- China

- /

- Electronic Equipment and Components

- /

- SHSE:603380

Unveiling Undiscovered Gems And 2 Other Promising Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets grapple with mixed performances and economic uncertainties, small-cap stocks have faced particular challenges, with the Russell 2000 Index underperforming against its larger counterparts. Amidst this backdrop of fluctuating indices and shifting monetary policies, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential growth in turbulent times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Padma Oil | 0.76% | 4.42% | 9.81% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Boursa Kuwait Securities Company K.P.S.C | NA | 14.28% | 2.26% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Al-Enma'a Real Estate Company K.S.C.P | 16.44% | -13.00% | 21.11% | ★★★★★☆ |

| National Investments Company K.S.C.P | 26.01% | 3.66% | 4.99% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Al-Ahleia Insurance CompanyK.P | 8.09% | 10.04% | 16.85% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Suzhou Etron TechnologiesLtd (SHSE:603380)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Etron Technologies Co., Ltd. offers electronics manufacturing services globally and has a market capitalization of CN¥3.76 billion.

Operations: Suzhou Etron Technologies generates revenue primarily from the production and sales of electronic components, amounting to CN¥2.11 billion.

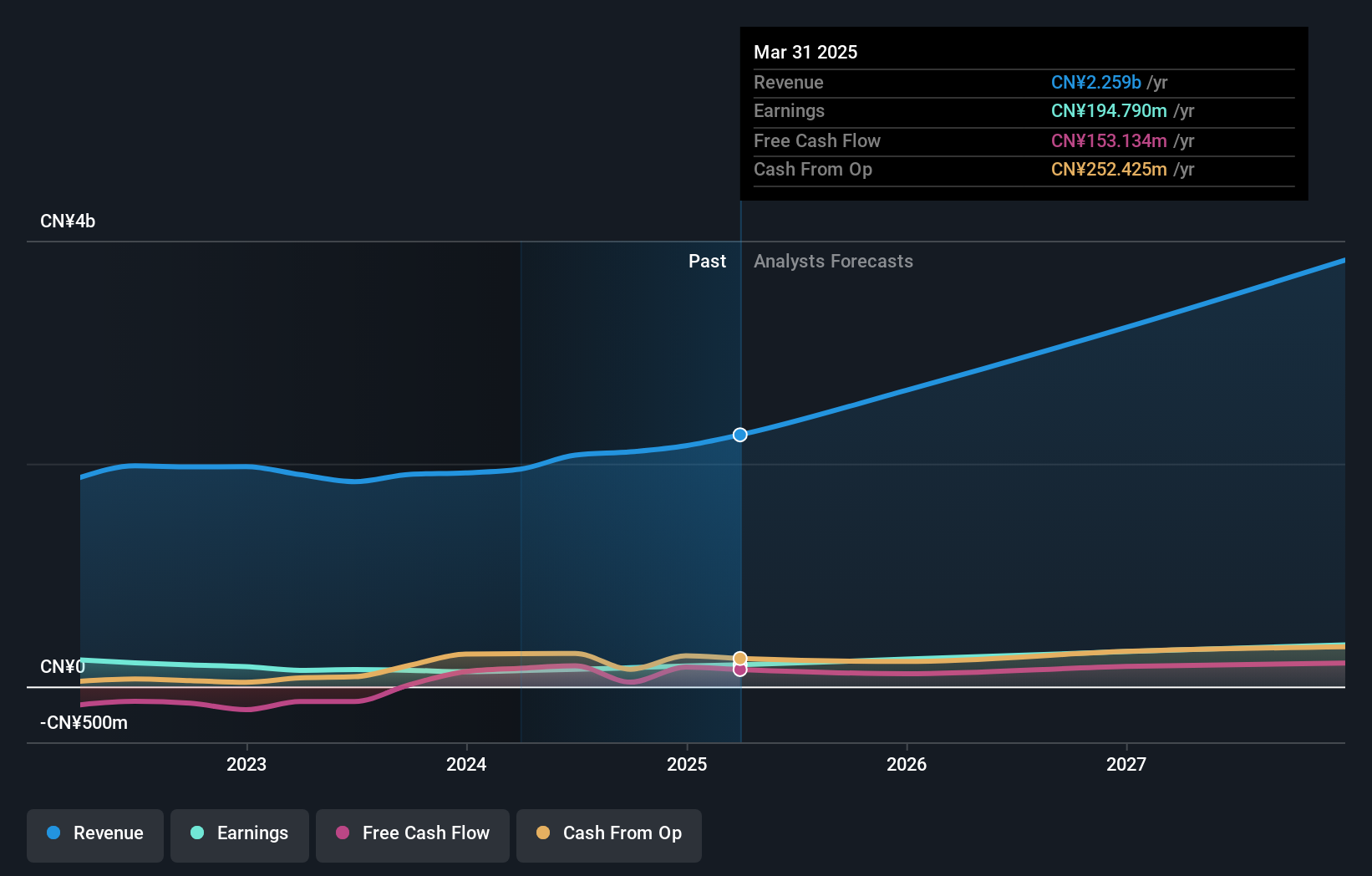

Etron Technologies, operating in the electronics sector, has shown impressive earnings growth of 15.9% over the past year, outpacing the industry average of 1.9%. The company reported net income of CN¥138.8 million for nine months ending September 2024, up from CN¥103.29 million a year earlier, with basic earnings per share rising to CN¥0.86 from CN¥0.64. Despite a debt-to-equity ratio increase to 11% over five years and a significant one-off gain of CN¥39.6 million impacting recent results, Etron remains financially robust with more cash than total debt and positive free cash flow trends observed recently.

Jiangsu Tongli Risheng Machinery (SHSE:605286)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Tongli Risheng Machinery Co., Ltd. operates in the machinery industry and has a market cap of CN¥5.41 billion.

Operations: Tongli Risheng generates revenue primarily from its machinery operations, with a market cap of CN¥5.41 billion. The company's financial performance is highlighted by its gross profit margin trends, which provide insight into its cost efficiency and pricing strategy within the industry.

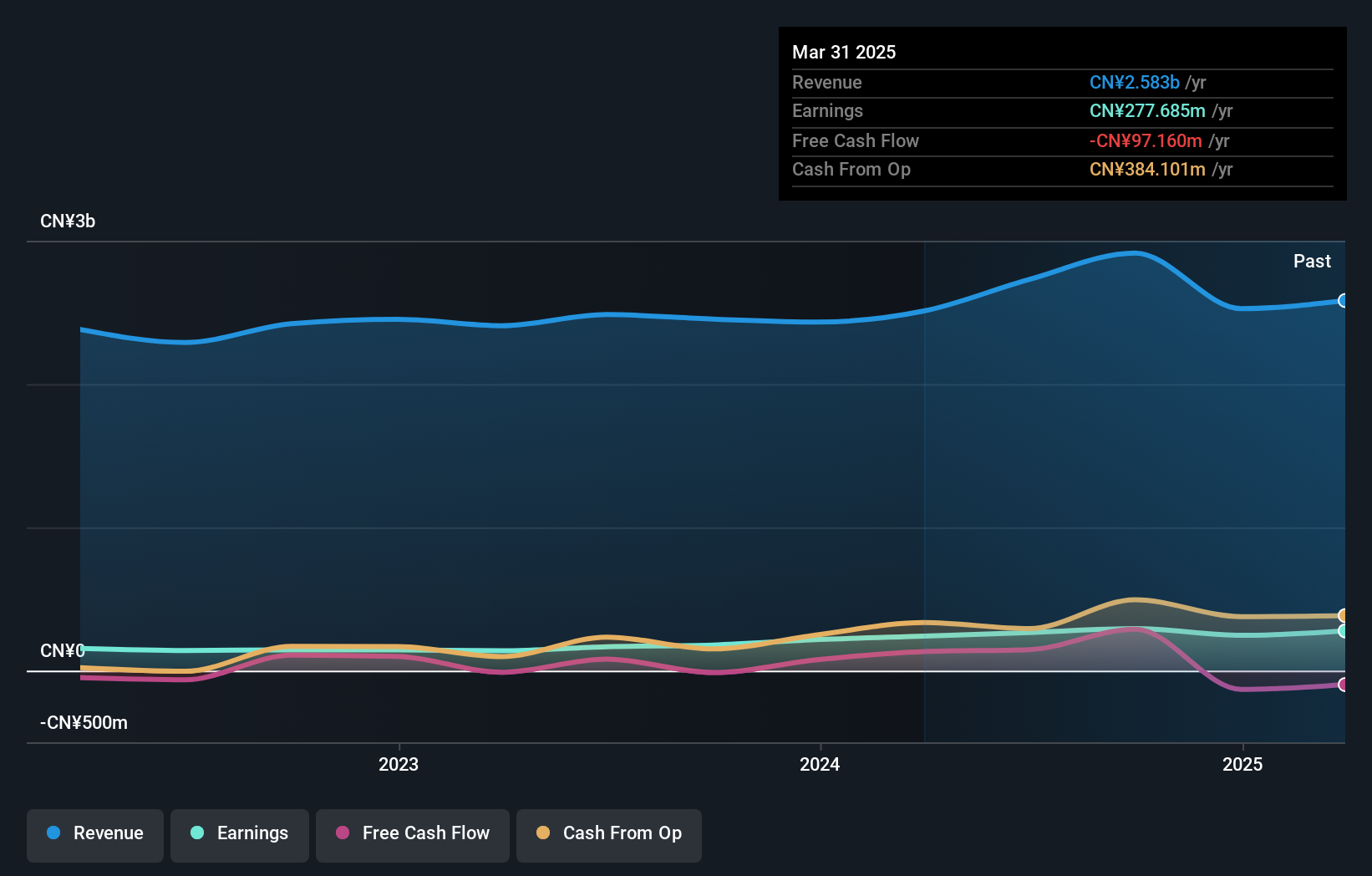

Jiangsu Tongli Risheng Machinery, a smaller player in the machinery sector, has shown impressive financial dynamics. Over the past year, earnings surged by 64%, outpacing the industry's -0.2% performance. The company's debt to equity ratio improved significantly from 34.9% to 5.9% over five years, indicating better financial health and reduced leverage risks. Recent earnings announcements highlight strong growth with sales reaching CNY 2,271 million for nine months ending September 2024 compared to CNY 1,790 million last year; net income rose to CNY 220 million from CNY 144 million previously, reflecting robust operational efficiency and profitability improvements.

- Click here and access our complete health analysis report to understand the dynamics of Jiangsu Tongli Risheng Machinery.

Understand Jiangsu Tongli Risheng Machinery's track record by examining our Past report.

baudroieinc (TSE:4413)

Simply Wall St Value Rating: ★★★★★☆

Overview: Baudroie, Inc. offers optimal IT solutions in Japan and has a market cap of ¥75.86 billion.

Operations: With a market cap of ¥75.86 billion, the company generates revenue primarily from its IT solutions in Japan.

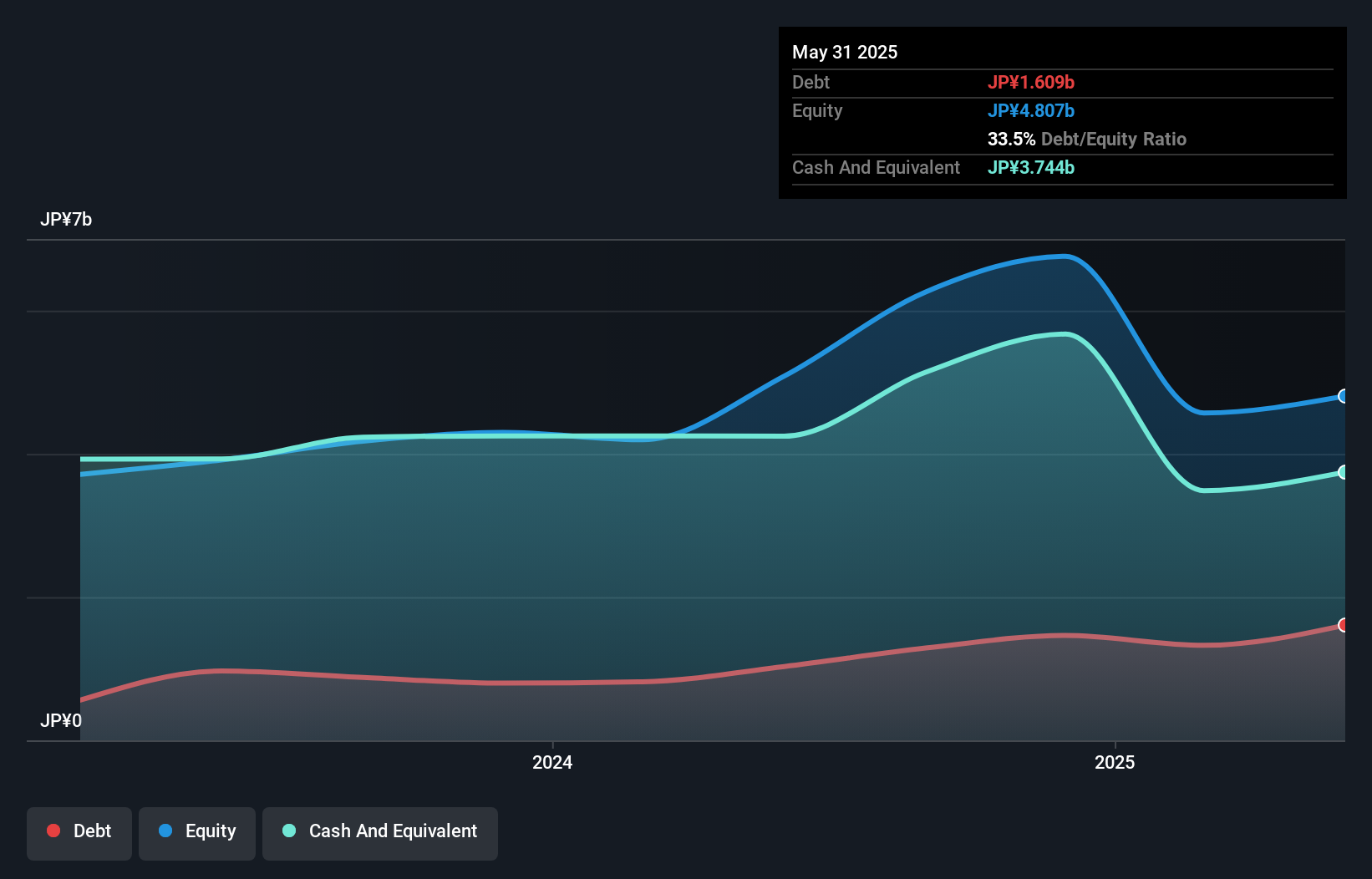

Baudroie Inc., a nimble player in the tech sector, has shown impressive growth with earnings surging by 49.9% over the past year, outpacing the IT industry's 9.7%. Trading at 8% below its estimated fair value, it offers potential for investors seeking undervalued opportunities. The company is executing a share repurchase program worth ¥3.5 billion to buy back up to 640,600 shares or about 4% of its capital by April 2025, reflecting strategic capital management amid evolving business conditions. Despite high volatility in recent months and limited financial history, Baudroie's robust cash flow and quality earnings suggest promising prospects ahead.

- Delve into the full analysis health report here for a deeper understanding of baudroieinc.

Examine baudroieinc's past performance report to understand how it has performed in the past.

Where To Now?

- Click through to start exploring the rest of the 4612 Undiscovered Gems With Strong Fundamentals now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603380

Suzhou Etron TechnologiesLtd

Provides electronics manufacturing services worldwide.

Undervalued with excellent balance sheet.