- Taiwan

- /

- Tech Hardware

- /

- TWSE:2376

High Growth Tech And 2 More Stocks With Strong Expansion Potential

Reviewed by Simply Wall St

Global markets have recently experienced a surge, with major indices like the Dow Jones Industrial Average and S&P 500 reaching record highs, while small-cap stocks have joined this upward trend, as evidenced by the Russell 2000 hitting an intraday peak. This positive momentum in the broader market underscores the potential for high growth tech stocks to capitalize on favorable economic conditions and investor sentiment, making them attractive prospects for those seeking robust expansion opportunities.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 28.04% | 56.19% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.35% | 70.33% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

Click here to see the full list of 1284 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Shanghai W-Ibeda High Tech.GroupLtd (SHSE:688071)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shanghai W-Ibeda High Tech.Group Co.,Ltd. operates in the high-tech sector, focusing on innovative solutions and products, with a market capitalization of approximately CN¥2.30 billion.

Operations: Shanghai W-Ibeda High Tech.Group Co.,Ltd. generates revenue primarily from its Auto Parts & Accessories segment, amounting to CN¥406.27 million.

Shanghai W-Ibeda High Tech.GroupLtd. faces a challenging landscape, evidenced by its recent shift from a net profit of CNY 6.18 million to a net loss of CNY 29.38 million year-over-year as per the latest earnings report for Q3 2024. Despite this setback, the company is positioned in a dynamic market with expected revenue growth at an impressive rate of 37% annually, significantly outpacing the broader Chinese market's growth rate of 13.8%. This potential is further underscored by forecasts suggesting earnings could surge by approximately 179.25% annually over the next three years, signaling robust future prospects if these trajectories hold true. However, it’s crucial to note that the firm has not repurchased any shares in its recent buyback program, reflecting possible strategic reservations amid current financial volatilities.

Zhejiang ZUCH Technology (SZSE:301280)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang ZUCH Technology Co., Ltd. specializes in providing electric connectors in China and has a market cap of CN¥4.37 billion.

Operations: Zhejiang ZUCH Technology Co., Ltd. focuses on the production and sale of electric connectors in China. The company operates within a market valued at CN¥4.37 billion, generating revenue primarily from its electric connector offerings.

Zhejiang ZUCH Technology has demonstrated robust financial performance, with a notable increase in sales to CNY 1.14 billion, up from CNY 897.38 million year-over-year as of September 2024. This growth is complemented by a rise in net income to CNY 135.09 million, reflecting a solid earnings growth rate of 28.5% over the past year, surpassing the electronic industry's average of 1.8%. Looking ahead, the company is poised for continued expansion with revenue and earnings forecasted to grow at an impressive rate of 28.4% and 31.2% per year respectively, significantly outstripping the broader Chinese market projections. This upward trajectory is underpinned by substantial investments in R&D which have strategically positioned ZUCH at the forefront of technological advancements within its sector.

- Dive into the specifics of Zhejiang ZUCH Technology here with our thorough health report.

Gain insights into Zhejiang ZUCH Technology's past trends and performance with our Past report.

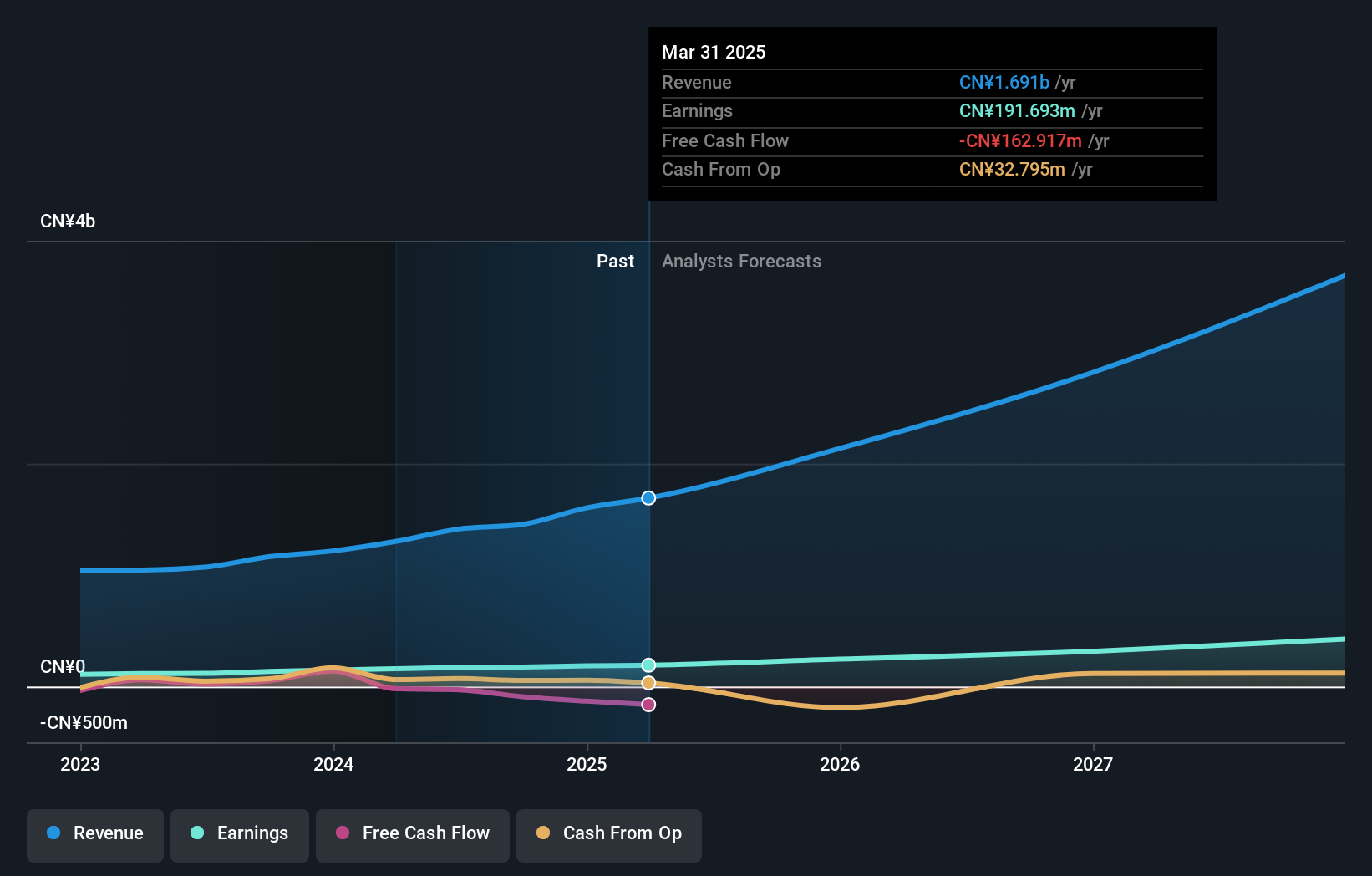

Giga-Byte Technology (TWSE:2376)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Giga-Byte Technology Co., Ltd. and its subsidiaries are involved in the manufacturing, processing, and trading of computer peripherals and component parts across Taiwan, Europe, the United States, Canada, China, and other international markets with a market cap of NT$186.23 billion.

Operations: The company's primary revenue stream comes from its Brand Business Division, generating NT$244.47 billion, while the Other Business Group contributes NT$658.17 million.

Giga-Byte Technology has shown impressive growth, doubling its sales to TWD 199.53 billion in the first nine months of 2024 from TWD 91.18 billion in the same period last year, with net income also surging to TWD 6.91 billion from TWD 3.39 billion. This financial upswing is supported by a robust R&D focus, where expenses are strategically channeled into developing cutting-edge motherboards and AI technologies that enhance performance and user experience significantly. With earnings forecasted to grow by 25.5% annually, Giga-Byte is not only outpacing its industry but also setting new benchmarks in tech innovation and market adaptation through products like the X870E series that cater to advanced gaming and computing needs.

Where To Now?

- Get an in-depth perspective on all 1284 High Growth Tech and AI Stocks by using our screener here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Giga-Byte Technology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2376

Giga-Byte Technology

Manufactures, processes, and trades in computer peripherals and component parts in Taiwan, Europe, the United States, Canada, China, and internationally.

Very undervalued with reasonable growth potential.

Market Insights

Community Narratives