- China

- /

- Electronic Equipment and Components

- /

- SHSE:688056

Exploring Beijing Labtech Instruments And 2 Other High Growth Tech Stocks In Asia

Reviewed by Simply Wall St

Amidst heightened global trade tensions and the imposition of new tariffs, Asian markets have experienced increased volatility, with small-cap stocks particularly affected as investors navigate the uncertainty surrounding economic growth and inflation. In this challenging environment, identifying high-growth tech companies that demonstrate resilience through innovation and adaptability is crucial for those looking to capitalize on potential opportunities within the sector.

Top 10 High Growth Tech Companies In Asia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Suzhou TFC Optical Communication | 34.26% | 32.15% | ★★★★★★ |

| Zhongji Innolight | 28.26% | 28.41% | ★★★★★★ |

| Fositek | 31.52% | 37.08% | ★★★★★★ |

| Shanghai Baosight SoftwareLtd | 20.52% | 25.50% | ★★★★★★ |

| eWeLLLtd | 24.66% | 25.31% | ★★★★★★ |

| Shanghai Huace Navigation Technology | 26.94% | 24.31% | ★★★★★★ |

| Seojin SystemLtd | 31.68% | 39.34% | ★★★★★★ |

| giftee | 21.13% | 67.05% | ★★★★★★ |

| Suzhou Gyz Electronic TechnologyLtd | 27.52% | 121.67% | ★★★★★★ |

| JNTC | 34.26% | 86.00% | ★★★★★★ |

Here we highlight a subset of our preferred stocks from the screener.

Beijing Labtech Instruments (SHSE:688056)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beijing Labtech Instruments Co., Ltd. manufactures and supplies laboratory products and solutions to the global laboratory industry, with a market cap of CN¥2.14 billion.

Operations: Beijing Labtech Instruments Co., Ltd. focuses on the production and distribution of laboratory products and solutions globally. The company operates within the laboratory industry, providing essential tools and services to support scientific research and development.

