Beijing Huaru Technology Co., Ltd. (SZSE:301302) Looks Just Right With A 41% Price Jump

Beijing Huaru Technology Co., Ltd. (SZSE:301302) shareholders have had their patience rewarded with a 41% share price jump in the last month. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 22% over that time.

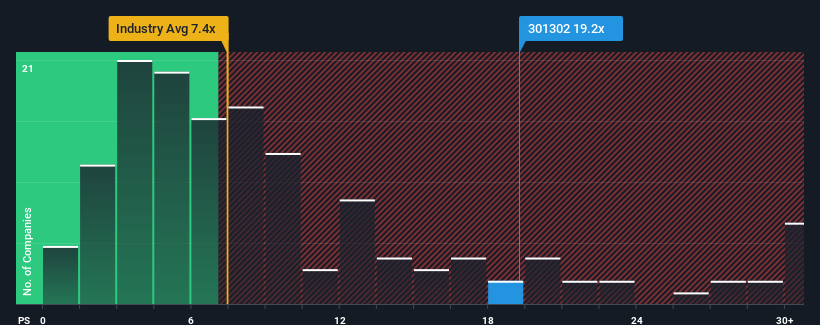

Since its price has surged higher, you could be forgiven for thinking Beijing Huaru Technology is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 19.2x, considering almost half the companies in China's Software industry have P/S ratios below 7.4x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Beijing Huaru Technology

How Has Beijing Huaru Technology Performed Recently?

Beijing Huaru Technology hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Beijing Huaru Technology.Is There Enough Revenue Growth Forecasted For Beijing Huaru Technology?

The only time you'd be truly comfortable seeing a P/S as steep as Beijing Huaru Technology's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 74%. The last three years don't look nice either as the company has shrunk revenue by 61% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue should grow by 296% over the next year. Meanwhile, the rest of the industry is forecast to only expand by 33%, which is noticeably less attractive.

With this information, we can see why Beijing Huaru Technology is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On Beijing Huaru Technology's P/S

Shares in Beijing Huaru Technology have seen a strong upwards swing lately, which has really helped boost its P/S figure. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Beijing Huaru Technology's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Beijing Huaru Technology that we have uncovered.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Beijing Huaru Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SZSE:301302

Beijing Huaru Technology

Researches, develops, produces, and sales of simulation technology products in China.

Excellent balance sheet with limited growth.

Market Insights

Community Narratives