- China

- /

- Electronic Equipment and Components

- /

- SHSE:688127

High Growth Tech And 2 Other Exciting Stocks For Potential Portfolio Boost

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and interest rate expectations, U.S. stock indexes are climbing toward record highs, with growth stocks outperforming value shares. In this dynamic environment, identifying high-growth tech stocks can be an exciting opportunity for potential portfolio enhancement, especially as investors seek companies that demonstrate strong innovation and adaptability in a rapidly evolving economic landscape.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| eWeLLLtd | 25.35% | 25.09% | ★★★★★★ |

| Elliptic Laboratories | 61.01% | 121.13% | ★★★★★★ |

| Mental Health TechnologiesLtd | 21.91% | 92.81% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1208 stocks from our High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

NCAB Group (OM:NCAB)

Simply Wall St Growth Rating: ★★★★★☆

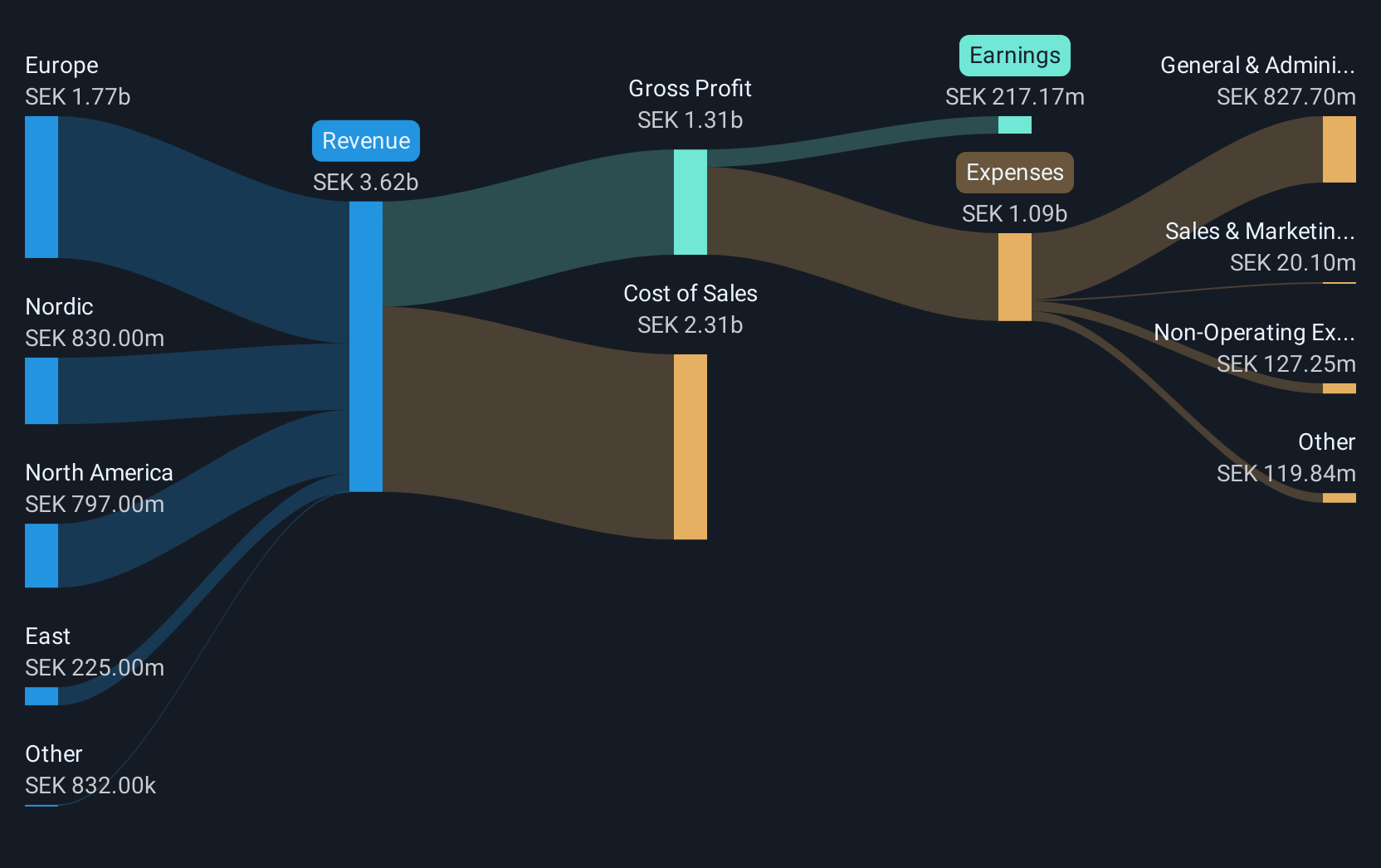

Overview: NCAB Group AB (publ) is a company that specializes in the manufacturing and sale of printed circuit boards (PCBs) across Sweden, the Nordic region, Europe, North America, and Asia with a market capitalization of approximately SEK10.59 billion.

Operations: The company generates revenue primarily from its operations in Europe, contributing SEK1.78 billion, followed by the Nordic region and North America with SEK822 million and SEK800 million, respectively. The East segment adds an additional SEK215 million to its revenue streams.

Amid a challenging fiscal year, NCAB Group AB remains poised for strategic expansion through mergers and acquisitions, targeting the fragmented $70 billion printed circuit board market. Despite a dip in annual revenue from SEK 4.12 billion to SEK 3.62 billion and net income falling to SEK 254.9 million from SEK 403.7 million, the company's forward-looking strategy focuses on enhancing technical capabilities and broadening its geographical footprint. With an expected earnings growth of 23% per annum outpacing the Swedish market's average, NCAB is strategically investing in growth opportunities within its niche sector, aiming to leverage its asset-light model to consolidate further and capture market share in high mix, low volume segments valued over USD 20 billion.

- Get an in-depth perspective on NCAB Group's performance by reading our health report here.

Explore historical data to track NCAB Group's performance over time in our Past section.

Zhejiang Lante Optics (SHSE:688127)

Simply Wall St Growth Rating: ★★★★☆☆

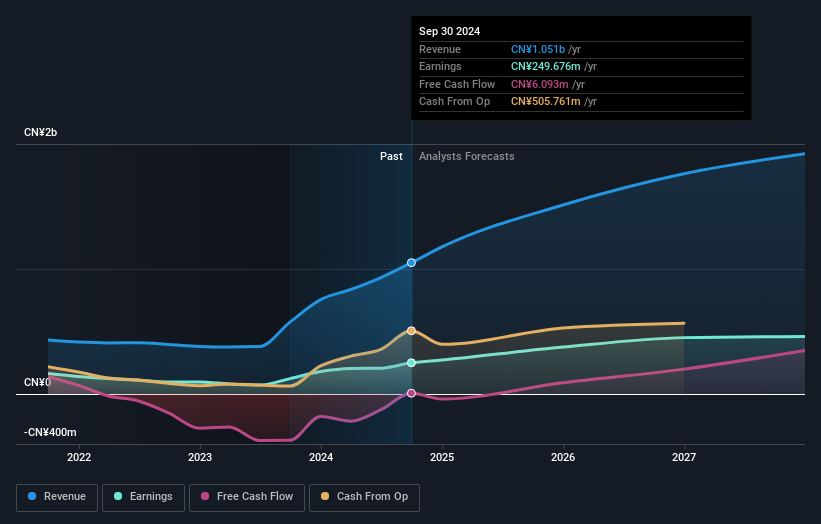

Overview: Zhejiang Lante Optics Co., Ltd. is a Chinese company specializing in the manufacturing and sale of optical products, with a market capitalization of CN¥11.81 billion.

Operations: Zhejiang Lante Optics Co., Ltd. primarily generates revenue from its photographic equipment and supplies segment, amounting to CN¥1.05 billion. The company operates within the optical products industry in China, focusing on manufacturing and sales activities.

Zhejiang Lante Optics has demonstrated robust growth, with its earnings surging by 102.8% over the past year, significantly outpacing the electronic industry's average. This performance is underpinned by an annual revenue growth rate of 20.4%, which exceeds the Chinese market's expansion rate of 13.3%. The company's commitment to innovation is evident in its R&D expenditures, crucial for sustaining its competitive edge in a rapidly evolving tech landscape. Looking ahead, Lante Optics is expected to maintain a vigorous earnings growth trajectory at an annual rate of 23.1%, leveraging strategic initiatives and ongoing technological advancements to enhance its market position further.

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orbbec Inc. designs, manufactures, and sells 3D vision sensors with a market cap of CN¥23.10 billion.

Operations: The company focuses on the development and sale of 3D vision sensors. With a market cap of CN¥23.10 billion, it operates in the technology sector, leveraging its expertise in sensor design and manufacturing to generate revenue.

Orbbec's trajectory in the tech sector is underscored by a remarkable annual revenue growth rate of 41%, significantly outpacing the broader market. Despite current unprofitability, earnings are projected to soar by 122.7% annually, positioning Orbbec for potential profitability within three years. The company's aggressive investment in R&D, essential for maintaining its competitive edge in evolving technologies, highlights its commitment to innovation. Recent activities include a special shareholders meeting and completing a modest share repurchase program, signaling ongoing strategic adjustments and shareholder value focus. These factors collectively suggest Orbbec is navigating its challenges while laying down substantial groundwork for future growth.

- Click here to discover the nuances of Orbbec with our detailed analytical health report.

Examine Orbbec's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Access the full spectrum of 1208 High Growth Tech and AI Stocks by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Lante Optics might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688127

Solid track record with excellent balance sheet.

Market Insights

Community Narratives