- United Arab Emirates

- /

- Healthcare Services

- /

- ADX:GMPC

Promising Undiscovered Gems To Explore In November 2024

Reviewed by Simply Wall St

In the wake of recent U.S. election results, global markets have experienced a significant rally, with major benchmarks like the Russell 2000 Index showing notable gains despite remaining slightly below record highs. This surge reflects investor optimism surrounding potential economic growth and tax reforms, creating a fertile environment for small-cap stocks to potentially thrive. In such dynamic conditions, identifying promising stocks often involves looking beyond market giants to discover smaller companies with strong fundamentals and growth potential that may not yet be fully recognized by mainstream investors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Parker Drilling | 46.25% | -0.33% | 53.04% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Industrias del Cobre Sociedad Anónima | NA | 19.63% | 22.92% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 9.68% | 28.34% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 190.18% | 16.52% | 21.58% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Gulf Medical Projects Company (PJSC) (ADX:GMPC)

Simply Wall St Value Rating: ★★★★★★

Overview: Gulf Medical Projects Company (PJSC) manages hospitals in the United Arab Emirates and has a market capitalization of AED1.47 billion.

Operations: GMPC's revenue streams are primarily derived from its hospital management operations in the UAE. The company has a market capitalization of AED1.47 billion.

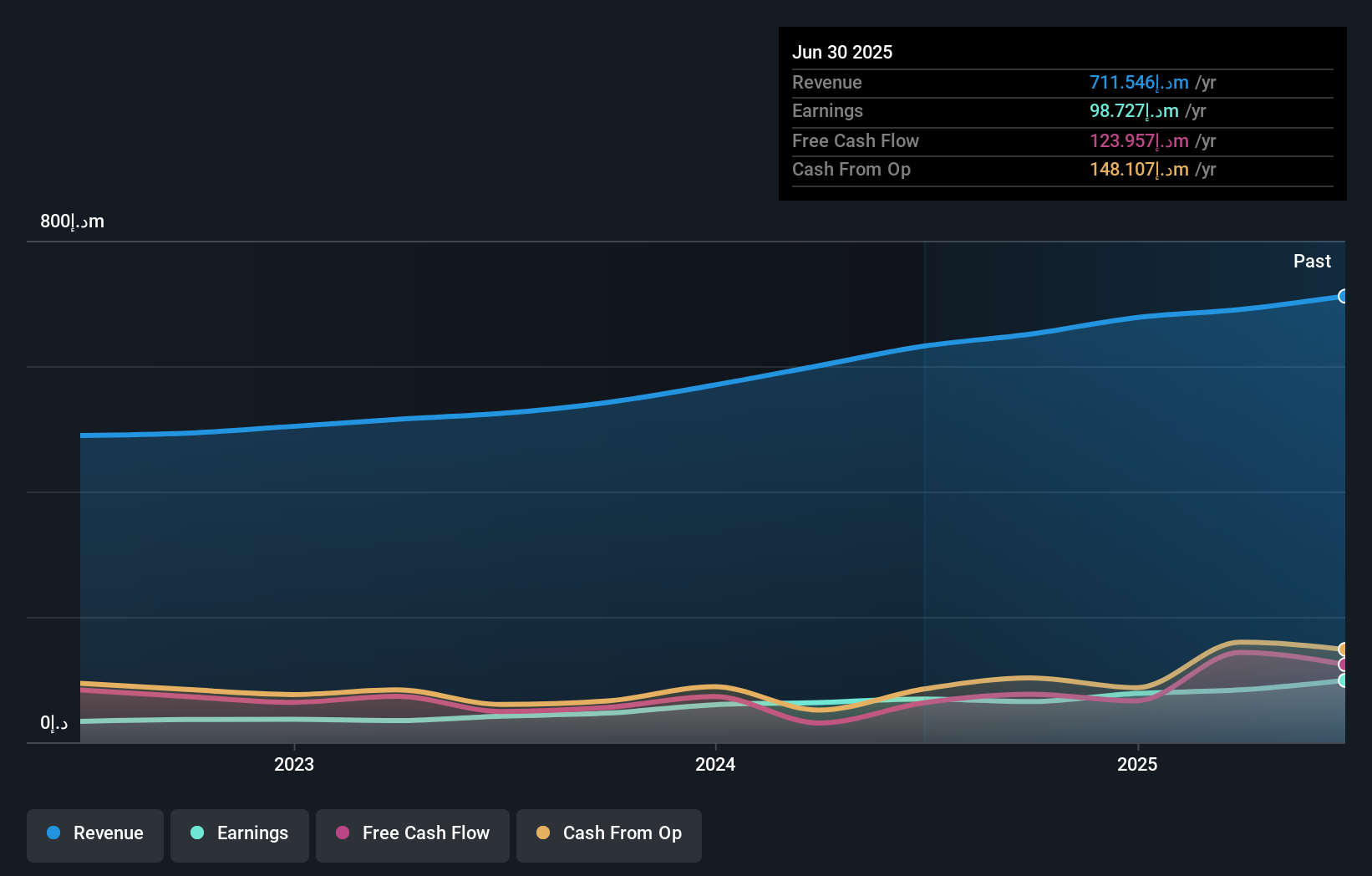

Gulf Medical Projects Company, known for its small market presence, recently reported third-quarter sales of AED 157.8 million, up from AED 138.74 million last year, though net income fell to AED 8.06 million from AED 12.06 million. Despite a volatile share price in recent months, the company trades at a significant discount of 37% below estimated fair value and boasts high-quality earnings with no debt on its balance sheet. Over the past year, earnings surged by nearly 40%, outpacing industry growth; however, there's been an average annual decline of about 6% over five years in earnings performance.

Shenzhen Pacific Union Precision Manufacturing (SHSE:688210)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Pacific Union Precision Manufacturing Co., Ltd. operates in the precision manufacturing industry with a market cap of CN¥3.35 billion.

Operations: Shenzhen Pacific Union Precision Manufacturing generates revenue through its precision manufacturing operations. The company's net profit margin has shown variability across reporting periods, reflecting changes in cost structures and market conditions.

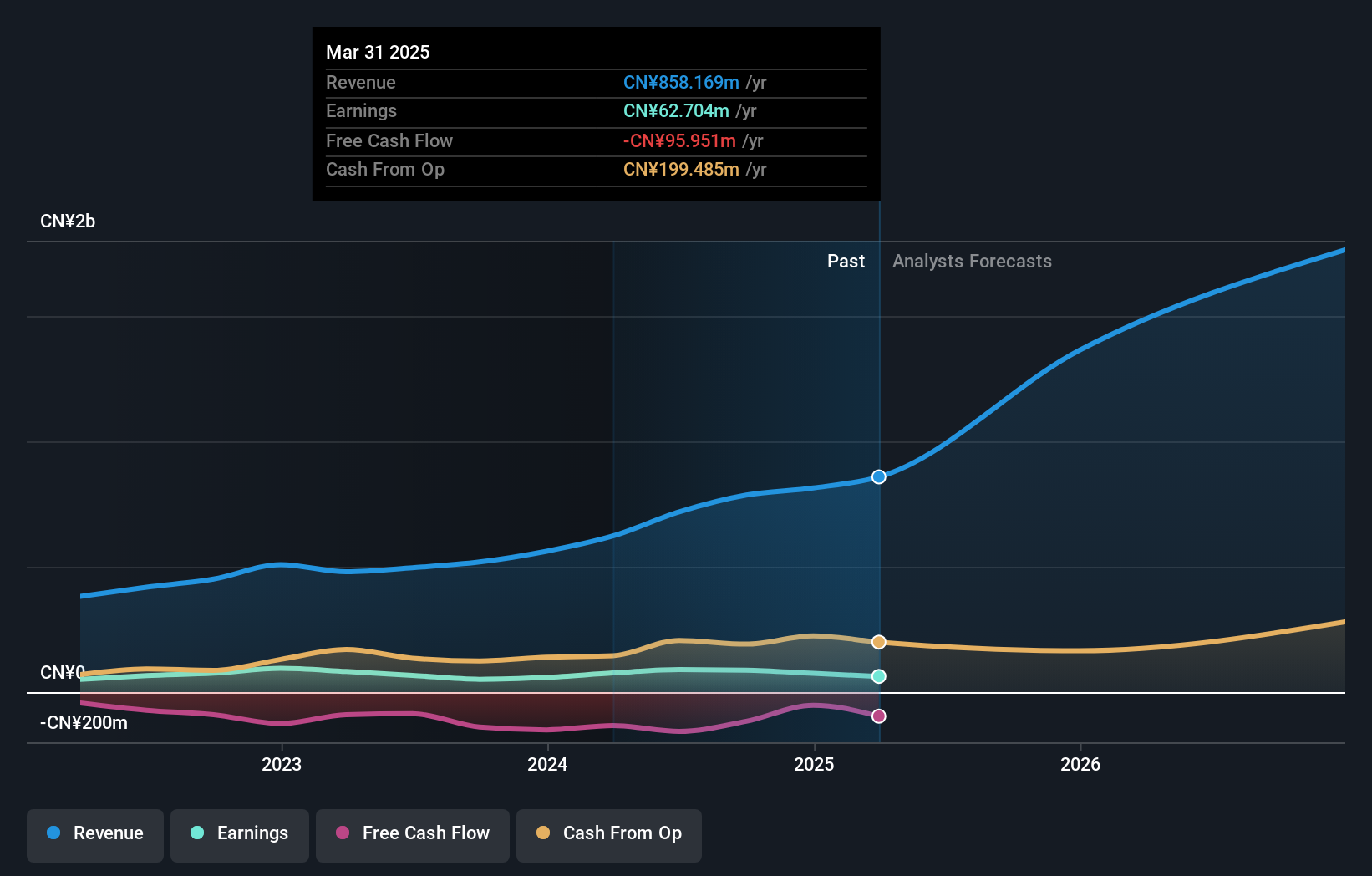

Shenzhen Pacific Union Precision Manufacturing, a nimble player in the electronics sector, has demonstrated impressive earnings growth of 71.1% over the past year, outpacing the industry average of 1.7%. With a price-to-earnings ratio at 38.2x, it presents better value compared to its peers' average of 47.1x. The company reported sales of CNY 592 million for nine months ending September 2024, up from CNY 367.91 million last year; net income rose to CNY 52.06 million from CNY 23.21 million previously. Recently announcing a share buyback plan for up to 3,300,330 shares highlights its commitment to enhancing shareholder value and confidence in future prospects.

Cybozu (TSE:4776)

Simply Wall St Value Rating: ★★★★★★

Overview: Cybozu, Inc. develops, sells, and operates groupware solutions across several countries including Japan, China, Vietnam, Taiwan, Malaysia, Australia, and the United States with a market cap of ¥104.43 billion.

Operations: Revenue from software development and sales stands at ¥27.23 billion.

