- China

- /

- Electronic Equipment and Components

- /

- SHSE:688322

3 Global Growth Companies With High Insider Ownership Growing Earnings Up To 67%

Reviewed by Simply Wall St

In the current global market landscape, investor sentiment has been buoyed by potential rate cuts from the Federal Reserve, while concerns about inflation and labor market weaknesses persist. Amid these conditions, stocks with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the company's operations.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Synspective (TSE:290A) | 12.8% | 48.9% |

| Pharma Mar (BME:PHM) | 11.8% | 44.2% |

| Novoray (SHSE:688300) | 23.6% | 28.2% |

| Laopu Gold (SEHK:6181) | 35.5% | 34.3% |

| KebNi (OM:KEBNI B) | 38.3% | 63.7% |

| Gold Circuit Electronics (TWSE:2368) | 31.4% | 35.2% |

| Fulin Precision (SZSE:300432) | 11.8% | 43.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 80.6% |

| CD Projekt (WSE:CDR) | 29.7% | 39.5% |

| Ascentage Pharma Group International (SEHK:6855) | 12.7% | 87.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

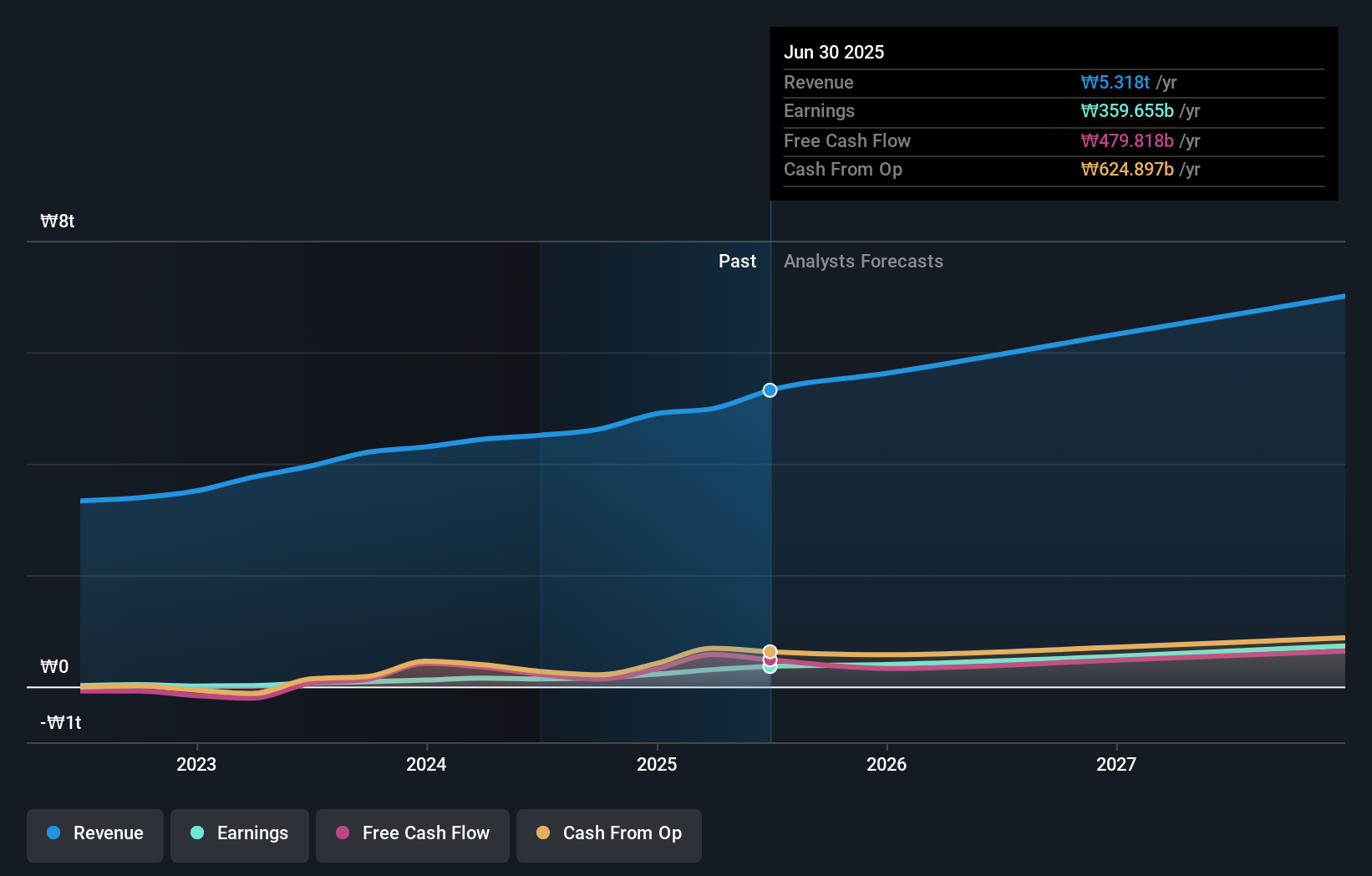

Hyosung Heavy Industries (KOSE:A298040)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hyosung Heavy Industries Corporation manufactures and sells heavy electrical equipment in South Korea and internationally, with a market cap of ₩11.16 billion.

Operations: Hyosung Heavy Industries generates its revenue primarily from the manufacturing and sale of heavy electrical equipment both domestically in South Korea and internationally.

Insider Ownership: 11.5%

Earnings Growth Forecast: 26% p.a.

Hyosung Heavy Industries demonstrates potential as a growth company with significant insider ownership. The company is expected to see robust earnings growth of 26% annually, outpacing the broader Korean market's 23%. Despite high share price volatility recently, revenue is forecast to grow at 10.8% per year, surpassing the market average of 7.3%. Additionally, its Return on Equity is projected to reach a strong 22.5% in three years.

- Get an in-depth perspective on Hyosung Heavy Industries' performance by reading our analyst estimates report here.

- According our valuation report, there's an indication that Hyosung Heavy Industries' share price might be on the expensive side.

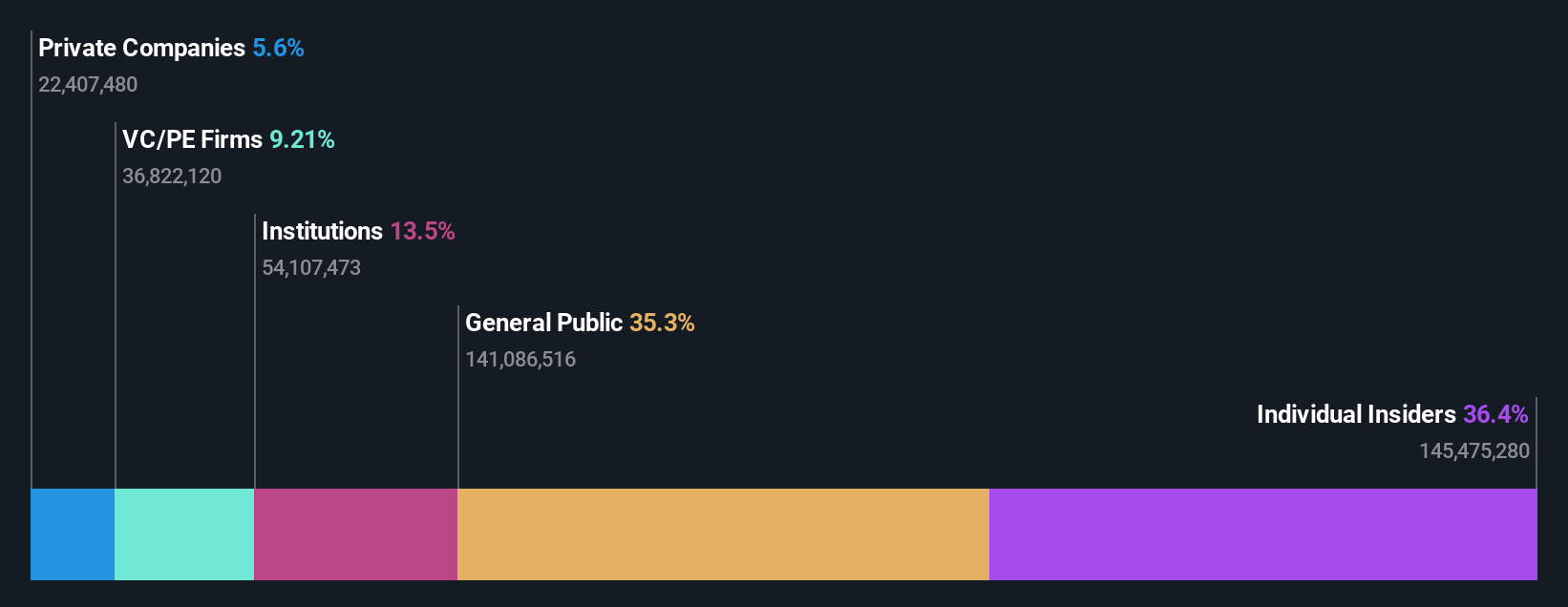

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orbbec Inc. designs, manufactures, and sells 3D vision sensors, with a market cap of CN¥33.30 billion.

Operations: Orbbec generates revenue primarily through the design, manufacture, and sale of 3D vision sensors.

Insider Ownership: 36.4%

Earnings Growth Forecast: 67.5% p.a.

Orbbec's growth trajectory is underscored by a significant revenue increase, reporting CNY 435.47 million for the first half of 2025, doubling from last year. The company turned profitable with a net income of CNY 60.19 million compared to a prior loss, and its earnings are projected to grow substantially at 67.51% annually over the next three years. Despite recent share buybacks worth CNY 20.03 million, insider trading activity remains minimal in recent months.

- Take a closer look at Orbbec's potential here in our earnings growth report.

- Our valuation report here indicates Orbbec may be overvalued.

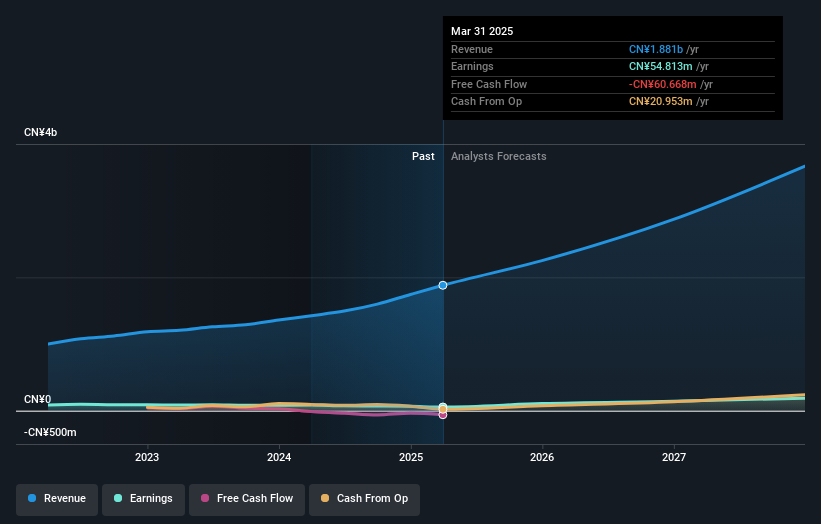

Hydsoft TechnologyLtd (SZSE:301316)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hydsoft Technology Co., Ltd. offers professional IT services both in China and internationally, with a market cap of CN¥20.86 billion.

Operations: Hydsoft Technology Co., Ltd. generates its revenue from providing professional IT services in both domestic and international markets.

Insider Ownership: 24.1%

Earnings Growth Forecast: 33.3% p.a.

Hydsoft Technology Ltd. is poised for substantial growth, with earnings expected to increase 33.31% annually over the next three years, outpacing the CN market's 25.2%. Revenue is also forecast to grow at a robust 23.8% per year, surpassing the market average of 13.3%. Despite a volatile share price and declining profit margins from last year (5.9% to 2.9%), no significant insider trading activity has been reported recently, indicating stable insider confidence in its potential trajectory.

- Navigate through the intricacies of Hydsoft TechnologyLtd with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Hydsoft TechnologyLtd implies its share price may be too high.

Seize The Opportunity

- Unlock more gems! Our Fast Growing Global Companies With High Insider Ownership screener has unearthed 824 more companies for you to explore.Click here to unveil our expertly curated list of 827 Fast Growing Global Companies With High Insider Ownership.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688322

High growth potential with mediocre balance sheet.

Market Insights

Community Narratives