- China

- /

- Electronic Equipment and Components

- /

- SHSE:603380

Undiscovered Gems Featuring 3 Promising Stocks with Strong Foundations

Reviewed by Simply Wall St

As global markets continue to navigate the complexities of rising inflation and shifting trade policies, small-cap stocks have lagged behind their larger counterparts, with the Russell 2000 trailing the S&P 500. Amidst this backdrop, identifying stocks with strong foundations becomes crucial for investors seeking resilience and potential growth in uncertain times.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tchaikapharma High Quality Medicines AD | 9.38% | 6.91% | 31.36% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Polyram Plastic Industries | 45.46% | 11.39% | 10.98% | ★★★★★☆ |

| Isracard | 69.54% | 9.35% | 3.37% | ★★★★★☆ |

| Transcorp Power | 29.70% | 115.27% | 164.65% | ★★★★★☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 16.56% | 6.15% | 10.19% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Dynamic Holdings (SEHK:29)

Simply Wall St Value Rating: ★★★★★★

Overview: Dynamic Holdings Limited is an investment holding company involved in property investment and development in the People’s Republic of China and Hong Kong, with a market capitalization of approximately HK$2.95 billion.

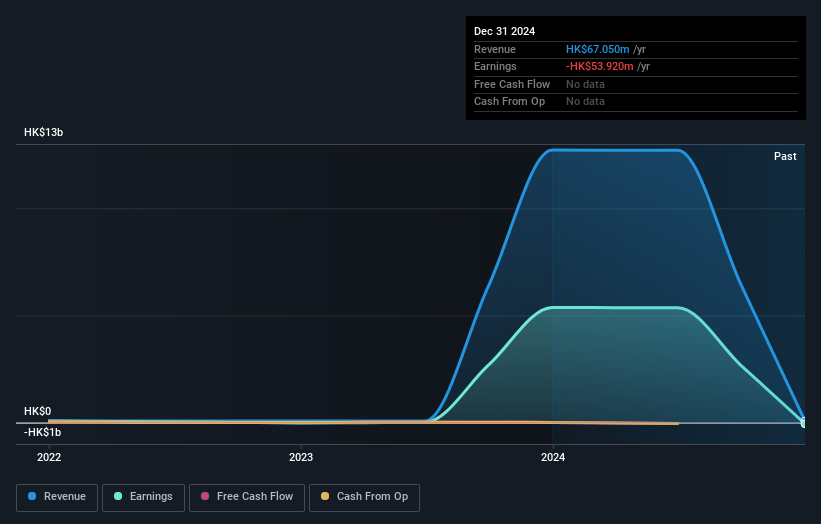

Operations: Dynamic Holdings generates revenue primarily from property rentals in Beijing and Shanghai, with the latter contributing HK$42.40 million. The company incurs a significant share of loss from a joint venture amounting to HK$12.64 billion, impacting its overall financial performance.

Dynamic Holdings, a compact player in the market, stands out with its impressive financial turnaround. The company boasts an astounding earnings growth of 80,605% over the past year, significantly outpacing the real estate sector's -15.9%. Its debt-free status marks a stark improvement from five years ago when it had a debt-to-equity ratio of 5.1%. With a price-to-earnings ratio of just 0.6x compared to Hong Kong's market average of 10.2x, Dynamic Holdings seems undervalued and offers potential for savvy investors seeking opportunities in niche markets.

- Unlock comprehensive insights into our analysis of Dynamic Holdings stock in this health report.

Assess Dynamic Holdings' past performance with our detailed historical performance reports.

Suzhou Etron TechnologiesLtd (SHSE:603380)

Simply Wall St Value Rating: ★★★★★☆

Overview: Suzhou Etron Technologies Co., Ltd. offers electronics manufacturing services globally and has a market capitalization of CN¥4.33 billion.

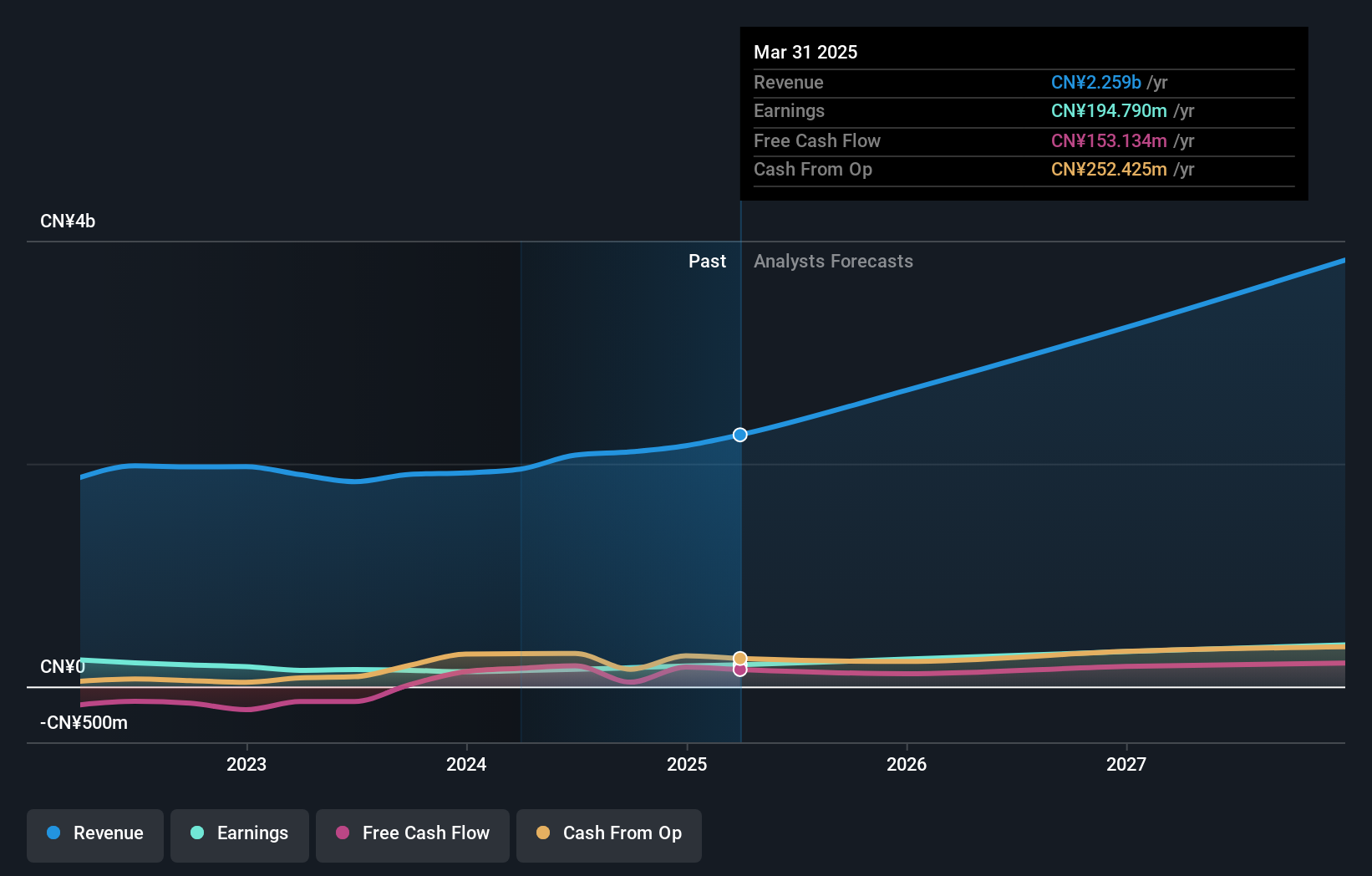

Operations: Suzhou Etron Technologies generates revenue primarily from the production and sales of electronic components, totaling CN¥2.11 billion. The company's gross profit margin exhibits notable trends over recent periods, reflecting its operational efficiency within the electronics manufacturing sector.

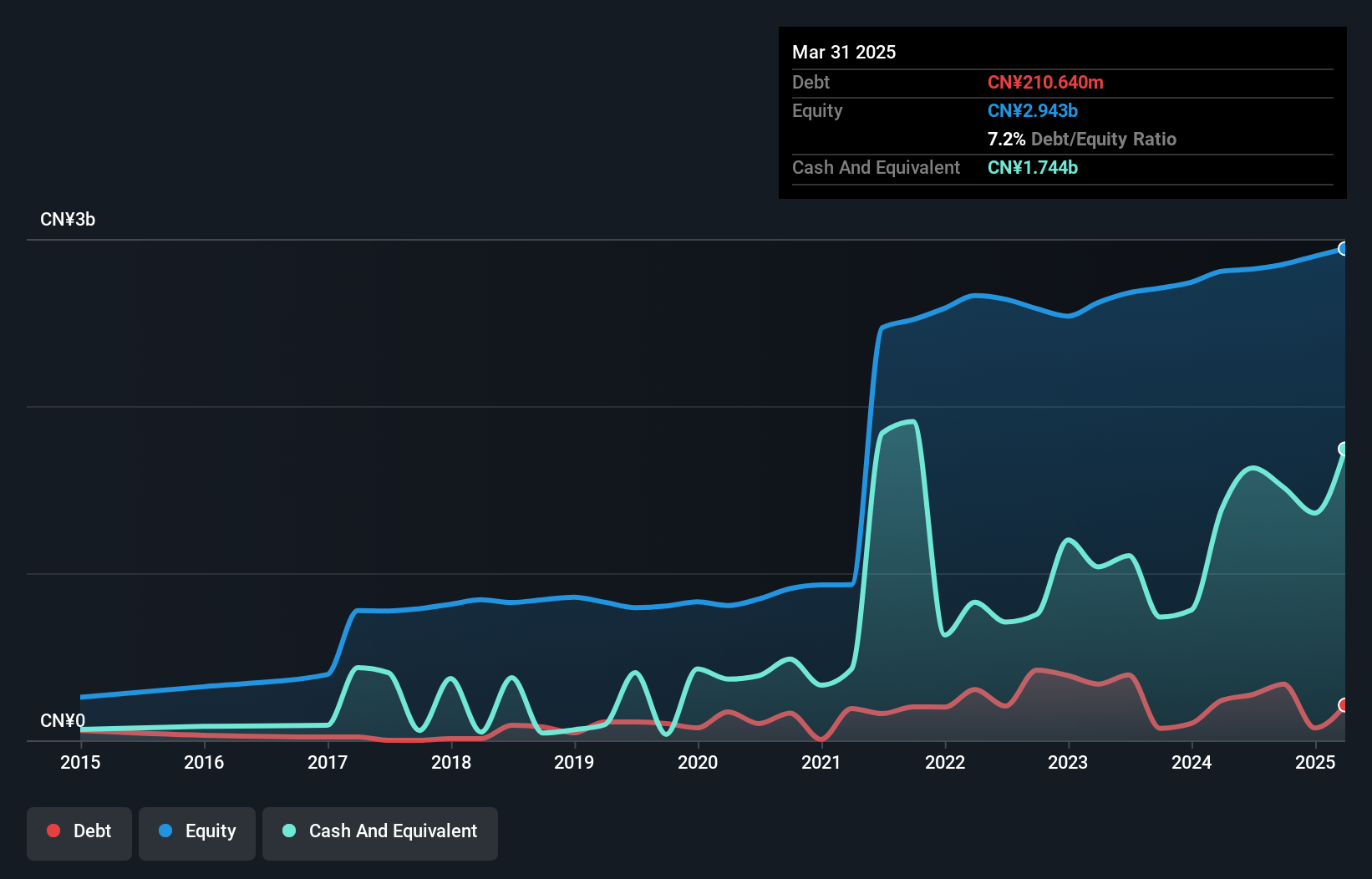

Etron Technologies, a relatively small player in the electronics sector, is trading at 63.9% below its estimated fair value, offering potential upside for investors. Over the past year, earnings surged by 15.9%, outpacing the industry average of 1.9%. The company's debt to equity ratio has risen from 0.9% to 11% over five years, yet it holds more cash than total debt and maintains positive free cash flow. A notable one-off gain of CN¥39M impacted recent results but doesn't overshadow its robust profitability and promising forecasted earnings growth of over 21%.

Jiangsu Ankura Intelligent Power (SZSE:300617)

Simply Wall St Value Rating: ★★★★★★

Overview: Jiangsu Ankura Intelligent Power Co., Ltd. specializes in the development and production of intelligent power equipment, with a market cap of CN¥5.32 billion.

Operations: Ankura Intelligent Power generates revenue primarily from its electric equipment segment, which contributes CN¥948.17 million.

Ankura Intelligent Power, a smaller player in the electrical industry, has shown promising financial metrics. Its earnings rose by 5.7% over the past year, outpacing the industry's 1.3% growth. The company's price-to-earnings ratio stands at 30.2x, which is below the Chinese market average of 37.9x, suggesting potential value for investors. Over five years, Ankura's debt-to-equity ratio decreased from 12.4% to 11.8%, and it holds more cash than total debt, indicating sound financial health despite negative free cash flow figures like -39M in recent quarters due to capital expenditures around -161M US$.

Next Steps

- Unlock our comprehensive list of 4754 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603380

Suzhou Etron TechnologiesLtd

Provides electronics manufacturing services worldwide.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives