High Growth Tech Stocks With Potential To Boost Your Portfolio

Reviewed by Simply Wall St

As global markets experience a rebound with easing inflation and strong bank earnings propelling U.S. stocks higher, the focus on high-growth tech stocks becomes increasingly relevant for investors looking to diversify their portfolios amid shifting economic conditions. In this environment, identifying promising tech companies that demonstrate robust innovation and adaptability can be key to capitalizing on potential growth opportunities in the market.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Empyrean Technology (SZSE:301269)

Simply Wall St Growth Rating: ★★★★★☆

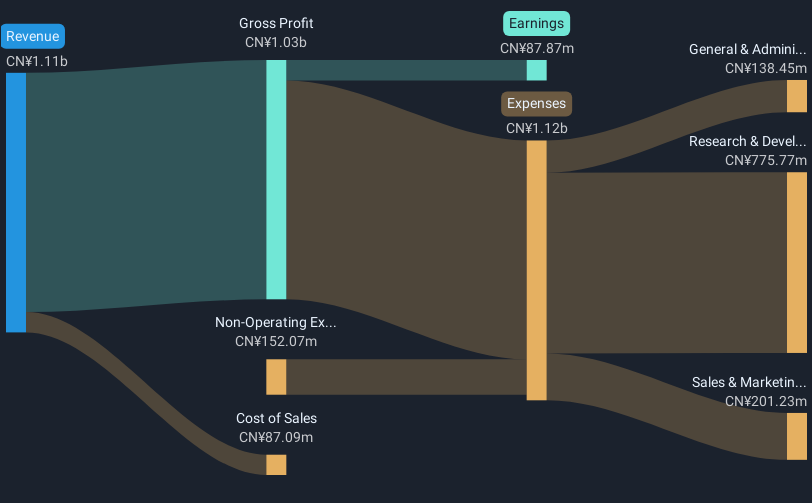

Overview: Empyrean Technology Co., Ltd. is engaged in the development, sale, and servicing of electronic design automation (EDA) software with a market capitalization of CN¥59.30 billion.

Operations: Empyrean Technology focuses on electronic design automation (EDA) software, generating revenue through development, sales, and service offerings. The company has a market capitalization of CN¥59.30 billion.

Empyrean Technology, amidst a challenging year with a 64% drop in earnings, still projects an impressive annual earnings growth of 50.8%. This contrasts sharply with the broader software industry's average downturn of 11.2%. Despite recent volatility and a significant one-off financial hit of CN¥101.3M affecting its profitability, the company's revenue growth outlook remains robust at 27.1% annually, outpacing the Chinese market forecast of 13.4%. These figures underscore Empyrean's resilience and potential to capitalize on market trends despite short-term setbacks.

Sansan (TSE:4443)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Sansan, Inc. is a Japanese company that focuses on the planning, development, and sale of cloud-based solutions with a market capitalization of ¥293.87 billion.

Operations: Sansan, Inc. specializes in cloud-based solutions, generating revenue primarily through its business card management and contact management services.

Sansan, Inc., amidst a volatile market, is poised for significant growth with expected annual revenue and earnings increases of 16.2% and 38.6%, respectively, outstripping the Japanese market projections of 4.3% and 8.1%. This performance is underpinned by robust R&D investments which have strategically positioned the company to leverage emerging tech trends effectively. Recent board discussions on strategic issuances suggest proactive governance aimed at fueling these growth trajectories further, showcasing Sansan's agility in adapting to dynamic market demands while maintaining a strong innovation pipeline that promises sustained competitive advantages in the tech sector.

- Click here to discover the nuances of Sansan with our detailed analytical health report.

Evaluate Sansan's historical performance by accessing our past performance report.

PharmaEssentia (TWSE:6446)

Simply Wall St Growth Rating: ★★★★★★

Overview: PharmaEssentia Corporation is a biopharmaceutical company that focuses on developing treatments for human diseases in Taiwan and internationally, with a market capitalization of NT$230.69 billion.

Operations: PharmaEssentia generates revenue primarily from its research and development of new drugs, amounting to NT$8.32 billion. The company's operations are centered on advancing biopharmaceutical treatments for various human diseases across Taiwan and international markets.

PharmaEssentia, a trailblazer in biotechnology, has demonstrated impressive growth with an anticipated annual revenue increase of 42.9% and earnings surge of 71.8%. This growth trajectory is supported by significant R&D investments, which are crucial for sustaining innovation and competitive edge in the high-stakes biotech industry. The company recently made headlines with the acceptance of its Phase III clinical trial application for Ropeginterferon alfa-2b by China's NMPA, marking a pivotal step in addressing unmet medical needs in myelofibrosis treatment. With these strategic moves, PharmaEssentia not only underscores its commitment to advancing healthcare but also positions itself as a strong contender in the global biotech arena.

- Delve into the full analysis health report here for a deeper understanding of PharmaEssentia.

Assess PharmaEssentia's past performance with our detailed historical performance reports.

Make It Happen

- Access the full spectrum of 1225 High Growth Tech and AI Stocks by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6446

PharmaEssentia

A biopharmaceutical company engages in treatment for human diseases in Taiwan and internationally.

Exceptional growth potential with flawless balance sheet.