- China

- /

- Personal Products

- /

- SHSE:603235

Three Undiscovered Gems With Promising Potential

Reviewed by Simply Wall St

As global markets face a turbulent start to the year, with small-cap stocks in particular underperforming their larger peers, investors are keenly observing economic indicators and policy shifts that could impact future growth prospects. Amidst this backdrop of choppy market conditions and inflation concerns, identifying stocks with strong fundamentals and unique growth potential becomes increasingly important for those seeking opportunities beyond the mainstream.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Sun | 14.28% | 5.73% | 64.26% | ★★★★★★ |

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ha Giang Mineral Mechanics | NA | 23.21% | 43.16% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Chilanga Cement | NA | 13.46% | 35.92% | ★★★★★★ |

| Yulie Sekuritas Indonesia | NA | 18.62% | 9.58% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

JiangXi Tianxin Pharmaceutical (SHSE:603235)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangxi Tianxin Pharmaceutical Co., Ltd. is a company that produces and sells vitamins in China, with a market cap of CN¥11.08 billion.

Operations: Tianxin Pharmaceutical generates its revenue primarily from the production and sale of vitamins.

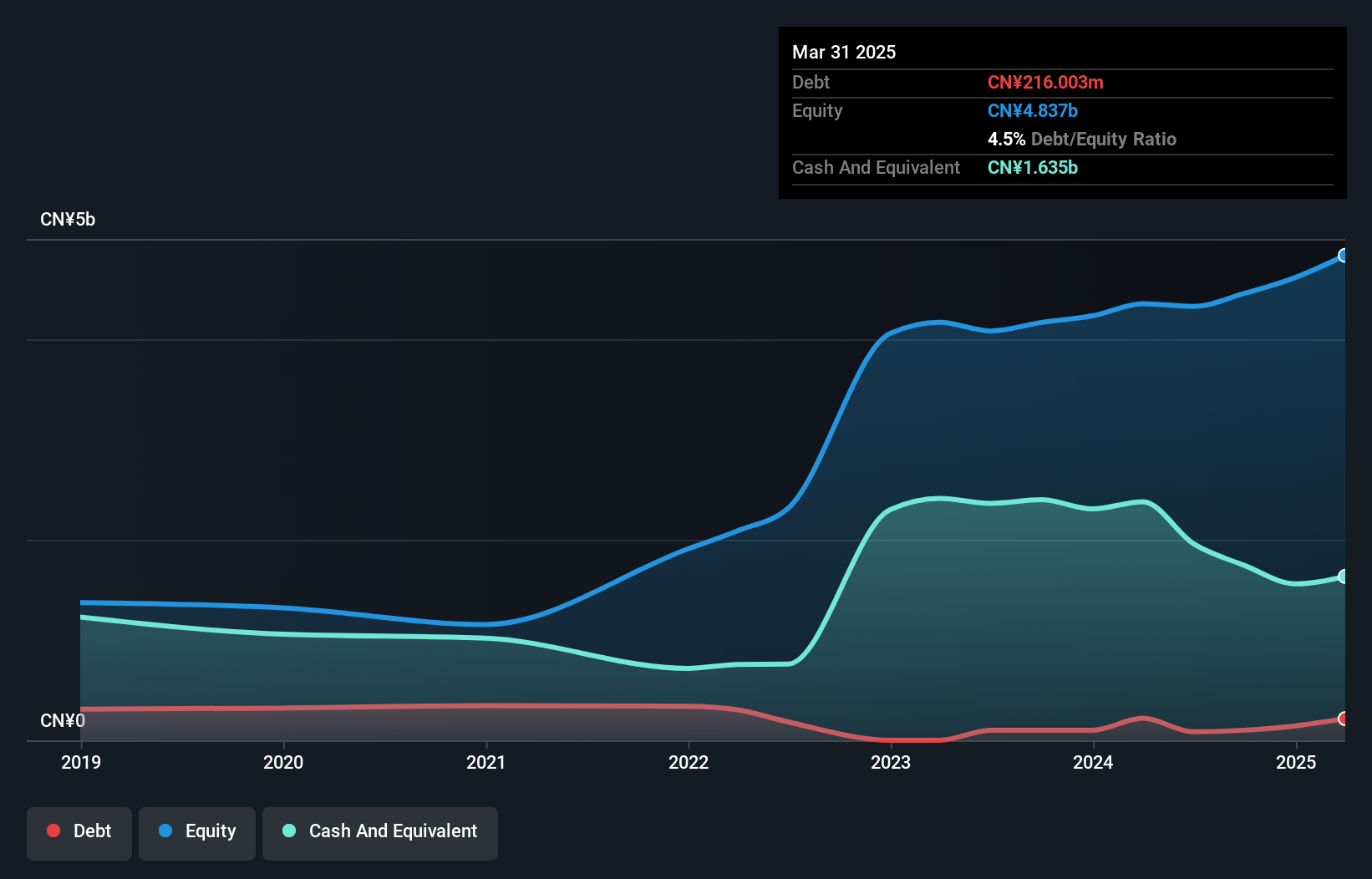

JiangXi Tianxin Pharmaceutical, a relatively small player in its industry, has shown notable financial resilience. Over the past year, earnings grew by 15.2%, outpacing the Personal Products industry's -10.1% performance. Despite a five-year earnings decline of 12.6% annually, the company remains profitable with more cash than total debt and a reduced debt-to-equity ratio from 23.9% to 2.3%. The price-to-earnings ratio stands at 19.9x, below China's market average of 31.8x, suggesting potential undervaluation for investors seeking value opportunities within this sector's landscape.

Optowide Technologies (SHSE:688195)

Simply Wall St Value Rating: ★★★★★☆

Overview: Optowide Technologies Co., Ltd. specializes in the research, development, production, and sale of precision optics and fiber components both domestically in China and internationally, with a market capitalization of CN¥5.18 billion.

Operations: Optowide Technologies generates revenue through the sale of precision optics and fiber components. The company's cost structure includes expenses related to research, development, production, and sales activities. Notably, its gross profit margin is a key financial metric to consider when evaluating its profitability.

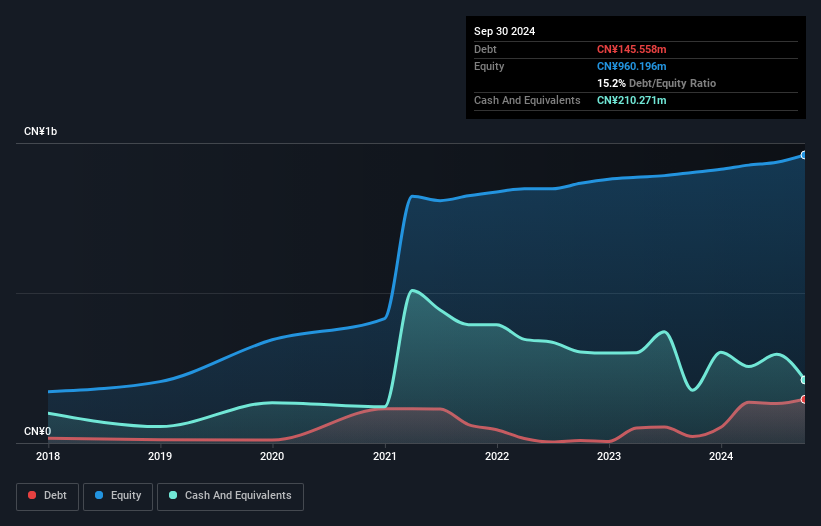

Optowide Technologies, a small player in the electronics sector, has shown impressive growth with earnings up 47.3% over the past year, outpacing the industry's 1.9%. Despite this success, its debt to equity ratio jumped from 3.3 to 15.2 over five years, indicating rising liabilities. The company’s net income for nine months ending September 2024 was CNY 55 million compared to CNY 31 million previously, reflecting strong profitability despite not being free cash flow positive recently. Optowide announced a share repurchase program worth CNY 20 million but hasn't executed any buybacks yet as of December 2024.

- Navigate through the intricacies of Optowide Technologies with our comprehensive health report here.

Assess Optowide Technologies' past performance with our detailed historical performance reports.

Nanjing Hanrui CobaltLtd (SZSE:300618)

Simply Wall St Value Rating: ★★★★★☆

Overview: Nanjing Hanrui Cobalt Co., Ltd. is involved in the extraction of cobalt and copper ores, with a market capitalization of CN¥10.43 billion.

Operations: Hanrui Cobalt generates revenue primarily from the extraction of cobalt and copper ores. The company's financial performance is impacted by fluctuations in commodity prices, which influence its revenue streams. Its cost structure includes expenses related to mining operations, which can affect profitability.