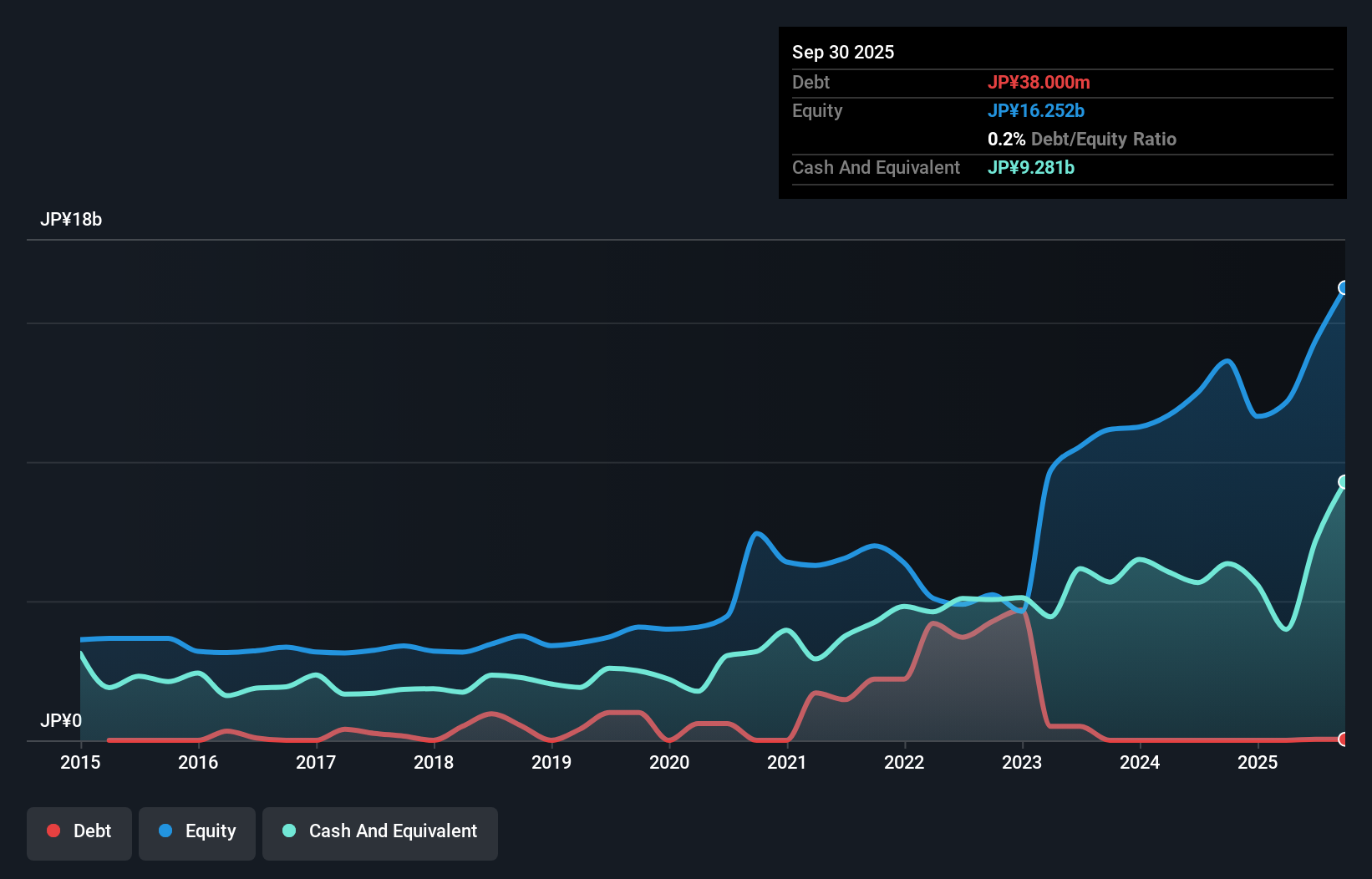

With impressive earnings growth of 78% over the past year, Cybozu is making waves in the software industry, outpacing the sector's average increase of 15%. This small cap company boasts high-quality earnings with significant non-cash components and remains debt-free, a notable improvement from five years ago when its debt-to-equity ratio stood at 27%. Recent announcements reveal plans to repurchase up to 3 million shares for ¥3 billion, aiming to adjust its capital structure. Despite recent share price volatility, Cybozu's strategic moves and financial health paint a compelling picture for potential investors.

- Get an in-depth perspective on Cybozu's performance by reading our health report here.

Understand Cybozu's track record by examining our Past report.

Next Steps

- Click here to access our complete index of 4664 Undiscovered Gems With Strong Fundamentals.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ADX:GMPC

Gulf Medical Projects Company (PJSC)

Manages hospitals in the United Arab Emirates.

Flawless balance sheet with proven track record.