- China

- /

- Electronic Equipment and Components

- /

- SHSE:600353

Discovering Undiscovered Gems in Global Markets July 2025

Reviewed by Simply Wall St

As global markets experience a surge, with the S&P 500 and Nasdaq Composite hitting record highs and smaller-cap indexes like the S&P MidCap 400 and Russell 2000 outperforming, investors are keenly observing economic indicators such as resilient job growth and fluctuating manufacturing activity. In this dynamic environment, identifying promising stocks requires a focus on companies that exhibit strong fundamentals and adaptability to evolving market conditions.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Anpec Electronics | NA | 1.77% | 4.97% | ★★★★★★ |

| Soft-World International | NA | -1.24% | 5.77% | ★★★★★★ |

| Daphne International Holdings | NA | -40.78% | 85.98% | ★★★★★★ |

| Sinopower Semiconductor | 22.36% | 1.45% | -4.33% | ★★★★★☆ |

| Tai Sin Electric | 28.69% | 9.56% | 4.66% | ★★★★★☆ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.60% | ★★★★★☆ |

| DorightLtd | 5.31% | 15.47% | 9.44% | ★★★★★☆ |

| Uniplus Electronics | 32.17% | 46.30% | 75.33% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Chengdu Xuguang Electronics (SHSE:600353)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Chengdu Xuguang Electronics Co., Ltd. specializes in the manufacturing and sale of metal-ceramic triodes, tetrodes, and transmitting tubes both domestically and internationally, with a market cap of CN¥11.75 billion.

Operations: The company's revenue is primarily derived from the sale of metal-ceramic triodes, tetrodes, and transmitting tubes in both domestic and international markets.

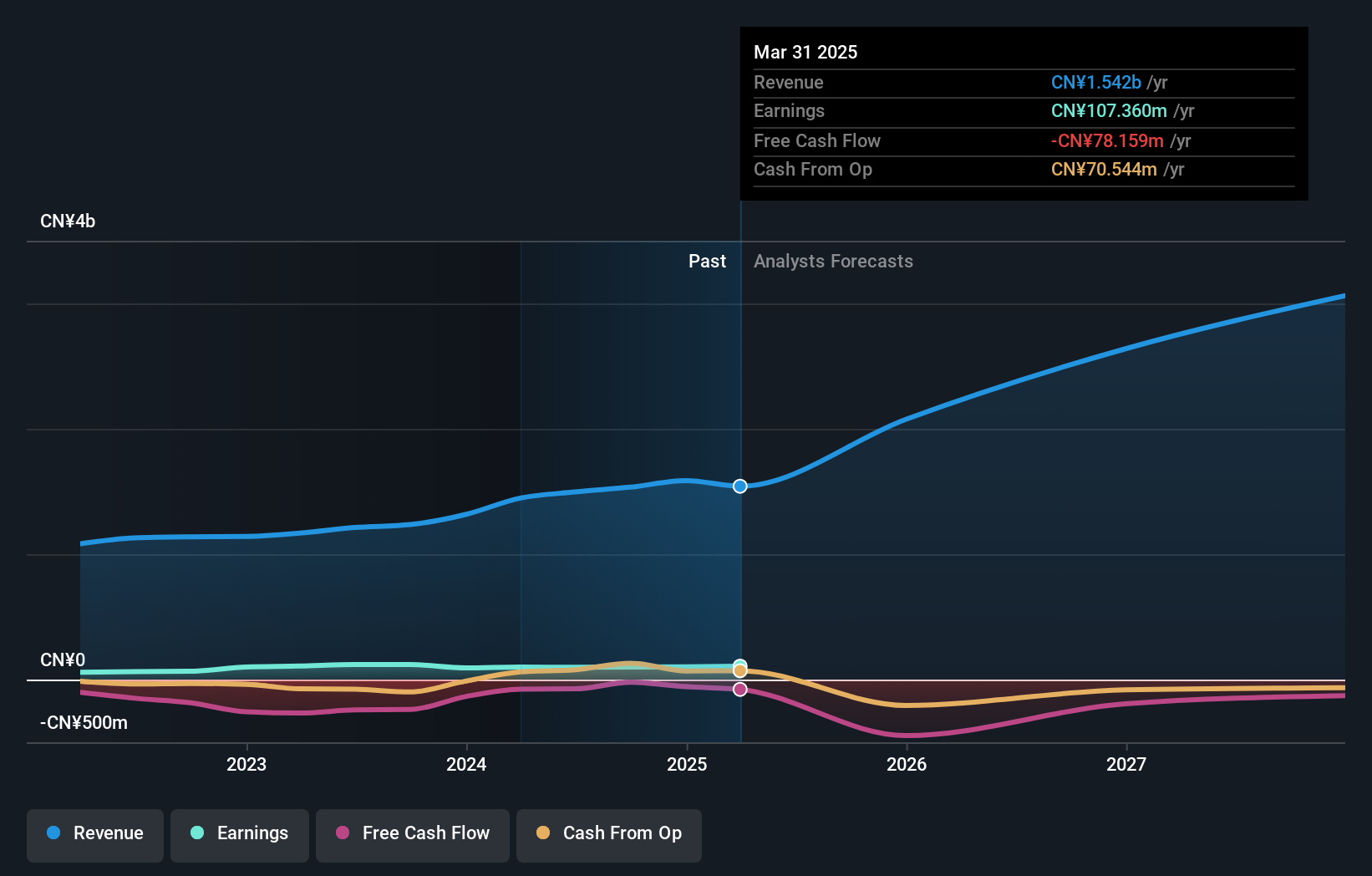

Chengdu Xuguang Electronics, a smaller player in the electronics sector, has showcased notable growth with earnings rising 7.6% last year, outpacing the industry average of 2.9%. Despite its debt to equity ratio climbing from 4.6% to 18.4% over five years, it remains satisfactory at a net level of 7.5%. The company trades at an attractive valuation, priced 47% below estimated fair value. Recent quarterly results showed net income increasing to CNY 30 million from CNY 25 million year-on-year despite a dip in sales from CNY 387 million to CNY 343 million, reflecting resilience amidst market volatility.

Harbin Hatou InvestmentLtd (SHSE:600864)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Harbin Hatou Investment Co., Ltd operates in the production and supply of heat and thermal power within China, with a market capitalization of CN¥12.90 billion.

Operations: Harbin Hatou Investment Co., Ltd generates revenue primarily from the production and supply of heat and thermal power in China. The company has a market capitalization of CN¥12.90 billion.

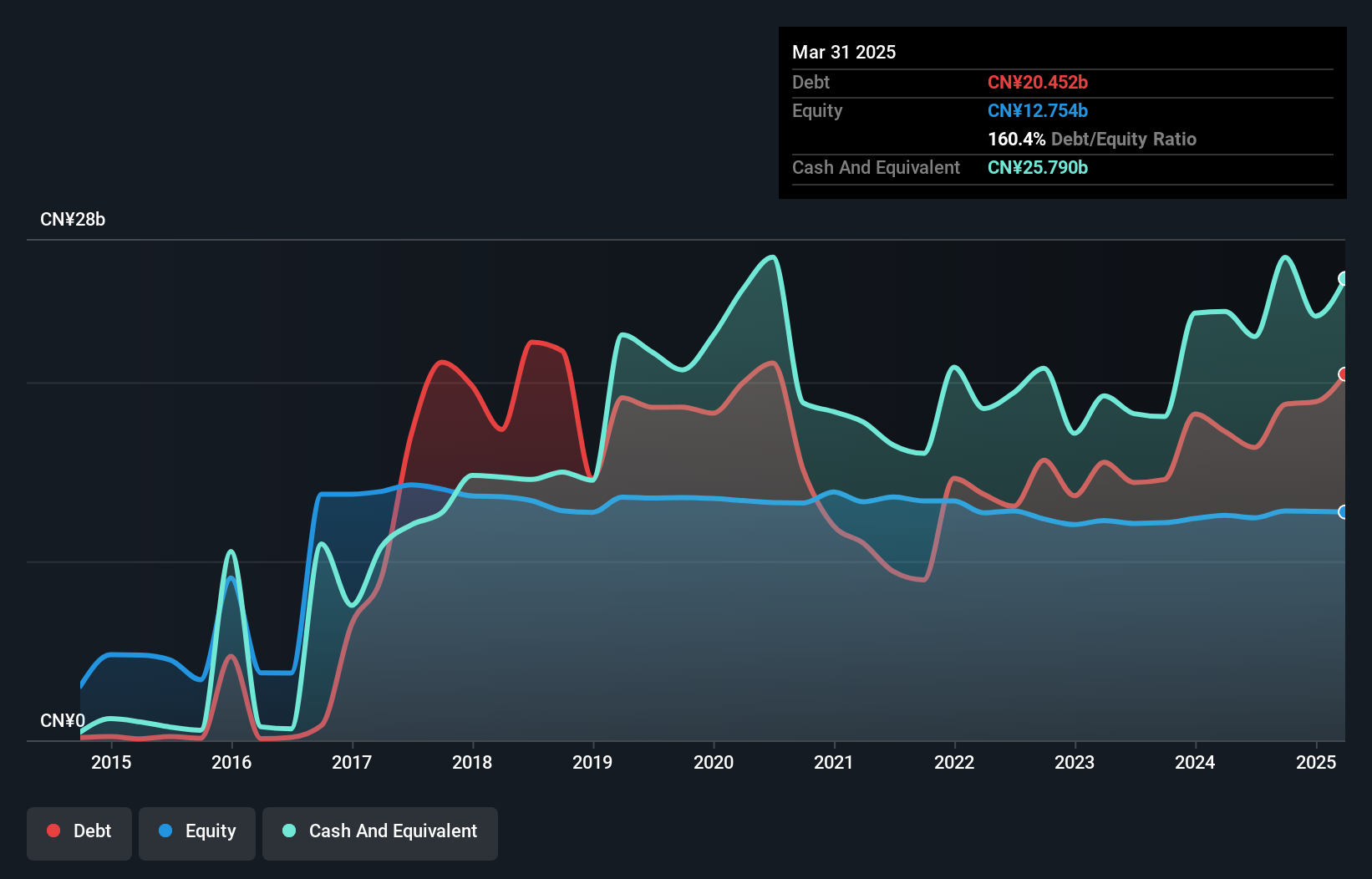

Harbin Hatou Investment, a smaller player in the market, has shown impressive earnings growth of 105% over the past year, outpacing its industry peers significantly. Despite a large one-off gain of CN¥137M affecting recent results, the company remains free cash flow positive and boasts more cash than total debt. However, its debt-to-equity ratio has increased to 160% over five years. Recent financials reveal a slight dip in net income to CN¥119M from CN¥141M last year. The firm also declared an annual dividend of CNY 0.05 per share payable on July 9th, indicating shareholder returns remain a focus.

Suzhou Nanomicro Technology (SHSE:688690)

Simply Wall St Value Rating: ★★★★★★

Overview: Suzhou Nanomicro Technology Co., Ltd. specializes in the production and distribution of spherical, mono-disperse particles for diverse global industries, with a market capitalization of CN¥9.98 billion.

Operations: The company's revenue is primarily derived from the manufacturing and supply of spherical, mono-disperse particles to various industries globally. It has a market capitalization of CN¥9.98 billion.

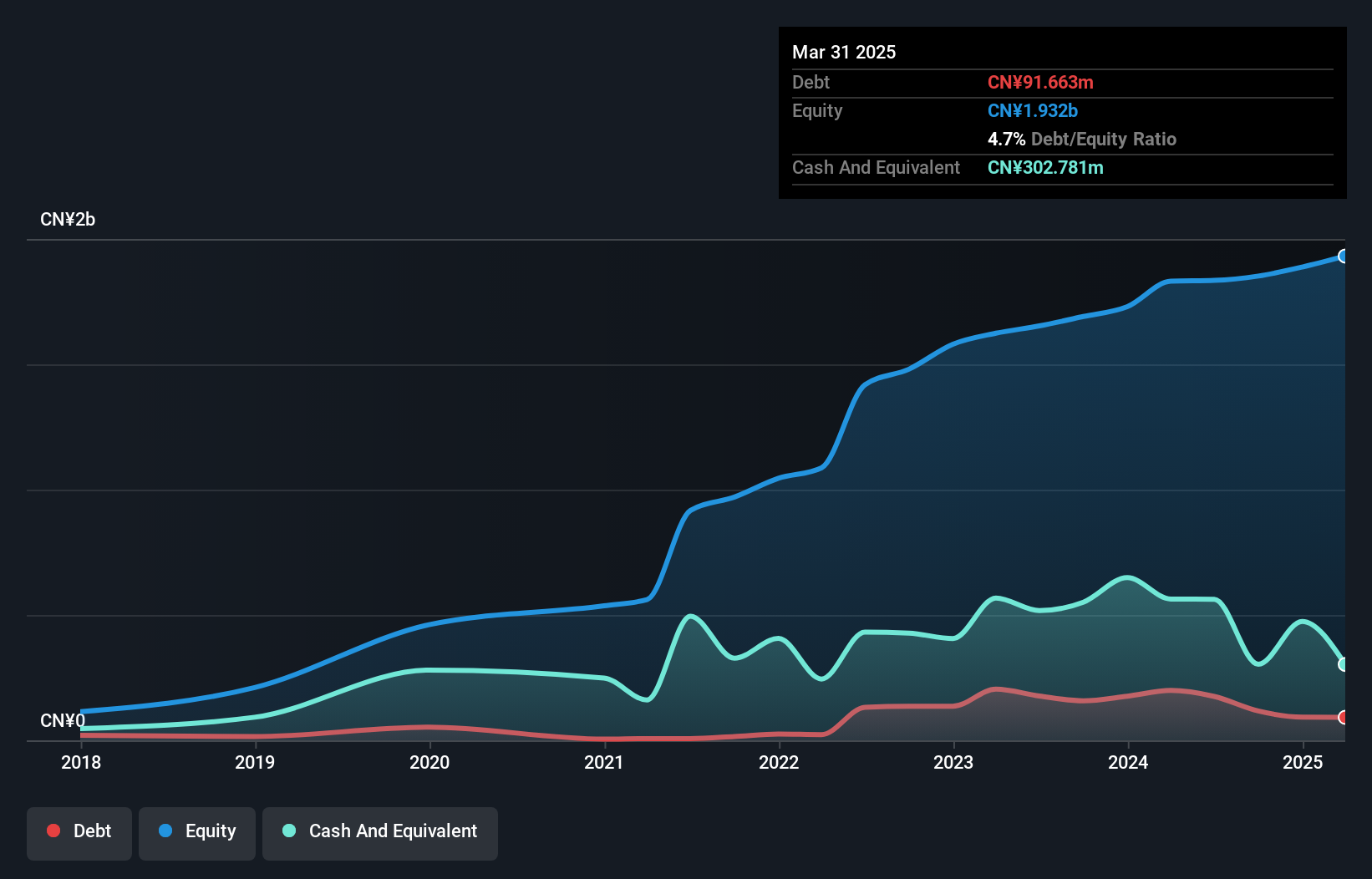

Suzhou Nanomicro Technology is making waves with its robust financial health, boasting more cash than total debt and a reduced debt-to-equity ratio from 8.5 to 4.7 over five years. The company reported first-quarter sales of CNY 188.59 million, up from CNY 154.1 million the previous year, while net income jumped to CNY 29.22 million from CNY 16.89 million, showcasing strong earnings growth of 30.2% annually—outpacing the broader chemicals industry at just 3.5%. With high-quality earnings and a forecasted growth rate of nearly 38% per year, this firm seems poised for continued success in its niche market segment.

- Click to explore a detailed breakdown of our findings in Suzhou Nanomicro Technology's health report.

Gain insights into Suzhou Nanomicro Technology's past trends and performance with our Past report.

Turning Ideas Into Actions

- Gain an insight into the universe of 3156 Global Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:600353

Chengdu Xuguang Electronics

Manufactures and sells metal-ceramic triodes and tetrodes and transmitting tubes in China and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives