- China

- /

- Electronic Equipment and Components

- /

- SHSE:603416

High Growth Tech Stocks In Asia To Watch For Potential Expansion

Reviewed by Simply Wall St

As global markets navigate a landscape marked by economic uncertainties and shifting monetary policies, the Asian tech sector remains a focal point for investors seeking growth opportunities. In such an environment, stocks that demonstrate strong fundamentals, innovative capabilities, and resilience to market fluctuations are particularly noteworthy for potential expansion.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Giant Network Group | 31.77% | 34.18% | ★★★★★★ |

| Fositek | 33.55% | 44.13% | ★★★★★★ |

| Eoptolink Technology | 37.70% | 35.42% | ★★★★★★ |

| Zhongji Innolight | 28.78% | 30.84% | ★★★★★★ |

| Gold Circuit Electronics | 26.64% | 35.16% | ★★★★★★ |

| Shengyi Electronics | 23.36% | 30.38% | ★★★★★★ |

| Foxconn Industrial Internet | 28.21% | 27.66% | ★★★★★★ |

| eWeLLLtd | 25.02% | 24.93% | ★★★★★★ |

| ALTEOGEN | 56.27% | 65.14% | ★★★★★★ |

| CARsgen Therapeutics Holdings | 100.40% | 118.16% | ★★★★★★ |

Let's uncover some gems from our specialized screener.

Essex Bio-Technology (SEHK:1061)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Essex Bio-Technology Limited is an investment holding company that develops, manufactures, and sells biologic drugs in China, Hong Kong, and internationally with a market cap of HK$2.73 billion.

Operations: The company generates revenue primarily from its surgical and ophthalmology segments, with HK$884.30 million and HK$811.46 million respectively, while also providing services amounting to HK$22.05 million.

Essex Bio-Technology's strategic maneuvers, including its recent addition to the S&P Global BMI Index and a consistent share buyback strategy, underscore its robust position in the biotech sector. The company reported a solid earnings increase with a 5.8% rise in sales to HKD 876.54 million and net income growth to HKD 163.4 million for the first half of 2025, reflecting an annualized earnings growth of 13.7%. Moreover, Essex is expanding its market reach with the BLA acceptance for HLX04-O by China's NMPA and ongoing international clinical studies, highlighting its commitment to innovation and global market penetration in ophthalmic treatments. This blend of financial health, strategic market actions, and innovative R&D investments positions Essex Bio-Technology favorably within Asia’s competitive high-growth tech landscape.

- Get an in-depth perspective on Essex Bio-Technology's performance by reading our health report here.

WuXi Xinje ElectricLtd (SHSE:603416)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: WuXi Xinje Electric Co., Ltd. focuses on developing, producing, and selling industrial automation products both in China and abroad, with a market cap of CN¥9.84 billion.

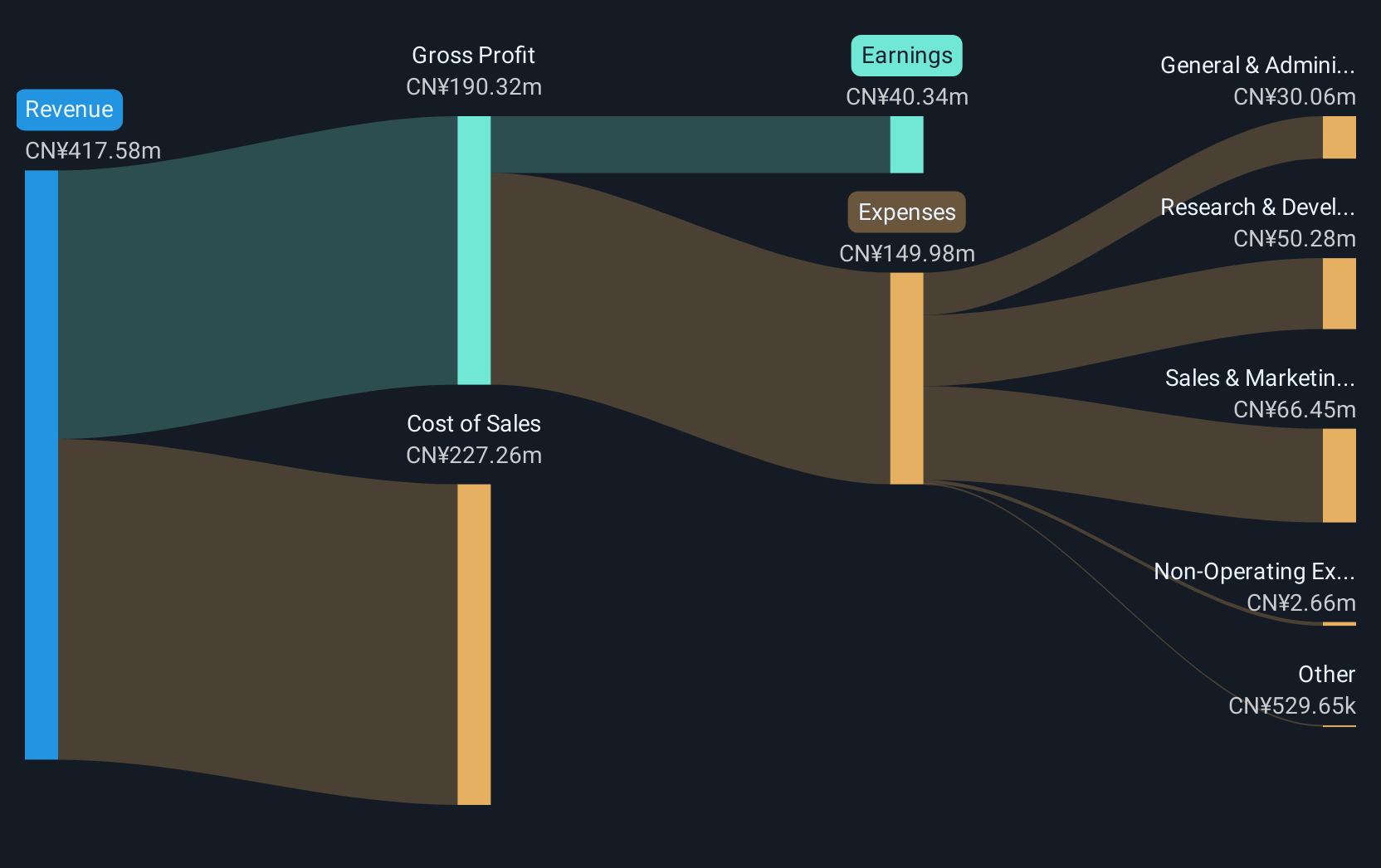

Operations: WuXi Xinje Electric Co., Ltd. generates revenue primarily from the instrument industry, amounting to CN¥1.79 billion. The company's operations span both domestic and international markets, focusing on industrial automation solutions.

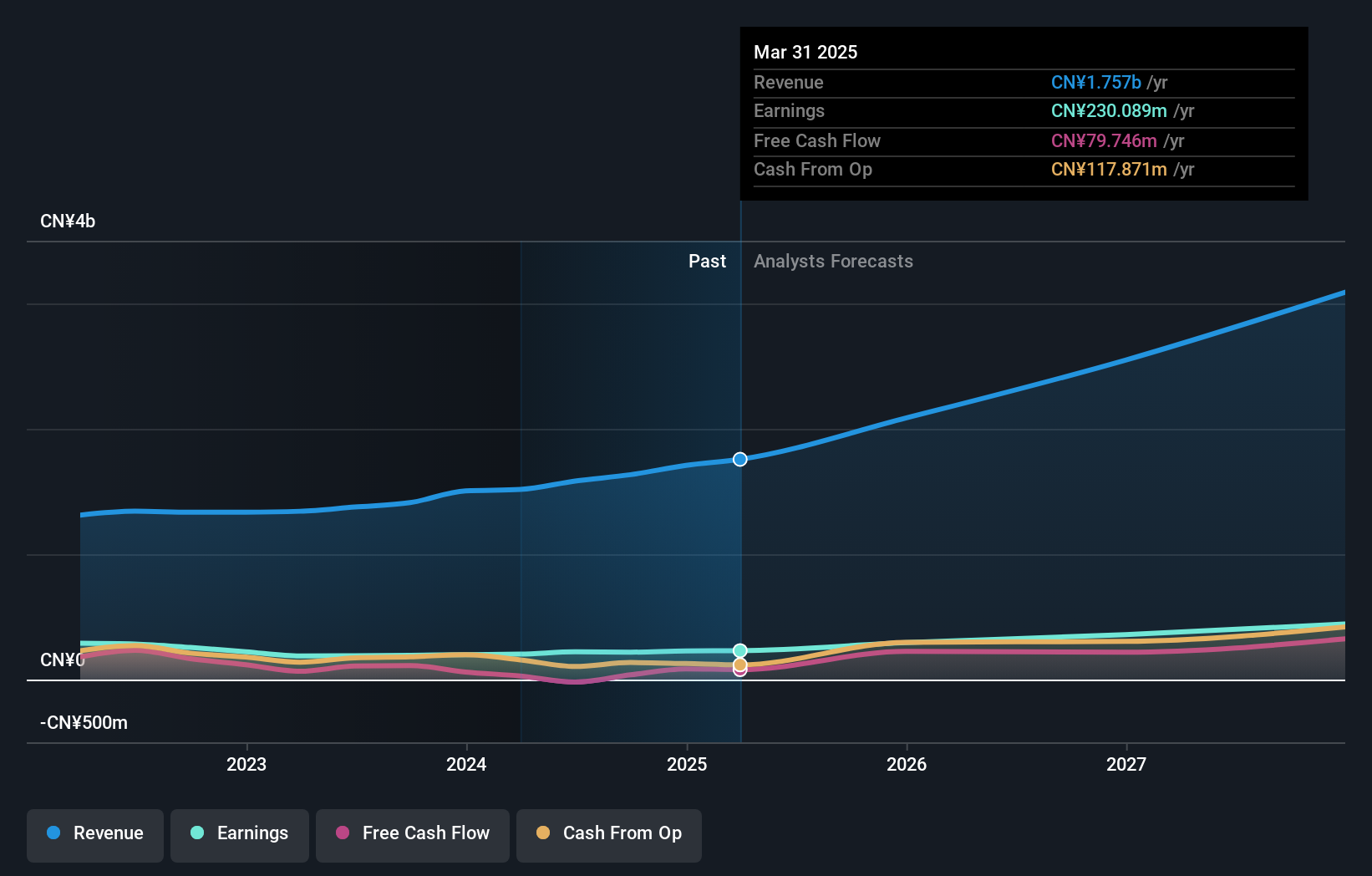

WuXi Xinje ElectricLtd showcases a robust trajectory in the tech sector, with revenue growth reported at 20.6% annually, outpacing the Chinese market average of 14.1%. The company's commitment to innovation is evident from its R&D investments, which are crucial for sustaining this momentum. Despite a slight dip in earnings per share from CNY 0.9 to CNY 0.87 year-over-year, WuXi Xinje maintains a positive outlook with expected earnings growth of 24% annually, slightly below the broader market forecast of 26.7%. This performance is underpinned by strategic shareholder meetings and consistent financial reporting that reinforces its competitive edge in Asia's dynamic tech landscape.

Beijing Labtech Instruments (SHSE:688056)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratory products and solutions globally, with a market capitalization of CN¥2.42 billion.

Operations: Beijing Labtech Instruments Co., Ltd. focuses on producing and distributing laboratory equipment and solutions on a global scale. The company operates with a market capitalization of approximately CN¥2.42 billion, indicating its significant presence in the laboratory industry.

Beijing Labtech Instruments is distinguishing itself in the high-tech sector of Asia, demonstrating a notable annual revenue growth of 24.6%, significantly outpacing the Chinese market average of 14.1%. This growth is supported by a robust strategy in research and development, with investments tailored to drive continuous innovation and maintain competitive advantage. Despite recent dips in net income and earnings per share—CNY 21.09 million and CNY 0.32 respectively from last year's CNY 23.84 million and CNY 0.35—the company's earnings are projected to surge by an impressive 36.5% annually, well above the broader market's forecast of 26.7%. The firm’s commitment to leveraging advanced technologies ensures it remains at the forefront of industry trends, poised for sustained growth amidst evolving market dynamics.

Key Takeaways

- Unlock our comprehensive list of 185 Asian High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if WuXi Xinje ElectricLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603416

WuXi Xinje ElectricLtd

Engages in the research, development, production, and application of automation products in China and internationally.

Flawless balance sheet and fair value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Waiting for the Inevitable

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026