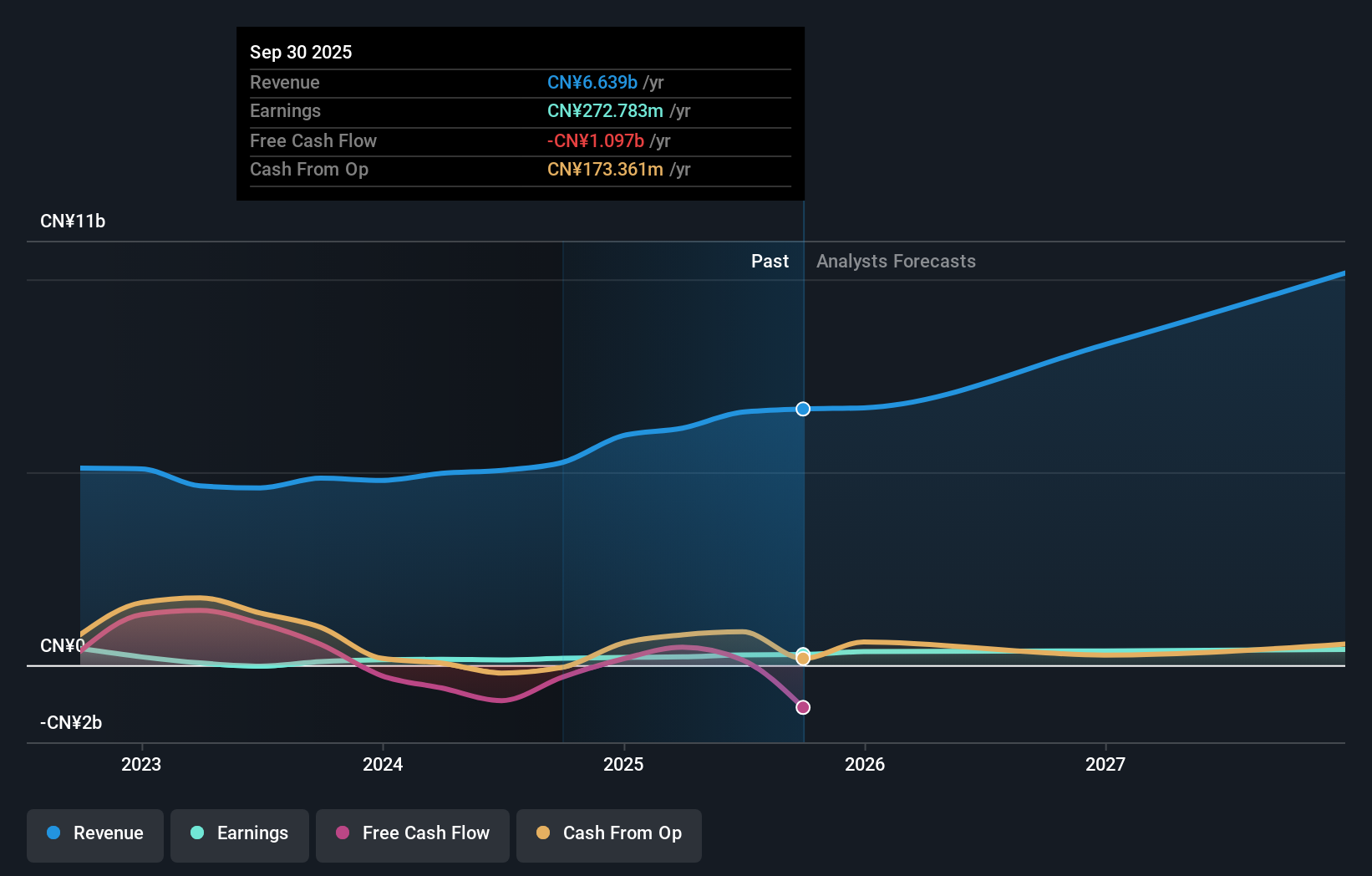

Nanjing Hanrui Cobalt, a nimble player in the metals and mining sector, has outpaced industry growth with a 96% earnings increase over the past year, contrasting sharply with the sector's -1.8%. The company boasts high-quality earnings and has effectively reduced its debt-to-equity ratio from 50.2% to 28.1% over five years. With EBIT covering interest payments by 104 times, financial stability seems robust. Recent reports highlight sales of CNY 4.18 billion for nine months ending September 2024, up from CNY 3.72 billion previously, while net income reached CNY 167 million compared to last year's CNY 131 million.

Key Takeaways

- Get an in-depth perspective on all 4510 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603235

JiangXi Tianxin Pharmaceutical

Jiangxi Tianxin Pharmaceutical Co., Ltd. produces and sells vitamins in China.

Flawless balance sheet with acceptable track record.