- China

- /

- Communications

- /

- SHSE:600487

Should You Be Adding Hengtong Optic-Electric (SHSE:600487) To Your Watchlist Today?

The excitement of investing in a company that can reverse its fortunes is a big draw for some speculators, so even companies that have no revenue, no profit, and a record of falling short, can manage to find investors. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Hengtong Optic-Electric (SHSE:600487). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Hengtong Optic-Electric with the means to add long-term value to shareholders.

View our latest analysis for Hengtong Optic-Electric

Hengtong Optic-Electric's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. Hengtong Optic-Electric managed to grow EPS by 14% per year, over three years. That's a pretty good rate, if the company can sustain it.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Hengtong Optic-Electric reported flat revenue and EBIT margins over the last year. While this doesn't ring alarm bells, it may not meet the expectations of growth-minded investors.

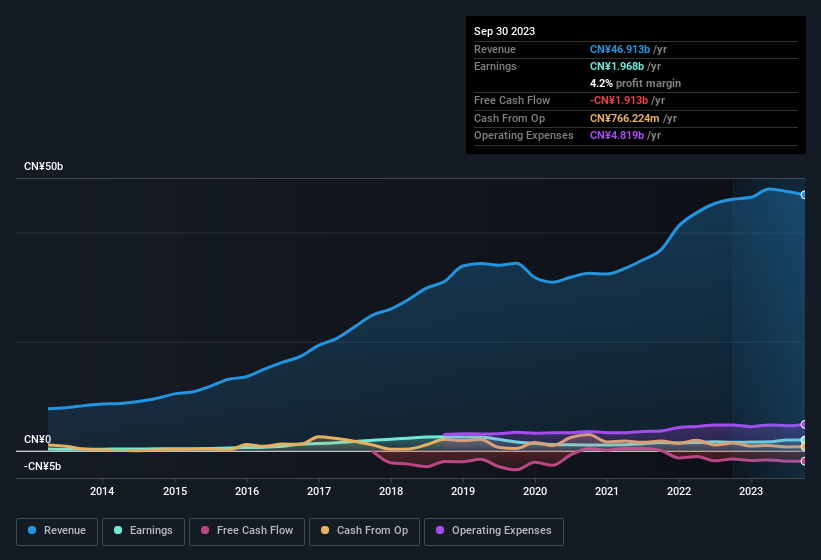

You can take a look at the company's revenue and earnings growth trend, in the chart below. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Hengtong Optic-Electric.

Are Hengtong Optic-Electric Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Shareholders will be pleased by the fact that insiders own Hengtong Optic-Electric shares worth a considerable sum. Indeed, they have a considerable amount of wealth invested in it, currently valued at CN¥1.4b. Holders should find this level of insider commitment quite encouraging, since it would ensure that the leaders of the company would also experience their success, or failure, with the stock.

It's good to see that insiders are invested in the company, but are remuneration levels reasonable? A brief analysis of the CEO compensation suggests they are. The median total compensation for CEOs of companies similar in size to Hengtong Optic-Electric, with market caps between CN¥14b and CN¥46b, is around CN¥1.5m.

Hengtong Optic-Electric's CEO took home a total compensation package worth CN¥1.3m in the year leading up to December 2022. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of good governance, more generally.

Is Hengtong Optic-Electric Worth Keeping An Eye On?

One positive for Hengtong Optic-Electric is that it is growing EPS. That's nice to see. Earnings growth might be the main attraction for Hengtong Optic-Electric, but the fun does not stop there. With a meaningful level of insider ownership, and reasonable CEO pay, a reasonable mind might conclude that this is one stock worth watching. It is worth noting though that we have found 1 warning sign for Hengtong Optic-Electric that you need to take into consideration.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Chinese companies which have demonstrated growth backed by recent insider purchases.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Hengtong Optic-Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SHSE:600487

Hengtong Optic-Electric

Operates in fiber optic communications industry in China and internationally.

Solid track record with excellent balance sheet.