- China

- /

- Electronic Equipment and Components

- /

- SHSE:688127

Subdued Growth No Barrier To Zhejiang Lante Optics Co., Ltd.'s (SHSE:688127) Price

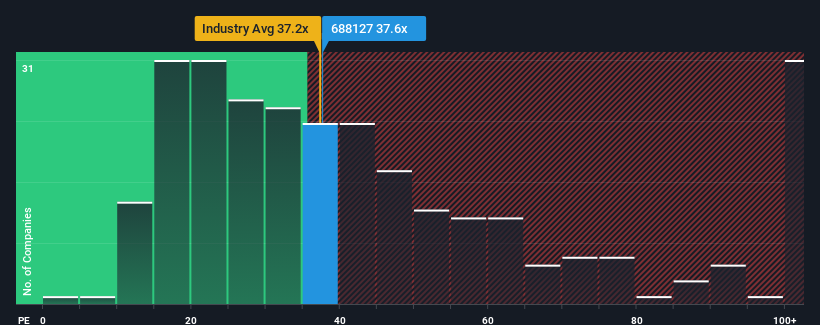

When close to half the companies in China have price-to-earnings ratios (or "P/E's") below 27x, you may consider Zhejiang Lante Optics Co., Ltd. (SHSE:688127) as a stock to potentially avoid with its 37.6x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's as high as it is.

With earnings growth that's superior to most other companies of late, Zhejiang Lante Optics has been doing relatively well. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

View our latest analysis for Zhejiang Lante Optics

Is There Enough Growth For Zhejiang Lante Optics?

In order to justify its P/E ratio, Zhejiang Lante Optics would need to produce impressive growth in excess of the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 180% last year. The latest three year period has also seen a 6.0% overall rise in EPS, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 26% each year during the coming three years according to the six analysts following the company. That's shaping up to be similar to the 24% each year growth forecast for the broader market.

With this information, we find it interesting that Zhejiang Lante Optics is trading at a high P/E compared to the market. It seems most investors are ignoring the fairly average growth expectations and are willing to pay up for exposure to the stock. These shareholders may be setting themselves up for disappointment if the P/E falls to levels more in line with the growth outlook.

What We Can Learn From Zhejiang Lante Optics' P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that Zhejiang Lante Optics currently trades on a higher than expected P/E since its forecast growth is only in line with the wider market. Right now we are uncomfortable with the relatively high share price as the predicted future earnings aren't likely to support such positive sentiment for long. Unless these conditions improve, it's challenging to accept these prices as being reasonable.

Before you settle on your opinion, we've discovered 3 warning signs for Zhejiang Lante Optics (1 is potentially serious!) that you should be aware of.

If these risks are making you reconsider your opinion on Zhejiang Lante Optics, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Lante Optics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688127

High growth potential with solid track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026