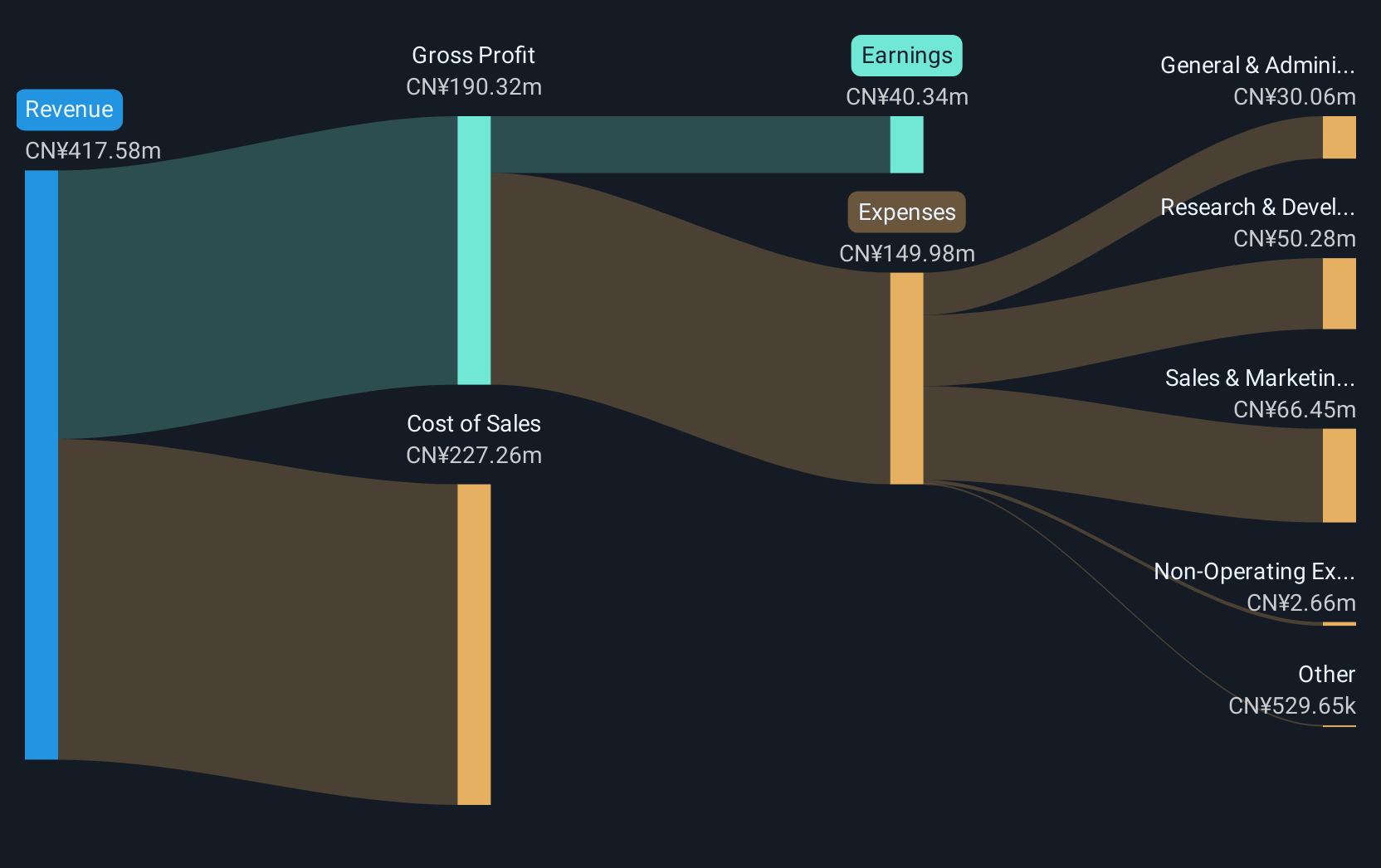

Beijing Labtech Instruments, a contender in Asia's high-growth tech sector, has shown remarkable financial performance with a 44.1% increase in earnings last year, outpacing the electronic industry's average of 4.7%. This growth is supported by robust R&D investments and strategic market positioning that promise further expansion. Despite a highly volatile share price recently, the company's revenue is expected to grow at 17.6% annually, surpassing China’s market average of 12.5%. With earnings projected to rise by 25.9% annually over the next three years and a solid full-year sales report showing an increase from CNY 416 million to CNY 424.37 million, Beijing Labtech is well-positioned for sustained growth amidst technological advancements and increasing demand within its sector.

Suzhou Sushi Testing GroupLtd (SZSE:300416)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Suzhou Sushi Testing Group Co., Ltd. offers environmental and reliability test verification equipment along with analysis services and solutions, with a market capitalization of CN¥9.01 billion.

Operations: Suzhou Sushi Testing Group Co., Ltd. specializes in providing environmental and reliability test verification equipment, as well as comprehensive analysis services and solutions.

