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Runben Biotechnology Co., Ltd. focuses on the research, production, and sale of mosquito repellent, baby care, and essential oil products with a market cap of CN¥11.14 billion.

Operations: The company generates revenue from personal products totaling CN¥1.25 billion.

Insider Ownership: 30.1%

Earnings Growth Forecast: 22.4% p.a.

Runben Biotechnology is poised for substantial revenue growth, with forecasts indicating a 24.8% annual increase, outpacing the broader CN market. Despite this, its earnings growth at 22.4% annually lags behind the market's 25%. Recent profit growth was robust at 46.3%, though future return on equity is expected to be modest at 17%. There has been no significant insider trading in the past three months, suggesting stability in insider sentiment.

- Navigate through the intricacies of Runben Biotechnology with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that Runben Biotechnology is trading beyond its estimated value.

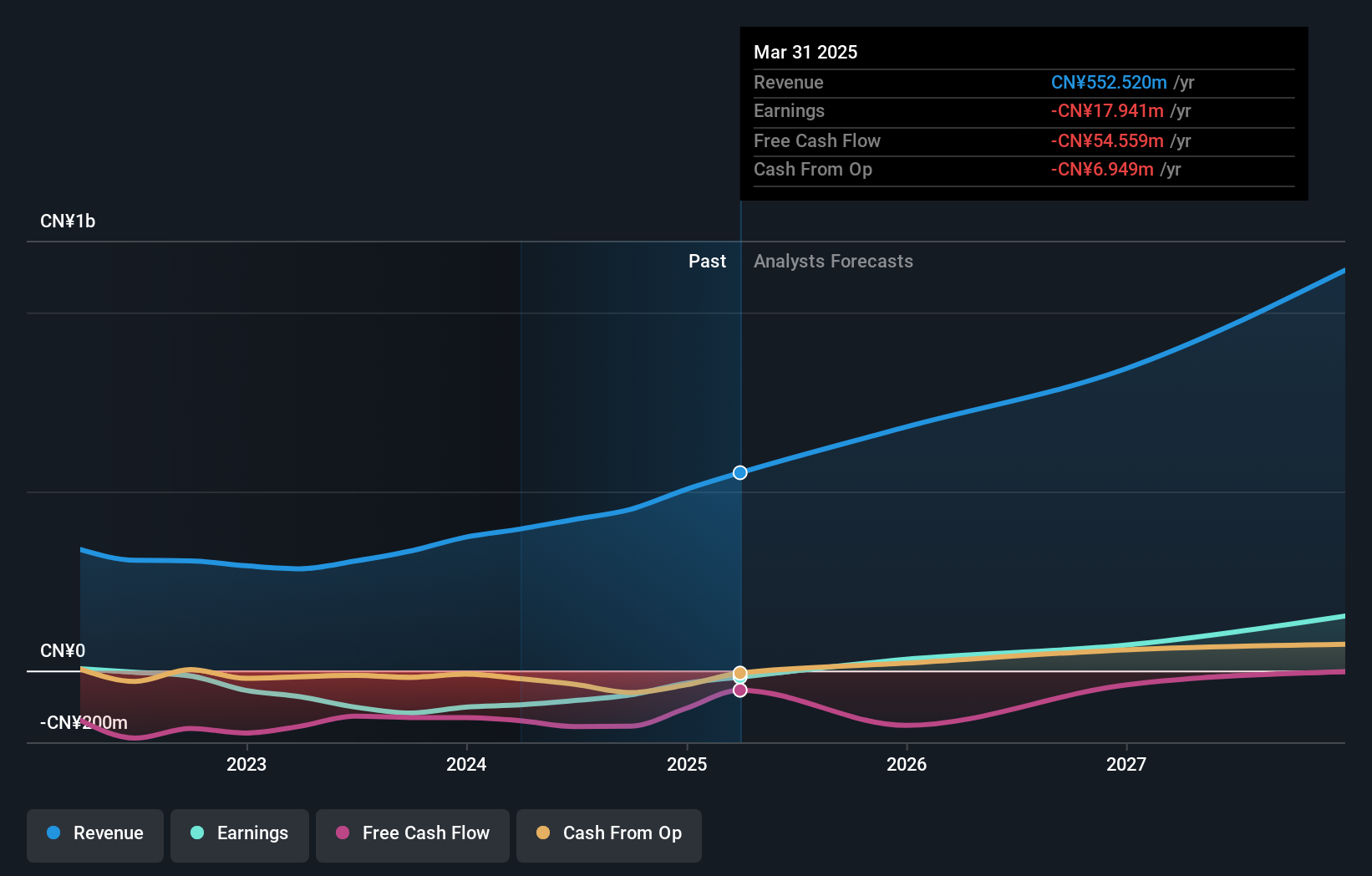

MEMSensing Microsystems (Suzhou China) (SHSE:688286)

Simply Wall St Growth Rating: ★★★★★☆

Overview: MEMSensing Microsystems (Suzhou, China) Co., Ltd. operates in the micro-electromechanical systems (MEMS) industry and has a market capitalization of approximately CN¥3.92 billion.

Operations: The company's revenue primarily comes from its Integrated Circuit segment, which generated CN¥450.24 million.

Insider Ownership: 26%

Earnings Growth Forecast: 119.8% p.a.

MEMSensing Microsystems is set for significant revenue expansion, with forecasts predicting a 27.1% annual increase, surpassing the broader CN market's growth rate. Earnings are expected to grow at an impressive 119.77% annually, with profitability anticipated within three years. However, its return on equity is projected to remain low at 5.3%. The company recently completed a share buyback of CNY 16 million, indicating confidence in its future prospects despite having less than one year of cash runway.

- Unlock comprehensive insights into our analysis of MEMSensing Microsystems (Suzhou China) stock in this growth report.

- According our valuation report, there's an indication that MEMSensing Microsystems (Suzhou China)'s share price might be on the expensive side.

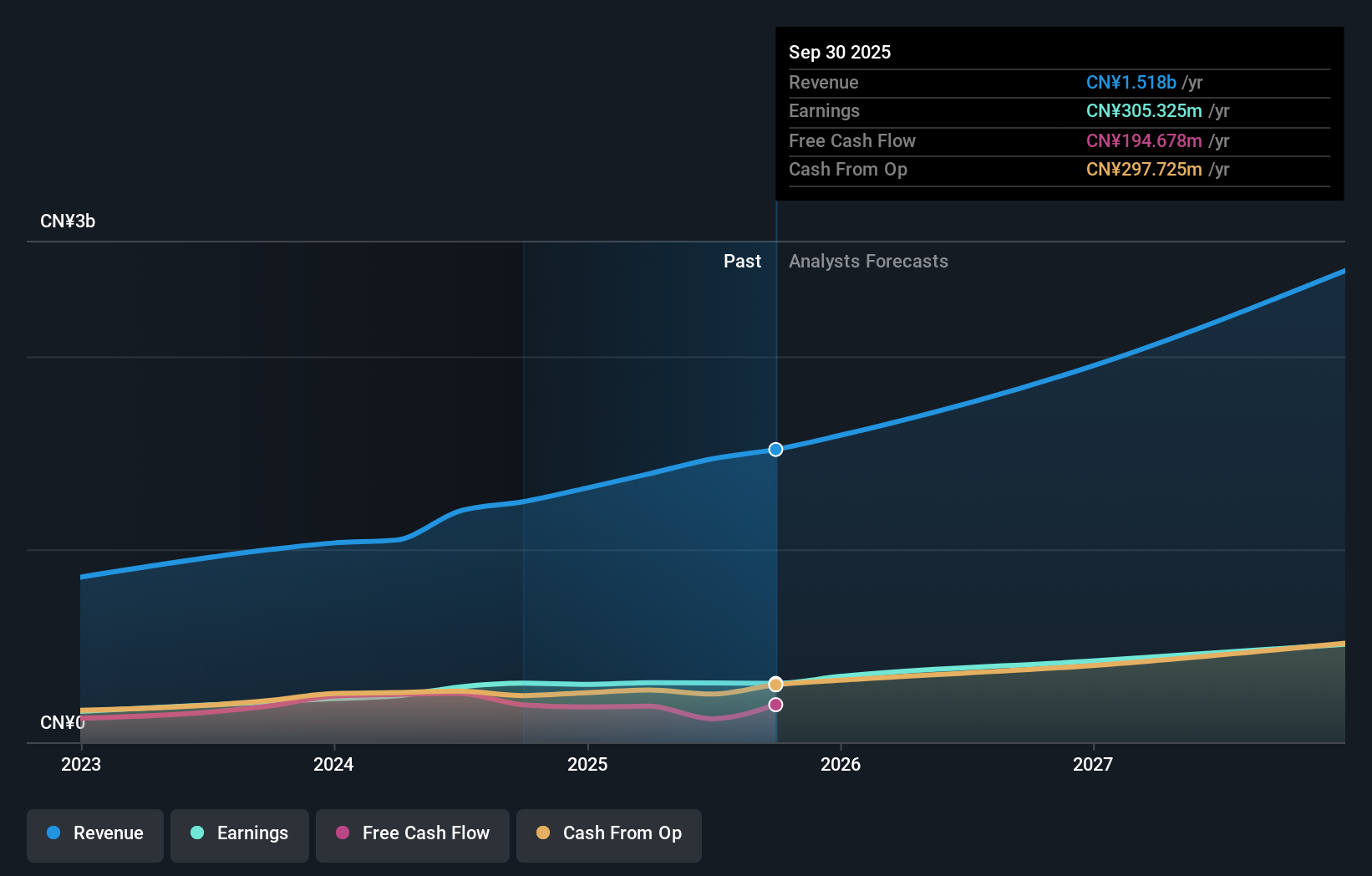

Porton Pharma Solutions (SZSE:300363)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Porton Pharma Solutions Ltd. manufactures and sells small molecule active pharmaceutical ingredients, dosage forms, and biologics to pharmaceutical companies in China, the United States, and Europe with a market cap of CN¥9.17 billion.

Operations: Porton Pharma Solutions Ltd. generates revenue through the production and distribution of small molecule active pharmaceutical ingredients, dosage forms, and biologics to pharmaceutical firms across China, the United States, and Europe.

Insider Ownership: 26.7%

Earnings Growth Forecast: 123.9% p.a.

Porton Pharma Solutions is poised for substantial growth, with revenue expected to increase by 20.6% annually, outpacing the broader CN market. Earnings are forecast to grow significantly at 123.94% per year, with profitability anticipated within three years. Despite its removal from key stock indices, Porton's strategic alliances in the ADC and XDC drug sectors aim to enhance market competitiveness and operational efficiency, leveraging its advanced technology platforms for global impact.

- Delve into the full analysis future growth report here for a deeper understanding of Porton Pharma Solutions.

- Insights from our recent valuation report point to the potential overvaluation of Porton Pharma Solutions shares in the market.

Taking Advantage

- Access the full spectrum of 1454 Fast Growing Companies With High Insider Ownership by clicking on this link.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300363

Porton Pharma Solutions

Provides contract development and manufacturing organization (CDMO) solutions for small molecules, tides, biologics, and conjugates from pre-clinical to commercial.

Good value with adequate balance sheet.

Market Insights

Community Narratives