- China

- /

- Metals and Mining

- /

- SZSE:000426

3 Asian Stocks Estimated To Be Trading At Discounts Of Up To 49%

Reviewed by Simply Wall St

As global trade tensions show signs of easing, Asian markets are experiencing a cautious optimism, with indices reflecting the potential for economic stabilization amid ongoing policy adjustments. In this environment, identifying undervalued stocks can be particularly appealing to investors seeking opportunities to capitalize on potential market corrections and growth prospects.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Ningbo Sanxing Medical ElectricLtd (SHSE:601567) | CN¥25.60 | CN¥50.32 | 49.1% |

| Bethel Automotive Safety Systems (SHSE:603596) | CN¥57.62 | CN¥114.61 | 49.7% |

| Auras Technology (TPEX:3324) | NT$487.00 | NT$963.61 | 49.5% |

| Alexander Marine (TWSE:8478) | NT$142.00 | NT$280.63 | 49.4% |

| Rakus (TSE:3923) | ¥2168.00 | ¥4270.57 | 49.2% |

| Newborn Town (SEHK:9911) | HK$8.17 | HK$16.05 | 49.1% |

| World Fitness Services (TWSE:2762) | NT$82.90 | NT$163.37 | 49.3% |

| Beijing Zhong Ke San Huan High-Tech (SZSE:000970) | CN¥10.50 | CN¥20.76 | 49.4% |

| China Ruyi Holdings (SEHK:136) | HK$2.04 | HK$4.06 | 49.8% |

| Everest Medicines (SEHK:1952) | HK$49.25 | HK$96.65 | 49% |

Below we spotlight a couple of our favorites from our exclusive screener.

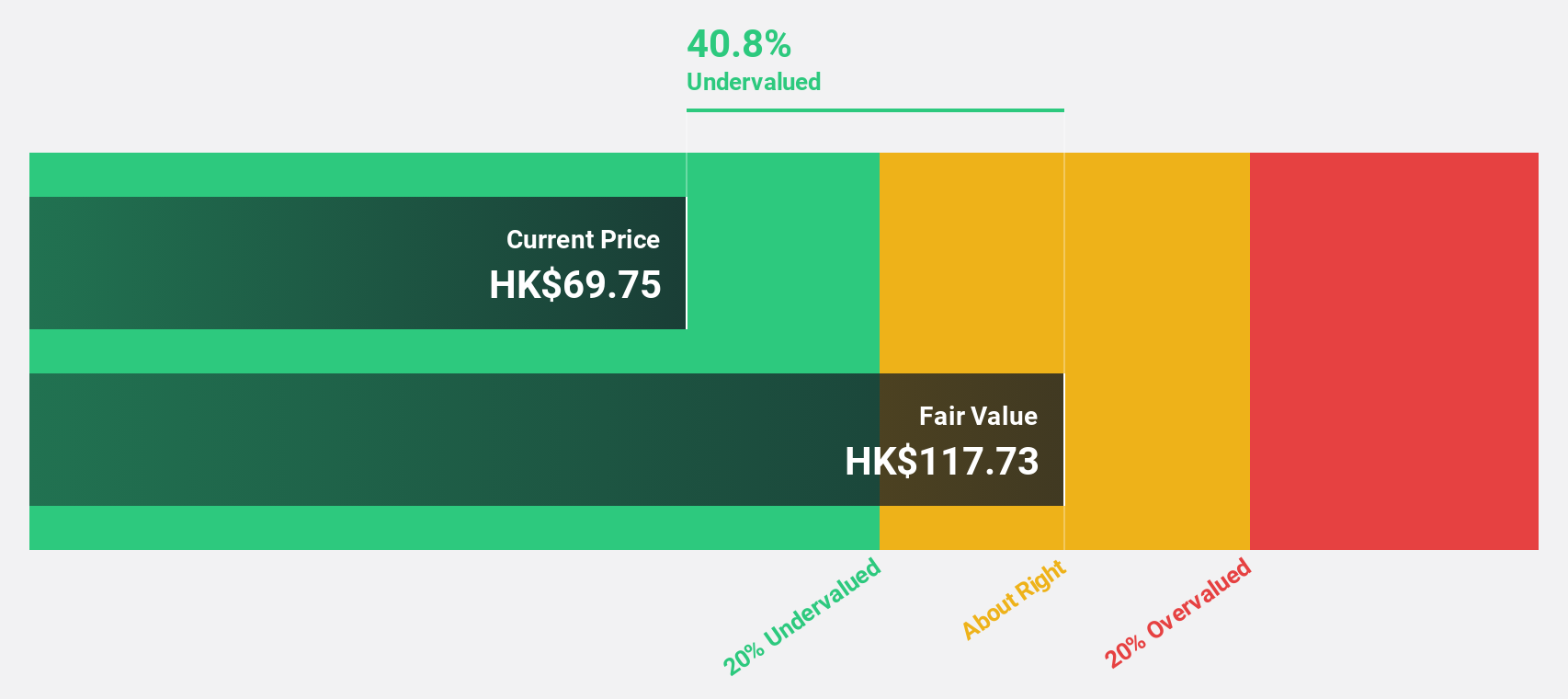

Everest Medicines (SEHK:1952)

Overview: Everest Medicines Limited is a biopharmaceutical company focused on the discovery, licensing, development, and commercialization of therapies and vaccines for critical unmet medical needs in Greater China and other Asia Pacific markets with a market cap of HK$15.98 billion.

Operations: The company generates revenue from its pharmaceuticals segment, which amounted to CN¥706.68 million.

Estimated Discount To Fair Value: 49%

Everest Medicines is trading at HK$49.25, significantly below its estimated fair value of HK$96.65, suggesting it may be undervalued based on cash flows. Despite a net loss of CNY 1,041.38 million in 2024, the company is expected to become profitable within three years with projected revenue growth of 29.1% annually, outpacing the Hong Kong market's growth rate. Recent developments include regulatory approvals for etrasimod in various regions and promising clinical trial results for ulcerative colitis treatment.

- Insights from our recent growth report point to a promising forecast for Everest Medicines' business outlook.

- Click here to discover the nuances of Everest Medicines with our detailed financial health report.

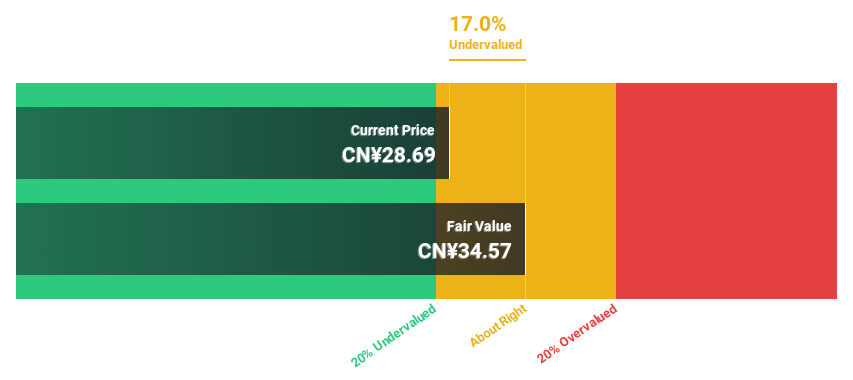

Olympic Circuit Technology (SHSE:603920)

Overview: Olympic Circuit Technology Co., Ltd specializes in the manufacturing and sale of rigid PCBs, with a market cap of CN¥19.10 billion.

Operations: The company's revenue primarily comes from the production and distribution of rigid printed circuit boards (PCBs).

Estimated Discount To Fair Value: 26%

Olympic Circuit Technology is trading at CNY 26.51, below its estimated fair value of CNY 35.84, indicating potential undervaluation based on cash flows. The company's Q1 2025 earnings showed a net income increase to CNY 179.84 million from CNY 108.59 million year-over-year, with revenue growth forecasted at over 20% annually, surpassing the Chinese market's average rate. However, share price volatility and lower future return on equity forecasts are considerations for investors.

- Our growth report here indicates Olympic Circuit Technology may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Olympic Circuit Technology stock in this financial health report.

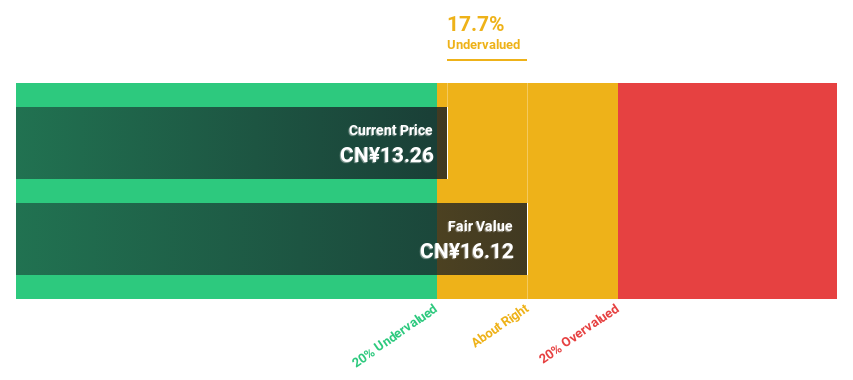

Inner Mongolia Xingye Silver &Tin MiningLtd (SZSE:000426)

Overview: Inner Mongolia Xingye Silver & Tin Mining Co., Ltd operates in the mining, extraction, and smelting of non-ferrous and precious metals with a market capitalization of CN¥23.54 billion.

Operations: Inner Mongolia Xingye Silver & Tin Mining Co., Ltd generates revenue through its activities in mining, extracting, and smelting non-ferrous and precious metals.

Estimated Discount To Fair Value: 18.1%

Inner Mongolia Xingye Silver & Tin Mining Ltd is trading at CN¥13.26, below its estimated fair value of CN¥16.19, reflecting undervaluation based on cash flows. Recent earnings for Q1 2025 showed a significant rise in net income to CN¥374.36 million from CN¥229.35 million year-over-year, with revenue also increasing substantially to CN¥1,149.28 million from the previous year's CN¥764.28 million, supporting expectations of continued strong profit growth despite slower market-relative earnings expansion forecasts.

- In light of our recent growth report, it seems possible that Inner Mongolia Xingye Silver &Tin MiningLtd's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of Inner Mongolia Xingye Silver &Tin MiningLtd.

Taking Advantage

- Click here to access our complete index of 273 Undervalued Asian Stocks Based On Cash Flows.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000426

Inner Mongolia Xingye Silver &Tin MiningLtd

Engages in mining, extracting, and smelting non-ferrous and precious metals.

High growth potential and good value.

Market Insights

Community Narratives