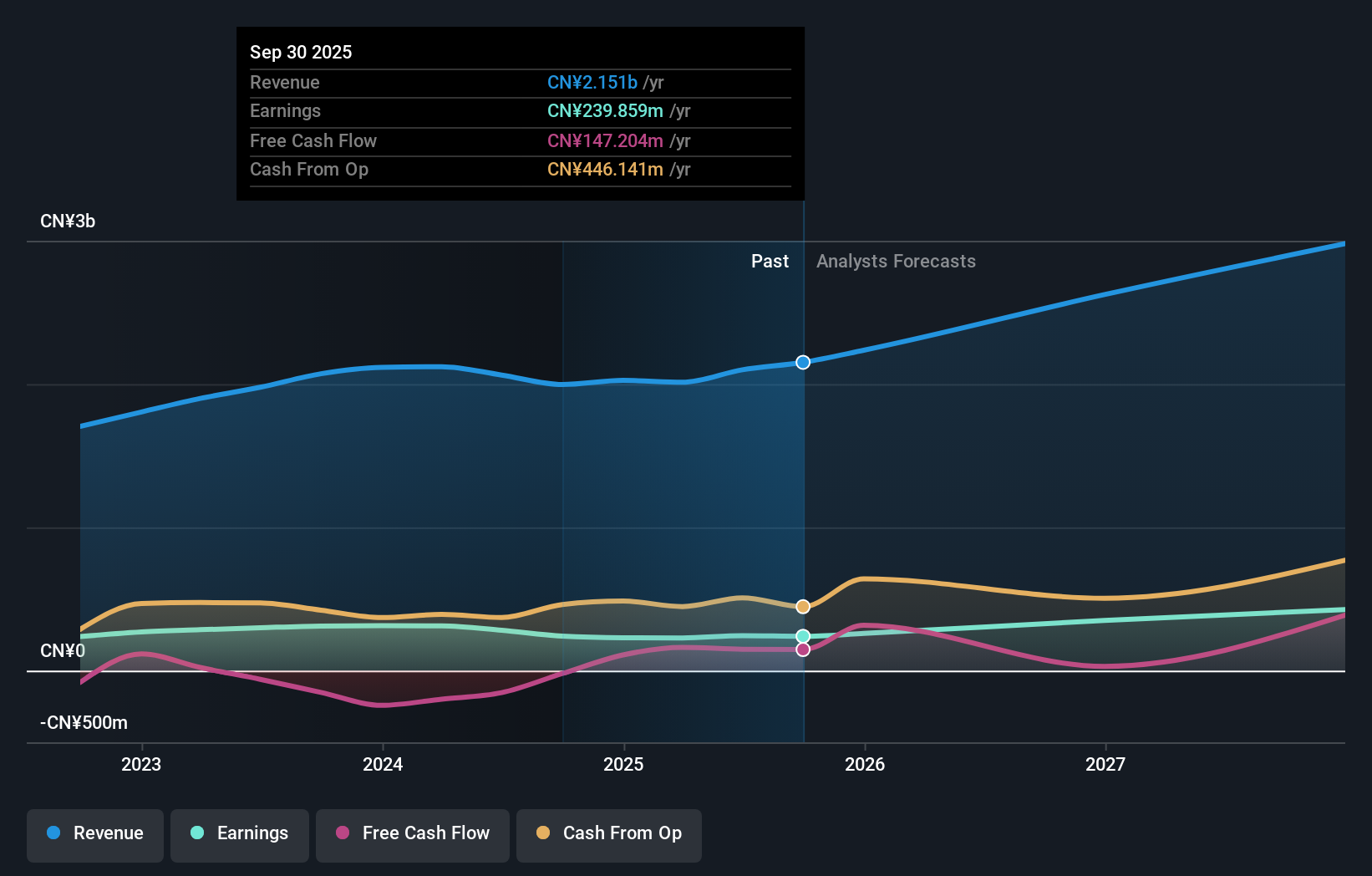

Suzhou Sushi Testing GroupLtd, a pivotal entity in Asia's tech landscape, has demonstrated robust financial dynamics with a notable annual revenue growth of 19.1%, surpassing the regional market average of 12.5%. This surge is underpinned by significant R&D expenditures which constituted 15% of their total revenue last year, reflecting a commitment to innovation that fuels advancements in testing technologies. With earnings expected to climb by 28.5% annually over the next three years and recent strategic share repurchases signaling confidence in sustained growth, Suzhou Sushi stands out for its aggressive expansion and technological contributions in high-stakes markets like semiconductor manufacturing.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥93.70 billion.

Operations: The company generates revenue through its platforms focused on recruitment and medical services. It operates in both Japan and the United States, contributing to its market presence.

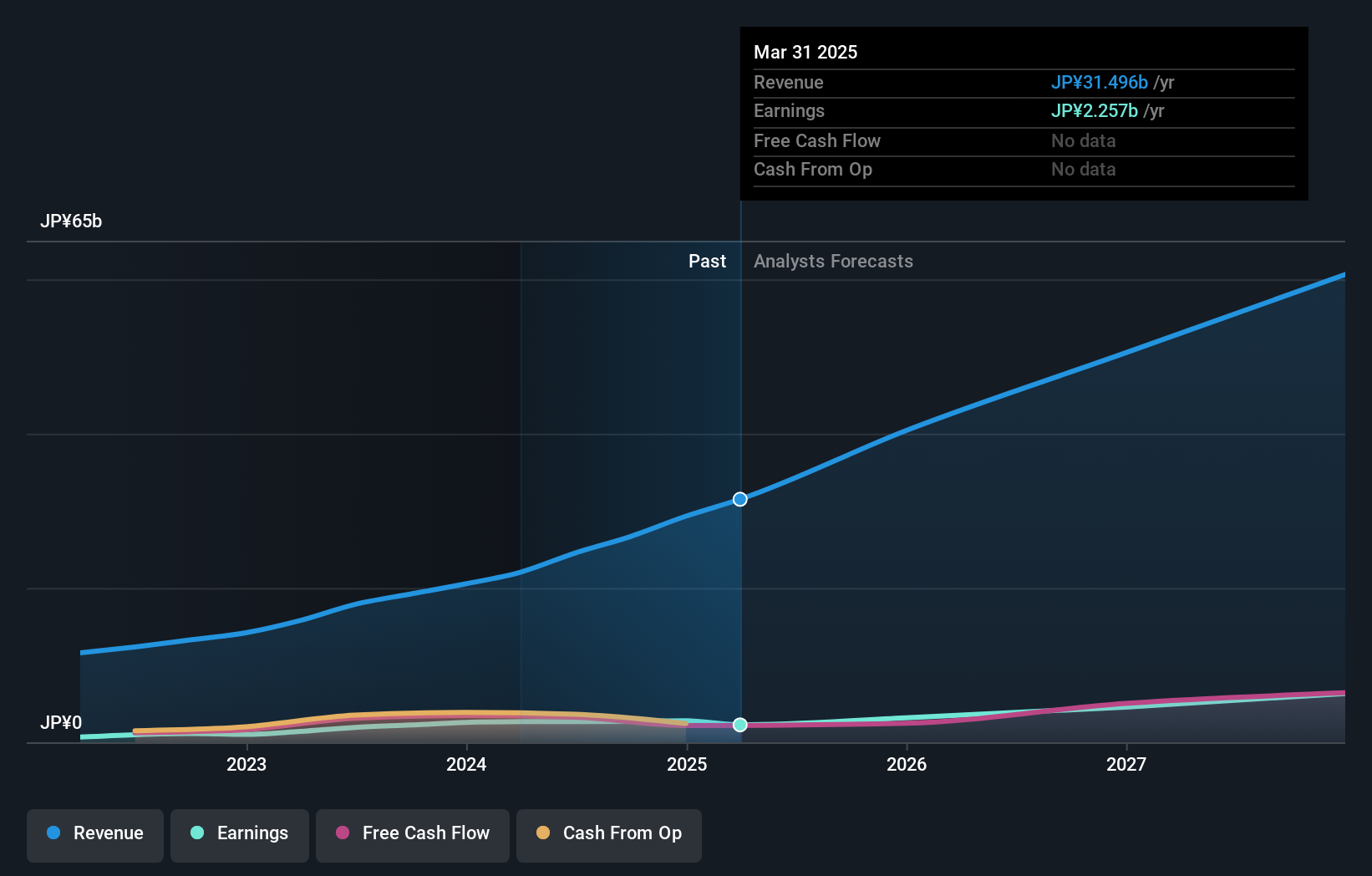

Medley's strategic maneuvers in Asia's high-growth tech sector are underscored by its aggressive share repurchase program, signaling robust confidence in its financial health and future prospects. With a forecasted annual revenue growth of 17.5% and earnings expected to surge by 23% annually, the company is outpacing the broader Japanese market significantly. Recent board decisions to streamline operations through mergers and acquisitions further highlight Medley’s proactive stance in fortifying its market position amidst dynamic industry shifts. Additionally, R&D investments remain a cornerstone of their strategy, ensuring continuous innovation and competitive edge in healthcare technology solutions.

- Take a closer look at Medley's potential here in our health report.

Review our historical performance report to gain insights into Medley's's past performance.

Next Steps

- Reveal the 500 hidden gems among our Asian High Growth Tech and AI Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Beijing Labtech Instruments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688056

Beijing Labtech Instruments

Manufactures and supplies laboratory products and solutions to laboratory industry worldwide.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives