- China

- /

- Electronic Equipment and Components

- /

- SHSE:603629

Jiangsu Lettall Electronic Co.,Ltd (SHSE:603629) Shares May Have Slumped 26% But Getting In Cheap Is Still Unlikely

To the annoyance of some shareholders, Jiangsu Lettall Electronic Co.,Ltd (SHSE:603629) shares are down a considerable 26% in the last month, which continues a horrid run for the company. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 26% in that time.

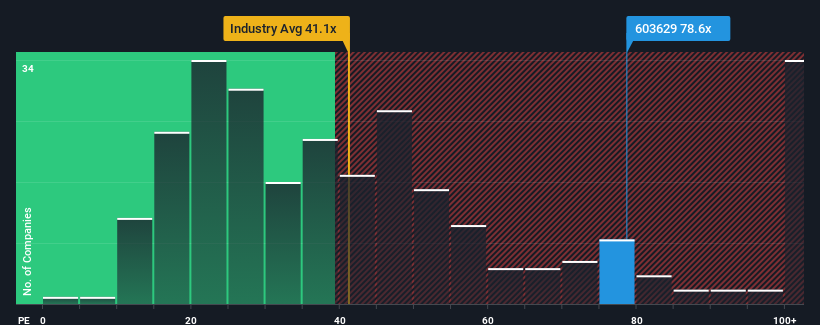

In spite of the heavy fall in price, Jiangsu Lettall ElectronicLtd's price-to-earnings (or "P/E") ratio of 78.6x might still make it look like a strong sell right now compared to the market in China, where around half of the companies have P/E ratios below 29x and even P/E's below 17x are quite common. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

As an illustration, earnings have deteriorated at Jiangsu Lettall ElectronicLtd over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Jiangsu Lettall ElectronicLtd

Is There Enough Growth For Jiangsu Lettall ElectronicLtd?

The only time you'd be truly comfortable seeing a P/E as steep as Jiangsu Lettall ElectronicLtd's is when the company's growth is on track to outshine the market decidedly.

Retrospectively, the last year delivered a frustrating 7.5% decrease to the company's bottom line. As a result, earnings from three years ago have also fallen 6.1% overall. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Comparing that to the market, which is predicted to deliver 36% growth in the next 12 months, the company's downward momentum based on recent medium-term earnings results is a sobering picture.

With this information, we find it concerning that Jiangsu Lettall ElectronicLtd is trading at a P/E higher than the market. It seems most investors are ignoring the recent poor growth rate and are hoping for a turnaround in the company's business prospects. Only the boldest would assume these prices are sustainable as a continuation of recent earnings trends is likely to weigh heavily on the share price eventually.

The Key Takeaway

Even after such a strong price drop, Jiangsu Lettall ElectronicLtd's P/E still exceeds the rest of the market significantly. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Jiangsu Lettall ElectronicLtd revealed its shrinking earnings over the medium-term aren't impacting its high P/E anywhere near as much as we would have predicted, given the market is set to grow. When we see earnings heading backwards and underperforming the market forecasts, we suspect the share price is at risk of declining, sending the high P/E lower. Unless the recent medium-term conditions improve markedly, it's very challenging to accept these prices as being reasonable.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Jiangsu Lettall ElectronicLtd (1 can't be ignored) you should be aware of.

You might be able to find a better investment than Jiangsu Lettall ElectronicLtd. If you want a selection of possible candidates, check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603629

Jiangsu Lettall ElectronicLtd

Jiangsu Lettall Electronic Co.,Ltd is involved in the design, manufacture, and sales of precision metal structural parts, appearance parts, and electronic components for liquid crystal displays in China and internationally.

Good value with proven track record.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026