- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:241

March 2025's Top Asian Growth Companies With Insider Ownership

Reviewed by Simply Wall St

As global markets grapple with trade policy uncertainties and inflation concerns, Asian indices have shown resilience, driven by strategic economic measures and growth initiatives. In this environment, companies with high insider ownership often stand out as they may indicate confidence from those closest to the business, making them appealing for investors seeking growth opportunities amidst market fluctuations.

Top 10 Growth Companies With High Insider Ownership In Asia

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Laopu Gold (SEHK:6181) | 36.4% | 42.9% |

| Global Tax Free (KOSDAQ:A204620) | 20.4% | 89.3% |

| Suzhou Sunmun Technology (SZSE:300522) | 35.4% | 92.8% |

| Bioneer (KOSDAQ:A064550) | 17.5% | 104.8% |

| Ascentage Pharma Group International (SEHK:6855) | 17.9% | 60.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 60% |

| Offcn Education Technology (SZSE:002607) | 26.1% | 93.3% |

Let's explore several standout options from the results in the screener.

Alibaba Health Information Technology (SEHK:241)

Simply Wall St Growth Rating: ★★★★☆☆

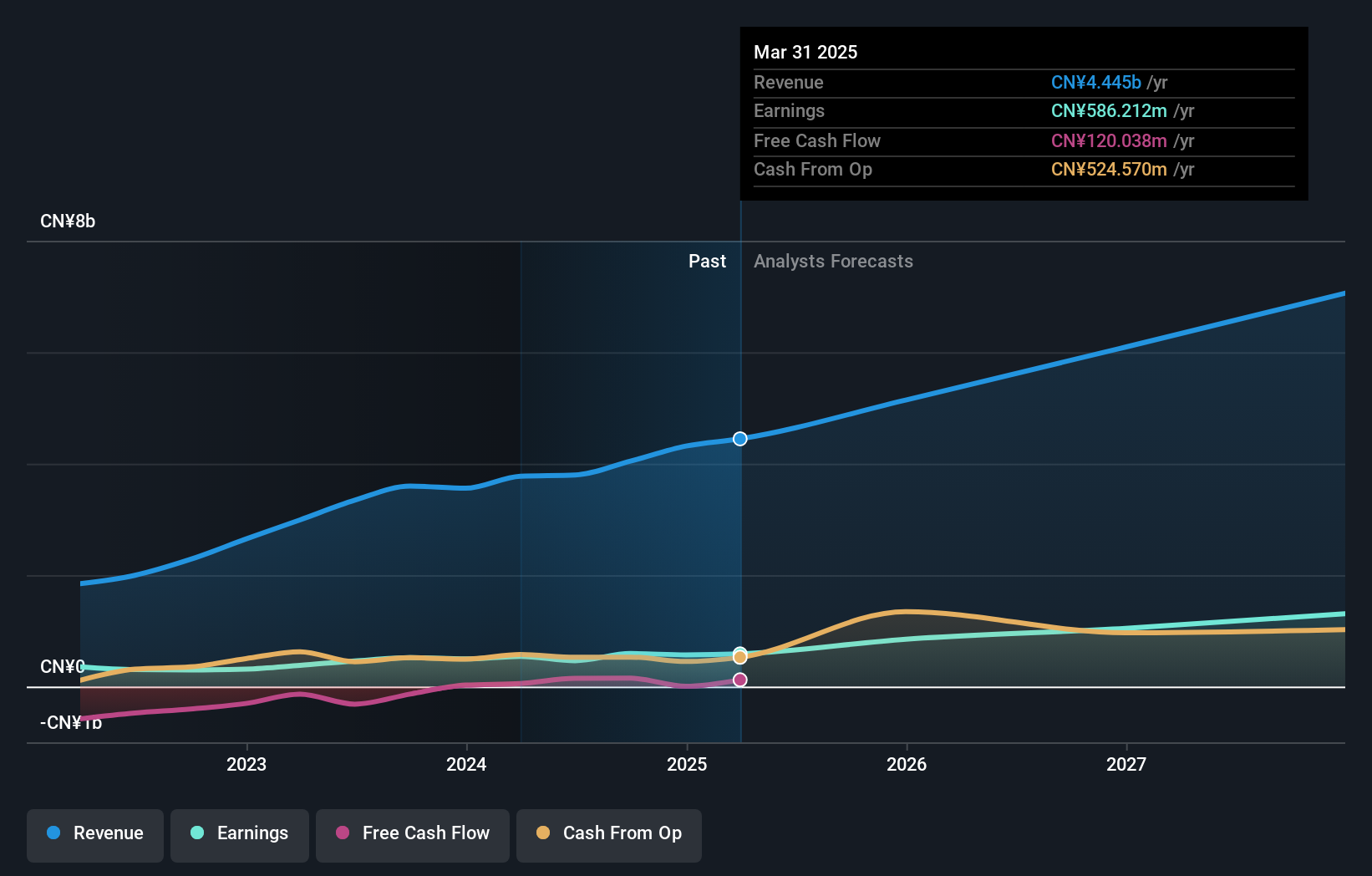

Overview: Alibaba Health Information Technology Limited operates in pharmaceutical direct sales, e-commerce platforms, and healthcare and digital services in Mainland China and Hong Kong, with a market cap of HK$88.93 billion.

Operations: The company's revenue segments include CN¥28.34 billion from the distribution and development of pharmaceutical and healthcare business.

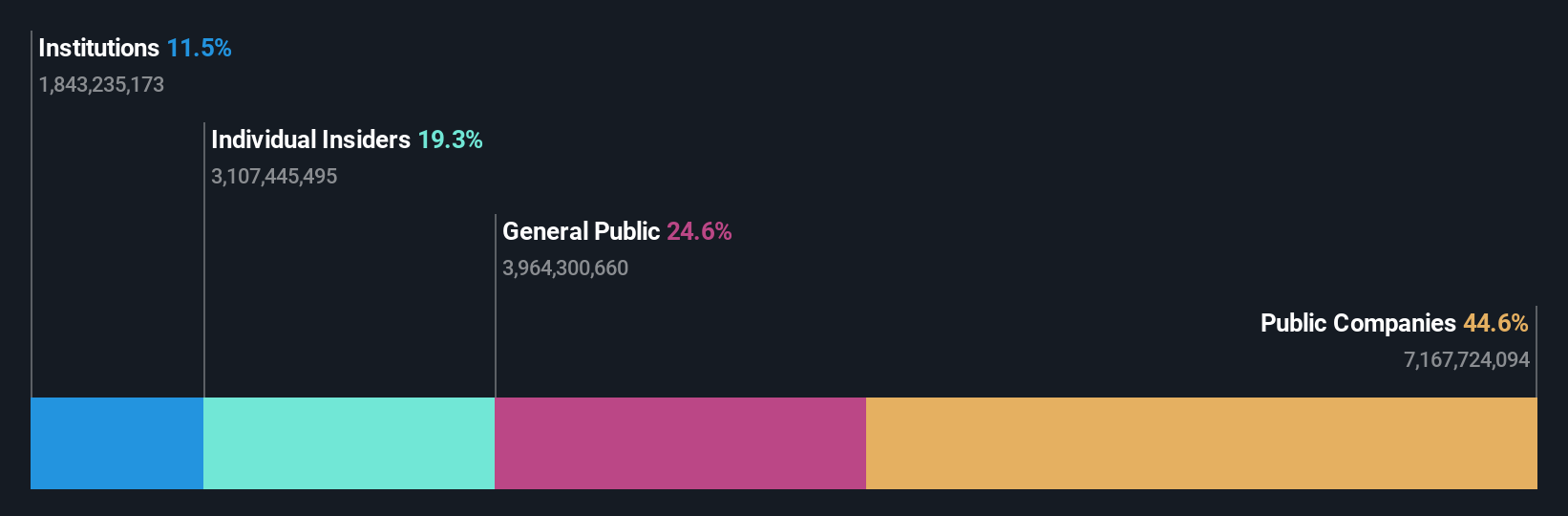

Insider Ownership: 19.3%

Alibaba Health Information Technology is positioned for significant profit growth, with earnings expected to grow 21.8% annually, outpacing the Hong Kong market's 11.6%. Revenue growth at 9.7% also surpasses the market average of 7.7%, though it's below high-growth thresholds. Despite its volatile share price, the stock trades at a substantial discount to estimated fair value and benefits from high-quality earnings, although recent results were impacted by large one-off items.

- Dive into the specifics of Alibaba Health Information Technology here with our thorough growth forecast report.

- Our valuation report unveils the possibility Alibaba Health Information Technology's shares may be trading at a premium.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. focuses on the R&D, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market cap of CN¥28.06 billion.

Operations: Raytron Technology Co., Ltd. derives its revenue from the development, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology within China.

Insider Ownership: 27.3%

Raytron Technology Ltd. demonstrates robust growth potential with its earnings projected to grow 29.2% annually, surpassing the Chinese market average of 25.5%. The company reported a substantial increase in net income for 2024, reaching CNY 610.14 million, up from CNY 495.77 million the previous year. Despite slower revenue growth compared to high-growth benchmarks, Raytron's price-to-earnings ratio remains attractive relative to industry standards and it has completed a significant share buyback program recently valued at CNY 65.01 million.

- Take a closer look at Raytron TechnologyLtd's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Raytron TechnologyLtd is trading beyond its estimated value.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sharetronic Data Technology Co., Ltd. is a provider of wireless IoT products in China and internationally, with a market cap of CN¥30.39 billion.

Operations: Sharetronic Data Technology Co., Ltd. generates its revenue by offering wireless IoT products both domestically in China and on an international scale.

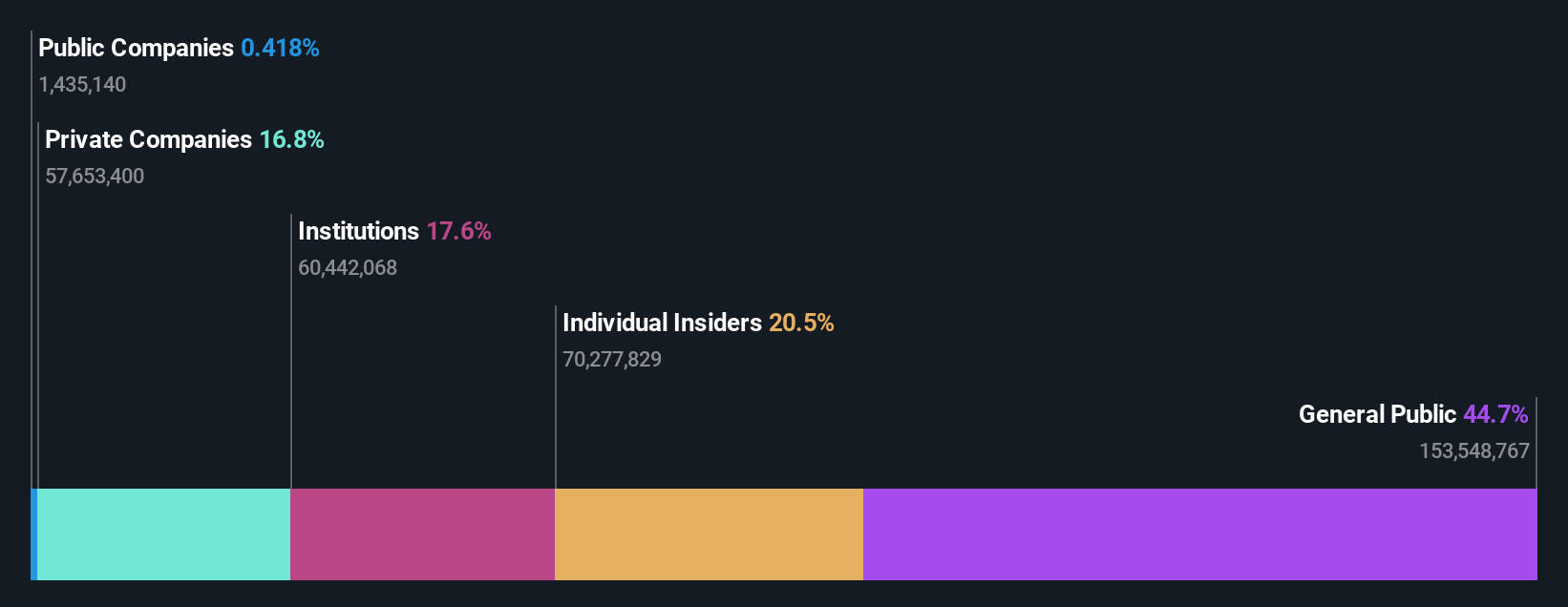

Insider Ownership: 20.5%

Sharetronic Data Technology exhibits strong growth prospects with earnings expected to rise 29.1% annually, outpacing the Chinese market's 25.5%. Revenue is also set to grow rapidly at 26.2% per year. Despite a volatile share price, its price-to-earnings ratio of 46.9x remains favorable compared to the tech industry average of 60.4x. Recent inclusion in Shenzhen Stock Exchange indices highlights its market presence, although no significant insider trading activity was recorded recently.

- Click here to discover the nuances of Sharetronic Data Technology with our detailed analytical future growth report.

- Our expertly prepared valuation report Sharetronic Data Technology implies its share price may be too high.

Summing It All Up

- Investigate our full lineup of 642 Fast Growing Asian Companies With High Insider Ownership right here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:241

Alibaba Health Information Technology

An investment holding company, engages in the pharmaceutical direct sales, pharmaceutical e-commerce platform, and healthcare and digital services businesses in Mainland China and Hong Kong.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives