- China

- /

- Electronic Equipment and Components

- /

- SHSE:601231

Does Universal Scientific Industrial (Shanghai) (SHSE:601231) Have A Healthy Balance Sheet?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. As with many other companies Universal Scientific Industrial (Shanghai) Co., Ltd. (SHSE:601231) makes use of debt. But is this debt a concern to shareholders?

When Is Debt A Problem?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Universal Scientific Industrial (Shanghai)

How Much Debt Does Universal Scientific Industrial (Shanghai) Carry?

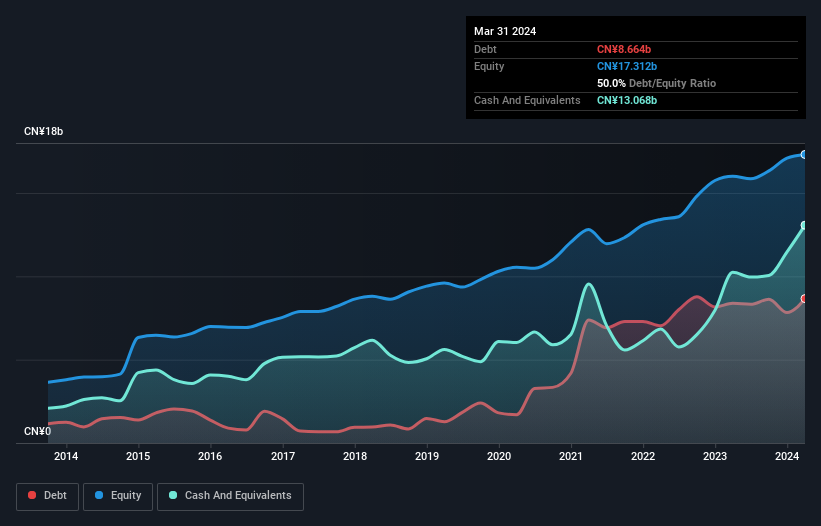

The chart below, which you can click on for greater detail, shows that Universal Scientific Industrial (Shanghai) had CN¥8.66b in debt in March 2024; about the same as the year before. But on the other hand it also has CN¥13.1b in cash, leading to a CN¥4.40b net cash position.

How Strong Is Universal Scientific Industrial (Shanghai)'s Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Universal Scientific Industrial (Shanghai) had liabilities of CN¥17.4b due within 12 months and liabilities of CN¥4.35b due beyond that. Offsetting this, it had CN¥13.1b in cash and CN¥8.41b in receivables that were due within 12 months. So these liquid assets roughly match the total liabilities.

This state of affairs indicates that Universal Scientific Industrial (Shanghai)'s balance sheet looks quite solid, as its total liabilities are just about equal to its liquid assets. So it's very unlikely that the CN¥37.8b company is short on cash, but still worth keeping an eye on the balance sheet. While it does have liabilities worth noting, Universal Scientific Industrial (Shanghai) also has more cash than debt, so we're pretty confident it can manage its debt safely.

In fact Universal Scientific Industrial (Shanghai)'s saving grace is its low debt levels, because its EBIT has tanked 31% in the last twelve months. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Universal Scientific Industrial (Shanghai)'s ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. While Universal Scientific Industrial (Shanghai) has net cash on its balance sheet, it's still worth taking a look at its ability to convert earnings before interest and tax (EBIT) to free cash flow, to help us understand how quickly it is building (or eroding) that cash balance. During the last three years, Universal Scientific Industrial (Shanghai) produced sturdy free cash flow equating to 73% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Summing Up

We could understand if investors are concerned about Universal Scientific Industrial (Shanghai)'s liabilities, but we can be reassured by the fact it has has net cash of CN¥4.40b. The cherry on top was that in converted 73% of that EBIT to free cash flow, bringing in CN¥3.9b. So we are not troubled with Universal Scientific Industrial (Shanghai)'s debt use. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. To that end, you should be aware of the 1 warning sign we've spotted with Universal Scientific Industrial (Shanghai) .

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:601231

Universal Scientific Industrial (Shanghai)

An electronic design and manufacturing service company, engages in the design, miniaturization, manufacture, industrial software and hardware solutions, material procurement, logistics, and maintenance services of electronic products worldwide.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives