- China

- /

- Communications

- /

- SHSE:688080

Beijing InHand Networks Technology And 2 Other Undiscovered Gems With Strong Fundamentals

Reviewed by Simply Wall St

As global markets grapple with geopolitical tensions and consumer spending concerns, major indices like the S&P 500 have experienced fluctuations, reflecting broader uncertainties in economic indicators such as the U.S. Services PMI entering contraction territory. In this context of market volatility, identifying stocks with strong fundamentals becomes crucial; these stocks often demonstrate resilience through solid financial health and growth potential despite prevailing challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Goldiam International | 0.67% | 12.04% | 14.02% | ★★★★★★ |

| Central Forest Group | NA | 5.93% | 20.71% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Bharat Rasayan | 5.93% | -0.16% | -5.78% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Britam Holdings | 8.55% | -2.40% | 35.94% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Beijing InHand Networks Technology (SHSE:688080)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing InHand Networks Technology Co., Ltd. operates in the technology sector with a focus on providing industrial IoT solutions, and it has a market capitalization of CN¥3.52 billion.

Operations: Beijing InHand Networks Technology generates its revenue through its industrial IoT solutions, contributing significantly to its financial performance. The company has a market capitalization of CN¥3.52 billion.

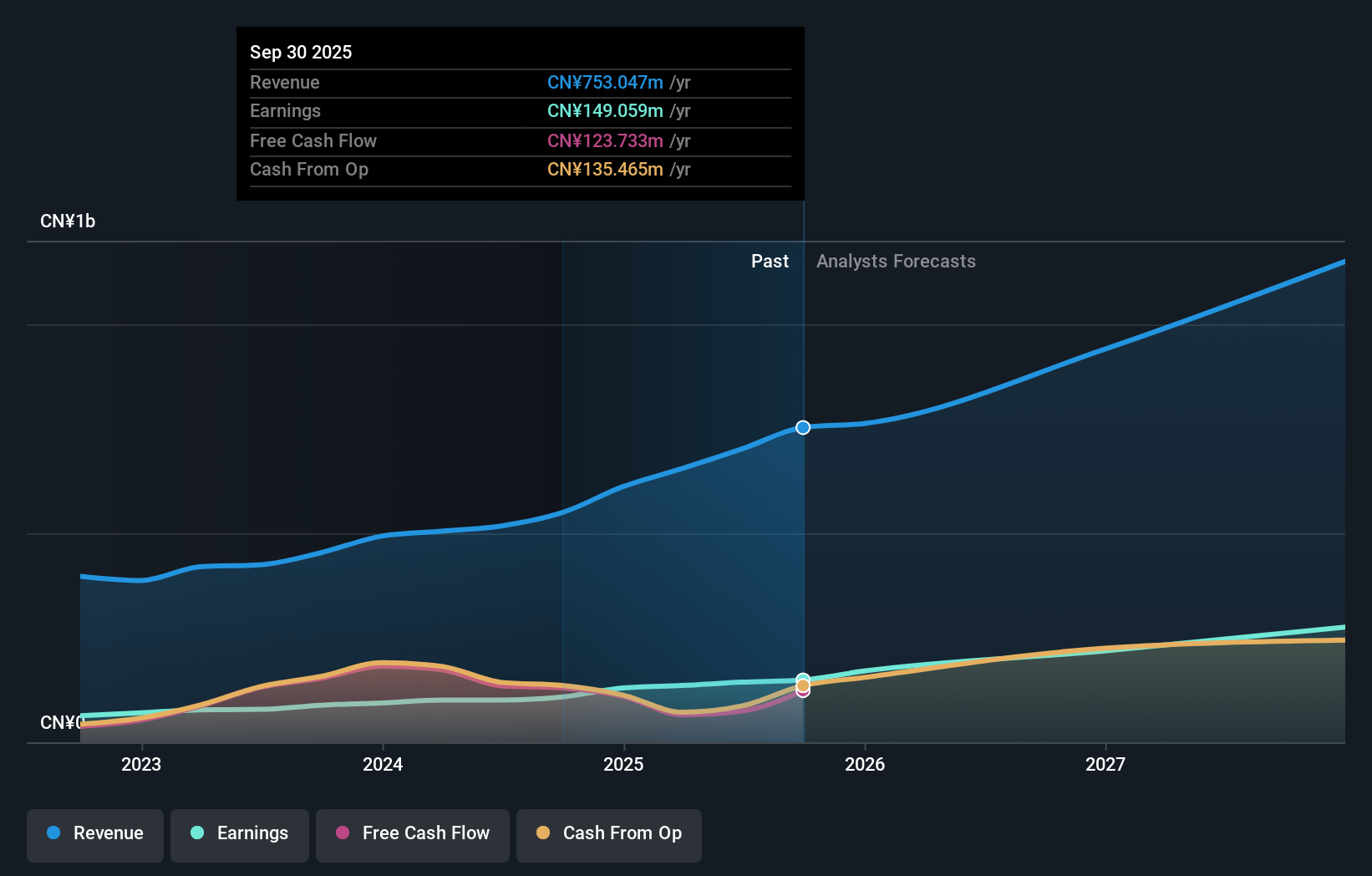

Beijing InHand Networks Technology, with its nimble market presence, showcases robust financial health. The company posted sales of CNY 611.77 million for the year ending December 2024, up from CNY 493.33 million the previous year, reflecting strong revenue growth. Net income rose to CNY 127.67 million from CNY 93.95 million, demonstrating a solid profit margin improvement to approximately 20%. The firm is debt-free and boasts a price-to-earnings ratio of 31x, which is appealing compared to China's market average of 38x. Recent share repurchases totaling CNY 4.74 million suggest confidence in future prospects despite recent share price volatility.

Beijing Fjr Optoelectronic Technology (SHSE:688272)

Simply Wall St Value Rating: ★★★★★★

Overview: Beijing Fjr Optoelectronic Technology Co., Ltd. operates in the optoelectronics industry and has a market capitalization of CN¥2.69 billion.

Operations: Revenue for Beijing Fjr Optoelectronic Technology primarily comes from its optoelectronics products. The company's cost structure includes production and operational expenses, impacting its profitability metrics. The net profit margin has shown variability over recent periods, reflecting changes in cost management and revenue generation efficiency.

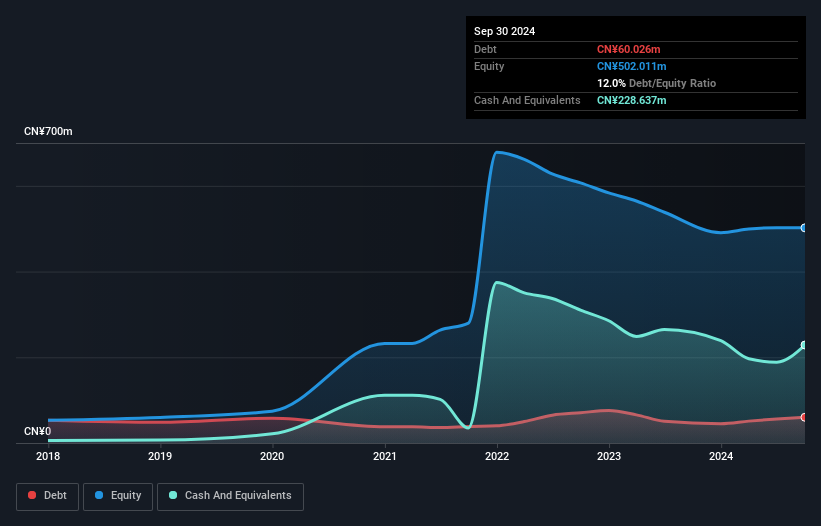

Beijing Fjr Optoelectronic Technology has shown significant improvement, with sales climbing to CNY 312.36 million from CNY 209.33 million and net income reaching CNY 12.66 million, a notable turnaround from last year's net loss of CNY 96.32 million. The company's basic earnings per share improved to CNY 0.17 from a loss of CNY 1.27 previously, reflecting its newfound profitability and high-quality earnings profile. Over the past five years, the debt-to-equity ratio decreased substantially from 78.6% to just 12%, indicating strong financial management and reduced leverage risk in its operations within the electronic industry context.

- Dive into the specifics of Beijing Fjr Optoelectronic Technology here with our thorough health report.

Understand Beijing Fjr Optoelectronic Technology's track record by examining our Past report.

Suzhou Sepax Technologies (SHSE:688758)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Sepax Technologies Co., Ltd. is engaged in the research, development, production, and sale of liquid chromatography materials for the separation and purification of biomacromolecules and other drugs globally, with a market cap of CN¥7.04 billion.

Operations: The company generates revenue from the sale of liquid chromatography materials used in drug separation and purification processes. Its financial performance is highlighted by a market capitalization of CN¥7.04 billion, indicating its scale within the industry.

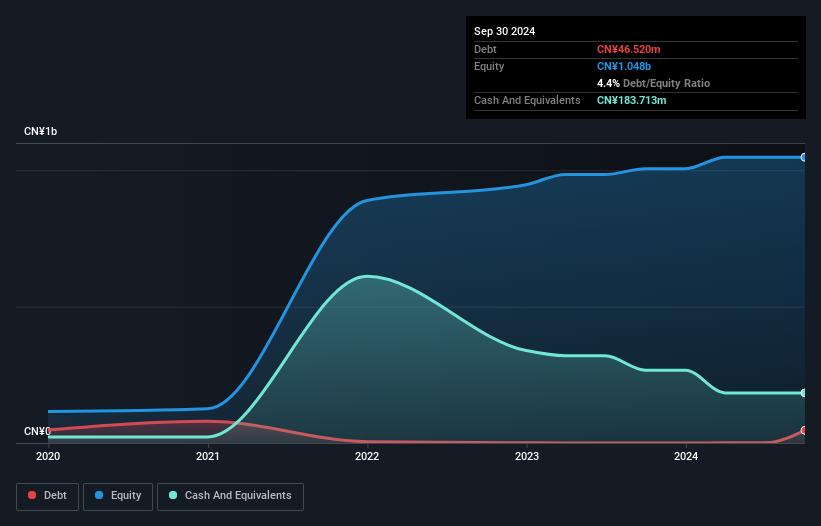

Suzhou Sepax Technologies, a dynamic player in the life sciences sector, has shown impressive earnings growth of 62%, outpacing the industry average. The company reported sales of CNY 315 million for 2024, up from CNY 245 million the previous year, with net income rising to CNY 85 million. Their recent IPO raised CNY 216 million, reflecting investor confidence despite highly illiquid shares. With high-quality earnings and more cash than debt on hand, they seem well-positioned financially. Basic earnings per share increased to CNY 0.23 from last year's CNY 0.14, highlighting robust financial health and potential for future growth.

Make It Happen

- Unlock our comprehensive list of 4760 Undiscovered Gems With Strong Fundamentals by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing InHand Networks Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688080

Beijing InHand Networks Technology

Beijing InHand Networks Technology Co., Ltd.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives