- China

- /

- Communications

- /

- SHSE:603083

CIG ShangHai Co., Ltd. (SHSE:603083) Surges 30% Yet Its Low P/S Is No Reason For Excitement

CIG ShangHai Co., Ltd. (SHSE:603083) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 37% in the last twelve months.

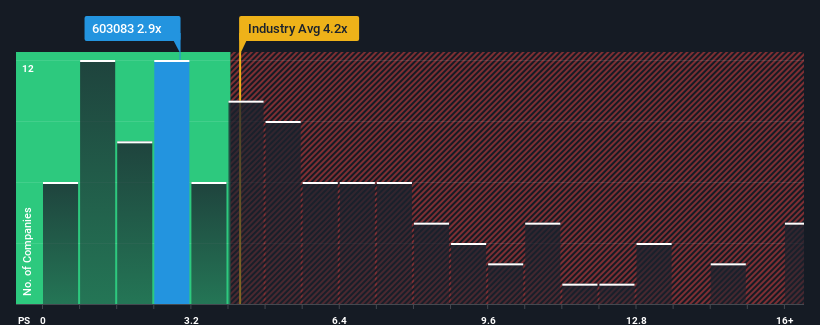

In spite of the firm bounce in price, CIG ShangHai may still be sending bullish signals at the moment with its price-to-sales (or "P/S") ratio of 2.9x, since almost half of all companies in the Communications industry in China have P/S ratios greater than 4.2x and even P/S higher than 7x are not unusual. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for CIG ShangHai

What Does CIG ShangHai's Recent Performance Look Like?

For example, consider that CIG ShangHai's financial performance has been poor lately as its revenue has been in decline. It might be that many expect the disappointing revenue performance to continue or accelerate, which has repressed the P/S. Those who are bullish on CIG ShangHai will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for CIG ShangHai, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.How Is CIG ShangHai's Revenue Growth Trending?

In order to justify its P/S ratio, CIG ShangHai would need to produce sluggish growth that's trailing the industry.

Retrospectively, the last year delivered a frustrating 24% decrease to the company's top line. Regardless, revenue has managed to lift by a handy 13% in aggregate from three years ago, thanks to the earlier period of growth. Accordingly, while they would have preferred to keep the run going, shareholders would be roughly satisfied with the medium-term rates of revenue growth.

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 42% shows it's noticeably less attractive.

With this in consideration, it's easy to understand why CIG ShangHai's P/S falls short of the mark set by its industry peers. Apparently many shareholders weren't comfortable holding on to something they believe will continue to trail the wider industry.

The Final Word

CIG ShangHai's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of CIG ShangHai confirms that the company's revenue trends over the past three-year years are a key factor in its low price-to-sales ratio, as we suspected, given they fall short of current industry expectations. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with CIG ShangHai, and understanding them should be part of your investment process.

If you're unsure about the strength of CIG ShangHai's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:603083

CIG Shanghai

Engages in the research and development, production, and sale of edge computing, industrial interconnection, and high-speed optical module products in China and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives