- South Korea

- /

- Chemicals

- /

- KOSE:A093370

October 2024's Top Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

Amid rising Treasury yields and a cautious outlook on Federal Reserve rate cuts, global markets have experienced mixed performances, with growth stocks generally outpacing value stocks. In this environment, companies with strong insider ownership often attract attention as they suggest confidence from those closely involved in the business. Understanding what makes a good stock involves looking at firms where insiders have significant stakes, indicating potential alignment with shareholder interests and possibly offering resilience during economic fluctuations.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.1% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 34% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Arctech Solar Holding (SHSE:688408) | 37.8% | 29.8% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.2% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.7% | 49.1% |

| Medley (TSE:4480) | 34% | 30.4% |

| Findi (ASX:FND) | 35.8% | 64.8% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 105.8% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

Let's dive into some prime choices out of the screener.

Foosung (KOSE:A093370)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foosung Co., Ltd. and its subsidiaries manufacture and sell chemical products for various industries including automotive, iron and steel, semiconductor, construction, and environmental sectors in South Korea, with a market cap of ₩628.52 billion.

Operations: The company's revenue segments include Chemical Equipment generating ₩167.17 billion and Fluorine Compounds contributing ₩300.83 billion.

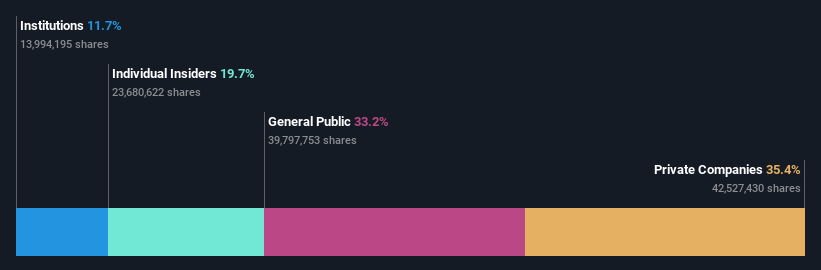

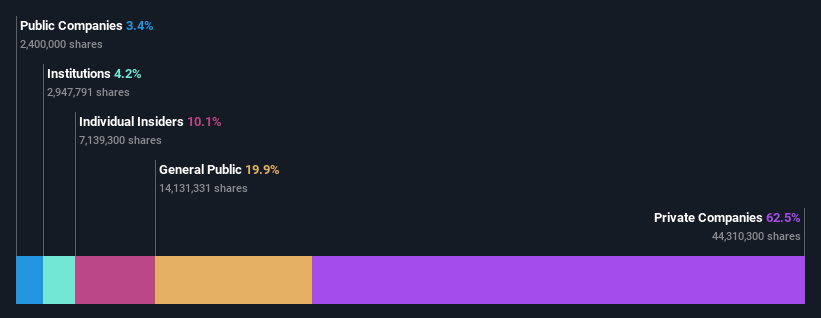

Insider Ownership: 32.9%

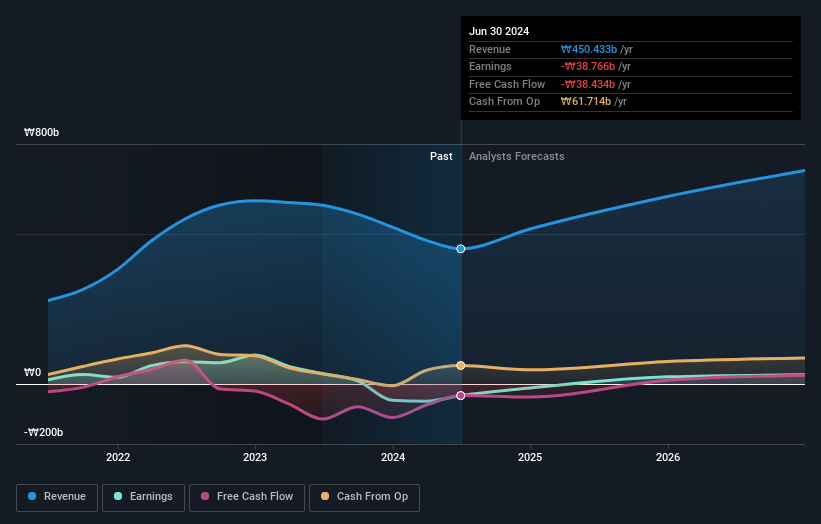

Foosung is forecast to become profitable over the next three years, with earnings projected to grow 72.64% annually. Despite past shareholder dilution and debt not well covered by operating cash flow, its revenue growth of 15.5% per year is expected to surpass the Korean market average of 10.3%. Recent earnings reports show a significant turnaround, with net income reaching KRW 14.43 billion compared to a loss last year, highlighting strong financial recovery potential.

- Take a closer look at Foosung's potential here in our earnings growth report.

- The analysis detailed in our Foosung valuation report hints at an inflated share price compared to its estimated value.

Suzhou Gyz Electronic TechnologyLtd (SHSE:688260)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Suzhou Gyz Electronic Technology Co., Ltd specializes in the research, development, design, and production of components for optical, automotive electronics, and optoelectronic semiconductors in China with a market cap of CN¥2.05 billion.

Operations: Revenue segments for the company include optical components, automotive electronics, and optoelectronic semiconductors.

Insider Ownership: 19.7%

Suzhou Gyz Electronic Technology Ltd. shows promising growth potential, with revenue expected to increase 44.7% annually, outpacing the Chinese market average of 13.6%. The company reported improved financials for the first half of 2024, reducing its net loss from CNY 48.81 million to CNY 27.55 million year-over-year. While it remains volatile and has less than a year's cash runway, profitability is anticipated within three years alongside substantial earnings growth forecasts of over 160% annually.

- Click to explore a detailed breakdown of our findings in Suzhou Gyz Electronic TechnologyLtd's earnings growth report.

- In light of our recent valuation report, it seems possible that Suzhou Gyz Electronic TechnologyLtd is trading beyond its estimated value.

DingZing Advanced Materials (TWSE:6585)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: DingZing Advanced Materials Inc. is engaged in the research, development, production, and sale of composite materials and technical films for various industries in Taiwan, with a market cap of NT$10.32 billion.

Operations: The company generates revenue from its Specialty Chemicals segment, amounting to NT$3.18 billion.

Insider Ownership: 10.1%

DingZing Advanced Materials exhibits strong growth prospects, with earnings forecasted to rise 25.8% annually, surpassing the Taiwan market's average. Recent financial results reflect this trend, as net income surged from TWD 92.01 million to TWD 225.27 million year-over-year for Q2 2024. Despite past shareholder dilution and an unstable dividend track record, its price-to-earnings ratio of 15.1x suggests it trades at a good value relative to peers and industry standards.

- Delve into the full analysis future growth report here for a deeper understanding of DingZing Advanced Materials.

- Our expertly prepared valuation report DingZing Advanced Materials implies its share price may be lower than expected.

Make It Happen

- Delve into our full catalog of 1510 Fast Growing Companies With High Insider Ownership here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A093370

Foosung

Engages in the manufacture and sale of chemical products for automotive, iron and steel, semiconductor, construction, and environmental industries in South Korea.

Reasonable growth potential with worrying balance sheet.

Market Insights

Community Narratives