- China

- /

- Electronic Equipment and Components

- /

- SHSE:603100

Chongqing Chuanyi Automation's (SHSE:603100) earnings growth rate lags the 29% CAGR delivered to shareholders

When you buy a stock there is always a possibility that it could drop 100%. But on a lighter note, a good company can see its share price rise well over 100%. For example, the Chongqing Chuanyi Automation Co., Ltd. (SHSE:603100) share price has soared 212% in the last half decade. Most would be very happy with that. On top of that, the share price is up 27% in about a quarter. But this move may well have been assisted by the reasonably buoyant market (up 33% in 90 days).

While the stock has fallen 6.3% this week, it's worth focusing on the longer term and seeing if the stocks historical returns have been driven by the underlying fundamentals.

See our latest analysis for Chongqing Chuanyi Automation

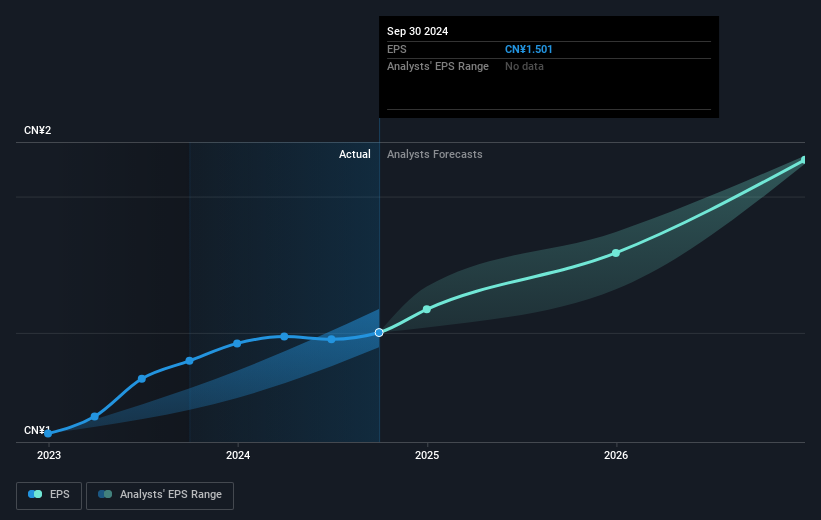

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Chongqing Chuanyi Automation achieved compound earnings per share (EPS) growth of 15% per year. This EPS growth is slower than the share price growth of 26% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. And that's hardly shocking given the track record of growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. Dive deeper into the earnings by checking this interactive graph of Chongqing Chuanyi Automation's earnings, revenue and cash flow.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Chongqing Chuanyi Automation, it has a TSR of 256% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Chongqing Chuanyi Automation provided a TSR of 4.5% over the last twelve months. But that return falls short of the market. On the bright side, the longer term returns (running at about 29% a year, over half a decade) look better. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Is Chongqing Chuanyi Automation cheap compared to other companies? These 3 valuation measures might help you decide.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603100

Chongqing Chuanyi Automation

Researches, manufactures, and markets industrial auto-control systems and devices, and engineering integration services in China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives